Table of Contents

Overview

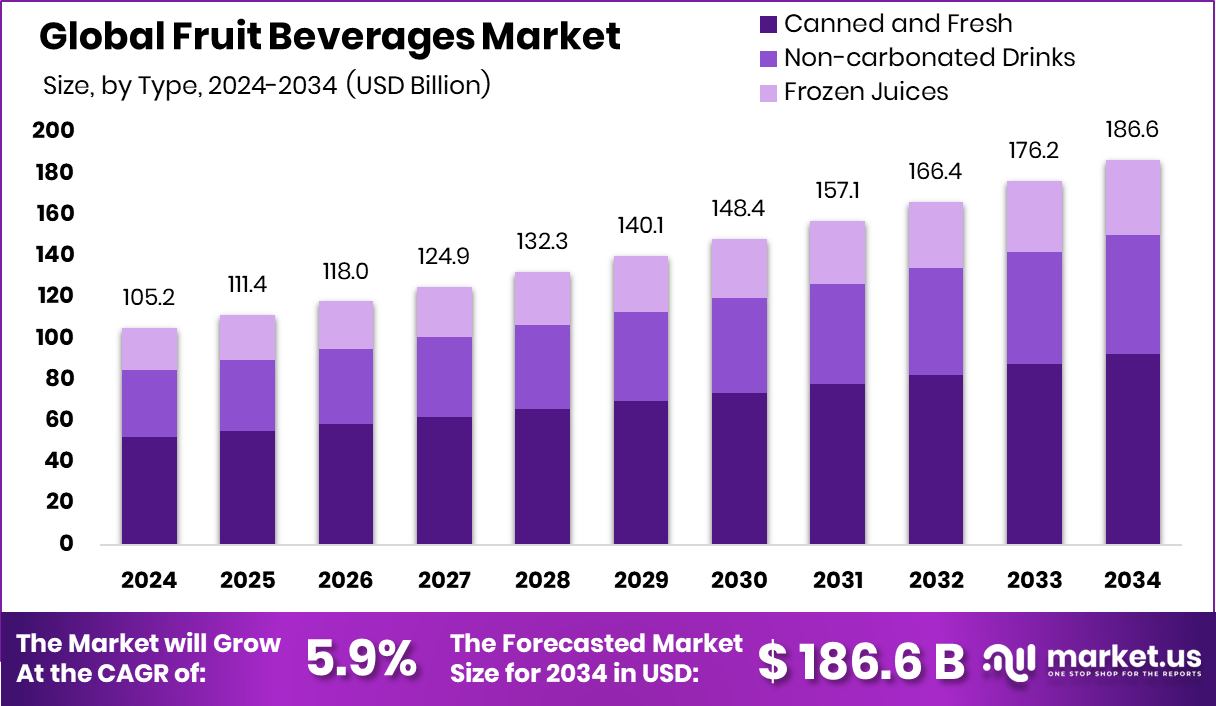

New York, NY – September 26, 2025 – The Global Fruit Beverages Market is projected to reach USD 186.6 billion by 2034, rising from USD 105.2 billion in 2024, at a steady CAGR of 5.9% between 2025 and 2034. North America dominates the market, holding a 48.3% share valued at USD 50.8 billion.

Fruit beverages include juices, nectars, smoothies, and flavored drinks derived from fruits, offering consumers natural taste and essential nutrients. These beverages can be consumed fresh, packaged, or in concentrated form, making them a popular alternative to carbonated and artificially flavored drinks.

Recent industry momentum highlights strong investor confidence. For example, soda maker Culture Pop secured $21 million to accelerate its expansion, while Beverage startup Rio Innobev raised Rs 10 crore in a funding round led by Atomic Capital. Similarly, sparkling water brand Dash attracted £8.7 million in Series A funding, and Paper Boat, a well-known F&B brand, received $50 million from Singapore’s sovereign fund GIC.

Market growth is primarily driven by rising health and wellness awareness. Consumers are shifting away from sugary sodas toward natural, fruit-based drinks rich in vitamins, minerals, and antioxidants, making fruit beverages a preferred daily refreshment. Additionally, increasing urbanization and fast-paced lifestyles are fueling the demand for ready-to-drink juices and smoothies, which provide both convenience and nutrition for young professionals and busy households.

Key Takeaways

- The Global Fruit Beverages Market is expected to be worth around USD 186.6 billion by 2034, up from USD 105.2 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- By Type, Canned and Fresh held 49.6% in the Fruit Beverages Market.

- Hypermarket and Supermarket channels captured 39.4% of the fruit beverages market.

- North America’s 48.3% dominance, worth USD 50.8 Bn, reflects strong consumer preference for healthy beverages.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/fruit-beverages-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 105.2 Billion |

| Forecast Revenue (2034) | USD 186.6 Billion |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Type (Canned and Fresh, Non-carbonated Drinks, Frozen Juices), By Distribution Channel (Hypermarket/Supermarket, Convenience Stores, Online, Others) |

| Competitive Landscape | Tropicana Products, Inc., The Coca‑Cola Company, The Campbell’s Company, Langer Juice Company, Inc., Ceres Fruit Juices Pty Ltd., Industries Lassonde Inc., Ocean Spray, Fresh Del Monte, Keurig Dr Pepper Inc., Danone S.A. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157595

Key Market Segments

By Type Analysis

Canned and fresh fruit beverages led the Fruit Beverages Market in 2024, commanding a 49.6% share. This dominance underscores a strong consumer preference for convenient yet fresh options. Canned beverages are favored for their extended shelf life and ease of storage, appealing to households and retailers alike. Meanwhile, fresh fruit beverages attract health-conscious consumers who prioritize natural flavors and nutritional benefits.

These categories complement each other, serving diverse needs like on-the-go convenience for canned products and immediate refreshment for fresh juices. Innovations in packaging technology, which preserve flavor and extend shelf life without sacrificing quality, along with growing demand for clean-label and minimally processed drinks, have further strengthened this segment.

By Distribution Channel Analysis

In 2024, hypermarkets and supermarkets captured a 39.2% share of the Fruit Beverages Market, reinforcing their critical role in distribution. These retail formats dominate due to their ability to offer a wide range of products, including canned, packaged, and fresh beverages, catering to varied consumer preferences.

Their one-stop shopping experience, coupled with promotional strategies like discounts and bundled offers, encourages bulk purchases. Supermarkets also maintain controlled environments to ensure product freshness, which is vital for fruit beverages. In-store displays and sampling further boost visibility and consumer engagement, driving sales of new and established products.

Regional Analysis

North America led the Fruit Beverages Market in 2024 with a 48.3% share, valued at USD 50.8 billion. This dominance is driven by high demand for natural and functional drinks, supported by a robust retail network of supermarkets, hypermarkets, and convenience stores. Health-conscious consumers in the U.S. and Canada increasingly favor fruit beverages over carbonated sodas, boosting both fresh and packaged options.

Europe follows as a key market, with growing demand for organic and clean-label products, particularly among younger demographics. Asia Pacific is experiencing rapid growth due to urbanization, evolving diets, and rising incomes in emerging economies. The Middle East & Africa are seeing increased interest in hydration and wellness, while Latin America leverages its abundant fruit resources for local production. North America’s leading share positions it as a hub for innovation and high consumption in the global fruit beverages market.

Top Use Cases

- Daily Health Boost: Fruit beverages serve as an easy way for busy people to get vitamins and antioxidants into their routine. Health-focused folks grab a glass of orange or mixed fruit juice each morning to support immunity and energy without extra effort. This habit fits modern lifestyles, replacing sugary sodas with natural refreshment that aids digestion and overall wellness, making it a simple step toward better daily habits.

- On-the-Go Convenience: For urban workers rushing through the day, ready-to-drink fruit smoothies or canned juices offer quick hydration and a nutrient hit during commutes or lunch breaks. These portable options blend convenience with fresh flavors like berry or tropical mixes, helping maintain focus and vitality amid tight schedules. They turn hectic moments into simple, satisfying pauses that keep energy steady without slowing down.

- Fitness and Post-Workout Recovery: Athletes and gym-goers turn to fruit beverages like pineapple or watermelon blends right after exercise to replenish fluids and natural sugars. These drinks aid muscle recovery with electrolytes and anti-inflammatory perks from real fruit, providing a tasty alternative to plain water. It’s a go-to choice that refreshes while supporting active bodies in their push for peak performance.

- Family-Friendly Kid Snacks: Parents pick fruit nectars or apple blends as fun, nutritious treats for children, sneaking in fruits they might skip at meals. These mild, sweet options make snack time engaging and healthy, boosting intake of essential nutrients without battles over veggies. They fit playdates or school lunches, fostering good eating habits in a lighthearted way that kids actually enjoy.

- Social and Cocktail Mixers: At gatherings or home bars, fruit beverages shine as versatile bases for mocktails or light cocktails, adding zesty citrus or berry twists to drinks. Hosts use them to create refreshing, low-alcohol options that appeal to all guests, enhancing flavors naturally. This use case turns everyday parties into vibrant, inclusive events where everyone sips something fresh and flavorful.

Recent Developments

1. Tropicana Products, Inc.

Following its sale by PepsiCo, Tropicana is focusing on innovation under new ownership. Recent developments include expanding its Tropicana Farmstand juice and smoothie line with new blends featuring vegetables and probiotics. The brand is also prioritizing packaging sustainability, increasing the use of recycled PET plastic. These initiatives aim to revitalize the classic juice brand for health-conscious consumers and align with broader environmental, social, and governance (ESG) goals in the beverage industry.

2. The Coca‑Cola Company

Coca-Cola continues to diversify its fruit beverage portfolio with a strong focus on reduced-sugar options and functional benefits. Recent launches include new Minute Maid Zero-sugar varieties and Simply Juice smoothies with added probiotics. The company is also leveraging its Beverages for Life strategy by expanding its Smartwater nutrient-enhanced water and Topo Chico Sabores lines, combining fruit flavors with hydration and wellness trends to drive growth beyond traditional juices.

3. The Campbell’s Company

Campbell’s is innovating within its V8 juice brand to tap into the functional beverage market. A key recent development is the launch of V8+Hydrate, a line of vegetable and fruit juice blends with electrolytes and no added sugar. This move positions V8 as a healthy hydration alternative to sports drinks, aiming to attract health-active consumers and revitalize the brand’s presence in the competitive fruit and vegetable beverage category.

4. Langer Juice Company, Inc.

Langer Juice is emphasizing its commitment to clean labels and health-focused innovation. Recent developments include introducing new cold-pressed juice varieties and expanding its line of organic juices. The company has also enhanced its marketing to highlight the “no sugar added” and 100% juice attributes of its products, directly appealing to consumers seeking natural and wholesome beverage options without artificial ingredients, a key differentiator in the marketplace.

5. Ceres Fruit Juices Pty Ltd.

Ceres is focusing on global expansion and leveraging its provenance as a South African brand. Recent developments include launching single-variety 100% fruit juices, like Valencia Orange and Ruby Red Grapefruit, targeted at premium international markets. The company is also innovating with kid-friendly juice boxes containing no added sugar or preservatives, capitalizing on the demand for clean-label, natural products for children and strengthening its position as a trusted fruit juice exporter.

Conclusion

Fruit Beverages are evolving as a cornerstone of modern wellness and convenience. With consumers ditching sodas for natural picks that promise real fruit goodness and added perks like immune support, these drinks are weaving deeper into daily life. Busy routines and a push for clean, sustainable choices are fueling fresh innovations in flavors and packaging, drawing in families, fitness fans, and social sippers alike. This category stands strong, blending joy with health in ways that keep it fresh and relevant for tomorrow’s tastes.