Table of Contents

Overview

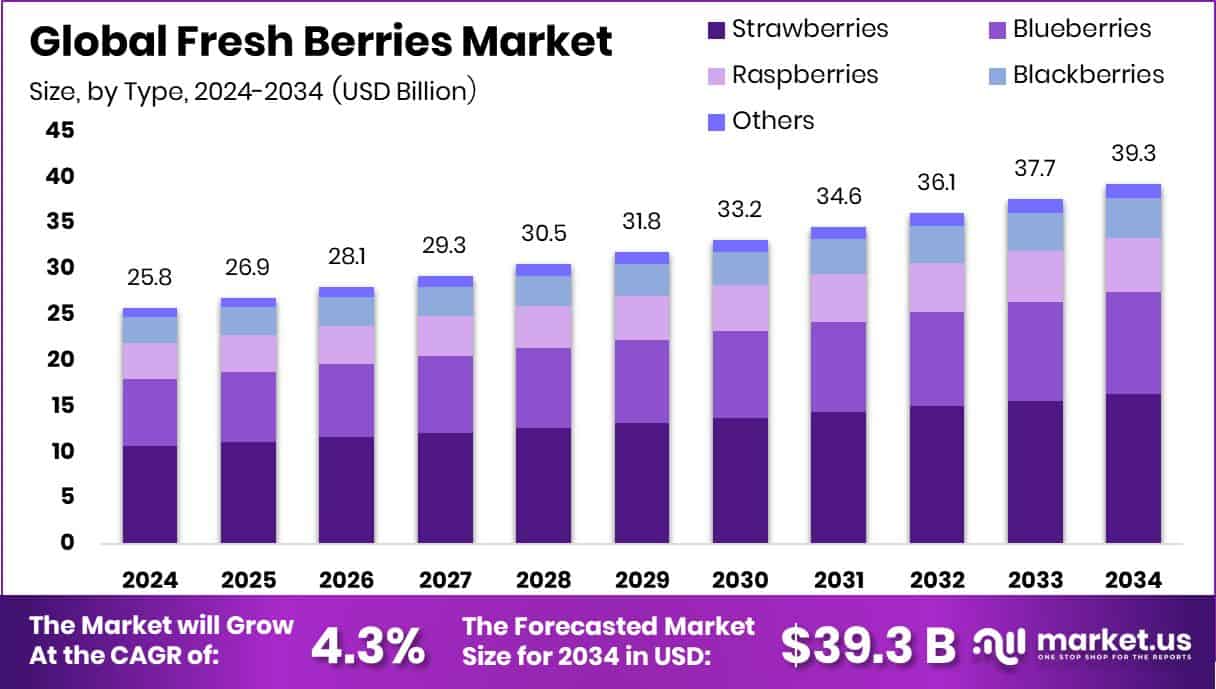

New York, NY – Aug 06, 2025 – The global fresh berries market is anticipated to reach approximately USD 39.3 billion by 2034, growing from USD 25.8 billion in 2024 at a steady CAGR of 4.3% between 2025 and 2034. North America, driven by the rising demand for healthy fruit options, accounted for a significant market share valued at USD 10.2 billion. Fresh berries such as strawberries, blueberries, raspberries, and blackberries are small, vibrant fruits known for their sweet tart taste and impressive nutritional profile. They are rich in antioxidants, vitamins, fiber, and natural sugars, making them a favorite among health conscious consumers.

Recent developments in the sector reflect a strong market outlook, with innovative cultivation and investment strategies leading the way. Companies like Oishii have made notable strides, raising $16 million to expand the global reach of their premium strawberries. Additionally, they secured $50 million to enhance their vertical farming capabilities, focusing on sustainable, bee pollinated strawberry production. These advancements underscore the increasing interest in eco friendly and efficient berry farming solutions that meet consumer demands for quality and sustainability.

The fresh berries market encompasses the worldwide production, trade, and consumption of unprocessed berries, relying on a well coordinated supply chain involving growers, distributors, and retailers. The market is experiencing robust growth due to heightened awareness of health and wellness, as consumers turn to nutrient dense, immunity boosting foods. Rising disposable incomes and the popularity of plant based, low calorie diets further drive demand. Moreover, improved cold chain infrastructure and greenhouse farming techniques now ensure year round availability of fresh berries, supporting consistent consumption beyond traditional harvest seasons.

Key Takeaways

- The global fresh berries market is projected to reach approximately USD 39.3 billion by 2034, rising from USD 25.8 billion in 2024, with a forecasted CAGR of 4.3% between 2025 and 2034.

- Strawberries lead the market by type, holding a substantial 41.6% share of the global market.

- The conventional segment dominates in terms of category, accounting for 87.4% of the overall market volume.

- Direct sales represent the primary distribution channel, making up 56.8% of the fresh berries market share.

- In 2024, North America achieved a market valuation of USD 10.2 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/fresh-berries-market/free-sample/

Report Scope

| Market Value (2024) | USD 25.8 Billion |

| Forecast Revenue (2034) | USD 39.3 Billion |

| CAGR (2025-2034) | 4.3% |

| Segments Covered | By Type (Strawberries, Blueberries, Raspberries, Blackberries, Others), By Category (Conventional, Organic), By Distribution Channel (Direct Sales, Indirect Sales, Supermarkets/Hypermarkets (Specialty Stores, Online Retail, Others) |

| Competitive Landscape | Driscoll’s Inc., Naturipe Farms LLC, Hortifrut S.A., Berry Fresh Group, Wish Farms, SunOpta Inc., Berryworld Ltd., Agrana Beteiligungs AG, Costa Group Holdings Limited, Del Monte Fresh Produce N.A. Inc., T&G Global Limited, The Kraft Heinz Company, Giddings Fruit, Planasa, North Bay Produce |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153317

Key Market Segments

1. By Type Analysis

- In 2024, strawberries emerged as the dominant type in the global fresh berries market, capturing a 41.6% share. This leadership is driven by their broad consumer appeal, versatile culinary uses, and consistent demand across various regions throughout the year. Their popularity is further enhanced by advancements in agricultural practices that ensure stable supply and extended shelf life. Strawberries continue to be favored for their sweet flavor, vibrant appearance, and rich nutritional content, including high levels of fiber, antioxidants, and essential vitamins. Their strong presence in the market reflects large scale production, year round availability, and growing consumer preference for healthful and visually appealing fruits.

2. By Category Analysis

- In the By Category segment, conventional berries held a substantial 87.4% market share in 2024. This dominance stems from the widespread use of traditional farming methods, which are cost effective and scalable for mass production. These methods cater to the high volume of consumer demand at competitive pricing. The conventional category’s success is largely due to its integration into established retail networks, including large supermarket chains and grocery stores. The affordability and availability of conventionally grown berries make them an accessible choice for a wide range of consumers, especially in price sensitive markets.

3. By Distribution Channel Analysis

- Direct sales accounted for the largest share of the distribution channel segment in 2024, with 56.8% of the market. This trend indicates a growing preference among consumers for fresh, locally sourced produce delivered directly from farms or producers. Direct to consumer methods such as farmers’ markets and subscription services are becoming increasingly popular due to their freshness and quality assurance. This distribution model allows producers to maintain control over pricing and product standards, while consumers benefit from greater transparency and traceability. The rise of community supported agriculture (CSA) and farm to table initiatives has further strengthened the appeal of direct sales, as more people seek out food that is fresh, sustainable, and minimally handled.

Regional Analysis

- In 2024, North America led the global fresh berries market, holding a dominant 39.70% share with a market value of USD 10.2 billion. This strong position is driven by high per capita consumption of fresh fruits, increasing health awareness, and well developed retail infrastructure that ensures year-round availability of berries. The region’s advanced supply chain and widespread preference for nutrient rich diets continue to support consistent demand.

- Europe also represents a major market, where consumers favor locally sourced, seasonal produce and show a growing inclination toward organic food options. The region benefits from supportive agricultural policies and established distribution networks, which help maintain a steady supply of high quality berries. Meanwhile, the Asia Pacific region is witnessing notable growth, fueled by urbanization, rising incomes, and a growing focus on health and wellness in emerging economies.

- Latin America plays a vital role as a key supplier to the global market, supported by its favorable climate and expanding export capacity. The Middle East and Africa region, while currently smaller in market size, is gradually growing due to the rise of modern retail formats and increasing awareness about the nutritional value of berries. Despite these developments, North America’s significant 39.70% share underscores its leadership in the global fresh berries market, backed by strong demand, advanced logistics, and a culture that embraces healthy eating.

Top Use Cases

- Food & Beverage Product Development: Food manufacturers use fresh berries to develop new products like smoothie mixes, yogurt toppings, snack packs, jams, and baked goods. These berries bring nutritional claims (antioxidants, fiber, vitamins), appealing flavor, and vibrant color. This drives innovation in convenient, healthier product offerings targeting wellness focused and on the go consumers.

- Retail & E‑commerce Distribution: Retailers and online grocers source fresh berries directly from growers or co ops to sell via supermarkets, farmers’ markets, or delivery platforms. This direct sourcing allows freshness, traceability, and competitive pricing. Subscription models and CSA boxes enhance customer loyalty by delivering farm fresh berries and transparency about origin and handling.

- Supply Chain Traceability & Food Safety: Traceability systems using barcodes, QR codes, RFID or blockchain track berries from farm to store shelf. This ensures food safety, enables rapid fraud or contamination responses, and meets regulatory requirements. Improved traceability enhances consumer confidence, supports recalls when needed, and strengthens brand trust in the produce supply chain.

- Smart Farming & Robotics Efficiency: Berry growers deploy smart sensors, co robot harvest aid systems, and automated quality sorting tools to optimize labor use and reduce crop losses. Robots assist workers by transporting berry trays, while sensors assess ripeness or detect defects. These technologies boost picking speed, reduce manual costs, and improve overall farm productivity.

- Value Added snacking & packaging innovation: Producers create pack and go berry snack lines combining fresh berries with complementary foods (e.g. mini muffins, cheese cubes) in convenient containers with extended shelf life. Attractive packaging formats like clamshells or compartmental trays enhance portability. These formats meet consumer demand for fresh, healthy, convenient snacks for children and adults.

Recent Developments

1. Driscoll’s Inc

- In mid 2025, Driscoll’s flagship “Sweetest Batch Blackberries” earned a Good Housekeeping 2025 Snack Awards distinction for their exceptional sweetness, texture, and unusually consistent flavor profile. The company also announced plans to launch its Sweetest Batch premium berry line in select retailers across Germany and the Middle East during 2025, expanding its global premium berry footprint.

2. SunOpta Inc

- For the first quarter of fiscal 2025, SunOpta reported 9.3% revenue growth (to US $201.6 million) driven by a 12.2% increase in volume, offset slightly by pricing changes tied to raw‑material cost pass downs. The company also authorized a $25 million share buyback, and raised its full year 2025 outlook while investing in capacity expansion and margin initiatives across its plant-based beverages, fruit snacks, and broth segments.

3. Driscoll’s Inc

- In October 2023, Driscoll’s appointed Søren Bjorn as CEO, effective January 2024, to oversee its global operations. The company continues its leadership by breeding and licensing proprietary berry varieties worldwide and maintaining its position as the largest berry company globally in 2024. It has invested heavily in its premium “Sweetest Batch™” program, selecting the top 30% of berries for quality, sweetness, and consistency after evaluating over 125,000 strawberry varieties annually. These efforts reflect its focus on innovation, flavor quality, and global reach.

4. Naturipe Farms LLC

- In 2025, Naturipe kicked off its Southeastern U.S. blackberry season, featuring its proprietary “Southern Grace” variety grown in Georgia with promotable volumes in 6 oz and 12 oz clamshell formats, timed to capitalize on the transition from Mexico’s supply. They also projected a strong blueberry season and began peak blackberry and raspberry harvests, citing improved yields and flavor. In 2024, the company launched its “Berry Buddies” value‑added snack line, tailored for convenience and children, and expanded into 200+ acres of strawberries in Central Florida to increase local availability.

Conclusion

Strawberries leading in type and conventional farming dominating production, the market benefits from strong consumer awareness and retail expansion. Companies like Driscoll’s and Naturipe Farms are actively innovating through premium offerings, sustainable farming, and regional expansions. North America remains the largest contributor, supported by advanced cold chains and high consumption rates. As health conscious diets and direct to consumer models continue to rise, the market is well positioned for long term, stable growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)