Table of Contents

Introduction

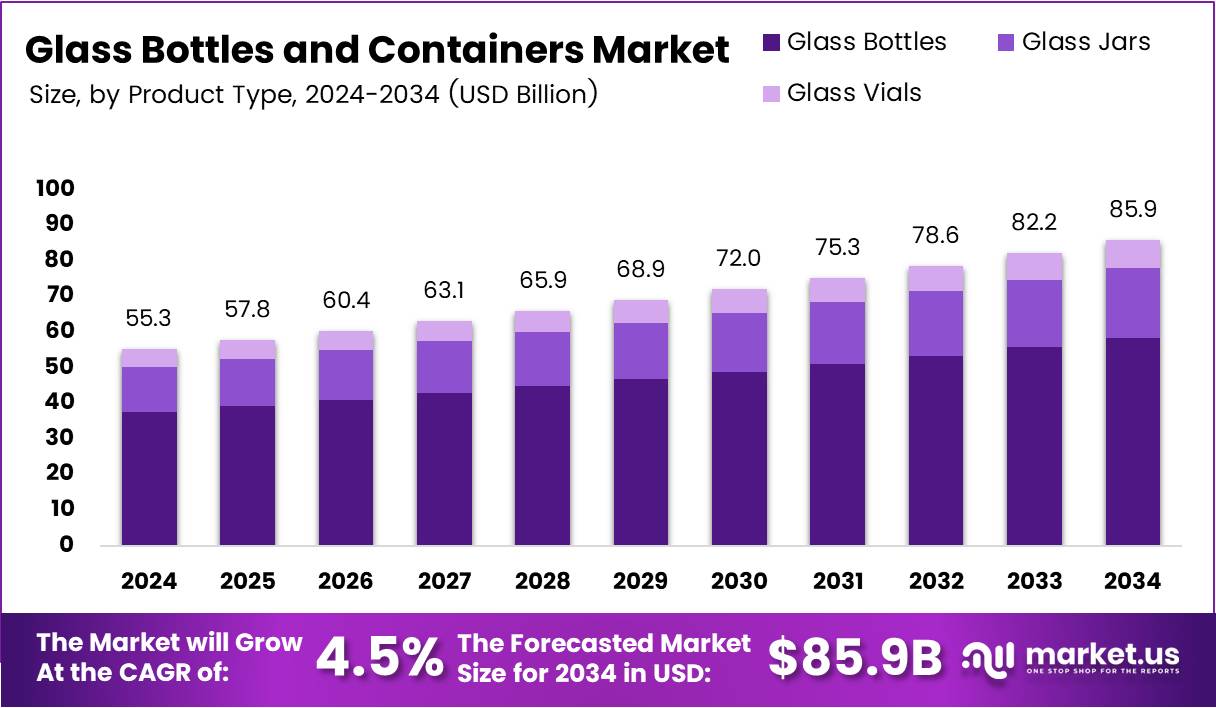

The Global Glass Bottles and Containers Market is witnessing significant expansion, driven by increasing environmental awareness and demand for sustainable packaging. Valued at USD 55.3 Billion in 2024, the market is expected to reach USD 85.9 Billion by 2034, growing at a steady CAGR of 4.5% from 2025 to 2034.

As consumers shift toward eco-friendly alternatives, glass continues to dominate as a preferred packaging material across multiple industries. Its non-toxic nature, recyclability, and ability to preserve product integrity position it as a sustainable choice for beverages, cosmetics, food, and pharmaceuticals globally.

Moreover, favorable government regulations, innovation in lightweight design, and strong consumer sentiment toward sustainability are driving companies to invest in advanced glass packaging solutions. This trend highlights the growing importance of glass in achieving long-term environmental and commercial objectives.

Key Takeaways

- The Global Glass Bottles and Containers Market is projected to reach USD 85.9 Billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034.

- In 2024, Glass Bottles held a dominant market position in the By Product Type Analysis segment, with a 67.9% share.

- Transparent Glass dominated the By Type Analysis segment in 2024, holding an 82.8% share.

- Beverages held the leading position in the By End-user Analysis segment in 2024, with a 48.2% share.

- Europe led the global market in 2024, capturing 45.8% of the market, valued at USD 25.3 Billion.

Market Segmentation Overview

By Product Type, Glass Bottles dominated the market with a 67.9% share in 2024. Their widespread adoption across beverages, pharmaceuticals, and cosmetics sectors reflects their superior product preservation qualities and recyclability. Glass jars and vials follow as secondary segments, serving food preservation and pharmaceutical applications effectively.

By Type, Transparent Glass held an impressive 82.8% share in 2024. Its dominance stems from high consumer appeal and visual clarity that enhances product trust. Transparent glass offers aesthetic value, cost efficiency, and wide applicability, making it the preferred choice for packaging beverages and cosmetics.

By End-user, Beverages led the market with a 48.2% share in 2024. This segment benefits from strong demand for premium and sustainable beverage packaging. Food, cosmetics, and pharmaceuticals also contribute substantially, leveraging glass’s safety, durability, and eco-friendly appeal to enhance product positioning.

Drivers

Increasing Consumer Preference for Eco-Friendly Packaging: Consumers worldwide are increasingly choosing sustainable options, driving demand for glass packaging. Its 100% recyclability and chemical stability make it an ideal substitute for plastic. Premium brands, especially in beverages and cosmetics, are adopting glass to align with green consumer trends and enhance brand perception.

Expansion of Food and Beverage Industry: The global food and beverage industry’s steady growth has accelerated glass container demand. From premium wines to baby food jars, glass packaging ensures taste preservation, hygiene, and safety. Its long shelf life and inert nature make it indispensable across various high-quality consumable goods segments.

Use Cases

Beverage Packaging: Glass bottles remain the gold standard in the beverage sector, particularly for alcoholic drinks, premium juices, and carbonated beverages. Their ability to preserve flavor, carbonation, and freshness makes them indispensable for brands seeking premium positioning and environmental responsibility.

Cosmetics and Personal Care: The luxury cosmetics industry increasingly favors glass containers for perfumes, serums, and skincare products. Glass offers an elegant appearance while ensuring product integrity. Its recyclable nature aligns perfectly with eco-conscious branding and consumer expectations in the beauty sector.

Major Challenges

Fragility and Breakage Risks: One of the main drawbacks of glass packaging is its fragility, which increases the risk of breakage during handling and transportation. This issue raises logistics costs and discourages adoption in segments that prioritize durability and convenience over aesthetics.

High Production and Transportation Costs: Manufacturing glass is energy-intensive, requiring significant raw materials and fuel. Additionally, glass’s heavy weight increases shipping expenses. These cost-related challenges limit adoption, especially among price-sensitive industries competing with lightweight and affordable packaging alternatives like plastic.

Business Opportunities

Personalized and Custom Glass Packaging: Custom-designed bottles and containers present a lucrative opportunity. Brands are increasingly adopting unique shapes, colors, and embossed designs to enhance shelf appeal and create distinctive brand identities. This trend is particularly strong in craft beverages and luxury product categories.

Emerging Markets Expansion: Rapid urbanization and rising disposable incomes across Asia, Africa, and Latin America are creating new opportunities for glass manufacturers. The growing middle-class population favors premium, eco-friendly packaging, making these regions hotspots for future glass packaging demand.

Regional Analysis

Europe: Europe dominates the global market with a 45.8% share, valued at USD 25.3 Billion. The region’s leadership is driven by strict sustainability regulations, consumer environmental awareness, and strong demand from the food and beverage sectors. European manufacturers continue to innovate in lightweight and recyclable glass solutions.

Asia Pacific: The Asia Pacific region is poised for rapid growth, fueled by industrial expansion, urbanization, and rising disposable incomes. Increasing demand for premium beverages and cosmetics is boosting glass container use. Manufacturers are also expanding production facilities to meet regional consumption trends effectively.

Recent Developments

- In February 2025, Pulpex raised USD 78 million to scale production of its paper-based bottles, enhancing eco-friendly packaging alternatives in the beverage and consumer goods markets.

- In August 2025, Ciner Glass secured USD 583.1 million to establish a new container glass facility in Belgium, expanding production capacity across Europe.

- In February 2024, Arglass secured USD 230 million for furnace investments to enhance energy efficiency and production scalability in glass bottle manufacturing.

- In June 2024, a USD 60 million capital infusion supported a Tanzanian glass bottle company to expand capacity and serve local food and beverage industries.

Conclusion

The Global Glass Bottles and Containers Market is on a robust growth trajectory, fueled by sustainability trends, premiumization, and regulatory support. Despite challenges such as fragility and high production costs, the industry’s commitment to innovation, lightweight design, and circular economy principles ensures a promising future.

As consumers continue to favor environmentally responsible packaging, glass will remain a vital component of the global packaging ecosystem. With emerging technologies and growing investment in energy-efficient production, the market is set to achieve sustainable expansion through 2034 and beyond.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)