Table of Contents

Overview

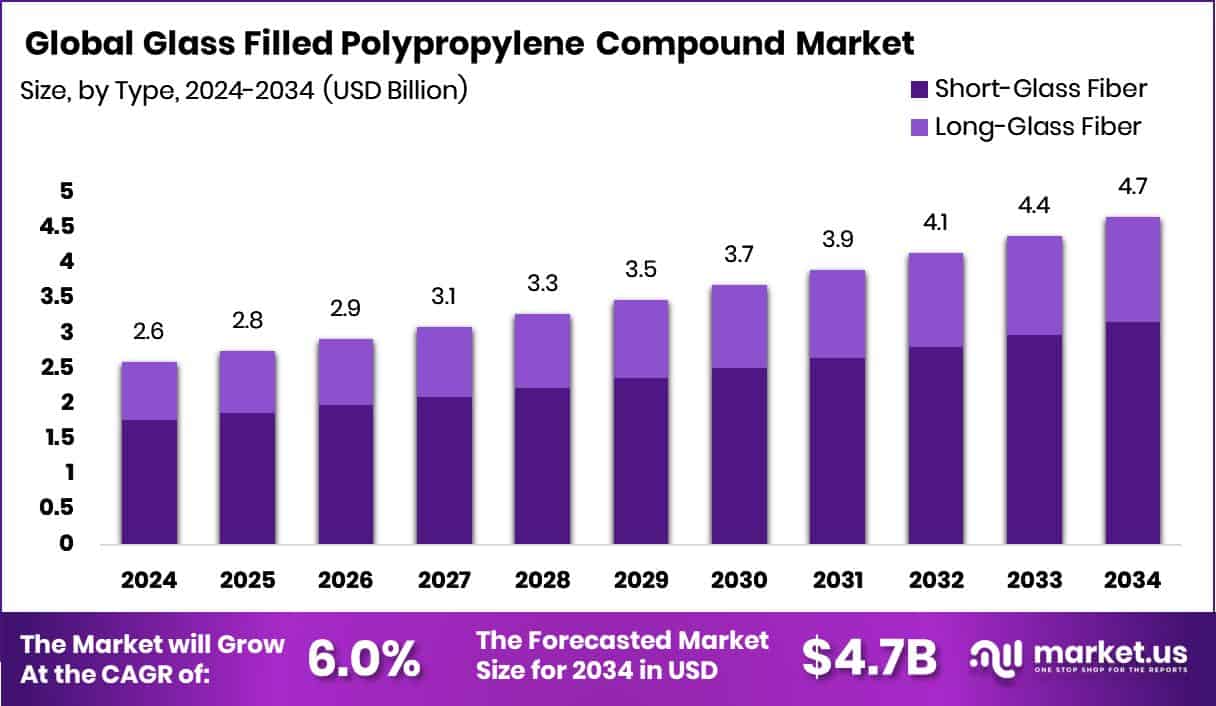

New York, NY – October 15, 2025 – The global glass-filled polypropylene (PP) compound market is poised for strong growth, reaching around USD 4.7 billion by 2034 from USD 2.6 billion in 2024, expanding at a 6.0% CAGR. Asia-Pacific leads with a 43.9% share due to robust industrialization and manufacturing expansion.

Glass-filled PP combines short glass fibers (10–40 wt%) with a PP matrix, enhancing stiffness, thermal stability, and strength while maintaining low density and easy processability. Demand is driven by automotive lightweighting—where metal parts are replaced with reinforced PP components for improved fuel or EV efficiency—and by durable applications in appliances, electronics, and infrastructure.

The market benefits from increasing adoption in dashboards, housings, piping, and structural parts. Opportunities lie in developing advanced grades offering better UV resistance and recyclability. Capital inflows further support growth: Knack Packaging filed for a ₹ 475 crore IPO to expand PP bag capacity; a PP Recycling Coalition aims for 5% recycling growth; a Houston firm raised USD 12 million Series A for a decarbonization plant; and BPCL announced a ₹ 5,044 crore investment in a polypropylene plant at Kochi Refinery. These moves highlight expanding capacity, improved sustainability, and ongoing innovation across the polypropylene value chain, strengthening the global glass-filled PP compound market’s long-term foundation.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-glass-filled-polypropylene-compound-market/request-sample/

Key Takeaways

- The Global Glass Filled Polypropylene Compound Market is expected to be worth around USD 4.7 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In 2024, short-glass fiber dominated the Glass Filled Polypropylene Compound Market with a 67.9% share.

- Injection molding held a 49.7% share in the Glass Filled Polypropylene Compound Market in 2024.

- Engine and transmission parts captured a 31.4% share in the Glass Filled Polypropylene Compound Market in 2024.

- The automotive sector led the Glass Filled Polypropylene Compound Market with a 39.6% share in 2024.

- The Asia-Pacific market value reached approximately USD 1.1 billion during the year.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161096

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.6 Billion |

| Forecast Revenue (2034) | USD 4.7 Billion |

| CAGR (2025-2034) | 6.0% |

| Segments Covered | By Type (Short-Glass Fiber, Long-Glass Fiber), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By Application (Air Vent Control, Door Panels, Bed Frames, Engine and Transmission, EV Charging Systems, Others), By End-Use (Automotive, (Passenger Vehicle, Commercial Vehicle), Electrical and Electronics, Furniture, Construction, Other) |

| Competitive Landscape | Mitsui Chemicals, Inc., Japan Polypropylene Corporation, Saudi Basic Industries Corporation, POLYONE Corporation, LyondellBasell Industries Holdings B.V., Kingfa Sci. & Tech. Co., Limited, Washington Penn Plastic Co., Inc., Borealis AG, Sparsh Polychem Private Limited, and Ravago S.A. |

Key Market Segments

By Type Analysis

In 2024, Short-Glass Fiber dominated the By Type segment of the Glass-Filled Polypropylene Compound Market, capturing a 67.9% share. This strong position stems from its balanced combination of strength, stiffness, and ease of processing, making it highly suitable for producing durable molded components.

Short-glass fiber compounds deliver excellent dimensional stability, heat resistance, and mechanical strength while retaining lightweight and cost-effective advantages. Their versatility drives extensive use in automotive parts, consumer appliances, and electrical components, where performance and efficiency are equally vital.

Additionally, their seamless compatibility with injection and compression molding processes enhances manufacturing productivity. As industries increasingly demand reliable and high-strength polymer composites, short-glass fiber continues to be the preferred reinforcement choice for manufacturers aiming to reduce weight, enhance durability, and optimize production costs in large-scale applications.

By Processing Method Analysis

In 2024, Injection Molding dominated the By Processing Method segment of the Glass-Filled Polypropylene Compound Market, capturing a 49.7% share. This leadership reflects its precision in producing complex and high-quality components with consistent repeatability and excellent surface finish. The process allows uniform dispersion of glass fibers within the polypropylene matrix, yielding parts with enhanced mechanical strength, dimensional stability, and thermal resistance.

Its efficiency and scalability make injection molding the preferred choice for mass production of automotive parts, appliance housings, and electrical fittings. Additionally, its compatibility with automated manufacturing systems, minimal material wastage, and cost-effectiveness further boost adoption.

As industries continue to prioritize high-performance materials and streamlined manufacturing, injection molding remains essential for achieving durable, lightweight, and precision-engineered glass-filled polypropylene components across diverse industrial sectors.

By Application Analysis

In 2024, Engine and Transmission dominated the By Application segment of the Glass-Filled Polypropylene Compound Market, securing a 31.4% share. This leadership is attributed to the material’s exceptional heat resistance, rigidity, and dimensional stability, essential for demanding automotive environments.

Glass-filled polypropylene is extensively used in engine covers, air intake manifolds, and transmission housings, replacing heavier metals to enhance fuel efficiency and reduce vehicle weight. Its strong resistance to oil, grease, and high thermal stress ensures durability and reliability in long-term use.

Offering an ideal blend of cost-effectiveness, design versatility, and mechanical strength, glass-filled polypropylene remains the preferred material for under-the-hood automotive components, supporting the industry’s ongoing shift toward lightweight, efficient, and high-performance vehicle manufacturing.

By End-Use Analysis

In 2024, the Automotive sector dominated the By End-Use segment of the Glass-Filled Polypropylene Compound Market, accounting for a 39.6% share. This leadership reflects the growing demand for lightweight, durable materials that improve vehicle efficiency and performance.

Glass-filled polypropylene provides superior stiffness, thermal stability, and chemical resistance, making it ideal for manufacturing interior panels, bumpers, engine covers, and under-the-hood parts. Its capability to replace metal components without sacrificing strength aligns with automakers’ sustainability and cost-reduction objectives.

Additionally, its flexibility in molding intricate designs and compatibility with mass-production techniques enhance production efficiency. As automotive manufacturers continue focusing on lightweight construction and fuel economy, glass-filled polypropylene remains a key material in modern vehicle design and engineering, supporting the transition toward more efficient and environmentally responsible manufacturing.

Regional Analysis

In 2024, Asia-Pacific dominated the Glass-Filled Polypropylene Compound Market with a 43.90% share, valued at approximately USD 1.1 billion. This regional leadership stems from rapid industrialization, robust automotive production, and expanding electrical and electronics manufacturing in key economies like China, Japan, India, and South Korea. The growing emphasis on lightweight, high-performance materials for vehicles and appliances continues to drive strong regional demand.

North America shows steady growth, supported by advanced manufacturing and demand for durable polymer components, while Europe benefits from strict environmental policies encouraging recyclable materials.

Emerging markets in the Middle East & Africa and Latin America are gradually expanding through investments in construction, packaging, and polymer compounding facilities.

Overall, Asia-Pacific’s vast production capacity, domestic consumption, and export advantage firmly position it as the global manufacturing hub for glass-filled polypropylene compounds, shaping the market’s long-term growth trajectory.

Top Use Cases

- Containers, crates & packaging parts: For rugged storage bins, crates, and specialty containers (e.g., in logistics or pharmaceutical), glass-filled PP offers strength, light weight, and impact resistance.

- Industrial machine parts: In factory machines, the material is used for pump bodies, gears, valve housings, and conveyor parts, where rigidity, chemical resistance, and durability are needed.

- Automotive interior trim & panels: Glass-filled PP helps make rigid instrument panels, door modules, mirror brackets, and bumper brackets—combining lightweight design with mechanical stability.

- Electrical & electronic housings: It’s used for connectors, switch casings, circuit breaker boxes, and electronic device enclosures because of its good insulation, structural strength, and ease of molding complex shapes.

- Appliance internal components: In washing machines and refrigerators, glass-filled PP is used for inner buckets, motor supports, fan parts, and housings. Its stiffness, temperature resistance, and chemical tolerance suit that environment.

Recent Developments

- In August 2025, Avient (formerly PolyOne) introduced Polystrand™, a fiberglass-reinforced unidirectional composite tape (50-inch wide) usable in multiple resins, including polypropylene. This gives manufacturers a new way to make reinforced PP components with continuous fiber.

- In May 2025, Mitsui Chemicals announced a partnership with Hagihara Industries to develop a technology that homogenizes viscosity in recycled plastics, improving reuse quality.

- In April 2025, the company initiated a joint study to develop CO₂-circular polypropylene. This involves exploring technologies to make PP in a way that reuses or offsets CO₂, aiming for more sustainable polymer production.

- In May 2024, at NPE2024, SABIC showcased composite panels using PP-UMS foam cores bonded with glass fiber-reinforced PP face sheets. This shows how glass-filled PP can be integrated with foam PP to build lightweight structural parts.

Conclusion

The Glass-Filled Polypropylene Compound Market continues to gain traction across automotive, electrical, and industrial sectors due to its unique blend of strength, stiffness, and lightweight properties. This material offers excellent dimensional stability, heat resistance, and cost efficiency, making it a preferred alternative to metals and traditional polymers. Growing emphasis on sustainability, recyclability, and fuel-efficient vehicle design further boosts its adoption.

Continuous innovations in composite processing and product formulations are expanding their application scope in both structural and functional components. With increasing industrial modernization and the shift toward high-performance materials, glass-filled polypropylene compounds are set to remain vital in advanced manufacturing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)