Table of Contents

Overview

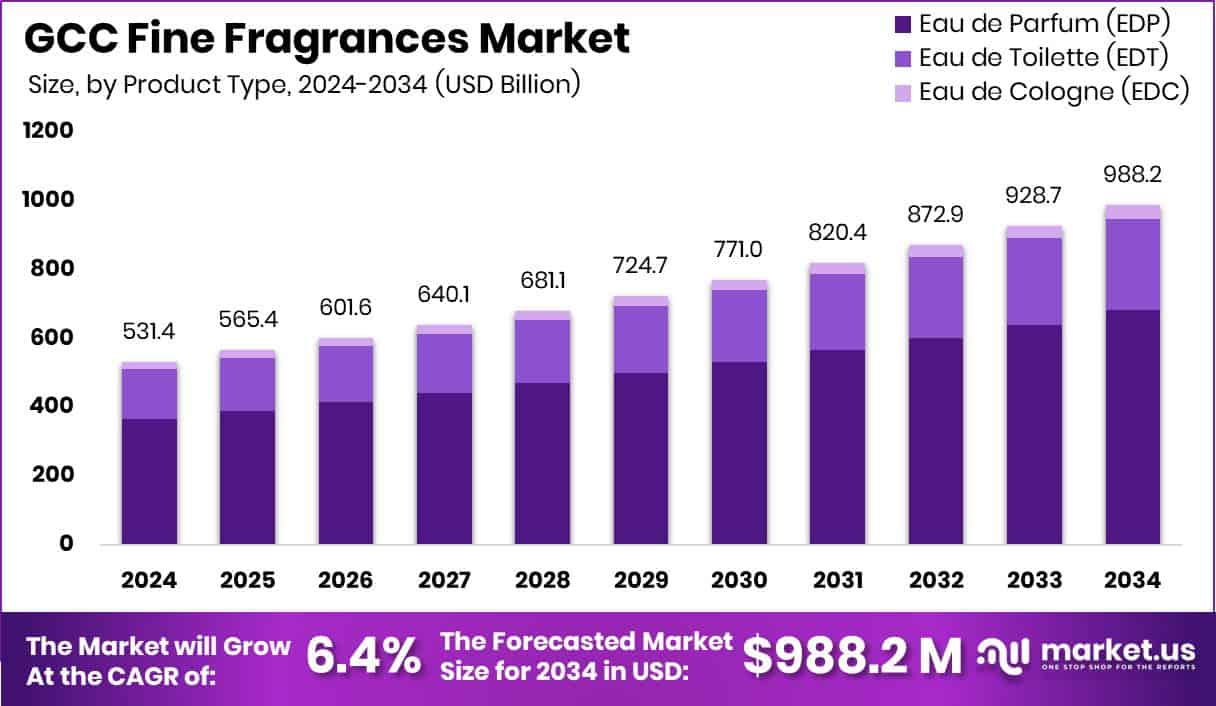

New York, NY – May 14, 2025 – The global GCC Fine Fragrances Market is set for strong growth, with its size expected to jump from USD 531.4 million in 2024 to around USD 988.2 million by 2034, expanding at a 6.4% CAGR from 2025 to 2034.

Eau de Parfum (EDP) commands a leading 69.3% share of the GCC Fine Fragrances Market in 2024, reflecting its popularity for long-lasting, premium scents. Synthetic ingredients overwhelmingly lead the GCC Fine Fragrances Market, capturing a 97.5% share in 2024. Their cost-effectiveness, consistency, and scalability make them ideal for meeting regional demand. Deodorants and perfumes hold a 54.2% share of the GCC Fine Fragrances Market in 2024, driven by cultural emphasis on grooming and the region’s hot climate. In 2024, specialty fragrance stores will lead the GCC Fine Fragrances Market with a 64.7% share in the distribution channel segment.

US Tariff Impact on Fine Fragrances Market

The president has promised to impose tariffs on imported goods once he’s in office. It’s not the first time: During the first Trump presidency, approximately USD 380 billion in tariffs were imposed on thousands of products. This resulted in about USD 80 billion in new taxes on the American people. This time around, Trump has promised a 25% bump on all imports from Canada and Mexico, plus an additional 10% tariff on all imports from China. Everyday essentials, like groceries and gas, will be hit most immediately—but luxury goods and non-essentials, including fragrance, may also be affected.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/gcc-fine-fragrances-market/request-sample/

Key Takeaways

- GCC Fine Fragrances Market is expected to be worth around USD 988.2 Million by 2034, up from USD 531.4 Million in 2024, and grow at a CAGR of 6.4% from 2025 to 2034.

- In the GCC Fine Fragrances Market, Eau de Parfum dominates with a 69.3% share.

- Synthetic ingredients lead the market, capturing a significant 97.5% share across fragrance formulations.

- Deodorants and perfumes contribute the most to demand, accounting for 54.2% of total applications.

- Specialty fragrance stores remain the key retail channel, representing 64.7% of total product distribution.

Report Scope

| Market Value (2024) | USD 531.4 Million |

| Forecast Revenue (2034) | USD 988.2 Million |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Product Type (Eau de Parfum (EDP), Eau de Toilette (EDT), Eau de Cologne (EDC)), By Ingredient (Natural, Synthetic), By Application (Deodorants and Perfumes, Soaps and Detergents, Cosmetics and Personal Care, Home Care Products, Others), By Distribution Channel (Specialty Fragrance Stores, Online Platforms, Others) |

| Competitive Landscape | LVMH Moët Hennessy Louis Vuitton, Rasasi, Kering Holland NV, Yas Perfumes, Firmenich SA, Al-Haramain, Gulf Flavours & Fragrances, Zohoor AL Reef Co., Bath & Body Works, Inc., ALREHAB PERFUMES, Other |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147703

Key Market Segments

By Product Type Analysis

- Eau de Parfum (EDP) commands a leading 69.3% share of the GCC Fine Fragrances Market in 2024, reflecting its popularity for long-lasting, premium scents. EDP’s high fragrance oil concentration suits the GCC’s hot, humid climate, where durability is prized. Rising disposable incomes and the cultural significance of fragrances in daily and social settings further drive its dominance. EDP appeals to both genders across age groups, offering a strong price-to-performance balance. The growth of specialty fragrance retail and consumer interest in niche, signature scents solidify EDP’s position as the preferred choice for luxury and versatility.

By Ingredient Analysis

- Synthetic ingredients overwhelmingly lead the GCC Fine Fragrances Market, capturing a 97.5% share in 2024. Their cost-effectiveness, consistency, and scalability make them ideal for meeting regional demand. Synthetics enable perfumers to craft diverse, stable scents that align with the GCC’s harsh climate and cultural preference for long-lasting fragrances. Unlike natural ingredients, synthetics ensure uniformity and availability, supporting large-scale production. The rise of specialty fragrance stores, offering a broad range of synthetic-based scents for mass and premium markets, reinforces their dominance, driving innovation and reliable supply chains.

By Application Analysis

- Deodorants and perfumes hold a 54.2% share of the GCC Fine Fragrances Market in 2024, driven by cultural emphasis on grooming and the region’s hot climate. Urbanization, a young population, and heightened focus on personal appearance boost demand for these products, used daily and for special occasions. Deodorants provide functional benefits, while perfumes enhance personal identity, and are often used together. Wide availability through specialty stores, diverse scent options, and frequent product launches sustain consumer engagement, cementing deodorants and perfumes as key market drivers.

By Distribution Channel Analysis

- In 2024, specialty fragrance stores will lead the GCC Fine Fragrances Market with a 64.7% share in the distribution channel segment. This dominance reflects consumer preference for personalized shopping, exclusive fragrance collections, and immersive retail experiences. In the GCC, where fragrances are integral to cultural identity and daily grooming, these stores excel by offering curated selections, expert consultations, and premium service. They foster product discovery and brand loyalty, particularly for luxury and niche perfumes, which resonate with the region’s fragrance-savvy shoppers. Strategically located in upscale malls and key urban areas, specialty stores benefit from accessibility, rising disposable incomes, and evolving consumer tastes, solidifying their pivotal role in the market.

Top Use Cases

- Daily Grooming and Personal Care: Fine fragrances, especially Eau de Parfum and deodorants, are a staple in daily routines across the GCC. Used after bathing or before work, they enhance personal hygiene and confidence. Their long-lasting scents suit the hot climate, making them essential for both men and women in maintaining a fresh, polished appearance.

- Cultural and Social Expression: Fragrances hold deep cultural value in the GCC, symbolizing hospitality and status. Applied during family gatherings, weddings, or religious events, they reflect personal identity and respect. Signature scents from specialty stores are popular, allowing individuals to express uniqueness and strengthen social bonds through shared olfactory experiences.

- Gifting and Special Occasions: Fine fragrances are a top choice for gifting during festivals, birthdays, or corporate events in the GCC. Luxury perfumes in elegant packaging appeal to consumers seeking thoughtful, high-value presents. Specialty stores cater to this demand with exclusive scents, driving sales during peak seasons like Eid and Ramadan.

- Professional and Workplace Appeal: In the GCC’s professional settings, fine fragrances enhance personal presence and confidence. Subtle yet lasting scents like Eau de Parfum are favored by professionals to maintain a sophisticated image. Their use in offices and meetings aligns with the region’s emphasis on grooming and creating positive impressions in business interactions.

- Tourism and Retail Experience: Tourists in the GCC, especially in cities like Dubai and Riyadh, seek fine fragrances as souvenirs. Specialty fragrance stores offer immersive shopping with niche and luxury scents, attracting visitors. This boosts retail sales, as travelers purchase high-end perfumes to capture the region’s essence or gift them back home.

Recent Developments

1. LVMH Moët Hennessy Louis Vuitton

- LVMH continues to dominate the luxury fragrance market with new launches like Louis Vuitton’s “Les Extraits” collection, featuring ultra-concentrated perfumes. The brand is also investing in sustainable sourcing and refillable bottles to appeal to eco-conscious consumers. Additionally, LVMH acquired Officine Universelle Buly, expanding its niche perfume portfolio.

2. Rasasi

- Rasasi, a leading Middle Eastern fragrance house, recently launched “Hawas for Her”, a feminine version of its popular Hawas perfume. The brand is also expanding globally, entering new markets in Europe and Asia, and focusing on long-lasting, bold oriental scents.

3. Kering Holland NV (Owner of Gucci, Balenciaga, and Bottega Veneta)

- Kering’s Gucci launched “The Alchemist’s Garden”, a luxury fragrance line with ornate bottles. Balenciaga introduced “Le City”, a unisex scent, while Bottega Veneta expanded its “Parco Palladiano” collection. Kering is also emphasizing clean and vegan fragrances.

4. Yas Perfumes

- Yas Perfumes, known for affordable luxury, recently introduced “Royal Oud”, a premium woody fragrance. The brand is enhancing its e-commerce presence and collaborating with regional influencers to boost sales in the Middle East and South Asia.

5. Firmenich SA (Now part of DSM-Firmenich)

- Firmenich, a leader in fragrance creation, developed sustainable aroma molecules to reduce environmental impact. It also partnered with Givaudan (post-merger) to innovate in biotech-derived scents and launched AI-powered fragrance customization tools for brands.

Conclusion

The GCC Fine Fragrances Market in 2024 showcases strong growth, driven by a deep cultural love for scents and rising consumer spending power. Eau de Parfum dominates with a 69.3% share, favored for its long-lasting quality in the region’s hot climate. Synthetic ingredients, holding a 97.5% share, ensure affordable and consistent fragrances, while deodorants and perfumes lead applications at 54.2%, reflecting daily grooming habits. Specialty fragrance stores, with a 64.7% distribution share, thrive by offering premium, personalized experiences. As urbanization and demand for luxury scents grow, the market is set to expand, fueled by innovation and a youthful, style-conscious population.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)