Table of Contents

Overview

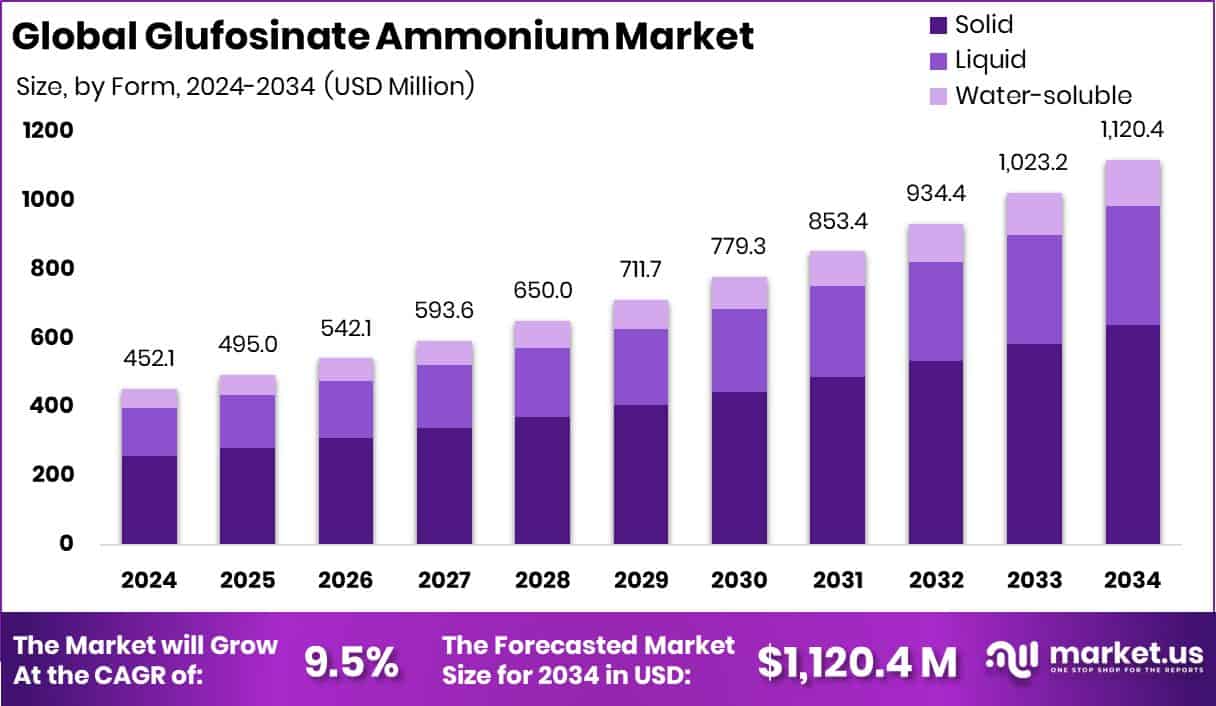

New York, NY – August 28, 2025 – The global Glufosinate Ammonium market is set for strong expansion, expected to climb from USD 452.1 million in 2024 to nearly USD 1,120.4 million by 2034, reflecting a 9.5% CAGR. North America remains the leading region, holding 41.7% of the market, valued at around USD 188.5 million, mainly due to the steady rise in herbicide-tolerant crop farming.

Glufosinate ammonium acts by blocking glutamine synthetase in plants, causing ammonia build-up and eventual plant death. Farmers favor it because of its effectiveness in tackling resistant weeds and its essential role in supporting sustainable production systems. This has made it a vital solution for ensuring better crop protection and securing higher yields on limited farmland.

Government-backed initiatives are accelerating this momentum. The USDA has directed USD 121 million into research for specialty crops and organic farming, alongside USD 72.9 million in grants to strengthen weed-control practices in fruits and vegetables.

In Asia, India secured USD 98 million from the Asian Development Bank to enhance horticulture productivity, while Sahyadri Farms attracted USD 47.8 million to expand climate-resilient crops. These actions demonstrate how glufosinate ammonium is becoming a cornerstone of global agriculture, offering dependable solutions to rising weed resistance and food security challenges.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-glufosinate-ammonium-market/request-sample/

Key Takeaways

- The Global Glufosinate Ammonium Market is expected to be worth around USD 1,120.4 million by 2034, up from USD 452.1 million in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034.

- In the Glufosinate Ammonium Market, the solid form dominates, accounting for 57.1% due to its superior storage stability.

- Weed control applications lead the Glufosinate Ammonium Market, holding a 68.7% share because of broad-spectrum effectiveness.

- Food crops drive the Glufosinate Ammonium Market, accounting for 46.3%, as farmers prioritize higher yield protection.

- Strong demand for effective weed control solutions contributed to North America’s 41.7% market share, reaching USD 188.5 million.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155612

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 452.1 Million |

| Forecast Revenue (2034) | USD 1,120.4 Million |

| CAGR (2025-2034) | 9.5% |

| Segments Covered | By Form (Solid, Liquid, Water-soluble), By Application (Weed Control, Crop Desiccant, Glufosinate-tolerant Crop), By End-Use (Food Crops (Wheat, Rice, Pulses, Others), Cash Crops (Sugarcane, Cotton, Oilseeds, Others), Horticulture Crops (Fruits, Vegetables, Plantation Crops, Tea, Coffee, Others), Others) |

| Competitive Landscape | Bayer AG, Syngenta, BASF SE, Bharat Certis AgriScience Ltd, Fargro, Lier Chemical, Sumitomo Chemical, Adama Agricultural Solutions, Corteva Agriscience, Nufarm |

Key Market Segments

By Form Analysis

In 2024, the Solid form led the By Form segment of the Glufosinate Ammonium Market, capturing 57.1% of the share. Its dominance is largely attributed to ease of storage, transportation, and use, making it the preferred option for both farmers and distributors. Solid variants, including granules and water-soluble powders, are appreciated for their longer shelf life, simple handling, and lower spill risks compared to liquids.

This strong position is also reinforced by their adaptability to different application techniques such as soil treatments and broadcast spraying, which makes them suitable for varied cropping systems. Farmers value solid formulations for accurate dosing and reduced waste, ensuring cost-effective weed management. Furthermore, their chemical stability under long storage periods and fluctuating climates enhances their demand, particularly in areas with seasonal changes.

Holding a 57.1% share in 2024, the solid form has established itself as the top segment, supported by its practical benefits and consistent results. Its use is expected to remain strong as agriculture continues to focus on reliable weed control practices.

By Application Analysis

In 2024, Weed Control dominated the By Application segment of the Glufosinate Ammonium Market with a 68.7% share. Its lead stems from proven effectiveness against both broadleaf and grassy weeds, which pose major threats to crop productivity. By reducing competition for nutrients, water, and sunlight, glufosinate plays a crucial role in protecting yields.

Farmers value its flexibility for use in both pre- and post-emergence stages, making it a reliable option across different crop cycles. Its widespread use in corn, soybeans, and cotton—crops highly susceptible to weed pressure—further secures its market strength. In addition, its alignment with herbicide-tolerant crop systems has reinforced its importance in modern agriculture.

With 68.7% of the application share in 2024, weed control remains the core growth driver for glufosinate ammonium, ensuring consistent adoption due to its versatility and dependable performance.

By End-Use Analysis

In 2024, Food Crops led the by-end-use segment of the Glufosinate Ammonium Market, holding a 46.3% share. This dominance is driven by the rising global need for cereals, grains, fruits, and vegetables, where effective weed management is critical to both food security and farm profitability. Farmers cultivating food crops face constant weed pressure that reduces yields and lowers quality, making glufosinate ammonium a key tool in their practices.

The segment’s strength is further supported by population growth and the push to increase agricultural output from limited land resources. With more than 46% of the share in 2024, food crops underscore the importance of efficient herbicides in meeting growing consumption demands. Glufosinate’s flexibility and proven results in safeguarding crop health have made it highly valued across diverse food systems.

As food crops remain central to human diets, their reliance on effective weed-control solutions ensures continued demand for glufosinate ammonium. The segment’s commanding position highlights its essential role in sustaining global food supply chains.

Regional Analysis

In 2024, North America led the Glufosinate Ammonium Market with a 41.7% share, valued at USD 188.5 million. This dominance is largely supported by the extensive cultivation of genetically modified crops like corn, soybeans, and cotton, where efficient weed control is vital for maximizing yields. Farmers in the region increasingly turn to glufosinate ammonium for its effectiveness against resistant weeds that threaten productivity.

The market’s strength is further reinforced by supportive agricultural policies, advanced cultivation methods, and the widespread adoption of precision farming. Growing emphasis on sustainable crop protection also drives demand, as producers seek solutions that combine efficiency with environmental responsibility.

Although Europe, Asia Pacific, and Latin America are contributing to global growth, North America continues to lead thanks to its advanced farming systems and higher share of herbicide-tolerant crops. This strong position underscores the region’s influence in shaping global market trends and its role in securing reliable adoption of Glufosinate Ammonium for sustainable food production.

Top Use Cases

- Burndown Weed Control Before Planting: Glufosinate is used for broadcast burndown application—sprayed across fields before planting or before crops emerge, such as corn, soybeans, canola, and sugar beets. It kills weeds on contact, helping farmers clear fields quickly for a fresh start.

- Post-Emergence in Herbicide-Tolerant Crops: Farmers apply glufosinate after crop emergence on genetically modified tolerant crops like LibertyLink® canola, corn, soybean, and cotton. It allows safe, targeted weed control without harming the resistant crop itself.

- Weed Control in Orchards and Vineyards: Because it acts only where sprayed, glufosinate can be used as a directed application around trees, vines, berries, and ornamentals—killing weeds without damaging the main plants or roots.

- Rapid Contact Control of Annual and Perennial Weeds: As a contact herbicide, glufosinate quickly kills annual and perennial grasses and broadleaf weeds. It requires good leaf coverage and works rapidly—necrosis is usually visible within 2–4 days—making it ideal for fast-season cropping and clean field maintenance.

- Managing Glyphosate-Resistant Weeds and Resistance Rotation: Glufosinate offers a different mode of action from glyphosate, making it valuable in rotating herbicides for resistance management. It’s effective against glyphosate-resistant weeds like Amaranthus, Lolium, and Conyza, reducing the risk of resistance development.

Recent Developments

- In June 2025, Bayer published an article about how glufosinate ammonium works—explaining that it’s a nonselective, water-soluble herbicide that blocks glutamine synthetase, effectively killing many emerging weeds. This reinforces its role in modern weed management systems.

- In October 2024, BASF received approval from the U.S. EPA for Liberty ULTRA herbicide, a next-generation product based on L‑glufosinate ammonium. This new version uses Glu‑L™ Technology and a special formulation to deliver 20% better weed control than generic versions, making it a powerful tool for farmers growing glufosinate‑resistant corn, soybeans, cotton, and canola.

- In March 2024, Syngenta opened a modern seed health laboratory in India. This high-tech facility tests seeds for diseases, ensuring healthier, stronger planting materials for farmers. Syngenta works on developing and supplying improved seeds, and this lab helps secure the quality of seeds before they reach farmers.

Conclusion

The Glufosinate Ammonium Market is set to remain a vital part of global agriculture, supported by its strong effectiveness against resistant weeds and adaptability across diverse crops. Its role in genetically modified and herbicide-tolerant systems highlights its importance in sustaining yields amid rising food demand.

Backed by supportive government initiatives, advanced formulations, and reliable performance, glufosinate continues to stand out as a preferred herbicide choice. With expanding adoption in both developed and emerging regions, it ensures farmers achieve higher productivity while balancing environmental concerns, securing its place as a cornerstone of modern and sustainable weed management solutions worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)