Table of Contents

Overview

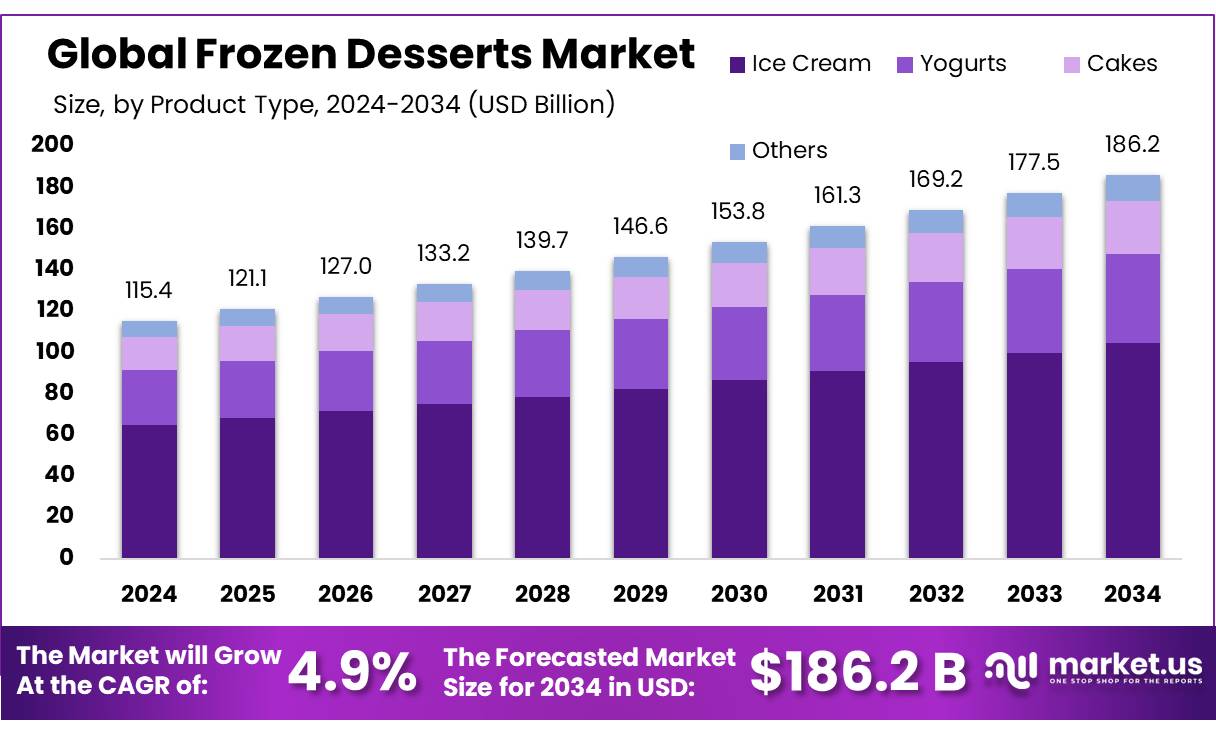

New York, NY – August 04, 2025 – The Global Frozen Desserts Market is projected to grow from USD 115.4 billion in 2024 to USD 186.2 billion by 2034, achieving a CAGR of 4.9% during the 2025–2034 forecast period. In 2024, North America led the market, accounting for a 42.8% share and generating USD 49.3 billion in revenue.

Frozen dessert concentrates are a key segment within the frozen food industry, driven by rising demand for convenient and indulgent dessert options. These concentrates streamline the production of ice creams, sorbets, and frozen yogurts, enabling manufacturers to deliver consistent flavor and texture cost-effectively.

Consumer preferences for convenience, affordability, and diverse flavor profiles are fueling market growth. According to the USDA, U.S. per capita consumption of frozen dairy products increased from 17.4 pounds in 2019 to 18.4 pounds in 2020, reflecting steady demand.

Advancements in food processing technology and improved shelf-life of concentrate products are further propelling the market, enhancing product consistency and enabling a wide range of dessert options tailored to evolving dietary needs.

The post-pandemic surge in demand for convenient food products has significantly boosted the frozen desserts sector. Ready-to-use concentrates, which save preparation time and ensure product uniformity, are particularly appealing to manufacturers.

Emerging markets are also driving demand for frozen dessert concentrates. The WHO reports a rise in processed and packaged food consumption in developing countries, with frozen desserts in China growing at an annual rate of 11% over the past five years. In India, nearly USD 1 billion was invested under the Twelfth Five-Year Plan to develop food parks, cold chains, and processing facilities. In the U.S., BEA data shows industrial production indices for frozen dessert manufacturing rising from 100 in 2021 to over 123 by late 2024, indicating robust growth.

Key Takeaways

- Frozen Desserts Market size is expected to be worth around USD 186.2 billion by 2034, from USD 115.4 billion in 2024, growing at a CAGR of 4.9%.

- Ice Cream held a dominant market position, capturing more than a 56.3% share of the global frozen desserts market.

- Conventional held a dominant market position, capturing more than an 82.4% share of the global frozen desserts market.

- Supermarket/hypermarket held a dominant market position, capturing more than a 48.1% share of the global frozen desserts market.

- North America emerged as the dominant region in the global frozen desserts market, accounting for 42.8% of the total market share, which is valued at approximately USD 49.3 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-frozen-desserts-market/request-sample/

Report Scope

| Market Value (2024) | USD 115.4 Billion |

| Forecast Revenue (2034) | USD 186.2 Billion |

| CAGR (2025-2034) | 4.9% |

| Segments Covered | By Product Type (Ice Cream, Yogurts, Cakes, Others), By Category (Conventional, Sugar-Free), By Distribution Channel (Supermarket/hypermarket, Convenience Store, Café and Bakery Shops, Online, Others) |

| Competitive Landscape | Amul, Arun Ice Cream, Baskin-Robbins LLC, Bulla Dairy Foods, Cielo, ConAgra Foods, Dunkin’ Brands Group Inc., Ferrero Spa, Fonterra Co-operative Group Limited, General Mills Inc., Kraft Foods Group Inc., London Dairy Co. Ltd, Meiji Holdings Co., Ltd, Mondelēz International Inc., Mother Dairy, Nestlé SA |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152769

Key Market Segments

By Product Type Analysis

Ice Cream commands a 56.3% share in 2024, driven by its widespread popularity and global consumption trends. Its dominance stems from broad appeal across age groups, diverse flavor offerings, and availability in various formats. Ice cream remains the most consumed frozen dessert, supported by traditional retail and foodservice channels. Seasonal demand during warmer months, coupled with rising urbanization and disposable incomes in developing nations, continues to boost sales.

By Category Analysis

Conventional Frozen Desserts hold an 82.4% share in 2024, reflecting strong consumer familiarity and a broad product range. This category, encompassing dairy-based ice creams, frozen yogurts, and sorbets, benefits from its entrenched presence in households and retail. Affordable pricing, widespread availability in supermarkets and foodservice outlets, and alignment with established tastes ensure consistent year-round demand.

By Distribution Channel Analysis

Supermarkets and hypermarkets dominate with a 48.1% share in 2024, fueled by accessibility and product variety. Their extensive geographical reach, robust cold chain infrastructure, and diverse brand offerings attract consumers seeking convenience, promotions, and bulk purchases. Dedicated freezer sections and impulse buying further drive sales in these retail formats.

Regional Analysis

In 2024, North America leads the global frozen desserts market with a 42.8% share, valued at USD 49.3 billion. This dominance is driven by strong demand for traditional and health-focused frozen desserts, available through supermarkets, hypermarkets, and specialty stores. In the U.S., the largest market in the region, over 90% of households consume ice cream, per the International Dairy Foods Association.

The rise of lactose-free, plant-based, and high-protein options reflects shifting dietary preferences, with non-dairy frozen dessert sales showing double-digit growth due to vegan and flexitarian trends. North America also leads in innovation, with frequent launches of clean-label, low-sugar, and sustainably packaged products addressing health and environmental concerns.

E-commerce growth further supports the market, with online grocery sales, including frozen desserts, reaching over 15.4% of total U.S. food and beverage retail in 2023, according to the U.S. Census Bureau. Enhanced cold-chain logistics and rapid delivery services have expanded product accessibility.

Top Use Cases

- Quick Snacking Solution: Frozen desserts like ice pops and pre-packaged ice cream are perfect for quick snacks. They require no prep, making them a go-to for busy families, students, or professionals needing a sweet treat on the fly, especially during hot weather.

- Health-Focused Alternatives: Low-calorie, dairy-free, and organic frozen desserts appeal to health-conscious consumers. Options like sorbets or plant-based ice creams meet the needs of those with dietary restrictions, such as vegans or those avoiding sugar, driving demand for guilt-free indulgence.

- Gourmet and Premium Experiences: Artisanal frozen desserts with unique flavors like lavender or salted caramel attract foodies. High-end brands use quality ingredients and eco-friendly packaging, appealing to consumers seeking luxury treats for special occasions or gifting.

- Social Media and Trendy Appeal: Eye-catching frozen desserts, like swirled gelato or colorful popsicles, gain traction on social media. Gen Z and millennials share these trendy treats online, boosting brand popularity and driving sales through viral marketing.

- Online Shopping Convenience: E-commerce platforms offer frozen desserts with reliable cold-chain delivery. Consumers can order ice cream or frozen yogurt online, enjoying convenience and variety, especially in cities where doorstep delivery is expanding rapidly.

Recent Developments

1. Amul

- Amul has expanded its frozen dessert portfolio with new sugar-free and vegan options, catering to health-conscious consumers. The brand launched “Amul Sugar-Free Frozen Dessert” in chocolate and vanilla flavors, made with natural sweeteners. Additionally, Amul introduced plant-based frozen desserts under its “Nutramul” range, using almond and coconut milk.

2. Arun Ice Cream

- Arun Ice Cream has introduced a new range of “Real Fruit Frozen Desserts,” incorporating natural fruit pulp without artificial additives. The company also launched probiotic frozen yogurt to attract health-focused buyers. Arun has expanded its retail presence in South India, partnering with modern trade outlets and quick-commerce platforms for faster delivery. Additionally, the brand is focusing on sustainable packaging to reduce environmental impact.

3. Baskin-Robbins LLC

- Baskin-Robbins has been innovating with limited-edition flavors and collaborations, such as the “Oreo Mint Chip” and “Non-Dairy Chocolate Chip Cookie Dough.” The company is expanding its non-dairy lineup to cater to vegan customers. Baskin-Robbins also introduced a new digital loyalty program and enhanced its mobile app for smoother ordering. Internationally, the brand is growing in markets like India and the Middle East with customized regional flavors.

4. Bulla Dairy Foods

- Bulla Dairy Foods launched a new premium gelato range in Australia, featuring authentic Italian recipes with locally sourced ingredients. The company introduced low-calorie frozen desserts under its “Bulla Light” series. Bulla is also investing in eco-friendly packaging and reducing sugar content in its products. The brand has strengthened its export market, particularly in Asia, with innovative flavors like matcha and black sesame.

5. Cielo

- Cielo, known for its artisanal gelato in Canada, has expanded its product line with organic and keto-friendly frozen desserts. The company introduced a “No Sugar Added” range sweetened with stevia and monk fruit. Cielo is also emphasizing sustainability by using biodegradable cups and spoons. The brand has partnered with high-end cafes and restaurants to feature its gelato in gourmet desserts.

Conclusion

The Frozen Desserts Market is booming, fueled by convenience, health-conscious options, and innovative flavors. Social media trends and e-commerce growth make these treats more accessible, while premium and localized products attract diverse consumers. To maintain momentum, brands must focus on sustainability and unique offerings to meet evolving demands in this vibrant market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)