Table of Contents

Overview

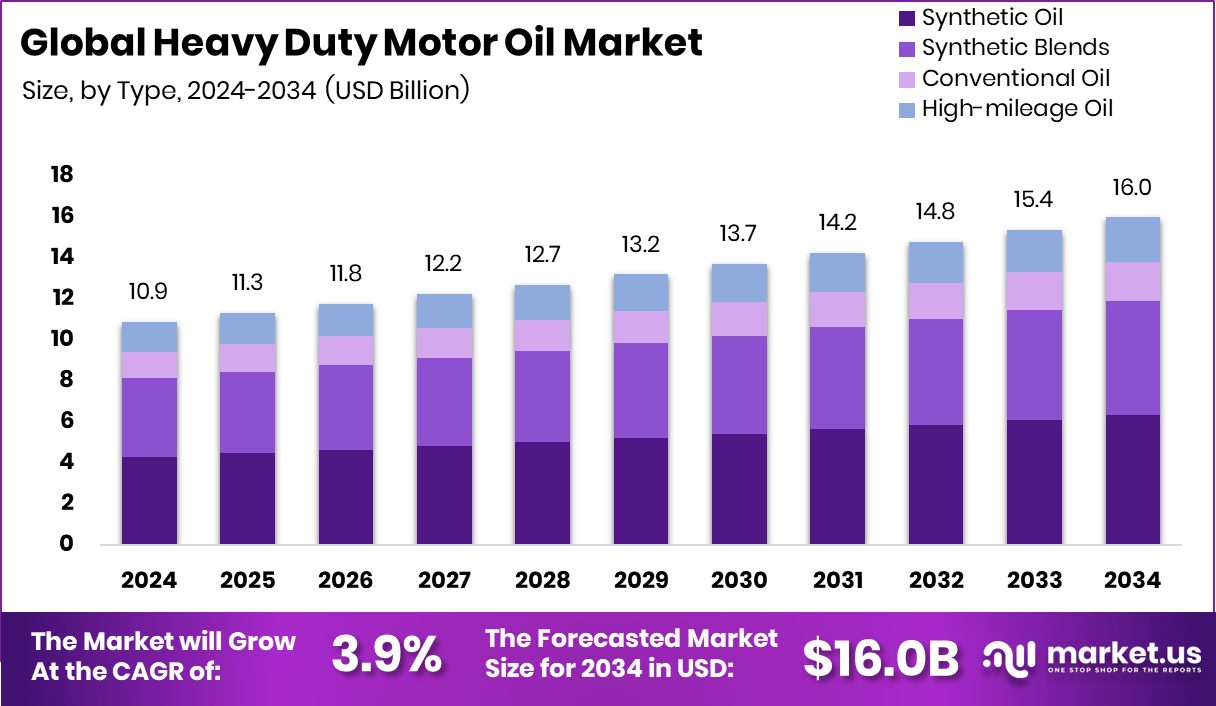

New York, NY – Nov 11, 2025 – The heavy-duty motor oil market is projected to rise from USD 10.9 billion in 2024 to around USD 16.0 billion by 2034, representing a CAGR of approximately 3.9% between 2025 and 2034. Key growth is driven by the expansion of transportation, logistics, and manufacturing in the Asia-Pacific region (≈ 48.30 % share), fueling higher consumption of heavy-duty oils.

Such oils—formulated for commercial trucks, buses, agricultural machinery, mining vehicles, and large off-road equipment—must endure heavier loads, elevated temperatures, and prolonged operation. They protect engines by reducing friction, preventing wear, resisting oxidation, and maintaining viscosity under severe duty cycles.

Demand is anchored in fleet operations, infrastructure build-out, and modern engine designs: stricter emissions regulations demand oils capable of supporting after-treatment systems and extended drain intervals. Preventive maintenance and uptime priorities further push operators to premium lubricant solutions. Exciting opportunities lie in sustainable and next-generation formulations: biodegradable base oils, recycled-oil solutions, and advanced additive packages that extend service life, enhance fuel efficiency, and reduce waste.

And the capital is flowing: one engine-oil firm saw its profit rise to Rs 2.33 billion on strong demand; another secured a Series A funding round of Rs 84 crore; meanwhile Germany granted € 350 million to a synthetic aviation-fuel producer, and a synthetic palm-oil startup raised US$ 1.2 million in a pre-seed round—suggesting that lubricant firms aligned with high-performance and sustainability stand to benefit.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-heavy-duty-motor-oil-market/request-sample/

Key Takeaways

- The Global Heavy Duty Motor Oil Market is expected to be worth around USD 16.0 billion by 2034, up from USD 10.9 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In 2024, Synthetic Oil dominated the Heavy Duty Motor Oil Market, capturing 39.5% of the global share.

- Trucks accounted for the largest segment in the Heavy Duty Motor Oil Market, holding 41.4% share

- The Asia-Pacific market value reached around USD 5.2 billion, reflecting strong industrial expansion.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164587

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 10.9 Billion |

| Forecast Revenue (2034) | USD 16.0 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Types (Synthetic Oil, Synthetic Blends, Conventional Oil, High-mileage Oil), By Application (Trucks, Buses and Vans, Tractors, Cars and Light-Duty Vehicles, Power Generation, Others) |

| Competitive Landscape | BASF, Chevron Oronite, Lubrizol, Lanxess, Evonik, Croda, Huntsman, Multisol, Total |

Key Market Segments

By Types Analysis

In 2024, synthetic oil dominated the Heavy Duty Motor Oil Market by type, securing a 39.5% share. Its leadership stems from superior engine protection, exceptional viscosity stability, and strong oxidation resistance, even under severe operating conditions. Widely used in heavy-duty commercial vehicles, synthetic oil supports extended drain intervals and enhances fuel efficiency, making it ideal for intensive fleet operations.

Its consistent performance in extreme high and low temperatures contributes to longer engine life and better reliability. Additionally, the shift toward advanced engine technologies and tighter emission standards has driven broader adoption of synthetic lubricants. Fleet operators and industrial users increasingly prefer synthetic oil for its efficiency, durability, and compliance benefits, solidifying its position as the top-performing segment in 2024.

By Application Analysis

In 2024, trucks dominated the Heavy Duty Motor Oil Market by application, accounting for a 41.4% share. This leadership is driven by the widespread use of heavy-duty oils in long-haul and commercial trucking fleets that operate under continuous, high-load conditions. Such vehicles rely on lubricants with exceptional wear protection, thermal stability, and extended service life to ensure reliability and minimize downtime.

The rapid growth of logistics, e-commerce, and freight transport industries has further fueled oil demand in this segment. Moreover, ongoing engine innovations and tighter emission norms have accelerated the adoption of high-performance motor oils, reinforcing trucks as the primary application area in 2024.

Regional Analysis

In 2024, Asia-Pacific dominated the Heavy Duty Motor Oil Market with a 48.30% share, valued at USD 5.2 billion. This leadership comes from its massive commercial vehicle base, rapid industrialization, and expanding logistics sector across China, India, and Southeast Asia. Growing infrastructure projects, construction machinery demand, and long-haul transport further boost lubricant consumption.

North America maintained steady growth through fleet modernization and advanced oil technologies, while Europe advanced with strict emission rules and wider synthetic-oil usage. The Middle East & Africa benefited from active construction and mining, and Latin America showed gradual improvement in transportation and industrial sectors.

Collectively, all regions contribute to global demand, yet Asia-Pacific remains unmatched due to its expanding heavy-duty vehicle population, robust manufacturing ecosystem, and rising adoption of premium synthetic lubricants meeting evolving environmental and performance standards.

Top Use Cases

- On-highway commercial truck engines: Heavy-duty motor oil protects large diesel truck engines from high loads and long hours on the road. It maintains film strength and resists wear while helping with fuel efficiency and extended oil-drain intervals.

- Off-road construction and mining equipment: In rugged machines used for construction or mining, heavy-duty oil must cope with extreme temperatures, dust, and heavy loads. It helps smooth operation and reduces downtime under harsh conditions.

- Stationary diesel generators and power units: Heavy-duty motor oil is used in stationary diesel engines (e.g., for power generation or backup) where continuous operation is required. The oil ensures reliable lubrication, thermal protection, and extended service intervals.

- Mixed fleet applications (on-road + off-road): Companies that manage both highway trucks and off-road vehicles rely on heavy-duty oils designed for mixed fleets. These oils must meet varied engine demands and emission requirements in one formulation.

- Engines with after-treatment systems and emission compliance: Heavy-duty oils now incorporate additives and base-oil technologies to support advanced diesel engines fitted with after-treatment systems, helping meet stricter emission standards while protecting the engine.

- Fuel efficiency and extended oil-change intervals for fleets: By reducing friction, resisting oxidation, and maintaining viscosity, heavy-duty motor oil allows fleets to operate longer between oil changes and lower fuel costs, improving operational efficiency.

Recent Developments

- In May 2024, Chevron Oronite made the final investment decision to expand its lubricant-additive manufacturing facility in Ningbo, China. The expansion supports its ability to supply additive products for heavy-duty engine oils and other lubricant markets in Asia and globally.

- In January 2024, BASF signed a license agreement with The Lubrizol Corporation to produce and distribute selected industrial lubricant products (EMGARD® and Plurasafe® series) under Lubrizol branding, effective April 1, 2024. This expands BASF’s reach in industrial/lubricant additives.

Conclusion

The Heavy Duty Motor Oil Market is evolving with growing demand for advanced and sustainable lubricants. Increasing fleet operations, industrial activities, and stricter emission regulations are shaping the shift toward high-performance and synthetic oils. Manufacturers are focusing on improved engine protection, longer drain intervals, and fuel efficiency.

Additionally, the rise of digital monitoring and eco-friendly formulations is redefining maintenance practices. Continuous innovations in additive technologies and collaborations between oil producers and OEMs are enhancing product quality and reliability. Overall, the market is moving toward cleaner, more efficient, and durable solutions to meet the changing needs of global transportation and industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)