Table of Contents

Overview

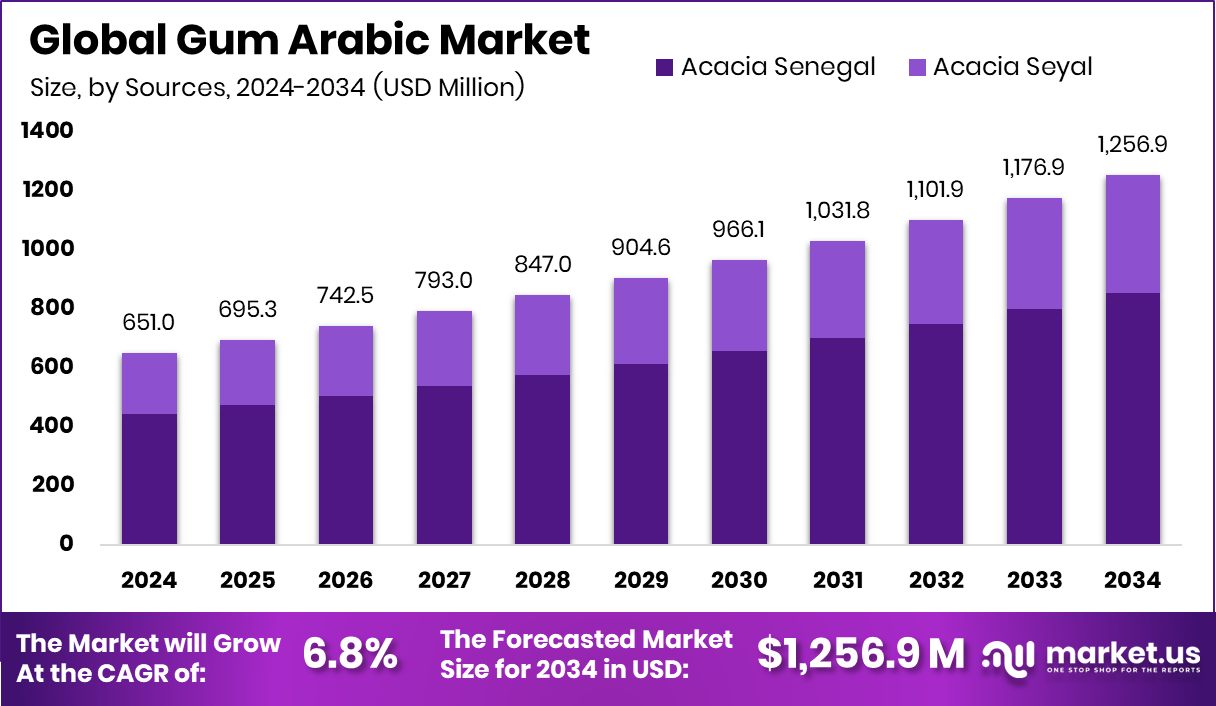

New York, NY – October 07, 2025 – The Global Gum Arabic Market is projected to reach USD 1,256.9 million by 2034, up from USD 651.0 million in 2024, growing at a CAGR of 6.8% from 2025 to 2034. In North America, strong demand for natural stabilizers drove market revenue to USD 251.2 million, accounting for a 38.6% share in 2024. This growth reflects the expanding preference for organic and plant-based ingredients across food, beverage, pharmaceutical, and cosmetic sectors.

Gum Arabic, also known as acacia gum, is a natural edible exudate derived mainly from Acacia senegal and Vachellia seyal trees. It is a water-soluble compound made of polysaccharides and glycoproteins, widely recognized for its stabilizing, emulsifying, and thickening properties. Its versatility has made it essential in multiple industries—from confectionery, bakery, and beverages to pharmaceuticals, cosmetics, and printing.

Market growth is primarily driven by rising consumer awareness of clean-label and natural products, along with the increasing use of dietary fibers and functional ingredients. Improved harvesting methods, better supply chains, and quality assurance have also expanded its global availability. Gum Arabic is used in soft drinks, candies, jams, and bakery items, as well as in pharmaceutical capsules, coatings, and industrial applications such as inks and adhesives.

Emerging opportunities lie in sustainable agroforestry practices and certified cultivation in arid regions, alongside innovation in nutraceuticals and functional foods. In India, supportive policies enhance this outlook. The National Mission on Natural Farming, approved in November 2024, allocates ₹2,481 crore to promote sustainable farming systems. Additionally, ICAR’s National Institute of Secondary Agriculture continues to drive R&D and technology development for natural gums and resins, supporting value addition and export potential.

Key Takeaways

- The Global Gum Arabic Market is expected to be worth around USD 1,256.9 million by 2034, up from USD 651.0 million in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- In 2024, Acacia Senegal dominated the gum arabic market with a strong 67.2% share globally.

- By functionality, Emulsifiers led the Gum Arabic Market in 2024, securing a 27.4% share worldwide.

- In terms of nature, conventional gum arabic captured a commanding 62.5% share in the global market.

- By application, the Food and beverages segment accounted for the largest 56.3% share of the Gum Arabic Market.

- The strong growth in North America at 38.6% share reflects expanding food and beverage applications.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-gum-arabic-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 651.0 Million |

| Forecast Revenue (2034) | USD 1,256.9 Million |

| CAGR (2025-2034) | 6.8% |

| Segments Covered | By Sources (Acacia Senegal, Acacia Seyal), By Functionality (Emulsifier, Viscosity, Solubility, Film Forming, Fat Substitute, Fiber, Stabilizer), By Nature (Organic, Conventional), By Application (Food and Beverages, Pharmaceutical, Printing and Painting, Others) |

| Competitive Landscape | Nexira, Kerry Group plc, Ingredion, Agrigum International Limited, Farbest Brands, ADM, Ashland, Hawkins Watts Limited, Gum Arabic Company |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158440

Key Market Segments

By Sources Analysis

Acacia Senegal commands a 67.2% share in the Gum Arabic Market’s By Sources segment in 2024. Its dominance stems from the gum’s superior quality, offering high solubility, excellent emulsification, and reliable performance in food, beverage, and pharmaceutical applications. Meeting stringent international standards, Acacia Senegal is the top choice for manufacturers seeking natural stabilizers and dietary fiber. The segment’s strength is fueled by rising global demand for clean-label products and natural additives, solidifying Acacia Senegal’s pivotal role in the gum arabic supply chain.

By Functionality Analysis

Emulsifiers lead the By Functionality segment of the Gum Arabic Market with a 27.4% share in 2024. Gum arabic’s role as a natural emulsifying agent in beverages, confectionery, and bakery products drives this dominance, ensuring stable ingredient blends without affecting taste or texture. The clean-label trend boosts its appeal as manufacturers pivot from synthetic alternatives. With growing use in traditional and health-focused products, the emulsifier function remains a key growth driver for the market.

By Nature Analysis

Conventional gum arabic holds a 62.5% share in the By Nature segment of the Gum Arabic Market in 2024. Its widespread cultivation, cost-effectiveness, and reliable supply chains make it the go-to choice for food, beverage, pharmaceutical, and cosmetic industries. Used extensively in soft drinks, candies, and bakery items, conventional gum arabic benefits from established trade networks and consistent availability. Its robust harvesting practices and global market acceptance ensure its continued dominance.

By Application Analysis

The Food and Beverages segment leads the Gum Arabic Market with a 56.3% share in 2024. Gum arabic’s role as a natural stabilizer, emulsifier, and thickener in soft drinks, confectionery, bakery, and flavored beverages drives its prominence. It enhances texture, improves mouthfeel, and ensures product stability, aligning with consumer demand for clean-label and natural products. The rise of functional foods and dietary fiber-enriched products further cements gum arabic’s critical role in global food and beverage formulations.

Regional Analysis

In 2024, North America led the Gum Arabic Market with a 38.6% share, valued at USD 251.2 million. The region’s dominance is driven by extensive use of gum arabic in the food and beverage industry, particularly in soft drinks, confectionery, and bakery products, where it acts as a natural emulsifier and stabilizer. Rising demand for clean-label and plant-based ingredients, especially in health-focused and functional foods, further accelerates its adoption.

North America’s edge is reinforced by advanced processing technologies and robust supply chains, ensuring consistent quality and availability. While Europe and the Asia Pacific show growing use in pharmaceuticals, cosmetics, and dietary fiber products, North America’s leadership persists due to strong consumer awareness, high demand for natural additives, and supportive regulations for clean-label formulations.

Top Use Cases

- Food and Beverages: Gum arabic acts as a natural stabilizer and emulsifier in drinks, candies, and baked goods. It mixes oils and water smoothly, prevents sugar from clumping, and keeps products fresh longer. This helps create tasty, clean-label items that consumers love for their natural feel and better texture without synthetic additives.

- Pharmaceuticals: In medicines, gum arabic serves as a binder and coating for pills and capsules. It improves drug delivery by protecting ingredients and ensuring even release in the body. Its safe, soluble nature makes it ideal for oral treatments, supporting health applications like digestive aids and wound care remedies.

- Confectionery: Gum arabic is key in making chewy candies, gums, and marshmallows. It provides stickiness and prevents crystallization, giving products a smooth, enjoyable mouthfeel. Manufacturers use it to enhance quality in sweets, meeting demand for natural alternatives that maintain flavor and shape during production.

- Cosmetics and Personal Care: This versatile gum thickens lotions, creams, and toothpaste for better spreadability and stability. It binds ingredients naturally, offering a gentle, plant-based option in skincare and oral products. Its emulsifying power helps create smooth formulas that appeal to eco-conscious users seeking clean beauty items.

- Industrial Printing and Textiles: Gum arabic controls viscosity in inks and dyes for printing and fabric work. It ensures even application and adhesion, improving efficiency in paints, glues, and textile processes. As a natural binder, it supports sustainable practices in these sectors by replacing harsher chemicals.

Recent Developments

1. Nexira

Nexira has heavily invested in sustainability and traceability for its Acacia Gum (gum arabic). They launched the “Cati” range, certified organic and sustainably sourced from the Sahel region, focusing on ethical partnerships with local communities. Recent developments highlight its application in fiber enrichment and sugar reduction in F&B, positioning it as a key natural, clean-label ingredient.

2. Kerry Group plc

Kerry leverages gum arabic within its broad portfolio of taste and nutrition solutions. Their recent focus is on system solutions, combining gum arabic with other ingredients to improve plant-based beverage stability, create low-sugar beverage emulsions, and enhance mouthfeel in reduced-fat products. This approach provides integrated, application-specific solutions for clients rather than just supplying the raw material, addressing key industry challenges like clean label and formulation efficiency.

3. Ingredion

Ingredion highlights gum arabic (under its Fibregum brand) as a critical prebiotic soluble fiber for digestive health and natural stabilization. Their recent developments focus on clinical studies supporting the symbiotic relationship between Fibregum and probiotics. They are promoting its dual function as a high-performance dietary fiber and a natural emulsifier/texturizer, helping customers meet fiber claims while ensuring product stability in beverages, dairy, and nutritional products.

4. Agrigum International Limited

As a specialist supplier, Agrigum focuses on a consistent and reliable supply of high-quality gum arabic from Sudan and West Africa. Their recent developments involve strengthening their supply chain logistics and quality control to mitigate market volatility. They emphasize providing a range of grades (spray-dried, kibbled, etc.) tailored for specific customer needs in sectors like pharmaceuticals, confectionery, and beverages, ensuring product purity and performance.

5. Farbest Brands

Farbest Brands, a distributor of specialty ingredients, has expanded its portfolio to include high-quality, non-GMO Project Verified, and organic gum arabic options. Their recent strategy involves responding to the clean-label demand by offering pure, allergen-free gum arabic as a natural alternative to synthetic stabilizers. They focus on providing technical support to North American food manufacturers for applications in beverage emulsions, flavor encapsulation, and glazes.

Conclusion

Gum Arabic is a promising natural ingredient with broad appeal across industries. Its role in stabilizing products and supporting health trends like clean labels drives steady growth. With rising focus on plant-based solutions, gum arabic stands out for its versatility, safety, and eco-friendly sourcing, positioning it well for future demand in food, health, and beyond.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)