Table of Contents

Overview

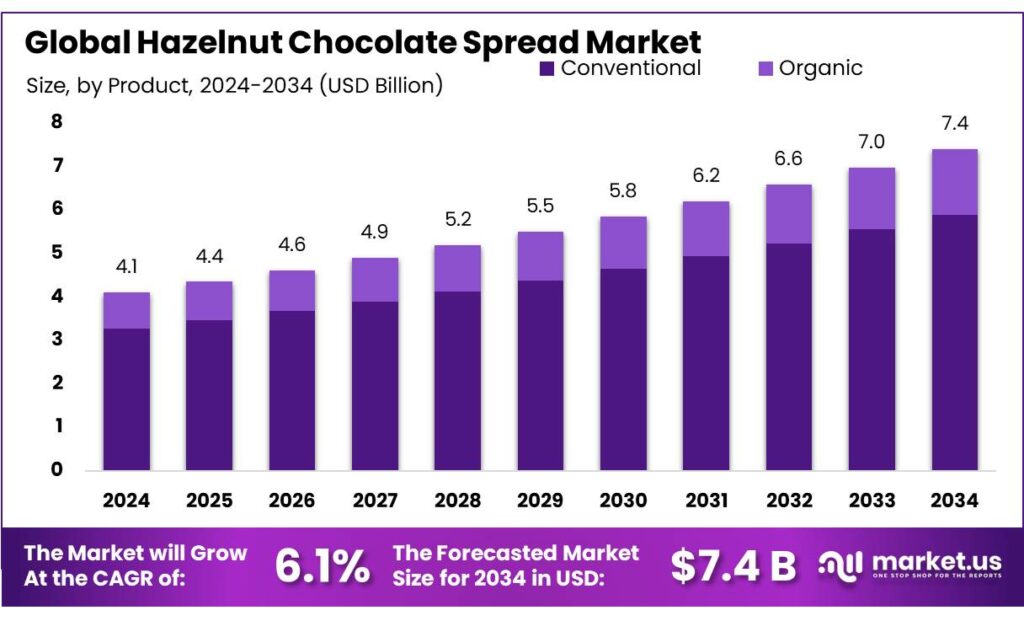

New York, NY – October 01, 2025 – The Global Hazelnut Chocolate Spread Market is projected to reach USD 7.4 billion by 2034, up from USD 4.1 billion in 2024, growing at a CAGR of 6.1% from 2025 to 2034. In 2024, North America led the market, capturing 44.8% share with revenues of USD 1.8 billion.

The industry’s expansion is shaped by changing consumer preferences, rising health awareness, and continuous product innovation. Government support for food processing and value-added products is also reinforcing growth momentum. Ferrero, the maker of Nutella, reported an 8.9% revenue increase for the financial year ending August 31, 2024, reaching EUR 18.4 billion (USD 19.2 billion).

The company boosted investments by 18% to strengthen its production capacity and expand into new product lines, including ice creams and biscuits. A major milestone is the launch of Nutella Peanut, the first new Nutella flavor in more than 60 years, set for release in the U.S. in Spring 2026. This innovation is designed to appeal to North American taste preferences and is backed by a USD 75 million investment in Ferrero’s Franklin Park factory.

Policies and programs are further accelerating market growth. In India, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) under the Ministry of Food Processing Industries is reducing wastage and supporting value addition in food products, key steps toward the country’s USD 5 trillion economy goal. Similarly, in Oregon, USA, the state government approved a USD 675,000 forgivable loan through Business Oregon’s Strategic Reserve Fund. This funding helps local hazelnut growers upgrade equipment and facilities, strengthening the regional hazelnut supply chain.

Key Takeaways

- The Global Hazelnut Chocolate Spread Market size is expected to be worth around USD 7.4 billion by 2034, from USD 4.1 billion in 2024, growing at a CAGR of 6.1%.

- Conventional hazelnut chocolate spread held a dominant market position, capturing more than 79.6% share of the global chocolate spread market.

- Supermarkets and hypermarkets held a dominant market position in the global hazelnut chocolate spread market, capturing more than a 45.8% share.

- North America held a dominant position in the global hazelnut chocolate spread market, capturing more than a 44.8% share, translating to approximately USD 1.8 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/hazelnut-chocolate-spread-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.1 Billion |

| Forecast Revenue (2034) | USD 7.4 Billion |

| CAGR (2025-2034) | 6.1% |

| Segments Covered | By Product (Conventional, Organic), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, Others) |

| Competitive Landscape | Ferrero International S.A., The Hershey Company, Nestlé S.A., Mondelez International, Inc., NUTKAO S.r.l., Dr. Oetker, Pernigotti S.p.A., Valsoia, Rigoni di Asiago, Lindt & Sprüngli |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157516

Key Market Segments

Product Analysis

In 2024, conventional hazelnut chocolate spread solidified its leading position, commanding over 79.6% of the global chocolate spread market. Its dominance stems from widespread consumer appeal, cost-effectiveness, and a loyal customer base. Popular as a versatile topping for bread, pancakes, and desserts, these spreads are marketed as convenient treats for fast-paced lifestyles.

Major brands like Nutella leverage strong brand recognition and effective marketing to maintain their edge. Additionally, the affordability of conventional spreads compared to organic alternatives makes them a preferred choice, particularly during economic downturns when consumers prioritize value.

Distribution Channel Analysis

In 2024, supermarkets and hypermarkets accounted for over 45.8% of the global hazelnut chocolate spread market. Their dominance is driven by broad accessibility, competitive pricing, and consumer convenience. These retail channels offer a diverse range of local and international brands, often paired with attractive promotions, influencing purchasing decisions. The extensive product variety and frequent discounts further strengthen their position as the leading distribution channel for hazelnut chocolate spreads.

Regional Analysis

In 2024, North America captured a commanding 44.8% share of the global hazelnut chocolate spread market, generating approximately USD 1.8 billion in revenue. This leadership is fueled by strong consumer demand, well-developed retail networks, and a rising preference for premium, indulgent food products. Canada and Mexico also contribute significantly, driven by similar consumer trends and expanding retail infrastructure. The presence of major chocolate manufacturers and the growing popularity of online retail platforms are expected to further drive market growth in the region.

Top Use Cases

- Morning Toast Delight: Start your day right by slathering hazelnut chocolate spread on warm toast for a quick, creamy treat that blends nutty richness with sweet cocoa. It’s a simple way to add indulgence to breakfast, loved by families for its easy prep and satisfying crunch when paired with fresh fruit slices, making busy mornings feel special without much effort.

- Pancake Party Topper: Transform fluffy pancakes into a weekend favorite by drizzling or spreading hazelnut chocolate over them. The smooth melt and bold flavors create a gooey, comforting layer that’s perfect for kids and adults alike, turning ordinary brunches into joyful gatherings with just a spoonful of this versatile kitchen staple.

- Dessert Crepe Filler: Fill delicate crepes with generous scoops of hazelnut chocolate spread for an elegant yet simple dessert that wows at dinner parties. The warm crepe hugs the creamy filling, offering a balance of subtle nuttiness and chocolatey bliss, ideal for romantic evenings or casual sweet tooth cravings after meals.

- Baking Blondie Booster: Mix hazelnut chocolate spread into blondie batter for fudgy, nutty bars that bake up soft and irresistible. Layer it between batter for hidden pockets of flavor, creating a homemade snack that’s great for lunchboxes or afternoon pick-me-ups, elevating basic baking with minimal ingredients and maximum yum.

- Hot Cocoa Swirl: Stir a dollop of hazelnut chocolate spread into steaming hot cocoa for an extra layer of warmth and depth. It melts seamlessly, infusing the drink with toasty hazelnut notes that make cozy nights in feel luxurious, perfect for sipping while curled up with a book or sharing stories with loved ones.

Recent Developments

1. Ferrero International S.A.

Ferrero continues to innovate within its iconic Nutella brand, focusing on sustainability and portion control. Recent developments include the global rollout of Nutella jars using 100% recycled PET plastic and the introduction of new serving formats like the Nutella & Go pot with breadsticks. The company heavily invests in marketing campaigns emphasizing natural ingredients and responsible consumption to maintain its market dominance against private-label competitors.

2. The Hershey Company

Hershey has aggressively expanded its presence in the spread category with its Hershey’s Chocolate Spread, a direct competitor to Nutella. The recent strategy involves leveraging its strong brand recognition and distribution network in North America. While recent public news is limited, the company focuses on in-store promotions and bundling with other Hershey products to gain market share, emphasizing its classic cocoa flavor profile as a key differentiator.

3. Nestlé S.A.

Nestlé re-entered the market by launching its Noa hazelnut spread in select European countries after selling its US candy business. This new brand focuses on premium quality, highlighting its use of 100% sustainable cocoa through the Nestlé Cocoa Plan and containing less sugar than the leading competitor. This launch signifies Nestlé’s commitment to capturing health-conscious consumers and leveraging its sustainability credentials.

4. Mondelez International, Inc.

Mondelez leverages its Cadbury brand strength to compete in the spread segment with Cadbury Dairy Milk Hazelnut Spread. Recent activity focuses on key markets like the UK and India, using the powerful association of the Cadbury chocolate taste. Marketing efforts often integrate the spread with other Cadbury products and seasonal campaigns, aiming to capture consumers loyal to the master brand’s flavor and heritage.

5. NUTKAO S.r.l.

As a major private-label and branded manufacturer, Nutkao’s recent development is the growth of its Rigoni di Asiago Nocciolata brand, emphasizing organic and natural ingredients. They focus on expanding distribution in North America and Europe, targeting health-food aisles. Simultaneously, their industrial arm continues to develop private-label spreads for global retailers, increasingly offering options with reduced sugar and sustainable sourcing to meet modern consumer demands.

Conclusion

Hazelnut Chocolate Spread evolves from a simple pantry favorite into a beloved staple that captures hearts worldwide. Its creamy allure and nutty charm make it a go-to for everyday joys and special moments, blending seamlessly into breakfast routines, baked goods, and sweet sips. With growing interest in healthier twists like organic versions and plant-based options, this spread continues to thrive amid busy lifestyles and wellness trends. Brands innovating with premium flavors and sustainable sourcing are set to keep it shining, offering endless ways to savor indulgence without guilt.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)