Table of Contents

Overview

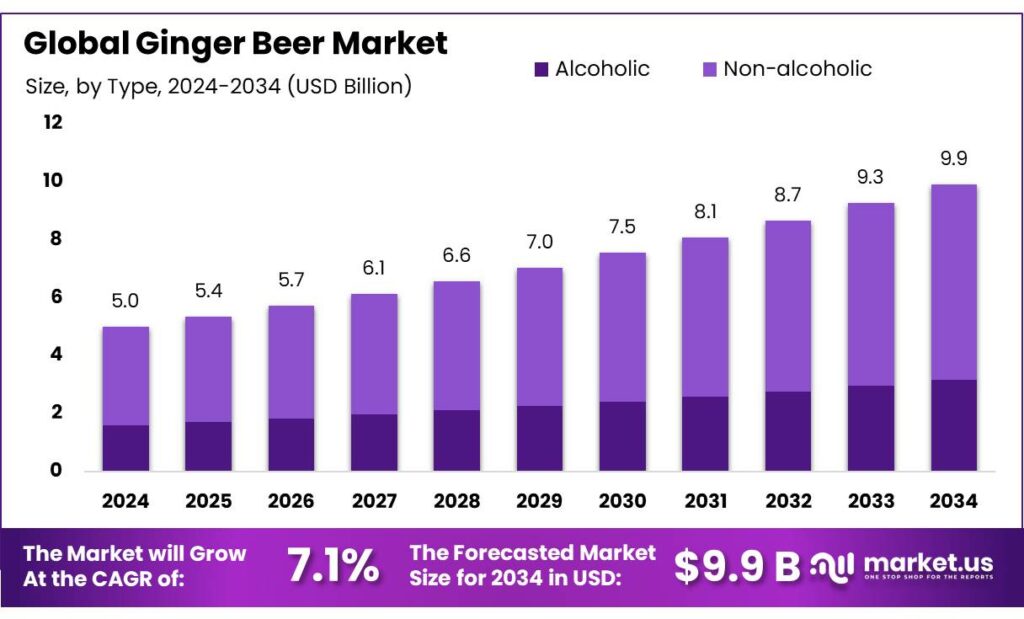

New York, NY – October 10, 2025 – The Global Ginger Beer Market is projected to reach USD 9.9 Billion by 2034, up from USD 5.0 Billion in 2024, registering a CAGR of 7.1% from 2025 to 2034. In 2024, North America led the market with a 45.8% share, generating around USD 2.2 billion in revenue.

Ginger beer is a carbonated or fermented beverage made primarily from ginger root, either in alcoholic or non-alcoholic form. It is often blended with sugar, yeast, and other natural spices, offering a strong sensory appeal through its distinctive spice, aroma, and effervescence.

The growing consumer shift toward natural and botanical beverages has positioned ginger beer as a popular choice in both craft and mainstream drink categories. Its production chain covers ginger farming, flavor extraction, beverage formulation, and distribution through retail and HoReCa channels.

According to FAOSTAT (2023), global ginger output reached 4.877 million tonnes, with India accounting for about 45%, ensuring a steady raw material base for producers. However, food safety remains a rising concern. Research by the Chinese Academy of Inspection and Quarantine detected pesticide residues like clothianidin, carbendazim, and imidacloprid in 17–28% of ginger samples, emphasizing the need for stricter quality checks in the beverage supply chain.

Government initiatives are reinforcing the industry’s growth. India’s One District One Product (ODOP) scheme has identified ginger in several regions, such as Karbi Anglong (Assam) and Kandhamal (Odisha), to encourage value-added processing and exports. Similarly, Mizoram’s Agricultural Market Assurance Scheme offered ₹50 per kg for ginger procurement, promoting structured supply networks for beverage production.

Key Takeaways

- Ginger Beer Market size is expected to be worth around USD 9.9 billion by 2034, from USD 5.0 billion in 2024, growing at a CAGR of 7.1%.

- Alcoholic held a dominant market position in the Ginger Beer Market, capturing more than a 56.9% share.

- Original Flavor held a dominant market position in the Ginger Beer Market, capturing more than a 63.7% share.

- Bottles (Glass) held a dominant market position in the Ginger Beer Market, capturing more than a 38.2% share.

- Off-Trade held a dominant market position in the Ginger Beer Market, capturing more than a 56.5% share.

- North America emerged as the leading region in the global Ginger Beer Market, capturing 45.8% of the total market, which translated into a value of around USD 2.2 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/ginger-beer-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.0 Billion |

| Forecast Revenue (2034) | USD 9.9 Billion |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Type (Alcoholic, Non-alcoholic), By Flavor (Original, Flavored), By Packaging (Bottles (Glass), Cans, PET Bottles, Kegs), By Distribution Channel (On-Trade, Off-Trade, Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Others) |

| Competitive Landscape | Crabbie’s Alcoholic Ginger Beer, Bundaberg Brewed Drinks, Fever-Tree, Fentimans, Rachel’s Ginger Beer, Gunsberg, Natrona Bottling Company, Goslings Rum, Q MIXERS, Reed’s Inc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158084

Key Market Segments

By Type Analysis

Alcoholic ginger beer led the Ginger Beer Market in 2024, holding a commanding 56.9% share. Its dominance stems from the surging popularity of craft alcoholic beverages and consumer demand for distinctive, flavorful drinks. Alcoholic ginger beer is favored both as a standalone drink and a key cocktail mixer, notably in the globally popular Moscow Mule. Its refreshing profile and natural ingredients appeal to health-conscious consumers seeking alternatives to conventional beers.

By Flavor Analysis

Original flavor ginger beer captured a dominant 63.7% market share in 2024, driven by its authentic, bold, and spicy taste. This classic flavor remains the category standard, attracting both loyal consumers and new drinkers seeking a genuine ginger beer experience. Its versatility as a standalone beverage and cocktail mixer fuels consistent demand worldwide.

By Packaging Analysis

Glass bottles held a leading 38.2% share of the Ginger Beer Market in 2024, favored for their premium appeal and sustainability. Consumers associate glass with quality, freshness, and authenticity, making it the top choice for both alcoholic and non-alcoholic ginger beer. Glass packaging preserves carbonation and the drink’s bold flavor profile better than alternatives, enhancing its appeal.

By Distribution Channel Analysis

Off-trade channels dominated the Ginger Beer Market in 2024 with a 56.5% share, driven by widespread availability in supermarkets, hypermarkets, convenience stores, and online platforms. These channels offer diverse brands, flavors, and packaging options at competitive prices, with the added convenience of bulk purchasing for home consumption, making them the preferred choice for consumers.

Regional Analysis

North America led the global Ginger Beer Market in 2024, commanding a 45.8% share, valued at approximately USD 2.2 billion. The region’s leadership is fueled by established beverage companies and growing consumer preference for craft, natural, and low-alcohol beverages.

Ginger beer’s popularity as a refreshing standalone drink and a key cocktail mixer, particularly in the Moscow Mule, drives demand in the U.S. and Canada. The shift toward healthier, natural beverage options, coupled with the rise of premium and artisanal brands emphasizing natural ingredients and reduced sugar, further strengthens the market in this region.

Top Use Cases

- Cocktail Mixer: Ginger beer shines as a go-to mixer in bars and homes, adding a spicy kick to drinks like the Moscow Mule or Dark ‘n’ Stormy. Its fizzy, bold flavor balances spirits such as vodka or rum, making cocktails more refreshing and exciting. This use case boosts its appeal in social settings, where mixology trends draw in both casual drinkers and enthusiasts seeking unique tastes without overwhelming sweetness.

- Standalone Refreshing Drink: As a simple, everyday beverage, ginger beer offers a crisp, spicy alternative to plain sodas, perfect for hot days or casual sipping. Its natural ginger zing provides a lively, invigorating feel that quenches thirst while hinting at wellness benefits. Consumers grab it for picnics, lunches, or relaxation, valuing its easy-drink vibe that fits busy lifestyles and light, flavorful hydration needs.

- Health-Focused Wellness Aid: Ginger beer serves as a gentle tummy soother, helping ease nausea or aid digestion after meals, thanks to its natural root base. Health-minded folks turn to it as a functional sip, blending refreshment with subtle anti-inflammatory perks. This makes it a smart pick for daily routines, like morning boosts or post-workout recovery, aligning with the rise in natural remedies for better gut health.

- Non-Alcoholic Mocktail Base: In sober-curious circles, ginger beer stars in fun, alcohol-free creations like virgin mules or fruity shandies, mimicking cocktail flair without the buzz. Its effervescent spice elevates juices and herbs into vibrant, party-ready drinks. This use case caters to inclusive gatherings, where everyone enjoys the sophisticated taste, supporting trends toward mindful drinking and versatile, family-friendly options.

- Culinary Flavor Enhancer: Chefs use ginger beer to jazz up recipes, like tenderizing meats in marinades or glazing sweets with its tangy sweetness. The spicy notes add depth to sauces, BBQ ribs, or baked goods, creating bold, fusion dishes. This behind-the-scenes role highlights its kitchen versatility, appealing to home cooks experimenting with global flavors for more exciting, everyday meals.

Recent Developments

1. Crabbie’s Alcoholic Ginger Beer

Crabbie’s has focused on expanding its ready-to-drink (RTD) portfolio, introducing new varieties like a Pink Gin Ginger Beer to capitalize on the cocktail RTD trend. Parent company Halewood Artisanal Spirits has invested in marketing campaigns emphasizing the brand’s heritage and “properly brewed” process to stand out in the competitive alcoholic soda market. Their strategy targets consumers seeking premium, mixed-drink convenience.

2. Bundaberg Brewed Drinks

Bundaberg continues its global expansion, emphasizing its family-owned heritage and natural brewing process. A key recent development is the launch of a 25.4oz (750ml) sharing bottle format in key markets like the US, targeting family gatherings and retail sales. They have also expanded their flavor lineup with limited-edition releases, such as Blood Orange, to drive consumer interest and reinforce their position as a premium non-alcoholic beverage brand.

3. Fever-Tree

Fever-Tree’s recent development is a major push into the US market, identifying it as a key growth driver. They have launched a Ginger Beer with Madagascan Ginger, specifically marketed as the “perfect partner” for dark spirits like rum. This move targets the premium mixer segment, leveraging their brand strength to compete directly with established players. Their strategy includes significant investment in marketing and distribution partnerships.

4. Fentimans

Fentimans has reinforced its premium botanical positioning by focusing on its traditional fermentation method. A key recent development is the redesign of its bottle and labeling to better communicate its heritage and natural ingredients to consumers. They have also expanded distribution in the premium on-trade (bars, restaurants) and retail sectors, emphasizing their role as a non-alcoholic craft option for sophisticated palates, often using a “botanically brewed” message.

5. Rachel’s Ginger Beer (RGB)

Rachel’s Ginger Beer has moved beyond its Seattle roots with significant expansion. A major recent development is the national launch of their canned, alcoholic Ginger Beer in partnership with Two Beers Brewing Co. They have also opened new taproom locations, growing their physical presence. This dual strategy focuses on scaling their unique, bold, and freshly-made product in both the RTD alcohol market and their direct-to-consumer experiential outlets.

Conclusion

Ginger Beer is evolving from a niche mixer to a beloved staple in the beverage world, fueled by its versatile charm and natural appeal. Its spicy, refreshing profile perfectly matches the shift toward healthier, craft-inspired choices, drawing in wellness seekers and social sippers alike. With innovative flavors and eco-friendly packaging on the rise, this drink promises a broader reach in homes, bars, and kitchens, fostering steady growth through authentic experiences that blend tradition with modern tastes.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)