Table of Contents

Overview

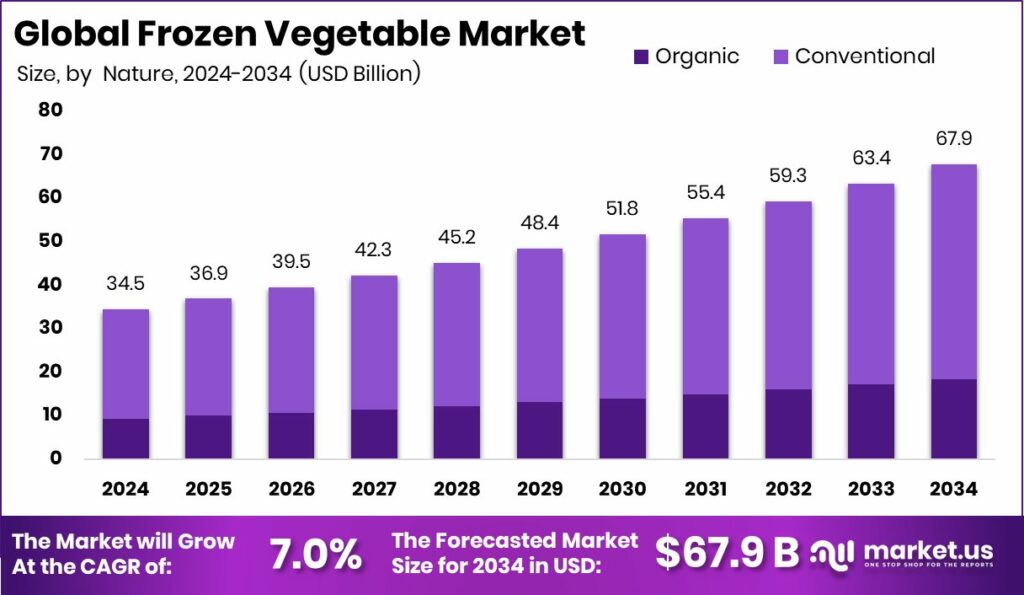

New York, NY – September 19, 2025 – The Global Frozen Vegetable Market is poised for steady expansion, projected to grow from USD 34.5 billion in 2024 to approximately USD 67.9 billion by 2034, registering a CAGR of 7.0% during 2025–2034. Europe currently leads the market with a 32.7% share, generating nearly USD 11.2 billion in revenue, underpinned by strong consumer demand for convenience-driven, nutrient-rich food options.

Frozen vegetables, which include peas, corn, broccoli, spinach, and mixed assortments, are processed through washing, cutting, and rapid freezing to preserve their taste, texture, and nutritional profile. This preservation method not only enhances shelf life but also reduces food waste, making it a practical solution for modern households. Their ease of use, requiring minimal preparation, aligns with the rising preference for quick meal solutions.

The market’s growth is fueled by increasing adoption of ready-to-cook meals, particularly among urban populations with busy lifestyles. Continuous advancements in freezing and cold chain technologies have further boosted consumer confidence by ensuring quality retention. Moreover, the health-conscious population increasingly values frozen vegetables for their ability to retain essential vitamins and minerals, positioning them as an affordable and accessible year-round alternative to fresh produce.

Opportunities also lie in the rapid expansion of e-commerce and online grocery platforms. As more households embrace digital shopping, frozen vegetables are gaining stronger traction through direct-to-home delivery models. This evolving retail landscape enables producers and distributors to tap into new consumer bases, bridging the gap between convenience, nutrition, and affordability, and strengthening the overall growth momentum of the frozen vegetable market.

Key Takeaways

- The Global Frozen Vegetable Market is expected to be worth around USD 67.9 billion by 2034, up from USD 34.5 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- Corn led the frozen vegetable market, capturing a strong 19.3% share.

- Conventional products dominated the frozen vegetable market in 2024, holding more than 73.7% overall share.

- Retail consumers accounted for a 48.9% share, showing their strong preference in the frozen vegetable market.

- Hypermarkets and Supermarkets drove sales in the frozen vegetable market with a 39.6% share.

- Europe’s Frozen Vegetable Market, valued at USD 11.2 Bn, captured a strong 32.7% share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/frozen-vegetable-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 34.5 Billion |

| Forecast Revenue (2034) | USD 67.9 Billion |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Vegetable Type (Broccoli and Cauliflower, Green Peas, Asparagus, Mushrooms, Spinach, Corn, Green Beans, Others), By Nature (Organic, Conventional), By End Use (Retail Consumers, Food Service Industry, Food Manufacturing, Institutional Buyers), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others) |

| Competitive Landscape | Ajinomoto Co., Inc., General Mills Inc., ITC Limited, ConAgra Foods, Inc., Uren Food Group Limited, B&G Foods Holdings Corp., Greenyard NV, J.R. Simplot Co., The Kraft Heinz Company, Nature’s Garden |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156620

Key Market Segments

By Vegetable Type

Corn led the frozen vegetable market in 2024, commanding a 19.3% share. Its popularity stems from its versatility in dishes like soups, salads, and side servings, appealing to both households and food service sectors. Frozen corn’s sweet flavor, ease of preparation, and year-round availability drive its demand. Rich in fiber, vitamins, and antioxidants, it appeals to health-conscious consumers seeking affordable, nutritious options. Advanced freezing technology ensures minimal nutrient loss, reinforcing corn’s role as a market leader and a staple across diverse cuisines.

By Nature

Conventional frozen vegetables dominated with a 73.7% share in 2024, driven by their affordability and widespread availability. Large-scale production and established supply chains keep costs low, making them accessible to households and food service providers. These products balance price, convenience, and nutrition, with freezing technology preserving essential nutrients. Supermarkets heavily stock conventional options, solidifying their market presence. This segment’s dominance highlights its critical role in meeting consumer demand and fueling market growth.

By End Use

Retail consumers accounted for 48.9% of the frozen vegetable market in 2024, reflecting a preference for convenient, ready-to-use products. Frozen vegetables suit fast-paced lifestyles, offering nutrition, easy storage, and flexible pack sizes for daily cooking. Their cost-effectiveness and ability to reduce food waste make them a go-to choice for households. Enhanced freezing techniques preserve taste, color, and nutrients, positioning frozen vegetables as a reliable alternative to fresh produce and a key driver of market growth.

By Distribution Channel

Hypermarkets and supermarkets held a 39.6% share of the frozen vegetable market in 2024, serving as the primary shopping destinations. These outlets offer diverse brands, pack sizes, and price points, supported by robust cold storage to maintain product quality. Promotional offers, bulk discounts, and loyalty programs boost affordability and sales. Their widespread presence in urban and semi-urban areas ensures consistent demand, making them pivotal in shaping consumer behavior and sustaining market growth.

Regional Analysis

Europe led the global frozen vegetable market in 2024 with a 32.7% share, valued at USD 11.2 billion. Strong demand for convenient, healthy, and sustainable food options drives this dominance. Advanced cold storage, strict quality standards, and widespread retail networks support the market, particularly in Germany, France, and the UK.

Urbanization, busy lifestyles, and growing interest in vegetarian and plant-based diets further boost consumption. While North America, Asia Pacific, Latin America, and the Middle East & Africa show growth, Europe’s mature market and strong infrastructure maintain its leadership.

Top Use Cases

- Home Meal Preparation: Busy families can quickly add frozen vegetables like peas or carrots to stir-fries, soups, or rice dishes without chopping or washing fresh ones. This saves time during weeknight dinners, keeps meals balanced with easy nutrition, and reduces kitchen mess for those juggling work and home life.

- Food Service Efficiency: Restaurants and catering services use frozen broccoli or mixed veggies in bulk for salads, sides, or entrees, ensuring consistent taste and portion sizes every time. It cuts prep costs, minimizes waste from spoilage, and allows chefs to focus on flavors in high-volume operations.

- Health-Focused Snacking: Fitness enthusiasts steam or microwave frozen green beans or cauliflower as low-calorie snacks or sides to protein meals, retaining vitamins without added sugars. This supports weight management and daily veggie intake goals, making healthy eating simple even on rushed days.

- Plant-Based Diet Support: Vegans blend frozen spinach or corn into smoothies, patties, or curries for nutrient-packed meals that mimic fresh produce year-round. It offers versatile, affordable ways to meet protein and fiber needs, helping sustain meat-free lifestyles with minimal effort.

- Off-Season Availability: In regions with harsh winters, consumers rely on frozen mixed vegetables for stews or casseroles when fresh options are scarce or pricey. This ensures steady access to diverse nutrients, promotes year-round cooking variety, and cuts food waste by extending produce usability.

Recent Developments

1. Ajinomoto Co., Inc.

Ajinomoto is leveraging its frozen vegetable operations to support its core seasonings and frozen meals business. A key development is the expansion of its Well-Fron line, which focuses on IQF (Individually Quick Frozen) vegetables that retain texture and color. This ensures a high-quality ingredient supply for food service and consumer products, emphasizing convenience and nutritional value without additives.

2. General Mills Inc. (via subsidiary Green Giant)

Green Giant has significantly innovated by expanding its Veggie Spirals and Riced Veggies lines, directly responding to consumer demand for low-carb and vegetable-based alternatives to pasta and rice. Their focus is on making vegetable consumption easier and more fun through product innovation in the frozen aisle, often incorporating trendy flavors and convenience-focused packaging.

3. ITC Limited (via ITC Foods)

ITC’s recent focus on frozen vegetables is on expanding its Farmland brand’s distribution and product range within India. The company is leveraging its extensive agri-sourcing network to ensure quality. A key development is the introduction of regional mixed vegetable blends and products like frozen okra (bhindi), catering to local culinary preferences and making them available year-round.

4. ConAgra Brands, Inc. (owner of Birds Eye)

ConAgra’s Birds Eye brand launched the Birds Eye Voila complete meal kits in the frozen section, which often feature vegetables as a primary component. While not solely a vegetable product, this development integrates their frozen vegetables into meal solutions. They also continue to promote their Steamfresh line, emphasizing the ease of preparing perfectly cooked frozen vegetables.

5. Uren Food Group Limited

As a major B2B supplier, Uren’s recent developments focus on sustainability and supply chain resilience. They have invested in advanced freezing technologies to enhance product quality and extend shelf life. A key focus is on securing long-term partnerships with growers to ensure a consistent supply of high-quality vegetables, mitigating climate and geopolitical risks for their global customer base.

Conclusion

Frozen Vegetables as a smart choice for modern eaters who want quick, wholesome meals without the hassle of fresh prep. They lock in peak freshness and goodness, fitting perfectly into busy routines and health goals, while cutting down on waste and costs. With rising interest in easy, plant-friendly foods, this category keeps growing as a reliable kitchen staple, helping more people enjoy balanced eating every day.