Table of Contents

Overview

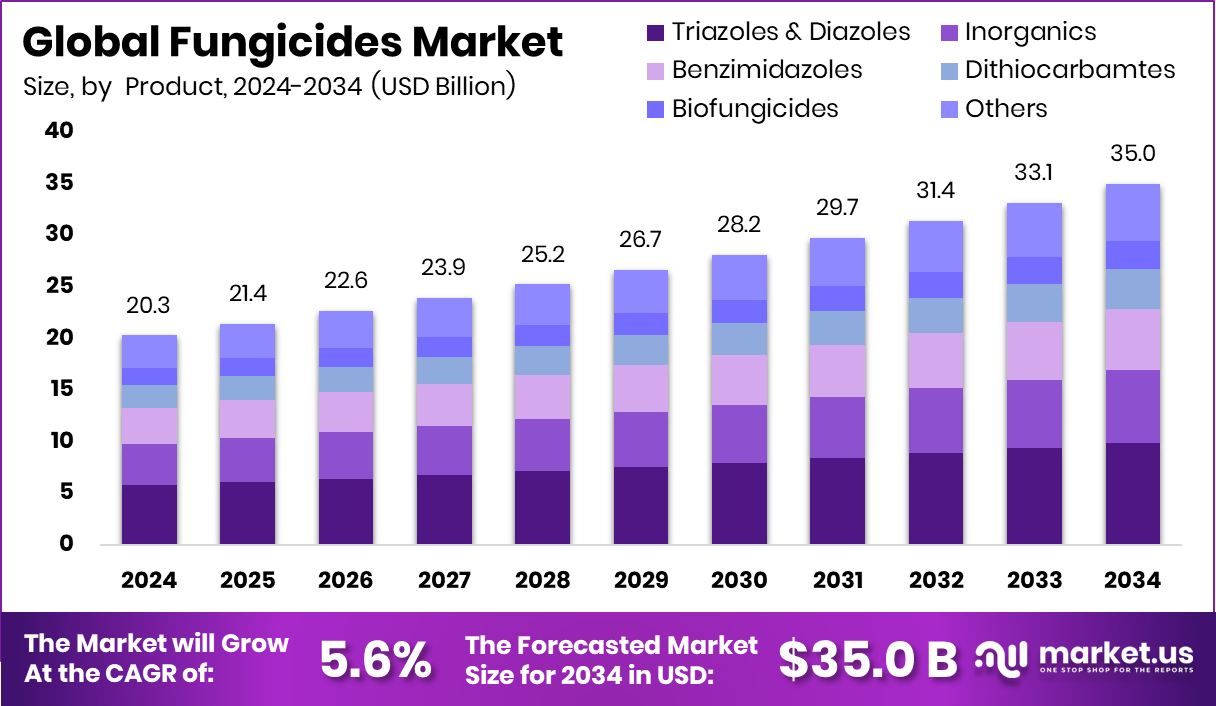

New York, NY – September 12, 2025 – The Global Fungicides Market, valued at USD 20.3 billion in 2024, is projected to reach USD 35.0 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.6% from 2025 to 2034.

Fungicides, which are chemical or biological substances designed to prevent, kill, or inhibit fungi and fungal spores, play a vital role in protecting crops from diseases like rusts, mildews, and blights that can devastate yields and quality. These products are essential in agriculture, horticulture, and forestry, safeguarding plants at various growth stages to ensure food security and healthy production.

The Asia Pacific region, driven by its robust agriculture sector, accounts for 43.8% of global fungicide demand growth. Rising food demand due to population growth and intensified fungal outbreaks caused by unpredictable weather patterns linked to climate change are key factors driving the increased adoption of fungicides. The market encompasses a wide range of synthetic and bio-based fungicidal products, catering to diverse farming practices and environmental regulations.

The industry’s shift toward sustainability, with BioPrime securing $6 million to develop advanced bio-fungicides and bio-insecticides. Additionally, initiatives like Exeter’s £1.7 million global research program for antifungal resistance innovation and a $4.75 million grant to combat fungicide resistance highlight the industry’s commitment to addressing emerging challenges and ensuring long-term effectiveness in crop protection.

Key Takeaways

- The Global Fungicides Market is expected to be worth around USD 35.0 billion by 2034, up from USD 20.3 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- In 2024, Triazoles & Diazoles held a 28.3% share, reflecting strong adoption in the fungicides market.

- Single-site inhibitors accounted for 68.1% of the Fungicides Market, highlighting their dominance in disease control efficiency.

- Foliar treatment captured 58.2% share of the Fungicides Market, showing its wide preference for crop disease management.

- Fruits and Vegetables represented 36.8% of the Fungicides Market, driven by rising demand for high-quality produce.

- The Asia Pacific fungicides market was valued at USD 8.8 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-fungicides-market/request-sample/

Report Scope

| Market Value (2024) | USD 20.3 Billion |

| Forecast Revenue (2034) | USD 35.0 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Product (Triazoles and Diazoles, Inorganics, Benzimidazoles, Dithiocarbamtes, Biofungicides, Others), By Mode Of Action (Multi-Site Inhibitors (Chloronitriles, Dithiocarbamates), Single-Site Inhibitors (Strobilurins, Triazoles)), By Application (Foliar Treatment, Chemigation, Seed Treatment, Others), By Crop Type (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Others) |

| Competitive Landscape | Nufarm Ltd., FMC Corporation, BASF Agricultural Solutions, Cheminova A/S, Bayer CropScience, Syngenta AG, Lanxess AG, Adama Agricultural Solutions, Simonis B.V., Rallis |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155196

Key Market Segments

By Product Analysis

Triazoles and Diazoles lead the Fungicides Market with a 28.3% share in 2024. Renowned for their broad-spectrum efficacy and systemic action, these compounds effectively combat fungal diseases in cereals, fruits, vegetables, and ornamental crops by inhibiting ergosterol biosynthesis.

Their compatibility with integrated pest management and advancements in formulation, such as improved residual activity and rainfastness, enhance their appeal. Growing awareness of economic losses from fungal infestations drives demand, with regulatory support and precise application techniques reinforcing their dominance in sustainable disease control.

By Mode of Action Analysis

Single-Site Inhibitors command a 68.1% share of the Fungicides Market in 2024. Targeting specific fungal biochemical pathways, they offer precise, effective control for high-value crops like fruits, vegetables, and specialty grains.

Their rapid action, extended residual protection, and compatibility with precision farming fuel their adoption. Effective against resistant fungal strains, these inhibitors benefit from regulatory support for low-toxicity solutions and advancements in formulation for lower-dose efficiency. Rising R&D investments in novel molecules ensure their continued market leadership.

By Application Analysis

Foliar Treatment dominates the Fungicides Market with a 58.2% share in 2024. Applied directly to plant leaves and stems, it ensures rapid absorption and protection against diseases like powdery mildew and rusts.

Its dominance stems from precise coverage, versatility as a preventive and curative measure, and enhanced efficiency through advanced spraying technologies like drones and electrostatic systems. Favorable for high-value horticultural crops and supported by innovations in leaf adherence and rainfastness, foliar treatment maintains its leading role.

By Crop Type Analysis

Fruits and Vegetables hold a 36.8% share of the Fungicides Market in 2024. Their high susceptibility to diseases like blights and mildews, combined with the need for quality and shelf life in fresh produce, drives fungicide use.

Intensive cultivation and rising global demand for fresh produce, particularly for export markets with strict standards, boost adoption. Innovations in bio-fungicides and residue-free formulations align with sustainable practices, ensuring this segment’s leadership amid increasing disease incidence due to climate change.

Regional Analysis

Asia Pacific leads the global Fungicides Market with a 43.8% share, valued at USD 8.8 billion in 2024. Its dominance is driven by extensive agricultural activity, high crop protection chemical use, and diverse climates fostering fungal diseases in countries like China, India, and Japan.

Rising demand for high-quality produce, government support for modern farming, and advancements in precision spraying and bio-fungicides fuel growth. Despite contributions from North America, Europe, the Middle East & Africa, and Latin America, Asia Pacific’s scale and disease pressure ensure its continued market leadership.

Top Use Cases

- Crop Yield Protection: Fungicides safeguard crops like wheat, rice, and soybeans from fungal diseases such as rusts and blights. By preventing yield losses, they ensure higher production and better-quality harvests, helping farmers meet global food demands while maintaining profitability in challenging climatic conditions.

- Quality Maintenance for Fresh Produce: Fungicides are vital for fruits and vegetables, preventing diseases like powdery mildew and anthracnose. They ensure produce remains visually appealing and safe for consumption, extending shelf life and meeting strict export quality standards, which is crucial for market competitiveness.

- Support for Precision Agriculture: Fungicides integrate with advanced technologies like drone spraying and data analytics. This allows precise application, reducing waste and environmental impact while effectively targeting fungal pathogens, enhancing crop health, and supporting sustainable farming practices.

- Resistance Management: Fungicides, especially single-site inhibitors, combat resistant fungal strains. Their targeted action helps manage diseases in high-value crops, ensuring consistent yields. Ongoing innovations in formulations enhance efficacy, making them essential for modern agriculture facing evolving fungal challenges.

- Sustainable Farming Solutions: Bio-fungicides, derived from natural sources, offer eco-friendly disease control. Used in organic farming, they align with consumer demand for residue-free produce. Their adoption in integrated pest management supports sustainable agriculture by reducing chemical use while maintaining crop productivity.

Recent Developments

1. Nufarm Ltd.

Nufarm has expanded its seed and soil health portfolio with the acquisition of two biologicals companies, Valagro and Agricen. This strategic move integrates conventional and biological fungicides, offering growers more sustainable tools for disease management and soil-borne pathogen control. Their focus is on creating synergistic solutions that enhance crop resilience and yield.

2. FMC Corporation

FMC recently launched Onsuva, a novel fungicide for broad-spectrum disease control in cereals. Its innovative isoflucypram chemistry offers a new mode of action, crucial for managing resistance in key pathogens like Septoria. This addition strengthens FMC’s cereal portfolio, providing growers with a powerful tool for protecting yield and quality in major crops.

3. BASF Agricultural Solutions

BASF is advancing digital farming with its xarvio HEALTHY FIELD platform, which now includes fungicide application models. The recent launch of Revysol (mefentrifluconazole) continues to be a focus, with new registrations expanding its use into more crops. This fungicide is central to their strategy of providing effective resistance management and high-efficacy disease control globally.

4. Cheminova A/S (Part of FMC)

As a wholly-owned subsidiary of FMC Corporation, Cheminova’s developments are integrated under the FMC brand. Their efforts are focused on leveraging FMC’s R&D pipeline, including new active ingredients like isoflucypram. The parent company’s recent launches and regulatory approvals for fungicides in various regions are deployed through the Cheminova commercial framework in Europe and other key markets.

5. Bayer Crop Science

Bayer launched Veltyma fungicide, a combination of Trifloxystrobin and Prothioconazole, for soybeans and corn. It is a key part of their broader disease management system. A major R&D focus remains on climate-resilient agriculture, developing solutions that help crops withstand disease pressure exacerbated by changing weather patterns, ensuring stable yields for farmers.

Conclusion

Fungicides play a critical role in modern agriculture, addressing rising fungal disease pressures driven by climate change and intensive farming. With a global market projected to grow steadily, innovations in bio-fungicides and precision application technologies are enhancing sustainability and efficacy. As demand for high-quality food increases, fungicides remain essential for ensuring crop yield, quality, and environmental responsibility.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)