Table of Contents

Overview

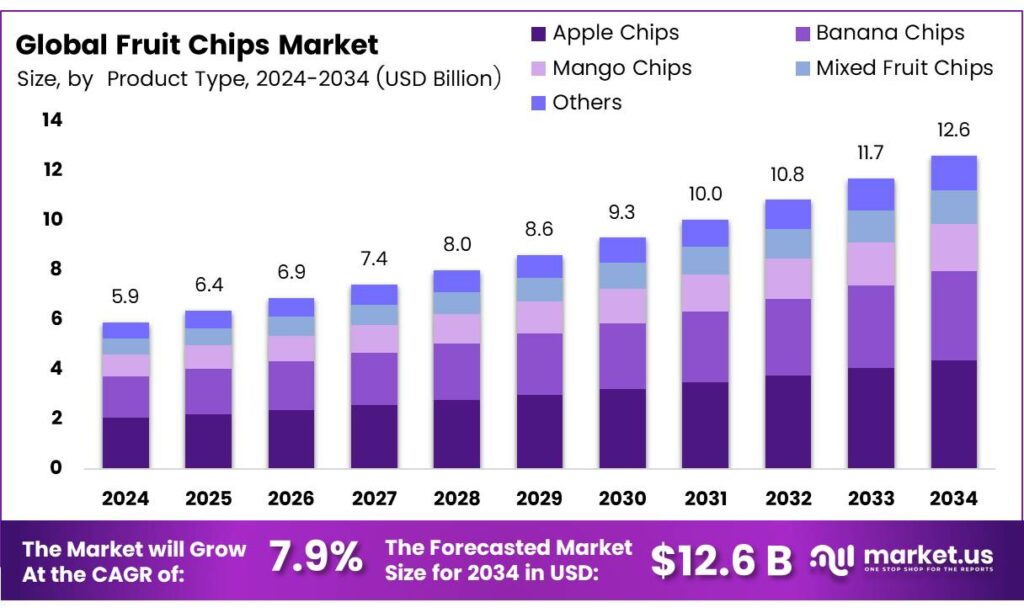

New York, NY – September 30, 2025 – The Global Fruit Chips Market is projected to grow from USD 5.9 billion in 2024 to USD 12.6 billion by 2034, expanding at a CAGR of 7.9% between 2025 and 2034.

Dried fruits have long been recognized as nutritious and popular snack options; however, detailed insights into their nutritional value and phytochemical composition remain limited. A recent study analyzed freeze-dried fruits from four species: two common ones (apple and goji) and two emerging products (kaki and kiwi). The research examined sugar and organic acid levels, total phenolic compounds (TPC), and other bioactive phytochemicals through HPLC fingerprinting.

The antioxidant capacity (AOC) of these fruits varied widely. Kiwis recorded the lowest TPC at 210.9 mg GAE/100 g DW, while kaki reached the highest at 872.6 mg GAE/100 g DW. Similarly, AOC ranged from 23.09 mmol Fe²⁺/kg DW in goji to 137.5 mmol Fe²⁺/kg DW in kaki. Apples, kiwis, and kaki were dominated by phenolics (74.6–93.3%), whereas goji contained a higher proportion of monoterpenes (67.5%). Interestingly, no anthocyanins were detected, likely due to their conversion into phenolic acids during the drying process.

Beyond fruit chips, baked carrot chips are increasingly marketed as healthier alternatives to traditional potato chips. While carrot chips are typically deep-fried, vacuum frying (VF) has emerged as a promising method for creating chips with reduced oil content and improved nutritional quality. This technique has also been applied to banana chips, where VF and conventional frying at 101.3 kPa, 170 °C produced distinct structural and textural differences.

Vacuum frying reduced chip volume by about 40.7%, primarily due to water vaporization, which created larger pores. This process yielded the highest breaking force (20 N) in vacuum-fried banana chips, attributed to starch network formation and crust porosity. Another study highlighted that VF produced banana chips with textures ranging from soft and rubbery to crisp and hard, with measured hardness values reaching 12.17 N.

Key Takeaways

- The Global Fruit Chips Market is projected to grow from USD 5.9 billion in 2024 to USD 12.6 billion by 2034, with a CAGR of 7.9%.

- Apple Chips held a 34.7% market share in 2024, driven by consumer preference for their healthy and flavorful profile.

- Conventional fruit chips captured a 63.6% market share in 2024, favored for their cost-effective, large-scale production.

- Sweet fruit chips dominated with a 48.5% market share in 2024, appealing to consumers seeking indulgent yet healthier snacks.

- Supermarkets and Hypermarkets led distribution with a 37.8% share in 2024, offering wide product visibility and bulk purchase options.

- Household consumption held a 52.7% market share in 2024, reflecting demand for convenient, nutritious at-home snacks.

- North America led the market in 2024 with a 44.8% share, valued at USD 2.6 billion, driven by a strong snacking culture and clean-label trends.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-fruit-chips-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.9 Billion |

| Forecast Revenue (2034) | USD 12.6 Billion |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Product Type (Apple Chips, Banana Chips, Mango Chips, Mixed Fruit Chips, Others), By Source (Conventional, Organic), By Flavor (Sweet, Savory, Spicy, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others), By End-User (Household, Foodservice, Others) |

| Competitive Landscape | Bare Snacks, Calbee Inc., Traina Foods, Chaucer Foods Ltd., Greenday Global, Seeberger GmbH, Nanguo Foodstuff Co., Ltd., Kiwi Garden Ltd., LioBites, Snackible |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157600

Key Market Segments

By Product Type

In 2024, Apple Chips led the global fruit chips market with a 34.7% share, driven by their popularity as a healthy and flavorful snack. Their natural sweetness, high fiber content, and portability make them a favorite among health-conscious consumers and families. Innovations like baked and vacuum-fried apple chips, which reduce oil while maintaining crispiness, have broadened their appeal to fitness enthusiasts and casual snackers alike. The segment is poised for continued growth, fueled by the rise of plant-based diets and increased presence in retail, supermarkets, and school meal programs.

By Source

Conventional sourcing dominated the fruit chips market in 2024, holding a 63.6% share. Its cost-effectiveness and scalability make it the preferred choice for large-scale production, ensuring affordability and consistent supply, particularly in price-sensitive markets. This segment’s strength is expected to persist as it meets growing demand for budget-friendly fruit chips, even in regions with limited access to organic alternatives.

By Flavor

Sweet-flavored fruit chips, capturing a 48.5% share in 2024, remain the top choice due to their indulgent yet healthier profile compared to traditional sugary snacks. Popular among families and younger consumers, sweet varieties like apple, banana, and mango chips are enhanced with flavors such as honey, cinnamon, and caramel. These innovations continue to attract a diverse consumer base. The sweet flavor segment is expected to lead into 2025, driven by demand for naturally sweet, minimally processed snacks aligned with healthy eating trends.

By Distribution Channel

Supermarkets and hypermarkets held a 37.8% share of the fruit chips market in 2024, benefiting from extensive product visibility, diverse brand offerings, and promotional opportunities. Strategic in-store placement and eye-catching packaging have boosted impulse purchases. As these retail chains expand into urban and semi-urban areas, their convenience and trusted reputation are expected to maintain their dominance in driving fruit chip sales.

By End-User

The household segment led with a 52.7% share in 2024, reflecting a growing preference for healthier at-home snacking options. Fruit chips, balancing taste and nutrition, are popular among both adults and children. The rise in mindful eating, busy lifestyles, and e-commerce accessibility has fueled at-home consumption, a trend expected to strengthen into 2025 as remote work and healthy snacking habits persist.

Regional Analysis

North America led the global fruit chips market in 2024, holding a 44.8% share with a market value of USD 2.6 billion. The region’s strong snacking culture and growing demand for healthier, plant-based alternatives to potato chips drive this dominance. In the U.S., nearly 60% of adults aim to cut sugar and fat, boosting the popularity of baked, clean-label fruit chips. Major retailers like Walmart, Costco, and Kroger, alongside e-commerce platforms like Amazon, enhance accessibility for brands, especially among millennials and Gen Z. Health campaigns promoting balanced diets and concerns about obesity further fuel the shift toward fruit-based snacks, solidifying North America’s market leadership.

Top Use Cases

- Healthy Everyday Snacking: Fruit chips serve as a tasty, crunchy alternative to traditional snacks, packed with natural sweetness and nutrients from fruits like apples and bananas. Busy people grab them for quick energy boosts during work or school, enjoying their portability without added sugars or oils. This keeps munching fun and guilt-free, fitting right into daily routines for better wellness.

- Trail Mix and On-the-Go Mixes: Mix fruit chips with nuts, seeds, or chocolate bits to create custom trail mixes perfect for hikes, road trips, or desk drawers. Their light crispiness adds texture and flavor bursts, making long adventures more enjoyable. Families love packing them for picnics, turning simple outings into delightful, shareable treats that stay fresh for hours.

- Toppings for Meals and Desserts: Sprinkle fruit chips over yogurt, salads, oatmeal, or ice cream for an instant crunch and fruity pop. Chefs use them to elevate everyday dishes, like crumbling banana chips on pancakes or apple slices atop smoothies. This simple trick transforms boring meals into exciting ones, appealing to home cooks who want easy ways to add nutrition and flair.

- Gifting and Party Favors: Package fruit chips in cute bags or boxes as thoughtful gifts for birthdays, holidays, or thank-yous, highlighting their natural appeal and vibrant colors. At parties, they shine as favors or snack stations, letting guests mix flavors like mango or berry. This builds connections through wholesome sharing, ideal for health-focused gatherings.

- Baking and Recipe Ingredients: Fold fruit chips into cookie dough, muffin batter, or granola bars for a chewy-crisp surprise in homemade treats. Bakers experiment by crushing them for pie crusts or coating energy balls, blending their subtle sweetness with other flavors. This sparks creativity in kitchens, helping hobbyists craft unique, fruit-forward goodies without much hassle.

Recent Developments

1. Bare Snacks

Bare Snacks has expanded its product line with new flavor innovations like Apple Cinnamon and Toasted Coconut Banana Chips. The company heavily emphasizes its simple, non-GMO ingredients and oven-baking process as key health differentiators. Recent marketing campaigns focus on positioning the chips as a clean-label, better-for-you snack for both children and adults, aligning with the demand for transparent and minimal processing in food products.

2. Calbee Inc.

Calbee has been leveraging its Frugra brand in Japan, which combines dried fruit with whole grains like oats and barley. Recent developments focus on R&D for texture enhancement and flavor retention in their freeze-dried products. While fruit chips are a smaller segment for them, Calbee is investing in sustainable packaging and promoting the health functional benefits of their fruit and grain combinations to health-conscious consumers.

3. Traina Foods

Traina Foods, known for its Sun Dried Fruits, has recently introduced new product formats, including single-serve bags of its baked fruit chips. The company highlights its use of California-grown, non-GMO Project Verified fruits. A key recent development is its increased focus on the private-label manufacturing sector, supplying natural and organic fruit chips to major retail brands seeking to capitalize on the clean-label snack trend.

4. Chaucer Foods Ltd.

Chaucer Foods, a major global supplier of freeze-dried ingredients, has recently invested in new state-of-the-art freeze-drying capacity to meet rising demand. Their development focuses on custom fruit solutions for the food industry, including various sugars, infusions (like yogurt coating), and piece sizes. They are also promoting the sustainability and long shelf-life of their freeze-dried fruits as a key advantage for manufacturers in multiple categories.

5. Greenday Global

Greenday Global has expanded its freeze-dried fruit snack offerings with new combinations, such as mixed fruit packs and veggie-fruit blends. A significant recent development is their push into new international markets, particularly in North America and Europe. The company emphasizes its sustainable sourcing and the retention of natural nutrients and color through its freeze-drying technology as primary marketing points to stand out in the competitive healthy snack aisle.

Conclusion

Fruit Chips is riding a wave of smart eating habits, where folks crave snacks that taste great yet feel light on the body. With more people juggling fast lives and wellness goals, these crispy bites fit seamlessly as go-to options in homes, stores, and travels. Flavors keep evolving to match bold tastes, while easy access through shops and online spots pulls in families and adventurers alike. Fruit chips aren’t just a trend; they’re becoming everyday heroes in the snack world, promising brighter, crunchier tomorrows for health lovers everywhere.