Table of Contents

Overview

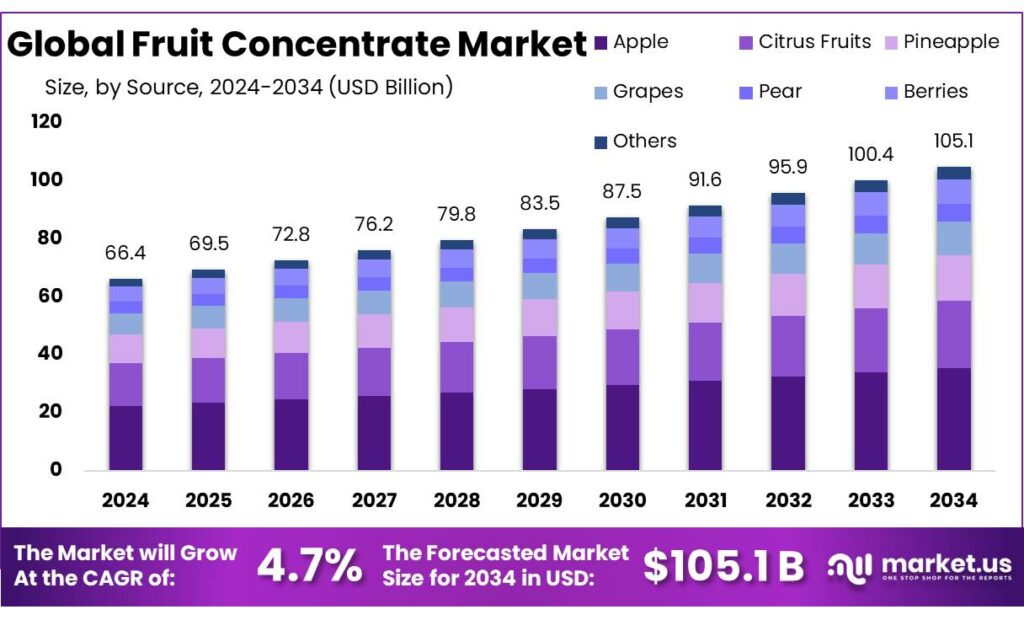

New York, NY – September 30, 2025 – The Global Fruit Concentrate Market is projected to reach USD 105.1 billion by 2034, up from USD 66.4 billion in 2024, reflecting a CAGR of 4.7% between 2025 and 2034. Asia Pacific held the leading position in 2024, accounting for more than 45.8% of global revenue, valued at USD 30.4 billion.

The fruit concentrate sector is expanding as a vital part of food processing and value-added agriculture. In India, government data highlights that only 4.5% of fruits were processed in 2020–21, a figure far below international standards. The Central Institute of Post-Harvest Engineering and Technology (CIPHET) aims to raise this level to 35%, strengthening value addition in the sector.

Market dynamics are influenced by both agricultural supply and evolving consumer demand. For instance, Brazil—an essential supplier of frozen concentrated orange juice is expected by the USDA to harvest 320 million 40.8-kg boxes in MY 2024/25, a 15% decline from the previous season. Meanwhile, consumer behavior continues to shift: U.S. per-capita orange juice intake dropped 54% between 2005 and 2021, while grapefruit juice fell 74%. These long-term trends have encouraged manufacturers to diversify toward blends, purées, and lower-sugar options.

The Government of India is reinforcing the fruit processing value chain through multiple initiatives. The Production Linked Incentive Scheme (PLIS) offers benefits to enterprises in processed fruits and vegetables, while the Agriculture Infrastructure Fund (AIF), launched in 2020 with a corpus of ₹1,00,000 crore (~USD 12 billion), supports entrepreneurs and farmer collectives in establishing processing units and cold-chain facilities. By February 2025, Punjab alone secured allocations rising to ₹7,050 crore under this scheme.

Further strengthening the sector, the government introduced the Prime Minister Dhan-Dhaanya Krishi Yojana in July 2025. With an annual budget of ₹24,000 crore for six years, it focuses on yield enhancement, sustainable farming practices, better storage infrastructure, and easier access to credit for approximately 1.7 crore farmers.

Key Takeaways

- The Global Fruit Concentrate Market size is expected to be worth around USD 105.1 billion by 2034, from USD 66.4 billion in 2024, growing at a CAGR of 4.7%.

- Apple held a dominant market position, capturing more than a 29.7% share in the global fruit concentrate market.

- Food & Beverages held a dominant market position, capturing more than a 68.8% share of the global fruit concentrate market.

- Hypermarkets and Supermarkets held a dominant market position, capturing more than a 36.3% share in the global fruit concentrate market.

- The Asia Pacific region stood out as the dominant force in the global fruit concentrate market—holding a commanding 45.8% share, which translates to about USD 30.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-fruit-concentrate-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 66.4 Billion |

| Forecast Revenue (2034) | USD 105.1 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Source (Apple, Citrus Fruits, Pineapple, Grapes, Pear, Berries, Others), By Application (Food and Beverages, Nutraceuticals and Supplements, Pet Food, Others), By Distribution Channel (Hypermarkets/Supermarkets, Online Sales, Wholesale Stores, Others) |

| Competitive Landscape | Royal Cosun, Kerr Concentrates, Inc., Dohler GmBH, Archer Daniels Midland, Agrana Beteiligungs Ag, Lemon Concentrate, S.L., Rudolf Wild GmBH & Co. Kg, Sunopata Inc., Tree Top Inc., FruitSmart Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157231

Key Market Segments

Source Analysis

Apple Secures 29.7% Market Share, Driven by Versatility and Global Demand

In 2024, Apple maintained a leading position in the global fruit concentrate market, commanding a 29.7% share. Its dominance stems from the widespread use of apple concentrate in diverse applications, such as juices, bakery fillings, sauces, and dairy products. Prized for its natural sweetness, long shelf life, and alignment with clean-label trends, apple concentrate appeals to both manufacturers and health-conscious consumers. A steady supply chain, supported by abundant apple production in countries like China, Poland, and the United States, further fuels this segment’s consistent growth.

Application Analysis

Food & Beverages Lead with 68.8% Share, Fueled by Demand for Natural Ingredients

The Food & Beverages sector dominated the global fruit concentrate market in 2024, capturing a 68.8% share. Fruit concentrates are integral to a wide range of products, including juices, smoothies, soft drinks, yogurts, bakery goods, and frozen desserts. Their natural sweetness, extended shelf life, and versatility in large-scale production make them a preferred choice, particularly as consumers increasingly favor healthier, fruit-based alternatives over artificial additives.

Distribution Channel Analysis

Hypermarkets and Supermarkets Hold 36.3% Share, Bolstered by Visibility and Trust

In 2024, Hypermarkets and Supermarkets led the global fruit concentrate market with a 36.3% share. These retail formats excel by offering a broad selection of brands and product types, enabling consumers to compare prices, inspect labels, and access promotional deals, especially on bulk purchases. The growth of organized retail in developed and emerging markets, such as the U.S., Germany, China, and India, reinforces this channel’s dominance. As in-person shopping for food products remains popular, Hypermarkets/Supermarkets are poised to retain their strong position into 2025, despite the rise of e-commerce.

Regional Analysis

Asia Pacific Commands 45.8% Share, Generating USD 30.4 Billion

In 2024, the Asia Pacific region led the global fruit concentrate market, holding a 45.8% share and contributing approximately USD 30.4 billion in revenue. This dominance is driven by a robust agricultural foundation, diverse fruit production, and rising demand from a growing middle class seeking convenient, natural food options.

Countries like China, India, and Southeast Asian nations benefit from cost-effective local fruit supplies and increasing consumer preference for fruit-based products. Government support for food processing and exports, particularly in India, enhances the region’s ability to serve both domestic and global markets. Expanded retail and e-commerce channels further accelerate distribution to urban and semi-urban consumers.

Top Use Cases

- Beverage Production: Fruit concentrate serves as a key ingredient in making juices, soft drinks, and smoothies, providing natural flavor and color without the bulk of fresh fruits. It blends easily in large-scale manufacturing, helping producers create consistent, tasty drinks that appeal to health-focused consumers seeking quick, refreshing options for daily hydration.

- Dairy Product Enhancement: In yogurts, ice creams, and milkshakes, fruit concentrate adds a burst of natural sweetness and fruity notes, improving taste while keeping products creamy and appealing. This makes it ideal for creating indulgent yet healthier dairy treats that families enjoy, especially as people look for simple ways to incorporate more fruit into meals.

- Bakery and Confectionery Fillings: Bakers use fruit concentrate in pies, jams, candies, and pastries to deliver intense fruit flavor and moisture, ensuring even distribution without sogginess. It supports the creation of shelf-stable sweets that taste homemade, catering to busy households and stores aiming to offer convenient, flavorful baked goods year-round.

- Sauce and Condiment Making: Fruit concentrate enriches sauces, syrups, and marinades with authentic fruit essence, balancing sweetness and tang for versatile cooking uses. Chefs and home cooks rely on it to elevate everyday meals like glazes or dips, making it a go-to for adding natural depth to dishes without needing fresh produce.

- Nutritional Supplements and Baby Foods: This versatile ingredient fortifies cereals, pouches, and health bars with concentrated vitamins and antioxidants from fruits, supporting wellness in easy-to-eat forms. It’s perfect for parents and active adults wanting nutrient boosts in portable snacks, aligning with the push for clean, fruit-based options in daily routines.

Recent Developments

1. Royal Cosun

Royal Cosun is focusing on sustainable sourcing and upcycling. Their recent developments include creating value from fruit and vegetable by-products, such as developing natural sweeteners and fibers from carrot pomace. This aligns with the circular economy trend, reducing waste and creating new revenue streams. They are investing in R&D to extract more functional ingredients from agricultural sidestreams.

2. Kerr Concentrates, Inc.

Kerr Concentrates continues to lead in clean-label fruit and vegetable concentrates. A key development is expanding their non-GMO and organic portfolio to meet rising consumer demand. They are also enhancing their technical support to help beverage and food manufacturers reduce sugar and artificial additives using their concentrated flavors and juice bases, emphasizing naturalness and simplicity in ingredient lists.

3. Dohler GmbH

Dohler is heavily investing in digitalization and natural ingredient solutions. A major development is their “Taste for More” program, focusing on plant-based and health-forward products. They are leveraging AI and big data to accelerate product development for clients, offering tailored fruit concentrate blends for beverages, dairy, and bakery that align with global taste and wellness trends faster than ever before.

4. Archer Daniels Midland (ADM)

ADM is expanding its global production and portfolio of citrus and tropical fruit concentrates. A significant recent development is the expansion of their Valencia, Spain, facility to increase citrus juice and concentrate capacity. This strengthens their supply chain in Europe. They are also launching new solutions that blend concentrates with flavors and probiotics to meet demand for functional, nutritious beverages.

5. Agrana Beteiligungs-AG

Agrana is strategically pivoting towards high-growth, value-added segments. A key development is their increased focus on fruit preparations and concentrates for the plant-based dairy alternative market, such as yogurt and drinks. They are creating specialized fruit solutions that provide optimal taste, texture, and color in these challenging applications, capitalizing on the shift away from traditional dairy products.

Conclusion

Fruit Concentrate is a powerhouse ingredient that’s reshaping the food world in exciting ways. With folks everywhere craving natural, hassle-free foods that pack real flavor and goodness, this simple extract from fruits is stepping up big time. It’s weaving into everything from quick drinks to cozy desserts, helping brands craft products that feel fresh and trustworthy. Looking ahead, its knack for fitting busy lives and clean eating vibes points to even brighter days, making it a smart bet for anyone eyeing smarter, tastier eats without the fuss.