Table of Contents

Introduction

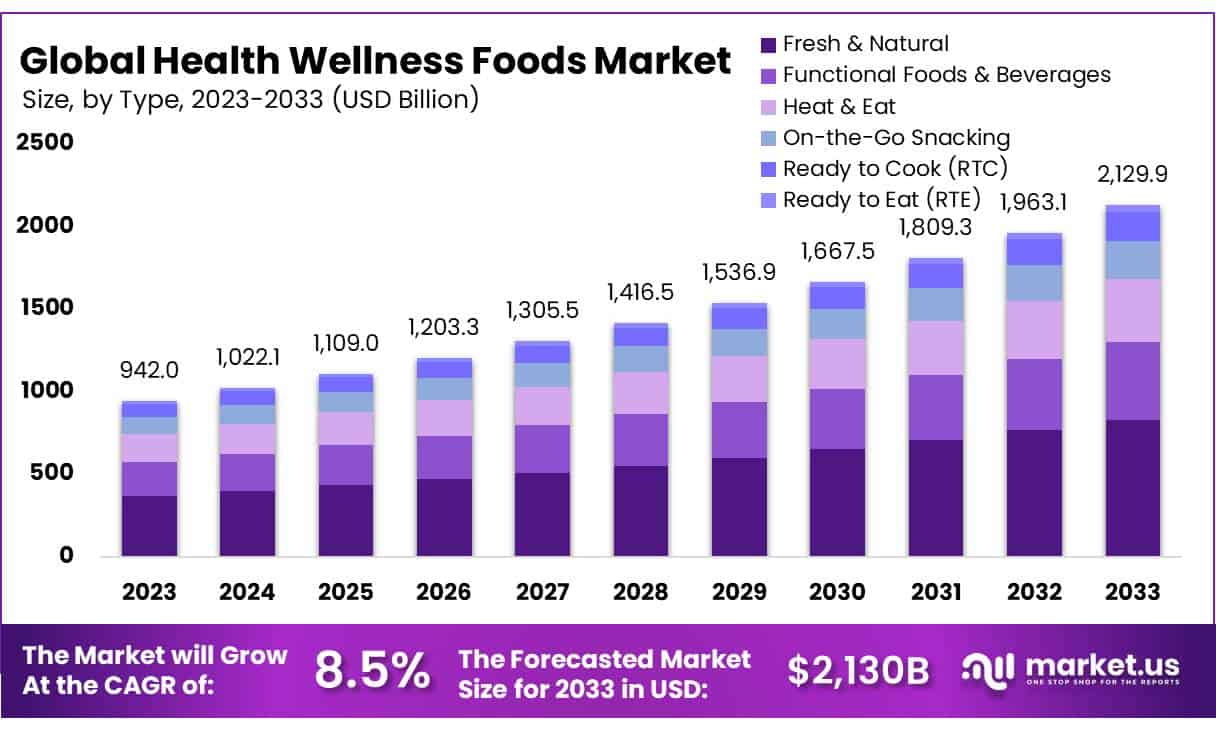

New York, NY – February 19, 2025 – The global Health Wellness Foods Market is projected to experience significant growth in the coming years. With a market size expected to reach approximately USD 2129.9 billion by 2033, up from USD 942.04 billion in 2023, the industry is set to grow at a robust compound annual growth rate (CAGR) of 8.5% during the forecast period from 2024 to 2033.

This growth is largely driven by rising consumer awareness about health and wellness, increased demand for natural and organic foods, and the shift towards healthier lifestyles. The growing popularity of functional foods, plant-based diets, and the increasing prevalence of lifestyle diseases are also contributing to the expansion of this market. As more consumers seek products that offer health benefits beyond basic nutrition, there are ample opportunities for businesses to innovate and cater to this evolving demand.

Additionally, market expansion is expected in emerging regions where the awareness of healthy living is rapidly growing, creating new avenues for growth. The market’s ability to address the diverse needs of consumers, such as offering immunity-boosting, weight management, and digestive health products, further supports its future growth trajectory.

Key Takeaways

- Health Wellness Foods Market size is expected to be worth around USD 2129.9 Bn by 2033, from USD 942.04 Bn in 2023, growing at a CAGR of 8.5%.

- Functional Foods & Beverages segment held a dominant position in the Health Wellness Foods Market, capturing more than a 38.4% share.

- Non-Genetically Modified Organism (Non-GMO) Food captured a dominant market position within the Health Wellness Foods Market, securing over a 74.3% share.

- Low Fat segment held a dominant market position in the Health Wellness Foods Market, capturing more than a 54.2% share.

- Conventional foods held a dominant position in the Health Wellness Foods Market, capturing more than a 65.2% share.

- The gluten-free category held a dominant market position in the Health Wellness Foods Market, capturing more than a 28.4% share.

- The weight Management segment held a dominant position in the Health Wellness Foods Market, capturing more than a 34.3% share.

Report Scope

| Market Value (2024) | USD 942.04 Billion |

| Forecast Revenue (2034) | USD 2129.9 Billion |

| CAGR (2025-2034) | 8.5% |

| Segments Covered | By Type (Fresh and Natural, Functional Foods and Beverages, Heat and Eat, On-the-Go Snacking, Ready to Cook (RTC), Ready to Eat (RTE)), By Nature (Genetically Modified Organism Food, Non-Genetically Modified Organism Food), By Fat Content (Low Fat, No Fat, Reduced-Fat), By Category (Conventional, Organic), By Free From Category (Artificial Color-Free, Artificial Flavor-Free, Gluten-Free, Lactose-Free, Nut-Free, Soy-Free, Sugar-free), By Application (Cardio Health, Clinical Nutrition, Digestive Health, Immunity, Sports Nutrition, Weight Management), By Distribution Channel (Convenience Stores, Pharmacies and Drugstores, Supermarkets and Hypermarket, Online Mode, Others) |

| Competitive Landscape | Nestlé S.A., Danone S.A., PepsiCo Inc., General Mills Inc., Kraft Heinz Company, Mondelez International Inc., GlaxoSmithKline PLC, Abbott Laboratories, Herbalife Nutrition Ltd., Archer Daniels Midland Company, Chobani Global Holdings LLC, Clif Bar & Company, Dairy Farmers of America Inc., Glanbia PLC, Yakult Honsha Co., Ltd. |

Emerging Trends

- Plant-Based Foods: There is a growing shift towards plant-based diets as more consumers adopt vegan, vegetarian, or flexitarian lifestyles. Plant-based foods are seen as healthier alternatives to traditional animal products, offering lower cholesterol and higher fiber content. This trend has led to increased innovation in plant-based snacks, beverages, and protein alternatives.

- Personalized Nutrition: Advances in technology have made personalized nutrition more accessible. Consumers are seeking foods tailored to their individual health needs, such as those targeting specific nutrient deficiencies or chronic conditions. Companies are offering products that are customized based on genetic, lifestyle, or health data, promoting more effective and individualized health benefits.

- Functional Foods: Foods that offer additional health benefits beyond basic nutrition are gaining popularity. Examples include probiotics for digestive health, fortified foods with added vitamins and minerals, and foods designed to boost immunity or support mental clarity. Consumers are increasingly looking for foods that serve a dual purpose—taste and wellness.

- Clean Label Products: Transparency in food labeling is a rising trend, with consumers demanding products with simple, natural ingredients and no artificial additives. Clean labels are important for those seeking healthier, more sustainable options. This trend is leading to an increase in demand for organic, non-GMO, and minimally processed foods.

- Gut Health Focus: As awareness of the importance of gut health grows, consumers are turning to foods that promote better digestion. This includes probiotics, prebiotics, and fermented foods such as yogurt, kefir, and kimchi. A healthy gut is linked to overall wellness, immunity, and mental health, making it a key area of focus in the health and wellness food sector.

Use Cases

- Weight Management: Health wellness foods, such as low-calorie snacks, protein bars, and meal replacements, are commonly used in weight management programs. These products help individuals control their calorie intake while providing essential nutrients. Many consumers use these foods to maintain or lose weight without sacrificing nutrition, making them a popular choice in the diet and fitness industry.

- Immune Support: Functional foods, such as those fortified with vitamins (like vitamins C and D) and probiotics, are widely used to boost immune health. Consumers are turning to these foods, especially during flu seasons or health crises, to enhance their body’s natural defenses. These products are marketed as tools for maintaining overall well-being and preventing illness.

- Gut Health: Probiotic-rich foods like yogurt, kefir, and fermented vegetables are used to support digestive health. These products help improve gut microbiota, leading to better digestion, reduced bloating, and overall comfort. Many people incorporate these foods into their diets to maintain a healthy gut, which is increasingly linked to overall health, including mood and immune function.

- Mental Wellness: Certain health wellness foods, such as those containing omega-3 fatty acids, antioxidants, and adaptogens, are gaining popularity for supporting mental well-being. Consumers use these foods to reduce stress, enhance cognitive function, and improve mood. As awareness of mental health grows, these products are becoming essential in diets focused on holistic wellness.

- Athletic Performance: Sports nutrition products, including protein powders, energy bars, and electrolyte drinks, are commonly used by athletes and fitness enthusiasts to enhance performance and recovery. These health wellness foods help replenish energy stores, support muscle growth, and reduce recovery time after workouts, making them a staple for active individuals.

Major Challenges

- High Cost of Products: Many health wellness foods, especially organic and functional options, tend to be more expensive than regular food items. This cost barrier limits their accessibility to a wider audience, making it challenging for some consumers to adopt these products as part of their daily diet, especially in developing markets or for price-sensitive consumers.

- Lack of Regulation and Standardization: The health and wellness food sector lacks uniform regulations and standardization, which can lead to misleading claims about the effectiveness of products. This can make it difficult for consumers to trust the nutritional benefits of certain foods, creating confusion and skepticism about the real impact of these products on health.

- Consumer Misconceptions: Despite growing awareness, many consumers still struggle to differentiate between genuinely healthy products and those that are marketed with exaggerated health claims. Misleading advertisements or a lack of understanding about food ingredients may prevent consumers from making informed choices, limiting the growth of healthy wellness foods.

- Supply Chain Issues: The demand for organic and natural ingredients often outpaces supply, leading to challenges in sourcing high-quality raw materials. Supply chain disruptions, whether due to seasonal changes, climate conditions, or geopolitical factors, can impact the production and pricing of health wellness foods, potentially affecting product availability and market stability.

- Taste and Texture Issues: Many health wellness foods, particularly those with alternative ingredients like plant-based proteins or sugar substitutes, may not appeal to all consumers due to taste or texture differences. Overcoming consumer preferences and getting them to accept new flavors or textures remains a challenge for companies in the health food industry.

Market Growth Opportunities

- Growing Demand for Plant-Based Foods: As more consumers embrace plant-based diets for ethical, environmental, and health reasons, there is a significant opportunity for health wellness food brands to expand their offerings. Products such as plant-based meats, dairy alternatives, and vegan snacks are seeing increasing demand, creating a key growth area for companies to innovate and capture a larger market share.

- Personalized Nutrition Products: The rise of personalized nutrition presents a major growth opportunity. Consumers are seeking foods tailored to their individual health needs, such as supplements, snacks, or meals based on genetic or lifestyle data. Brands can leverage data and technology to offer customized wellness products, providing targeted solutions for weight management, immunity, and overall well-being.

- Expansion in Emerging Markets: Emerging markets, especially in Asia-Pacific and Latin America, are experiencing a growing middle class with rising disposable incomes. As these regions become more health-conscious, there is a significant opportunity for health wellness food brands to expand. Offering affordable, healthy alternatives will meet the increasing demand for nutritious products in these developing markets.

- Focus on Gut Health: With growing awareness around the importance of gut health, there is an opportunity for companies to develop more functional foods aimed at improving digestion. Probiotics, prebiotics, and fermented foods can address rising concerns about digestive health, offering companies the chance to capitalize on this expanding market segment.

- Innovation in Functional Snacks: As busy lifestyles continue, functional snacks that offer health benefits beyond basic nutrition are in demand. Products that provide energy, enhance immunity, or support mental clarity, while being portable and convenient, represent a strong growth opportunity. These innovative snack options cater to on-the-go consumers looking for healthy, quick solutions.

Recent Developments

1. Nestlé S.A.

Recent Developments:

- Innovations:

- Nestlé launched a new range of plant-based products under its Garden Gourmet brand, including vegan seafood alternatives, to cater to the growing demand for sustainable and healthy food options.

- Introduced Nestlé Health Science’s Precision Nutrition Platform, which uses AI to provide personalized nutrition recommendations.

- Developed low-sugar and low-fat versions of popular products like KitKat and Nescafé to align with global health trends.

- Acquisitions:

- Acquired Orgain, a U.S.-based leader in plant-based protein powders and functional nutrition products, to strengthen its health and wellness portfolio.

- Partnerships:

- Partnered with Perfect Day to develop animal-free dairy products using precision fermentation technology.

- Collaborated with Digimarc to enhance traceability and transparency in its supply chain, ensuring healthier and safer food products.

Contribution to Health & Wellness:

Nestlé has focused on reducing sugar, salt, and unhealthy fats in its products while expanding its plant-based and functional nutrition offerings. Its acquisitions and partnerships aim to address consumer demand for personalized, sustainable, and health-focused food options.

2. Danone S.A.

Recent Developments:

- Innovations:

- Launched probiotic-rich yogurt drinks and plant-based beverages under its Activia and Silk brands to support gut health and cater to vegan consumers.

- Introduced low-sugar and high-protein versions of its popular dairy and plant-based products.

- Acquisitions:

- Acquired Follow Your Heart, a plant-based food company, to expand its portfolio of vegan alternatives.

- Partnerships:

- Partnered with Brightseed to use AI for discovering bioactive compounds in plants that promote gut health.

- Collaborated with Mondelēz International to develop healthy snacking options combining Danone’s yogurt with Mondelēz’s crackers.

Contribution to Health & Wellness:

Danone has emphasized gut health, plant-based nutrition, and reduced sugar content in its products. Its partnerships and acquisitions aim to leverage technology and innovation for healthier food options.

3. PepsiCo Inc.

Recent Developments:

- Innovations:

- Expanded its healthier snack options under the Baked Lay’s and Off the Eaten Path brands, focusing on reduced sodium and whole grains.

- Launched functional beverages under the Gatorade Fit and Propel brands, targeting hydration and electrolyte balance.

- Acquisitions:

- Acquired Rockstar Energy Beverages to diversify its portfolio and introduce healthier energy drink options.

- Partnerships:

- Partnered with Beyond Meat to develop plant-based snacks and beverages.

- Collaborated with Danone to launch Evian+, a functional water brand infused with vitamins and minerals.

Contribution to Health & Wellness:

PepsiCo has focused on reducing unhealthy ingredients in its snacks and beverages while expanding into functional and plant-based products. Its acquisitions and partnerships aim to align with consumer demand for healthier options.

4. General Mills Inc.

Recent Developments:

- Innovations:

- Launched Annie’s Organic line of snacks and cereals with reduced sugar and added probiotics.

- Introduced Lärabar Alt, a low-sugar, high-protein snack bar.

- Acquisitions:

- Acquired TNT Crust, a manufacturer of high-quality, health-focused frozen pizza crusts, to expand its portfolio of better-for-you products.

- Partnerships:

- Partnered with MyFitnessPal to provide personalized nutrition recommendations based on General Mills’ products.

Contribution to Health & Wellness:

General Mills has focused on organic, low-sugar, and high-protein products to cater to health-conscious consumers. Its acquisitions and partnerships aim to enhance its offerings in the health and wellness space.

5. Kraft Heinz Company

Recent Developments:

- Innovations:

- Launched Oscar Mayer P3 (Protein, Portion, and Portable) snacks, focusing on high-protein, low-sugar options.

- Introduced Plant-Based Kraft Mac & Cheese to cater to the growing demand for vegan alternatives.

- Acquisitions:

- Acquired Just Spices, a German-based spice and seasoning company, to expand its portfolio of healthier flavoring options.

- Partnerships:

- Partnered with NotCo to develop plant-based versions of its iconic products, including Kraft Mayo and Cheese.

Contribution to Health & Wellness:

Kraft Heinz has focused on reducing artificial ingredients and expanding its plant-based offerings. Its acquisitions and partnerships aim to provide healthier and more sustainable food options.

Conclusion

The Health Wellness Foods Market is poised for significant growth, driven by increasing consumer demand for healthier, functional, and sustainable food options. As consumers become more health-conscious, the market presents vast opportunities for innovation, particularly in plant-based products, personalized nutrition, and functional foods targeting specific health concerns. Companies that embrace trends like clean labels, sustainable practices, and the rise of personalized health solutions are well-positioned to capitalize on the evolving market. However, challenges such as high costs, regulatory concerns, and market saturation will require strategic planning and adaptation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)