Table of Contents

Overview

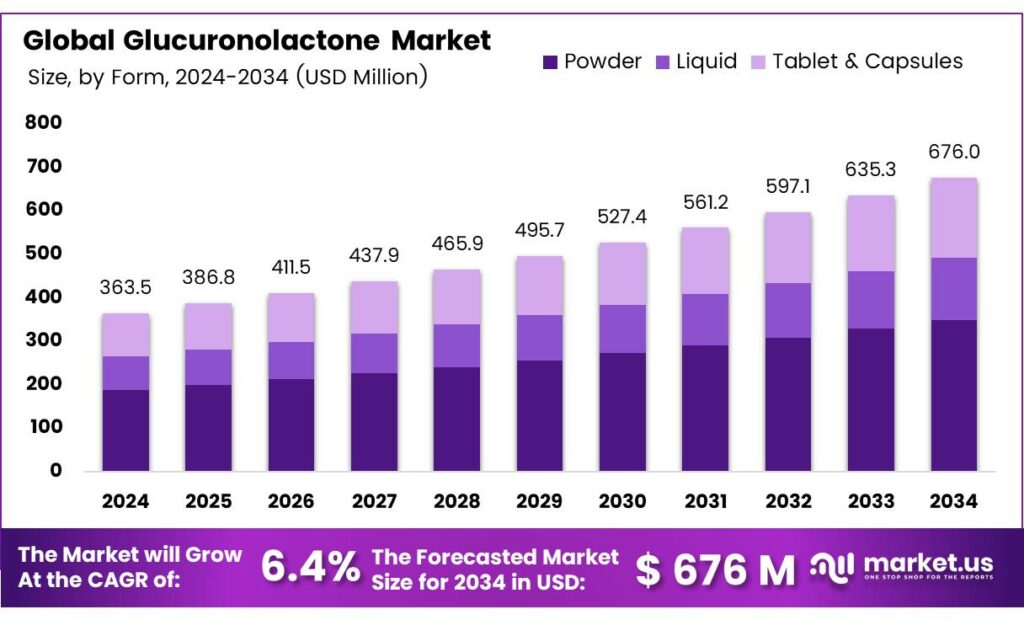

New York, NY – September 24, 2025 – The Global Glucuronolactone Market is projected to reach USD 676.0 million by 2034, up from USD 363.5 million in 2024, growing at a CAGR of 6.4% between 2025 and 2034.

Glucuronolactone, a metabolite of glucose, is naturally produced in the human body and plays a role in forming fibrous connective tissue. Typical dietary intake is relatively low, averaging 1–2 mg per day. When consumed orally, glucuronolactone is fully absorbed, metabolized, and excreted in urine as glucuronic acid, xylitol, and L-xylulose. Studies have shown that glucuronolactone supplementation can enhance swimming performance, raise blood sugar levels, and increase liver glycogen, effects not observed with other sugars.

The rising global consumption of energy drinks (EDs) has brought glucuronolactone into the spotlight, alongside caffeine (approximately 32 mg/100 mL) and taurine (around 4,000 mg/L), as key active ingredients. Research assessing exposure to these components across different consumption scenarios highlights potential health risks and safe intake limits. Caffeine intake from EDs ranges between 80–160 mg (1.14–4 mg/kg body weight). To prevent sleep disturbances, the recommended daily ED limits are 175 mL for individuals weighing 40 kg, 262.5 mL for those weighing 60 kg, and 350 mL for those weighing 80 kg.

To avoid broader caffeine-related health issues, limits rise to 375 mL, 562.5 mL, and 750 mL, respectively. Dietary exposure to D-glucuronolactone from EDs ranges from 600–1200 mg (7.5–30 mg/kg body weight). A safe margin of safety (MOS ≥ 100) is achieved only when consumption is limited to 250 mL for individuals over 60 kg, with higher intakes posing some risk. Taurine exposure varies between 1000–2000 mg (12.5–50 mg/kg body weight), exceeding reference values if consumption surpasses 500 mL.

Key Takeaways

- The Global Glucuronolactone Market is projected to grow from USD 363.5 million in 2024 to USD 676.0 million by 2034, with a CAGR of 6.4%.

- Powder form dominated the market in 2024, holding a 51.7% share due to its versatility in energy drinks, supplements, and pharmaceuticals.

- Supermarkets and Hypermarkets led distribution channels in 2024, capturing a 34.5% share due to their accessibility in health product purchases.

- Energy Drinks were the top application in 2024, with a 43.8% market share driven by demand for functional beverages.

- The Asia-Pacific region held the largest market share in 2024 at 42.8%, generating USD 155.5 million in revenue.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-glucuronolactone-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 363.5 Million |

| Forecast Revenue (2034) | USD 676.0 Million |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Form, Powder (Liquid, Tablet, and Capsules), By End Use (Energy Drinks, Dietary Supplements, Pharmaceuticals, Cosmetics, Functional Foods, Others), By Distribution channel (Supermarkets and Hypermarkets, Online Retail, Pharmacies and Drugstores, Specialty Health Stores, Others) |

| Competitive Landscape | Aceto Corporation, Anhui Fubore Pharmaceutical and Chemical Co., Ltd., Hubei Yitai Pharmaceutical Co., Ltd., Foodchem International Corporation, Shandong Fuyang Bio-Tech Co., Ltd., Roquette Freres, Jungbunzlauer Suisse AG, Suzhou Fifth Pharmaceutical Factory Co., Cargill |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157003

Key Market Segments

By Form

Powder Commands 51.7% Market Share

In 2024, the powder form of glucuronolactone held a leading 51.7% share of the global market. Its dominance is driven by its versatility in applications like energy drinks, dietary supplements, and pharmaceuticals, where it enables precise formulations and easy blending. Manufacturers favor powder for its stability, extended shelf life, and cost-efficiency in large-scale production. With growing consumer demand for energy-boosting and detox-supporting supplements, powdered glucuronolactone is expected to maintain its strong position, supported by its ease of transport and storage across both developed and emerging markets.

By Distribution Channel

Supermarkets and Hypermarkets Lead with 34.5% Share

Supermarkets and hypermarkets captured a 34.5% share of the glucuronolactone market in 2024, driven by their accessibility and appeal as go-to shopping destinations for health-focused products. These retail channels benefit from prominent product displays and consumer trust, making them ideal for selling glucuronolactone-based items like energy drinks and supplements. As urbanization and organized retail grow in emerging economies, supermarkets and hypermarkets are expected to strengthen their dominance by offering dedicated health and wellness sections and leveraging promotions to attract consumers.

By End Use

Energy Drinks Hold 43.8% Market Share

Energy drinks dominated the glucuronolactone market in 2024, accounting for 43.8% of the market share. Their popularity is fueled by rising demand for beverages that enhance energy, focus, and endurance across diverse consumer groups, including young adults, athletes, and professionals.

Glucuronolactone’s detoxifying and cognitive-enhancing properties make it a key ingredient in these formulations. The segment is poised for continued growth, driven by innovations like sugar-free, plant-based, and fortified energy drinks that appeal to health-conscious consumers with active lifestyles.

Regional Analysis

Asia-Pacific Leads with 42.8% Share and USD 155.5 Million

In 2024, the Asia-Pacific (APAC) region led the global glucuronolactone market, capturing a 42.8% share and generating USD 155.5 million in revenue. This dominance is driven by rapid urbanization, rising disposable incomes, and growing awareness of health and wellness in countries like China and India.

These nations serve as both major production hubs and high-demand markets, supported by robust growth in the food and beverage and pharmaceutical sectors. APAC’s strong manufacturing base and expanding middle class position it as the market’s growth engine, surpassing regions like North America and Europe. With favorable economic trends and a focus on functional products, APAC is set to maintain its leadership in the global glucuronolactone industry.

Top Use Cases

- Energy Drink Formulation: Glucuronolactone serves as a key ingredient in energy drinks, helping to boost stamina and mental sharpness during workouts or long days. It pairs well with caffeine and taurine to fight tiredness, making drinks more appealing to active folks like athletes and busy professionals who need quick pick-me-ups without crashes. This use drives steady demand in the beverage sector for natural-feeling energy solutions.

- Sports Nutrition Supplements: In sports supplements, glucuronolactone aids recovery by easing muscle strain and sharpening focus after intense exercise. Bodybuilders and runners often add it to pre-workout mixes for better endurance and less fatigue. It’s natural detox support helps clear out exercise byproducts, appealing to fitness enthusiasts seeking cleaner, effective ways to enhance performance and bounce back faster.

- Detox and Liver Health Aids: Glucuronolactone acts as a gentle detox helper in wellness supplements, supporting the liver in flushing everyday toxins from diet and stress. Health-conscious users turn to it for better overall cleansing, especially after heavy meals or alcohol. This application fits the rising trend of preventive health products that promote natural body balance and vitality without harsh methods.

- Cognitive and Focus Enhancers: As a nootropic in brain-boosting supplements, glucuronolactone helps clear mental fog and improve concentration for students or office workers. It supports better memory and alertness by aiding brain detox processes, making it popular in daily capsules. This use taps into the growing need for simple, natural aids to stay sharp in fast-paced lives.

- Skincare and Beauty Formulations: In topical skincare, glucuronolactone hydrates and detoxifies skin, reducing dullness and boosting elasticity for a fresher look. It’s added to creams for its mild exfoliating touch, helping with anti-aging by clearing impurities. Beauty brands love it for clean, plant-based appeal, attracting users wanting gentle, effective routines that enhance glow from within.

Recent Developments

1. Aceto Corporation

Aceto Corporation was acquired by New Mountain Capital in 2021 and is now operating as a private company. Its strategic focus has shifted towards high-growth areas like biopharmaceuticals and specialty ingredients. While historically a supplier, recent developments suggest a refined portfolio, with Glucuronolactone likely positioned as a reliable, compliant ingredient within their broader life sciences and performance chemicals segment, emphasizing supply chain stability and regulatory support for their customers.

2. Anhui Fubore Pharmaceutical and Chemical Co., Ltd.

Anhui Fubore focuses on the integrated production of pharmaceutical intermediates and fine chemicals. Recent developments for their Glucuronolactone involve emphasizing their vertically controlled manufacturing process, which ensures high purity suitable for pharmaceutical applications. The company is likely investing in regulatory compliance (e.g., GMP standards) to strengthen its position as a supplier for both the nutraceutical and pharmaceutical industries, targeting markets in Europe and North America.

3. Hubei Yitai Pharmaceutical Co., Ltd.

Hubei Yitai Pharmaceutical specializes in the research and production of APIs and intermediates. Their recent developments in Glucuronolactone are centered on technological advancements in fermentation and synthesis to improve yield and purity. The company highlights its capabilities in producing pharmaceutical-grade material, focusing on rigorous quality control to meet the stringent requirements of global pharmaceutical clients and expand its international market share.

4. Foodchem International Corporation

As a leading global distributor, Foodchem’s recent developments focus on supply chain resilience for ingredients like Glucuronolactone. The company emphasizes its extensive warehouse network and logistics expertise to ensure reliable, global delivery. Key developments include obtaining new third-party certifications (like ISO 22000) for its quality management system, enhancing its documentation and traceability processes to provide customers with consistent, food-grade quality Glucuronolactone.

5. Shandong Fuyang Bio-Tech Co., Ltd.

Shandong Fuyang Bio-Tech is a key manufacturer with a focus on bio-fermentation technology. Their most significant recent development is the expansion of production capacity for Glucuronolactone to meet rising global demand, particularly from the energy drink and sports nutrition sectors. They are actively promoting their non-GMO, plant-based fermentation process, positioning their product as a natural and sustainable ingredient for health-conscious consumers.

Conclusion

Glucuronolactone stands out as a versatile natural compound in the health and wellness space, quietly powering everything from energizing beverages to recovery aids and beauty essentials. As consumers chase balanced lifestyles with fewer artificial additives, this ingredient’s detox and performance perks position it for broader adoption across supplements and personal care. Market trends point to steady growth, fueled by demand for simple, body-friendly options that support daily vitality without complexity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)