Table of Contents

Overview

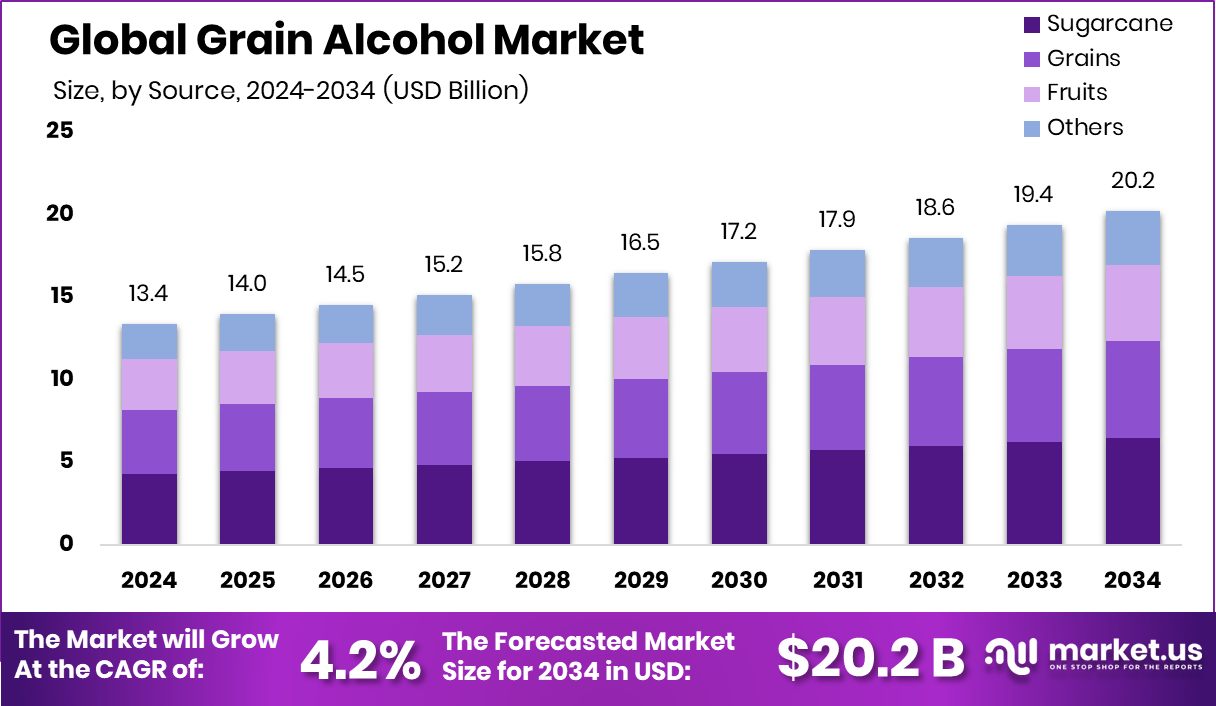

New York, NY – August 06, 2025 – The Global Grain Alcohol Market is projected to reach USD 20.2 billion by 2034, growing from USD 13.4 billion in 2024 at a CAGR of 4.2% from 2025 to 2034. Europe holds a 42.9% share, generating USD 5.7 billion in revenue.

Grain alcohol, also known as ethanol or ethyl alcohol, is a highly purified, clear, flammable liquid with an alcohol content of approximately 95% or higher, produced through the fermentation and distillation of grains like corn, wheat, rye, or barley. Its versatility drives its use across multiple sectors, including food and beverage, pharmaceuticals, personal care, and industrial applications.

The grain alcohol market involves the production, distribution, and consumption of ethanol derived from grain sources, serving both food-grade and industrial purposes. In the food and beverage industry, it is a key component in spirits, flavor extracts, and sanitizers. In industrial applications, it acts as a solvent, fuel additive, and disinfectant.

Market growth is fueled by increasing demand for bio-based solvents and clean-label products, as well as a global shift away from synthetic chemicals and petroleum-based alternatives. Grain alcohol’s biodegradability and low toxicity make it ideal for eco-friendly formulations. For instance, the government has allocated 2.8 million tonnes of surplus rice for ethanol production at subsidized rates to meet rising demand.

The pharmaceutical and personal care sectors are driving significant demand, particularly for hand sanitizers, antiseptics, and tinctures, spurred by heightened health and hygiene awareness. Its use in extracting botanical ingredients for natural medicine further supports market growth. Additionally, initiatives like Lincolnway Energy’s grain-to-alcohol system in Nevada, backed by a $1 million federal grant, highlight ongoing investments in production capacity.

Key Takeaways

- The Global Grain Alcohol Market is expected to be worth around USD 20.2 billion by 2034, up from USD 13.4 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- In the Grain Alcohol Market, sugarcane accounts for a 29.3% share as a key raw material.

- Ethanol dominates the Grain Alcohol Market by type, capturing a substantial 71.9% of the market.

- Preservative functionality leads in the Grain Alcohol Market, holding a 44.7% share in total use.

- Beverages remain the top application segment in the Grain Alcohol Market, contributing 45.8% of total demand.

- Grain alcohol demand in Europe reached USD 5.7 billion, covering 42.9 of % market.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/grain-alcohol-market/request-sample/

Report Scope

| Market Value (2024) | USD 13.4 Billion |

| Forecast Revenue (2034) | USD 20.2 Billion |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Source (Sugarcane, Grains, Fruits, Others), By Type (Ethanol, Polyols), By Functionality (Preservative, Coloring / Flavoring Agent, Coatings, Others), By Application (Beverages, Food, Pharmaceutical and Health care, Others) |

| Competitive Landscape | ADM, Cargill Inc., ChemCeed LLC, Cristalco SAS, Diageo plc, Glacial Grain Spirits LLC, Grain Processing Corporation, Greenfield Global Inc., Kweichow Moutai Co. Ltd., Manildra Group, MGP Ingredients, Pernod Ricard SA, Roquette Frères SA, Wilmar International Limited, Wuliangye Yibin Co. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153714

Key Market Segments

By Source Analysis

Sugarcane commands a 29.3% share of the grain alcohol market in 2024, leading the By Source segment due to its high fermentable sugar content, which enables cost-effective and efficient ethanol production. Its natural abundance in tropical and subtropical regions, coupled with fewer processing steps compared to grains like corn or wheat, makes sugarcane a preferred feedstock for manufacturers.

Additionally, sugarcane-based alcohol offers a lower carbon footprint, aligning with global sustainability goals and biofuel mandates. The reliable supply chain, supported by established agricultural infrastructure, ensures consistent availability, reinforcing sugarcane’s dominance. Its widespread use in beverages, biofuels, and pharmaceuticals further solidifies its position, with continued growth expected as demand for renewable raw materials rises.

By Type Analysis

Ethanol holds a commanding 71.9% share of the grain alcohol market in 2024 within the By Type segment, driven by its versatility and high purity. Widely used in food-grade applications like alcoholic beverages, flavor extracts, and preservatives, ethanol also plays a key role in personal care products, pharmaceuticals, and sanitizers due to its disinfectant properties and safety.

Its dominance is bolstered by increasing demand for bio-based solvents and clean-label products, with regulatory approvals enhancing its appeal in health-conscious sectors. Ethanol’s multifunctionality as a solvent, carrier, and active ingredient ensures its continued leadership, supported by growing industry focus on sustainable, renewable inputs.

By Functionality Analysis

In 2024, the preservative function leads the By Functionality segment with a 44.7% share, driven by grain alcohol’s ability to inhibit microbial growth and extend shelf life in food and beverage products. As consumer preference shifts toward natural and clean-label preservatives, grain alcohol is favored over synthetic alternatives in processed foods, confectionery, sauces, and ready-to-drink beverages.

Its antimicrobial properties and volatility, which leave no residue, make it ideal for maintaining product safety and quality. The global demand for stable, long-shelf-life products in food distribution chains further fuels its use, with its natural origin and regulatory acceptance ensuring sustained growth in this segment.

By Application Analysis

Beverages dominate the By Application segment in 2024, accounting for 45.8% of grain alcohol demand. Grain alcohol’s high purity, neutral flavor, and consistent quality make it a key ingredient in producing vodka, gin, whiskey, and liqueurs, catering to both large-scale and craft beverage markets.

Rising global demand for premium and flavored alcoholic drinks, particularly in regions with growing middle-class populations, drives this segment’s strength. Grain alcohol’s role in flavor extraction and preservation further enhances its value in beverage production. As consumer preferences lean toward natural and locally sourced ingredients, the beverage sector continues to anchor the grain alcohol market’s growth.

Regional Analysis

Europe leads the global grain alcohol market in 2024 with a 42.9% share, valued at USD 5.7 billion, driven by its robust alcoholic beverage industry in countries like Germany, France, and the United Kingdom. High demand for natural solvents and preservatives in food and pharmaceutical applications further strengthens Europe’s position, supported by favorable regulations and advanced alcohol processing technologies.

North America follows, with strong agricultural output and ethanol infrastructure, particularly in the U.S., fueling demand in beverages and personal care. Asia Pacific sees steady growth due to population growth, industrialization, and rising consumption of processed foods and alcoholic beverages. Latin America and the Middle East & Africa, while emerging markets, show increasing demand driven by urbanization and awareness of natural ingredients, but Europe remains the dominant force in 2024.

Top Use Cases

- Alcoholic Beverages: Grain alcohol, mainly ethanol, is a key ingredient in spirits like vodka, gin, and whiskey. Its high purity and neutral flavor make it ideal for crafting premium and flavored drinks, meeting the rising demand for craft and artisanal beverages among consumers globally.

- Pharmaceuticals: Grain alcohol is widely used in medicines, sanitizers, and antiseptics due to its disinfectant properties. It acts as a solvent in liquid drugs and tinctures, supporting the growing need for health-focused products, especially in response to increased hygiene awareness.

- Food Preservation: As a natural preservative, grain alcohol prevents microbial growth in foods like sauces and confectionery. Its ability to extend shelf life without altering taste makes it popular in processed foods, aligning with consumer demand for clean-label, natural ingredients.

- Biofuels: Grain alcohol, particularly ethanol, is blended with gasoline to create eco-friendly fuels like E10 or E20. Its renewable nature supports global mandates for reducing carbon emissions, driving demand in the energy sector, especially in regions with strong biofuel policies.

- Personal Care Products: Grain alcohol is a key component in cosmetics, perfumes, and hand sanitizers. Its solvent and antimicrobial properties make it valuable for creating safe, high-quality products, catering to the growing trend of natural and sustainable personal care solutions.

Recent Developments

1. ADM

- ADM has expanded its bioethanol production to meet growing demand for sustainable fuel and beverage alcohol. The company is investing in carbon capture and storage (CCS) to reduce emissions from its ethanol plants. ADM also collaborates with breweries and distilleries to supply high-purity grain alcohol for beverages and sanitizers. Their focus remains on innovation in fermentation technology.

2. Cargill Inc.

- Cargill has increased grain alcohol output for food, beverage, and industrial uses, emphasizing sustainability. The company is optimizing corn-based ethanol production to reduce water and energy use. Cargill also supplies non-GMO and organic grain alcohol to meet clean-label trends. Partnerships with distilleries highlight their commitment to quality and traceability.

3. ChemCeed LLC

- ChemCeed provides high-purity grain alcohol for pharmaceutical and industrial applications. Recent developments include enhanced distillation processes for ultra-pure ethanol, meeting USP and FDA standards. The company also supplies denatured alcohol for sanitizers and lab use, with a focus on rapid delivery and bulk supply chains.

4. Cristalco SAS

- Cristalco, a European leader in alcohol production, has expanded its grain-derived ethanol capacity for beverages and cosmetics. The company focuses on sustainable sourcing and carbon-neutral production. Recent innovations include flavored alcohol extracts for the food industry and bioethanol for hand sanitizers.

5. Diageo plc

- Diageo continues to innovate in grain alcohol for its premium spirits portfolio, including vodka and whiskey. The company has invested in regenerative agriculture to sustainably source grains. Diageo also uses byproducts from alcohol production for animal feed, supporting circular economy initiatives.

Conclusion

The Grain Alcohol Market is thriving due to its versatile applications in beverages, pharmaceuticals, food preservation, biofuels, personal care, industrial solvents, and herbal extracts. Growing consumer demand for premium, sustainable, and natural products, alongside supportive regulations for biofuels and health-focused goods, fuels market expansion. With ongoing trends toward craft spirits and eco-friendly solutions, grain alcohol’s role across industries will continue to grow, offering significant opportunities for innovation and market penetration.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)