Table of Contents

Overview

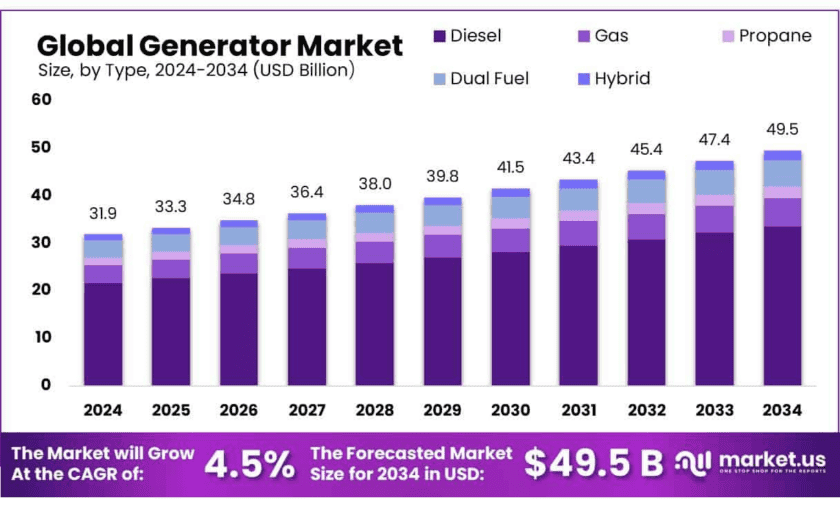

New York, NY – June 09, 2025 – The global generator market is experiencing steady growth, with its size expected to rise from USD 31.9 billion in 2024 to USD 49.5 billion by 2034, growing at a CAGR of 4.5%. This surge is driven by rising demand for reliable continuous and backup power across industrial, commercial, and residential sectors. Growth factors include expanding data centers, critical infrastructure resilience, and off-grid electrification. Generators are popular due to their versatility, fuel flexibility (diesel, gas, hybrid), and ability to support electrification in remote areas.

Market opportunities are abundant, especially in integrating generators with renewables, smart monitoring, and eco-friendly fuels. Expansion is expected in emerging markets across Asia-Pacific, Africa, and Latin America, where infrastructure investment and power grid limitations create demand for resilient power solutions. As economies modernize and grid stability becomes increasingly important, generator deployment is poised to grow significantly through 2034.

In 2024, Diesel generators led the global generator market by type with a 67.9% share due to their reliability and wide usage across construction, mining, and off-grid applications. By voltage rating, generators below 100 kVA held the top spot with a 36.4% share, driven by strong demand from households, small businesses, and rural areas.

In terms of design, stationary generators dominated with a 73.1% share, owing to their widespread deployment in hospitals, data centers, and industrial sites for long-duration backup. By application, backup power generators accounted for a 67.2% share, reflecting rising use in critical infrastructure and regions with unstable power supply. Finally, by end use, the industrial sector led the market with a 56.5% share in 2024, driven by the heavy and continuous power needs of manufacturing, oil & gas, and mining operations, particularly in areas where grid power is limited or unreliable.

In 2024, the Asia-Pacific (APAC) region led the global generator market with a dominant 46.8% share, valued at approximately USD 14.9 billion. This strong market position was driven by rapid industrial growth, large-scale urban development, and ongoing issues with power reliability across developing nations. Countries such as India, China, and Indonesia contributed significantly to this growth due to their expanding manufacturing bases and rising demand for backup and off-grid power solutions.

How Growth is Impacting the Economy

The growth of the generator market is having a positive impact on global economies, particularly in regions facing unstable power infrastructure or rising energy demand. Generators play a crucial role in maintaining business continuity during power outages, supporting industrial output, and enabling operations in remote or off-grid areas. In developing countries, widespread adoption of low-capacity generators is enhancing rural electrification and stimulating local economic activity.

Industries such as construction, oil and gas, and telecom are using generators to avoid downtime, reduce production losses, and meet round-the-clock power needs. This reliability supports job creation in equipment manufacturing, service, fuel supply, and logistics. The growth of standby generator installations in hospitals, data centers, and banking also improves critical infrastructure resilience. As nations modernize, the generator market not only boosts industrial productivity but also supports disaster preparedness and energy security strategies, making it a key contributor to both economic development and infrastructure stability.

Key Takeaways

- Generator Market size is expected to be worth around USD 49.5 Billion by 2034, from USD 31.9 Billion in 2024, growing at a CAGR of 4.5%.

- Diesel held a dominant market position, capturing more than a 67.9% share in the global generator market.

- Below 100 kVA held a dominant market position, capturing more than a 36.4% share in the generator market.

- Stationary held a dominant market position, capturing more than a 73.1% share in the generator market.

- Backup Power held a dominant market position, capturing more than a 67.2% share in the generator market.

- Industrial held a dominant market position, capturing more than a 56.5% share in the generator market.

- Asia-Pacific (APAC) region solidified its position as the dominant force in the global generator market, commanding a substantial 46.8% share, equivalent to a market value of $14.9 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-generator-market/free-sample/

Experts Review

To stay competitive, generator manufacturers should invest in fuel-efficient, low-emission models that align with global sustainability goals. Developing hybrid systems that integrate renewable sources like solar or wind can offer an edge in emerging markets. Companies should expand product lines across power ratings—from portable units to industrial-grade systems—to serve diverse customer segments.

Digital monitoring, remote diagnostics, and predictive maintenance tools can enhance value-added services. Partnerships with construction, telecom, and energy companies can unlock long-term supply contracts. Moreover, targeting Tier II and III cities and rural zones with affordable, compact generators will boost sales as electrification and small enterprise growth continue in developing regions.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=150120

Key Market Segments

By Type

- Diesel

- Gas

- Propane

- Dual Fuel

- Hybrid

By Voltage Rating

- Below 100 kVA

- 100kva to 350 kVA

- 350 kva to 1000 kVA

- Above 1,000 kVA

By Design

- Portable

- Stationary

By Application

- Backup Power

- Continuous Power

- Peak Shaving Power

By End Use

- Industrial

- Residential

- Commercial

Regional Analysis

In 2024, the Asia-Pacific (APAC) region dominated the global generator market with a 46.8% share, valued at USD 14.9 billion. This leadership is driven by rapid industrialization, infrastructure development, and power supply gaps in countries like India, China, Indonesia, and Vietnam. Rising construction activity, manufacturing expansion, and the need for off-grid power systems have fueled high demand across both urban and rural zones. Meanwhile, North America and Europe show stable demand in healthcare, IT, and residential sectors, with growing interest in hybrid and low-emission generators. Latin America and Africa are emerging markets with strong potential due to electrification initiatives and growing energy needs.

Top Use Cases

Data Center Backup Power: Generators in data centers kick in during grid failures to keep servers, cooling systems, and security equipment up and running. They prevent data loss and service interruption, ensuring that critical online operations remain uninterrupted. Regular maintenance and automatic switchover systems make these generators reliable safety backups.

Construction Site Power: Portable generators provide essential electricity for tools, lighting, and site offices at construction sites, especially in areas without grid access. Durable and easy to transport, they help keep projects on schedule and on budget by powering heavy equipment and temporary infrastructure, making them valuable in remote or newly developed locations.

Industrial Process Support: In manufacturing, mining, and chemical plants, generators provide stable power for heavy machinery, pumps, and ventilation systems. They prevent production delays during outages and ensure operations run smoothly. Their reliability helps industries maintain output levels, avoid losses, and meet tight production schedules while supporting remote or off-grid sites.

Residential Standby Power: Home standby generators automatically activate during power outages to maintain essential services like heating, refrigeration, lighting, and medical devices. They offer families peace of mind and safety during storms or utility failures, ensuring comfort and minimizing disruption, especially in regions prone to severe weather or unreliable electricity supply.

Critical Infrastructure Protection: Hospitals, water treatment plants, telecom towers, and government facilities use stationary generators to ensure continuous operations in emergencies. These generators support public safety and essential services, preventing system failures during blackouts. Their role in maintaining life support systems and communication networks is critical for community resilience.

Telecommunications Continuity: Telecom networks rely on diesel generators at cell towers and switching stations to maintain signal strength during grid interruptions. They ensure uninterrupted mobile and internet connectivity in remote or disaster-prone areas. This backup is vital for emergency services and public communication when other systems fail.

Recent Developments

Mitsubishi Heavy Industries Engine & Turbocharger (MHIET), a subsidiary of MHI, carried out successful demonstration tests in March 2025 of a 6-cylinder, 500 kW-class hydrogen engine generator set at its Sagamihara plant. The pilot run achieved stable operation on 100% hydrogen, including start-up and shutdown, paving the way for commercialization pending further safety and reliability validation. Additionally, MHIET has developed an electronically controlled emergency generator engine offering 10% higher power output for data centers and semiconductor facilities, with performance verification currently underway.

GE Vernova continues to innovate in high-capacity generator systems. Its air-cooled generator packages, boasting 98.9% efficiency and up to 400 MVA output, offer easy integration and reduced installation time—ideal for power-plant and microgrid applications. GE Vernova also supports aeroderivative gas turbines with H-capable designs, targeting a 75% hydrogen blend, and has maintained over 120 million operating hours on its LM2500 turbine fleet, evidencing its global energy system presence

In 2025, Siemens Energy reported expectations of 8–10% revenue growth, supported by rising electricity demand and infrastructure investments. The company secured two major combined-cycle gas turbine power plant contracts in Saudi Arabia, each expected to generate ~2,000MW, including steam turbines and high-performance generators. Siemens also deepened its support for modular nuclear SMRs via a turbine and generator supply agreement with Rolls-Royce, expected to be finalized by end-2025

Kohler Energy has rebranded to Rehlko, reflecting its focus on resilient backup power and clean energy solutions. The company also released upgrades to its KD Series generators (KD2000 to KD3750), improving transient response, lowering NOₓ emissions, and reducing unit weight by around 2,000 lbs—with future compatibility for hydrogen and ammonia fuels

ABB has extended its footprint in energy resilience with orders for permanent magnet shaft generator systems for 30 LNG carriers, enhancing fuel efficiency and reducing emissions. The company also launched an AI Startup Challenge 2025, investing US$30,000 per project to integrate AI-driven solutions in its motors and generators domain. ABB continues U.S. electrification support through its drive-control upgrades, which cut energy consumption by up to 6% at its Ratingen site, aiding in achieving carbon-neutral goals by 2025

Conclusion

Diesel generators will remain predominant due to their dependability and established infrastructure, while innovations in hybrid systems and cleaner fuels are beginning to shift dynamics. As commercial, industrial, and residential consumers seek energy resilience and operational security, generators will remain vital—serving both backup and primary power needs in a rapidly evolving energy mix.