Table of Contents

Overview

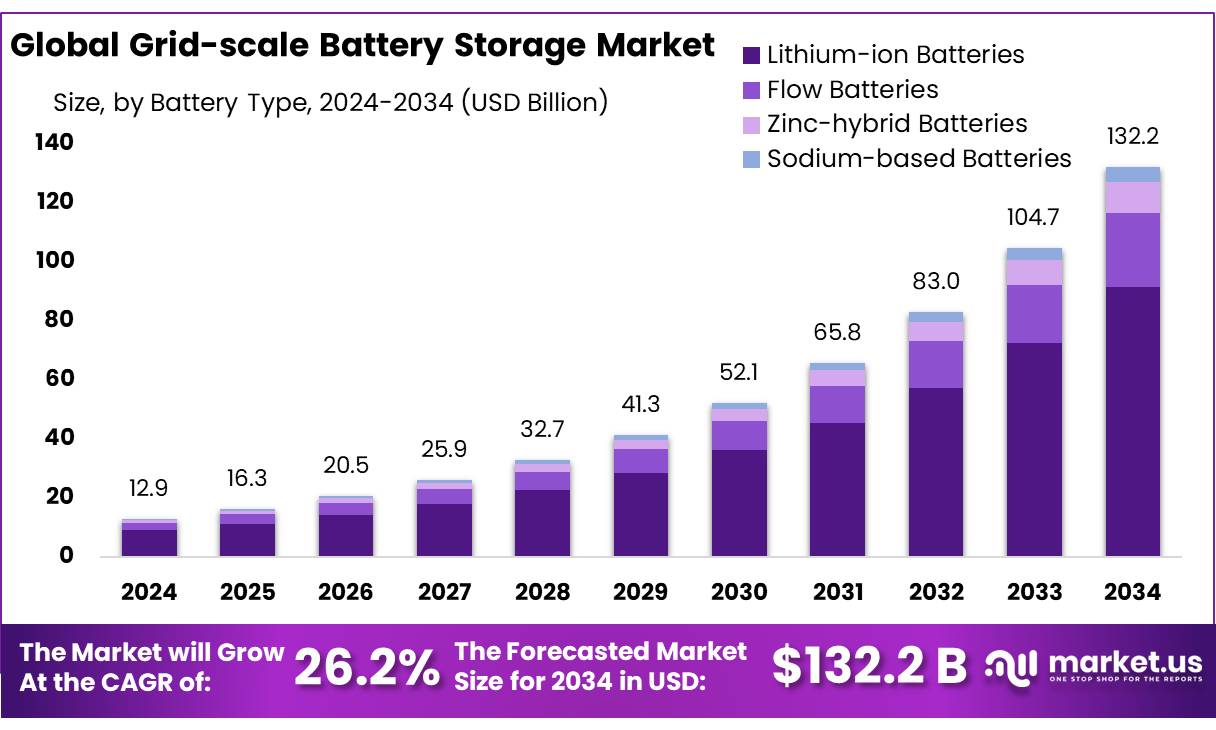

New York, NY – August 21, 2025 – The Global Grid-Scale Battery Storage Market is projected to grow significantly, reaching an estimated USD 132.2 billion by 2034, up from USD 12.9 billion in 2024, with a robust CAGR of 26.2% during the 2025–2034 forecast period. In 2024, the Asia-Pacific (APAC) region led the market, commanding a 48.3% share, equivalent to USD 6.2 billion in revenue.

Grid-scale Battery Energy Storage Systems (BESS) are crucial for India’s shift toward a sustainable and reliable energy ecosystem. These systems support the integration of variable renewable energy (VRE) sources, such as solar and wind, into the national grid by enabling load balancing, frequency regulation, and peak shaving. According to the Energy Storage System (ESS) Roadmap for India, developed by NITI Aayog and the India Smart Grid Forum, India’s energy storage demand is expected to reach 1,710 GWh and 2,416 GWh.

The Indian government has prioritized energy storage to meet renewable energy goals and ensure grid stability. The Ministry of Power introduced the Viability Gap Funding (VGF) scheme to bolster BESS projects. Under this initiative, Rajasthan has been allocated 4,000 MWh of BESS capacity, supported by central funding of ₹720 crore at ₹18 lakh per MWh. This investment aims to strengthen renewable energy storage, enhance grid reliability, and position Rajasthan as a green energy hub.

Key drivers for BESS adoption in India include declining battery technology costs, the need for flexible grid operations to support growing renewable energy integration, and supportive government policies. The National Mission on Transformative Mobility and Battery Storage provides a framework for advancing battery storage through manufacturing, deployment, and renewable energy integration. The Central Electricity Authority (CEA) estimates a need for 136 GWh of grid storage, highlighting its critical role in future energy systems.

Globally, significant investment is required to scale BESS infrastructure. Wood Mackenzie projects that USD 1.2 trillion will be needed to support the deployment of over 5,900 GW of new wind and solar capacity. In Australia, the Waratah Super Battery, recently commissioned with a capacity of 350 MW, is expected to expand to 850 MW by the end of 2025. This facility operates within a system integrity protection scheme, enhancing grid resilience during extreme events.

Key Takeaways

- Grid-scale Battery Storage Market size is expected to be worth around USD 132.2 billion by 2034, from USD 12.9 billion in 2024, growing at a CAGR of 26.2%.

- Lithium-ion Batteries held a dominant market position, capturing more than a 69.2% share of the global grid-scale battery storage market.

- Distribution Network held a dominant market position, capturing more than a 43.6% share in the grid-scale battery storage market.

- Renewable Load Sharing held a dominant market position, capturing more than a 31.7% share in the grid-scale battery storage market.

- Asia‑Pacific region stood as the leading area in the global grid‑scale battery storage sector, accounting for a commanding 48.3% share, corresponding to USD 6.2 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-grid-scale-battery-storage-market/request-sample/

Report Scope

| Market Value (2024) | USD 12.9 Billion |

| Forecast Revenue (2034) | USD 132.2 Billion |

| CAGR (2025-2034) | 26.2% |

| Segments Covered | By Battery Type (Lithium-ion Batteries, Flow Batteries, Zinc-hybrid Batteries, Sodium-based Batteries), By Deployment Network (Transmission Network, Distribution Network, Renewable Energy Generators), By Application (Renewable Load Sharing, Peak Shaving, Load Shifting, Backup Power, Others) |

| Competitive Landscape | NGK Insulators Ltd., BYD Co. Ltd., Sumitomo Electric Industries, Ltd., Samsung SDI Co. Ltd., General Electric, GS Yuasa Corp., LG Chem Ltd., Mitsubishi Electric Corp., Panasonic Corp., ABB Group, Hitachi Ltd., Fluence Energy |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154853

Key Market Segments

By Battery Type Analysis

In 2024, lithium-ion batteries dominated the global grid-scale battery storage market, securing a 69.2% share. Their leadership stems from high energy density, long cycle life, and declining production costs, making them ideal for large-scale energy storage. Lithium-ion batteries excel in handling frequent charge-discharge cycles with minimal degradation, positioning them as the top choice for utilities and grid operators.

By Deployment Network Analysis

In 2024, the distribution network segment led the grid-scale battery storage market with a 43.6% share. This segment’s prominence is driven by its critical role in local energy balancing, supporting utilities in managing peak demand, preventing outages, and integrating renewable energy sources like solar and wind at the community level.

Battery deployments in distribution networks provide rapid load balancing and voltage control, particularly in urban and semi-urban settings. By 2025, continued grid modernization and policies promoting decentralized energy systems are expected to further boost storage adoption at the distribution level, enhancing local grid reliability and renewable integration.

By Application Analysis

In 2024, renewable load sharing accounted for a 31.7% share of the grid-scale battery storage market. This application is vital for stabilizing the integration of variable renewable energy sources, such as wind and solar, by storing excess energy during high-generation periods and releasing it during low-generation times.

As global renewable energy capacity grows and governments target net-zero emissions, renewable load sharing is expected to expand further by 2025. Battery storage in this application reduces curtailment and maximizes clean energy utilization, making it a cornerstone of sustainable grid planning.

Regional Analysis

In 2024, the Asia-Pacific region dominated the global grid-scale battery storage market, contributing USD 6.2 billion and capturing a 48.3% share. This leadership is fueled by rapid renewable energy growth, particularly in solar and wind, alongside robust policy support for grid modernization and energy resilience.

In India, energy storage tenders reached 8.1 GWh of capacity in July 2025, reflecting strong momentum in large-scale storage adoption. Similarly, Australia saw significant investment, with approximately USD 2.4 billion committed to battery storage projects in early 2025, many of which reached financial close, underscoring the region’s growing demand for grid-integrated storage solutions.

Top Use Cases

- Renewable Energy Integration: Grid-scale battery storage captures excess energy from solar and wind during high production periods, releasing it when generation is low. This ensures a steady power supply, reduces reliance on fossil fuels, and supports the growth of clean energy by addressing the intermittent nature of renewables, enhancing grid reliability.

- Peak Shaving: Batteries store energy during off-peak hours when electricity is cheaper and release it during high-demand periods. This reduces strain on the grid, lowers energy costs for utilities, and prevents the need for expensive peak power plants, making electricity more affordable and efficient for consumers.

- Frequency Regulation: Grid-scale batteries quickly adjust power output to maintain grid stability by balancing supply and demand. They respond in seconds to fluctuations, ensuring consistent voltage and frequency. This is critical for modern grids with increasing renewable energy, preventing blackouts and improving overall system reliability.

- Energy Arbitrage: Batteries store energy when prices are low, such as at night, and sell it during high-price periods, like peak daytime hours. This helps utilities and operators maximize profits while stabilizing energy costs for consumers, making grid-scale storage a smart financial tool for energy markets.

- Backup Power and Resilience: During outages or extreme weather, grid-scale batteries provide instant backup power to critical infrastructure and communities. They enhance grid resilience by ensuring uninterrupted electricity supply, supporting hospitals, data centers, and remote areas, and reducing the impact of power disruptions.

Recent Developments

1. NGK Insulators Ltd.

NGK continues to advance its proprietary NAS (sodium-sulfur) battery technology, a leading solution for long-duration energy storage. A major recent development is the collaboration with BASF Stationary Energy Storage GmbH to co-develop and market the next generation of NAS batteries, aiming to enhance performance and reduce costs.

2. BYD Co. Ltd.

BYD is aggressively expanding its global footprint in the Battery-Box Premium LVL grid-scale energy storage system portfolio. A key recent development is the launch of its new MC Cube system in 2023, a large-scale containerized solution with enhanced safety features like a “knife-proof” blade design to prevent cascading failures.

3. Sumitomo Electric Industries, Ltd.

Sumitomo Electric is progressing with its unique redox flow battery (RFB) technology, which uses vanadium electrolytes. A significant recent milestone is the completion of a capacity, output flow battery system for the Hokkaido Electric Power Co. This project, one of the largest of its kind in the world.

4. Samsung SDI Co. Ltd.

Samsung SDI is focusing on high-energy density and high-power lithium-ion battery solutions for the grid. A major recent development is the launch of its latest “PRiMX” branded grid-scale battery platform, which incorporates its proven Gen.5 technology to offer superior energy density, safety, and lifecycle.

5. General Electric

GE Vernova is leveraging its deep grid expertise to develop integrated storage solutions. A key recent development is the commercial rollout of its “LV5+” 4-hour duration battery energy storage system. This product is designed to be seamlessly integrated with GE’s solar and grid-forming inverters, creating a holistic and simplified solution for developers. Furthermore.

Conclusion

Grid-scale battery storage is transforming the energy sector by enabling cleaner, more reliable, and cost-effective power systems. With growing renewable energy adoption, declining battery costs, and supportive policies, the market is set for rapid expansion. By addressing intermittency, stabilizing grids, and enhancing resilience, battery storage is a key driver in the global shift toward sustainable energy, meeting rising electricity demands efficiently.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)