Table of Contents

Overview

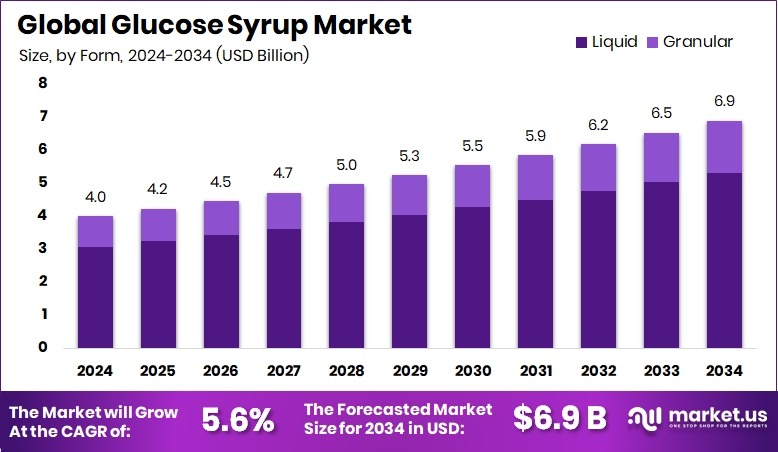

New York, NY – October 06, 2025 – The Global Glucose Syrup Market is projected to grow from USD 4.0 billion in 2024 to around USD 6.9 billion by 2034, registering a CAGR of 5.6% between 2025 and 2034. North America, valued at USD 1.9 billion, remains a key market supported by the rising consumption of processed foods.

Glucose syrup demand is expanding across food, beverage, pharmaceutical, and industrial sectors due to its dual role as a sweetener and functional ingredient—preventing crystallization, enhancing texture, and extending shelf life. Its wide use in confectionery, bakery products, ice creams, sauces, and soft drinks reflects growing reliance on processed and convenience foods globally.

The industry benefits from abundant starch crops like corn and wheat, supported by favorable government subsidies. For instance, U.S. corn farmers received USD 3.2 billion in subsidies in 2024, ensuring stable feedstock for syrup manufacturers. India’s ethanol policies also open new opportunities by allowing sugar and syrup producers to diversify production.

Financial support, such as the Rs 604.04 crore interest subvention for sugar mills in 2024–25, enables modernization and ethanol integration. Additionally, niche opportunities are emerging in specialized glucose syrups, like high-maltose variants used in brewing and confectionery. Together, government policies, raw material availability, and strong demand for processed food position glucose syrup as a vital component in the global food and industrial supply chain.

Key Takeaways

- The Global Glucose Syrup Market is expected to be worth around USD 6.9 billion by 2034, up from USD 4.0 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- In 2024, Liquid held a dominant 76.9% share in the global Glucose Syrup Market.

- Corn emerged as the leading source with a 49.2% share in the Glucose Syrup Market.

- Food application dominated, capturing a 37.4% share, strengthening its role in the Glucose Syrup Market.

- The 48.9% share in North America reflects strong demand for confectionery, beverages, and bakery applications.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-glucose-syrup-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.0 Billion |

| Forecast Revenue (2034) | USD 6.9 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Form (Liquid, Granular), By Source (Corn, Wheat, Barley, Potatoes, Rice, Cassava, Others), By Application (Foods, Confectionery, Baking and Desserts, Beverages, Pharmaceuticals, Others) |

| Competitive Landscape | Cargill, Inc., Agrana Group, Avebe U.A., Bakers Kitchen, Archer Daniels Midland, Beneo, Ingredion, Dr. Oetker, Grain Processing Corporation, L’Epicerie |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158163

Key Market Segments

By Form Analysis

Liquid glucose syrup led the market in 2024, capturing a 76.9% share in the By Form segment. Its dominance is driven by its versatility and ease of use in the food and beverage industries, particularly in confectionery, bakery, beverages, and ice cream production.

Liquid glucose syrup prevents crystallization, improves texture, and ensures moisture stability, making it a preferred choice. Its smooth consistency enables efficient blending, reducing processing times and ensuring consistent quality. The cost-effectiveness of liquid glucose, supported by abundant starch-based raw materials, further solidifies its widespread use, fueled by rising demand for processed foods and ready-to-drink beverages.

By Source Analysis

Corn dominated the By Source segment in 2024, holding a 49.2% market share. Its leadership stems from corn’s abundant availability, high starch content, and cost-effectiveness for large-scale glucose syrup production. Corn-based glucose syrup is widely used in confectionery, beverages, bakery products, and processed foods due to its reliable sweetness, texture enhancement, and stability. In 2024, US$3.2 billion in government subsidies for corn farmers bolstered affordability and supply chain reliability, reinforcing corn’s position as the most economical and preferred source for glucose syrup globally.

By Application Analysis

The food sector led the By Application segment in 2024, accounting for 37.4% of market demand. Glucose syrup’s critical role in bakery products, confectionery, sauces, jams, and ice creams drives its dominance, offering texture improvement, crystallization prevention, and enhanced gloss. The surge in demand for packaged and ready-to-eat foods, driven by urban lifestyles and expanding retail networks, has boosted its adoption. As a cost-effective sweetener compared to traditional sugar, glucose syrup remains a staple in large-scale food production, solidifying the food industry’s position as the largest consumer.

Regional Analysis

North America led the global Glucose Syrup Market in 2024, with a 48.9% share valued at USD 1.9 billion. This dominance is driven by the region’s advanced food and beverage industry, where glucose syrup is extensively used in confectionery, bakery, beverages, and processed foods.

The U.S., a major global corn producer, benefits from a stable and cost-effective starch supply, supported by government subsidies. Rising consumer demand for convenience foods, including ready-to-eat and frozen products, combined with robust retail infrastructure and multinational food companies, further strengthens North America’s market leadership.

Top Use Cases

- Confectionery Production: Glucose syrup acts as a key ingredient in making candies and sweets, where it prevents sugar from crystallizing to ensure a smooth, chewy texture. It adds sweetness without overpowering flavors and helps control viscosity for easier molding and shaping during production. This makes it ideal for creating glossy, stable confections that appeal to consumers seeking enjoyable treats.

- Bakery Goods: In baking, glucose syrup keeps cakes, pastries, and breads moist by retaining water and preventing dryness over time. It enhances softness and volume while adding mild sweetness that complements other ingredients. Bakers rely on it to improve overall texture and extend freshness, making products more appealing in busy retail settings.

- Beverage Formulation: Glucose syrup sweetens soft drinks, juices, and sports beverages without causing cloudiness or separation. It blends easily into liquids, providing consistent flavor and body while acting as a stabilizer for carbonation. This versatility supports the creation of refreshing, shelf-stable drinks that meet everyday consumer demands for taste and convenience.

- Ice Cream Manufacturing: For ice creams and frozen desserts, glucose syrup lowers the freezing point to create a creamy, scoopable consistency without ice crystals forming. It maintains smoothness and prevents hardening during storage, enhancing mouthfeel and indulgence. This functional role ensures high-quality frozen treats that delight customers year-round.

- Pharmaceutical Applications: Glucose syrup serves as a base in syrups, tablets, and oral medications, offering sweetness and binding properties for better palatability. It acts as a humectant to keep formulations stable and easy to swallow, especially for children and the elderly. Its neutral profile makes it a reliable choice for improving drug delivery in health products.

Recent Developments

1. Cargill, Inc.

Cargill is expanding its portfolio of clean-label sweeteners, developing glucose syrups with improved process tolerance for confectionery. They are also investing in sustainable production, leveraging their global supply chain to ensure reliability. A key focus is providing technical support to help manufacturers optimize recipes for texture and shelf-life using their diverse syrup range, catering to the demand for consistent, high-quality ingredients.

2. Agrana Group

Agrana continues to strengthen its position in the European market by emphasizing the non-GMO and EU-origin status of its starch sugars, including glucose syrups. Recent developments focus on supplying the beverage and confectionery industries with syrups that ensure stable sweetness and mouthfeel. They are also integrating their syrup production more deeply with their fruit preparations business to create innovative solutions for the dairy and bakery sectors.

3. Avebe U.A.

Avebe, a potato starch cooperative, is innovating with potato-based glucose syrups, highlighting their neutral taste and non-GMO credentials. Recent developments include optimizing their Potex texturizer, a glucose syrup derivative, to replace gelatin in gummy candies for vegan applications. They are also focusing on syrups with specific carbohydrate profiles for efficient fermentation in industrial biotechnology and alcohol production.

4. Bakers Kitchen

As a UK-based supplier, Bakers Kitchen’s recent focus is on securing a stable supply of glucose syrup for the craft bakery and foodservice sectors amidst volatile market prices. Their developments are less about production and more about logistics and customer support, ensuring consistent availability of essential syrups for icings, fillings, and baked goods. They emphasize reliable delivery and technical advice for small-to-medium enterprises.

5. Archer Daniels Midland (ADM)

ADM is aggressively expanding its carbohydrate solutions, including a new net-zero glucose syrup facility in Clinton, Iowa. They are leveraging fermentation and biotechnology to create novel ingredients from glucose syrups, such as sustainable food proteins and biosolutions. ADM’s recent developments focus on using syrup as a renewable feedstock for a wide range of products beyond traditional food, positioning it as a cornerstone of the bioeconomy.

Conclusion

Glucose Syrup stands out as a versatile staple in the food and pharmaceutical sectors, driven by its ability to enhance texture, sweetness, and stability in everyday products. As consumer preferences shift toward convenient and indulgent items, the market continues to thrive on innovation and reliable supply chains, promising sustained relevance for manufacturers adapting to evolving demands.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)