Table of Contents

Overview

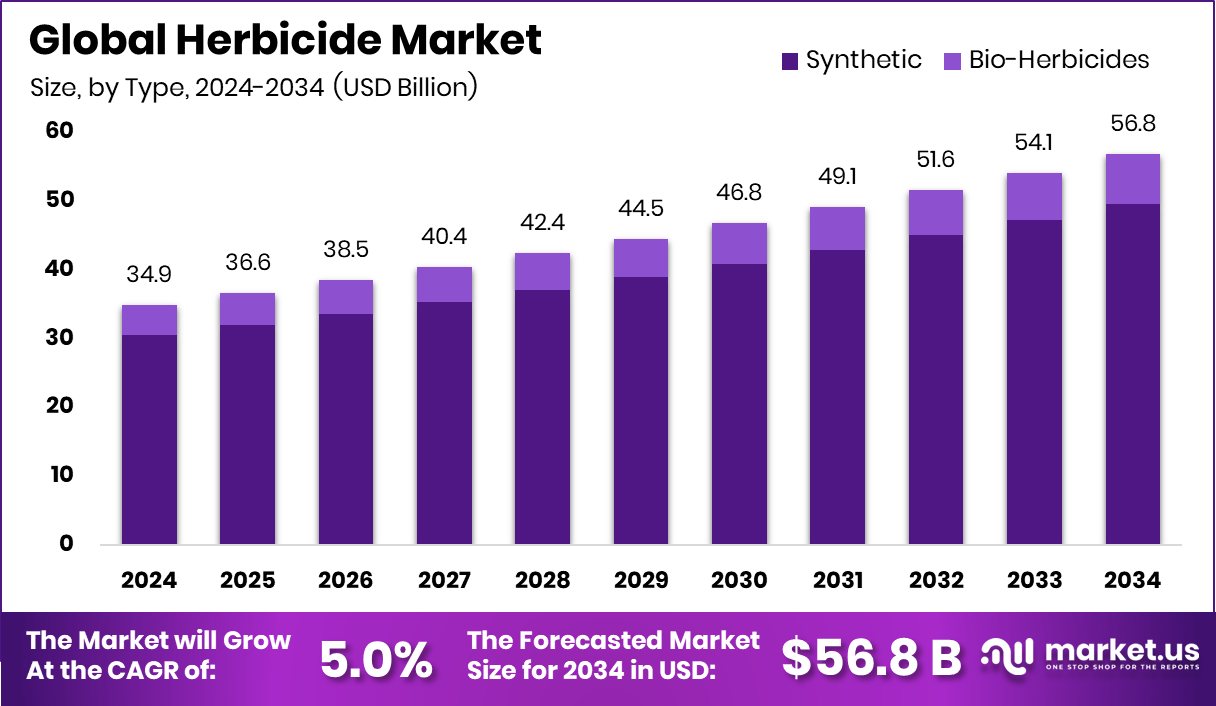

New York, NY – September 12, 2025 – The Global Herbicide Market, valued at USD 34.9 billion in 2024, is projected to reach USD 56.8 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.0% from 2025 to 2034. Asia-Pacific leads the market with a dominant 42.3% share, contributing USD 14.7 billion.

Herbicides, chemical substances designed to control or eliminate unwanted plants (weeds), play a critical role in agriculture, landscaping, and industrial vegetation management. Weeds compete with crops for essential resources like nutrients, water, and sunlight, reducing agricultural productivity. Herbicides, which can be selective (targeting specific weeds without harming crops) or non-selective (eliminating all vegetation), are applied in farmlands, gardens, forests, and industrial areas to enhance crop yields and maintain land health.

The herbicide market encompasses the production, formulation, distribution, and application of these products across various sectors. Key drivers include population growth, rising food demand, advancements in farming practices, and the adoption of precision agriculture to maximize crop productivity on limited arable land.

Climate change further fuels demand by promoting the spread of invasive weeds and pests, necessitating effective weed control solutions. Recent innovations and investments underscore the sector’s growth potential. For instance, an MSU-led research group received a USD 500,000 grant to address herbicide-resistant weeds in soybean crops, while UK-based RootWave secured USD 15 million to develop herbicide alternatives.

Oxford-based Moa raised USD 40 million in seed funding and USD 44 million in Series B funding to create next-generation herbicides, and the Gates Foundation led a USD 45 million funding round for pesticide innovator Enko. Additionally, a precision AI farming firm obtained USD 20 million to deploy herbicide-spraying drone fleets, highlighting the industry’s shift toward innovative and sustainable solutions.

Key Takeaways

- The Global Herbicide Market is expected to be worth around USD 56.8 billion by 2034, up from USD 34.9 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- In 2024, synthetic herbicides dominated the herbicide market, accounting for a significant 87.3% market share.

- Selective herbicides led the herbicide market by mode of action, holding a strong 67.8% share globally.

- Foliar application methods captured 51.6% of the herbicide market, driven by efficiency and targeted weed control.

- Cereals and grains were the largest crop segment in the herbicide market, representing 48.9% market share.

- Asia-Pacific, 42.3% share, USD 14.7 Bn, leads the global market.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/herbicide-market/request-sample/

Report Scope

| Market Value (2024) | USD 34.9 Billion |

| Forecast Revenue (2034) | USD 56.8 Billion |

| CAGR (2025-2034) | 5.0% |

| Segments Covered | By Type (Synthetic (Glyphosate, Atrazine, 2,4-Dichlorophenoxyacetic Acid, Acetochlor, Paraquat, Others), Bio-Herbicides), By Mode of Action (Selective, Non-selective), By Application (Fertigation, Foliar, Soil, Others), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others) |

| Competitive Landscape | BASF SE, Bayer AG, Corteva Inc., Drexel Chemical Co. Inc., DuPont, FMC Corporation, Heranba Industries Ltd., ICL Group, Nissan Chemical Corporation, Nufarm, Nutrien |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155182

Key Market Segments

By Type: Synthetic Herbicides

Synthetic herbicides lead the herbicide market in 2024, commanding an 87.3% share due to their widespread use in large-scale agriculture. Prized for rapid action, reliable performance, and broad-spectrum weed control, they suit both selective and non-selective applications across diverse crops. Their cost-effectiveness and compatibility with modern farming equipment enable efficient, large-area weed management.

Driven by global demand for higher agricultural productivity amid limited arable land, synthetic herbicides remain essential for maximizing crop yields. Advancements in formulations enhance safety, precision, and resistance management, reinforcing their market dominance despite environmental and regulatory challenges.

By Mode of Action: Selective Herbicides

Selective herbicides dominate the mode of action segment with a 67.8% share in 2024, reflecting their importance in modern farming. By targeting specific weeds while sparing crops, they ensure minimal crop damage and high yield quality. Their precision reduces application frequency, boosting cost efficiency and supporting sustainable practices.

Widely used across various crop types to control broadleaf weeds and grasses, selective herbicides benefit from advancements in formulations and compatibility with advanced spraying technologies. As global food demand rises and arable land remains constrained, selective herbicides are vital for integrated weed management and sustainable crop production.

By Application: Foliar Application

Foliar application holds a 51.6% share of the herbicide market in 2024, favored for its rapid and effective weed control. Applied directly to weed leaves, foliar herbicides ensure quick absorption, disrupting plant growth swiftly an advantage during critical crop growth stages.

Suitable for both selective and non-selective treatments, they offer flexibility across crop types and weed challenges. Modern spraying technologies improve application precision, reducing waste and enhancing cost-effectiveness. Enhanced formulations, including better rainfastness and faster results, make foliar herbicides a top choice for farmers aiming to optimize productivity and resource use.

By Crop Type: Cereals and Grains

Cereals and grains account for 48.9% of herbicide use in 2024, driven by their critical role in global food security. Crops like wheat, rice, maize, and barley, grown on vast swaths of farmland, require effective weed control to safeguard yields against competing broadleaf weeds and grasses.

Rising global demand for staple foods, particularly in developing regions, fuels herbicide adoption to reduce labor, minimize crop losses, and boost harvest efficiency. Innovations in herbicide formulations and precision agriculture compatibility further drive their use, ensuring cereals and grains remain a cornerstone of agricultural productivity.

Regional Analysis

In 2024, Asia-Pacific dominates the global herbicide market with a 42.3% share, valued at USD 14.7 billion. The region’s leadership stems from its extensive agricultural base, high population, and urgent need to enhance crop yields to meet growing food demand.

Countries like China, India, and Australia drive large-scale herbicide adoption, supported by government initiatives promoting modern farming and precision agriculture. Favorable climates and expanding commercial agriculture further boost herbicide use. While North America, Europe, Latin America, and the Middle East & Africa show steady growth, Asia-Pacific’s critical role in global food production solidifies its market dominance.

Top Use Cases

- Weed Control in Agriculture: Herbicides are widely used in farming to eliminate weeds that compete with crops for nutrients, water, and sunlight. By applying herbicides before or during planting, farmers can boost crop yields and reduce manual labor, making farming more efficient and cost-effective.

- Urban Landscaping Maintenance: In cities, herbicides help maintain tidy lawns, parks, and golf courses by controlling unwanted weeds. They ensure attractive green spaces with minimal effort, saving time and money for municipalities and property managers while enhancing the aesthetic appeal of public and private areas.

- Aquatic Weed Management: Herbicides are applied in water bodies like lakes and canals to control invasive aquatic weeds. These weeds can block irrigation systems or disrupt recreational activities. Targeted herbicide use keeps waterways clear, supporting industrial uses and maintaining ecosystems for fishing and boating.

- Forest Management Support: In forestry, herbicides prepare logged areas for replanting by clearing competing vegetation. This promotes healthy tree growth and faster forest recovery. Herbicides are used less frequently than in agriculture but cover large areas, ensuring sustainable forest regeneration and efficient land use.

- Herbicide Resistance Research: Herbicides are studied to understand weed resistance, helping scientists develop better weed control solutions. By analyzing resistance data, researchers can create new, more effective herbicides, ensuring long-term weed management and supporting sustainable agriculture practices globally.

Recent Developments

1. BASF SE

BASF is advancing its herbicide pipeline with a focus on sustainability and resistance management. Recent highlights include the introduction of Luximo herbicide (cinmethylin) for grass weed control in Europe and the ongoing global rollout of its latest-generation herbicide, Luxxuron. These solutions are part of their strategy to offer new modes of action and integrated systems for farmers.

2. Bayer AG

Bayer continues to invest in next-generation weed control, notably with its proprietary Prepona and Skylance herbicides. A major development is the ongoing commercial expansion of its novel DASH herbicide system, designed for precise application to reduce environmental impact. This is central to their integrated system approach, combining chemistry, biotechnology, and data science to combat resistant weeds.

3. Corteva Inc.

Corteva Agriscience is actively launching and developing new herbicide formulations. A key recent introduction is Kyro herbicide, a pre-emergent for soybeans with a novel active ingredient (pyroxasulfone + flumioxazin). They are also expanding the use of their Reklemel active ingredient platform, aiming to provide farmers with new tools to manage hard-to-control broadleaf and grass weeds.

4. Drexel Chemical Co. Inc.

As a manufacturer of generic and value-oriented agricultural chemicals, Drexel Chemical’s developments focus on expanding production and registration of established herbicide active ingredients. Their recent efforts include ensuring reliable supply and broad availability of key generic herbicides like 2,4-D, glyphosate, and atrazine, providing cost-effective solutions for weed management amid global supply chain challenges.

5. DuPont

Following the Dow-DuPont merger and subsequent spin-off, DuPont’s legacy agriculture business is now part of Corteva Agriscience. The standalone DuPont de Nemours, Inc. today focuses on electronics, water, protection, and industrial technologies, not on agricultural herbicides. For recent herbicide developments from this lineage, please refer to the Corteva Inc. entry above.

Conclusion

The Herbicide Market is expanding due to rising food demand, urbanization, and sustainable farming trends. With advancements in formulations and application methods, herbicides are becoming more effective and eco-friendly. The adoption of GMO crops and precision agriculture further drives growth, though regulatory challenges and environmental concerns push innovation toward bioherbicides, ensuring long-term market potential.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)