Table of Contents

Overview

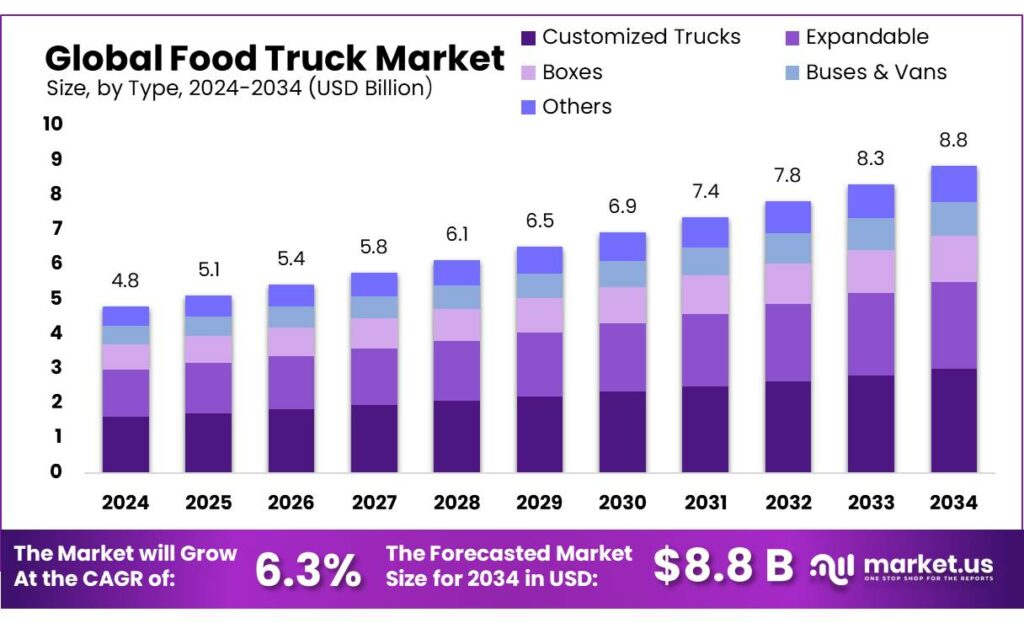

New York, NY – October 01, 2025 – The Global Food Truck Market is projected to reach around USD 8.8 billion by 2034, growing from USD 4.8 billion in 2024 at a CAGR of 6.3% between 2025 and 2034. Europe led the market in 2024, holding a share of over 33.7%, equivalent to USD 1.6 billion in revenue.

The concept of food trucks, mobile kitchens serving urban and public spaces, has gained global recognition and is gradually shaping India’s informal food service sector. While more established in countries like the United States, India is witnessing a slow but steady rise, particularly in metro and tier-1 cities, where street vending traditions are merging with modern demand for convenience and diverse cuisines.

In India, urbanization and lifestyle changes are fueling this growth. Though exact figures for food trucks are scarce, the broader street food industry is regulated under the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014. This Act formally recognizes the nearly 10 million vendors across India, including around 450,000 in Delhi, 250,000 in Mumbai, more than 150,000 in Kolkata, and 100,000 in Ahmedabad, while ensuring the establishment of vending zones and providing legal safeguards.

Government initiatives also play a role, such as the Akka Cafe Trucks launched under the National Rural Livelihoods Mission (NRLM) in Dakshina Kannada. These women-led food trucks, supported with up to ₹15 lakh per self-help group (₹7 lakh for trucks and operations), have shown successful revenue models, with examples like Ujire earning ₹9,000–12,000 daily and Munnoor generating ₹5,000–7,000.

The regulatory framework is further strengthened by the Food Safety and Standards Authority of India (FSSAI), established under the Food Safety and Standards Act, 2006. FSSAI requires businesses to obtain licenses based on turnover levels—basic registration for those below ₹12 lakh, state licenses for those between ₹12 lakh and ₹20 crore, and central licenses for enterprises above ₹20 crore. It also ensures food safety through a strong testing network that includes 22 referral laboratories, 72 state/UT labs, and 112 NABL-accredited private labs, reinforcing the quality standards for the evolving food truck ecosystem.

Key Takeaways

- Food Truck Market size is expected to be worth around USD 8.8 billion by 2034, from USD 4.8 billion in 2024, growing at a CAGR of 6.3%.

- Customized Trucks held a dominant market position, capturing more than a 33.8% share of the food truck market.

- 14 to 22 ft food trucks held a dominant market position, capturing more than a 49.5% share of the total market.

- Fast Food held a dominant market position, capturing more than a 38.9% share in the food truck market.

- Independent Operators held a dominant market position, capturing more than a 56.5% share in the food truck market.

- Europe holds a dominant position in the global food truck market, accounting for approximately 33.7% of the market share, valued at USD 1.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/food-truck-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.8 Billion |

| Forecast Revenue (2034) | USD 8.8 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Type (Customized Trucks, Expandable, Boxes, Buses and Vans, Others), By Length (Up to 14 ft, 14 to 22 ft, Above 22 ft), By Cuisine/Menu (Fast Food, Vegan/Plant-based, Bakery and Desserts, Ethnic/Fusion, Beverage-only, Others), By Ownership Model (Independent Operators, Franchise Chains, Corporate / Institutional Fleets) |

| Competitive Landscape | Prestige Food Trucks, United Food Truck, M&R SPECIALTY TRAILERS AND TRUCKS, Veicoli Speciali, Futuristo trailers, MSM CATERING TRUCKS MFG. INC., The Fud Trailer, Cruising Kitchens, VS Veicoli Speciali, Food Truck Company BV |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157426

Key Market Segments

By Type Analysis

Customized Trucks lead with a 33.8% market share, driven by their flexibility and strong customer appeal.

In 2024, Customized Trucks commanded over 33.8% of the food truck market, favored for their adaptability to specific business needs, such as tailored kitchen layouts, cuisine-focused interiors, and vibrant exterior branding. In cities like Mumbai, Delhi, and Bengaluru, entrepreneurs prefer these trucks for their enhanced dining and cooking experiences, which boost footfall and customer loyalty.

Compared to standard or rented trucks, customized models offer superior utility, durability, and a distinctive identity in a crowded market. In 2025, this segment is poised to maintain its momentum, with new operators choosing tailored designs to cater to niche markets like gourmet burgers, vegan cuisine, and global street food, reflecting a growing demand for unique and innovative mobile food solutions in India.

By Length Analysis

14 to 22 ft Food Trucks hold a 49.5% share, striking an optimal balance of space and mobility.

In 2024, food trucks measuring 14 to 22 feet captured over 49.5% of the market, emerging as the top choice for operators across India. This size range offers ample space for comprehensive kitchen setups while remaining agile for navigation in urban and semi-urban settings. In cities like Bengaluru, Pune, and Hyderabad, these trucks thrive in high-traffic areas such as tech parks, festivals, and college campuses, where space is constrained but demand is high.

They enable efficient staff workflows, ample storage, and diverse menu options without compromising speed. In 2025, this segment is expected to remain dominant, offering a practical blend of operational efficiency, fuel economy, and customer accessibility, making it a preferred choice for both new and seasoned food truck entrepreneurs.

By Cuisine/Menu Analysis

Fast Food leads with a 38.9% share, fueled by its appeal to busy urban consumers.

In 2024, Fast Food accounted for over 38.9% of the food truck market, driven by the popularity of quick bites like burgers, fries, wraps, and sandwiches. These options resonate with working professionals and students in metro cities, where food trucks stationed near offices, colleges, and busy marketplaces attract large crowds due to their speed and familiarity.

Fast food menus offer easy customization and high profit margins, making them a top choice for vendors. In 2025, this segment is likely to retain its dominance as demand expands into tier-2 cities and digital ordering enhances accessibility. The fast food format’s affordability, speed, and broad appeal ensure its continued success in India’s food truck industry.

By Ownership Model Analysis

Independent Operators lead with a 56.5% market share, driven by low entry costs and creative autonomy.

In 2024, Independent Operators captured over 56.5% of the food truck market, making them the preferred choice for first-time entrepreneurs and culinary enthusiasts seeking affordable entry and full creative control. Free from franchise regulations or corporate branding, these operators can innovate with unique menus, fusion cuisine, and localized offerings that connect with diverse audiences.

From solo taco trucks in Pune to family-run momo vans in Guwahati, the segment showcases remarkable variety. In 2025, Independent Operators are expected to see continued growth as more young entrepreneurs embrace food trucks as a flexible and expressive pathway to business ownership in India’s competitive food industry.

Regional Analysis

Europe commands a 33.7% share of the global food truck market, valued at USD 1.6 billion in 2025, driven by its rich culinary heritage and vibrant tourism sector. The region’s strong street food culture and surging popularity of food festivals have fueled the food truck boom, with events doubling in frequency since 2019 and boosting demand for mobile vendors.

Countries like Italy and France lead the charge, with cities such as Rome, Milan, and Paris emerging as hubs for gourmet food trucks offering everything from traditional Italian dishes to global cuisines. Technological advancements, including digital ordering platforms and social media marketing, have further accelerated growth by enhancing customer engagement and operational efficiency, enabling operators to adapt to evolving consumer preferences and reach wider audiences.

Top Use Cases

- Event Catering: Food trucks shine at festivals, weddings, and corporate gatherings by offering quick, tasty meals to large crowds. They roll in easily, set up fast, and serve diverse options like tacos or gourmet burgers, keeping guests happy without the hassle of fixed kitchens. This setup boosts fun and convenience for organizers while letting vendors test new spots and build buzz through word-of-mouth.

- Office Lunch Service: Parked near busy workplaces, food trucks deliver affordable, speedy bites to workers craving a break from desks. Menus with wraps, salads, or coffee draw in professionals for grab-and-go lunches, cutting cafeteria lines and adding variety to daily routines. Vendors thrive on steady daytime traffic, fostering repeat visits and loyalty in urban hubs.

- Street Food Exploration: Roaming city streets, food trucks bring global flavors like Thai noodles or fresh ceviche right to curious walkers. They pop up in parks or markets, tempting passersby with unique twists on classics, sparking spontaneous meals and cultural discovery. This mobility helps owners adapt to foot traffic and spotlight niche cuisines in vibrant neighborhoods.

- Health-Focused Mobile Eatery: Specializing in vegan bowls or fruit smoothies, these trucks cater to wellness seekers in gyms or health fairs. They emphasize fresh, plant-based dishes that fit active lifestyles, using local produce for rotating menus. Owners connect with eco-conscious crowds, promoting nutritious eats on the go and riding the wave of mindful dining trends.

- Late-Night Snack Stop: After concerts or bar hops, food trucks serve comfort foods like loaded fries or fusion hot dogs to night owls. Positioned in lively districts, they provide warm, satisfying options when restaurants close, extending the evening vibe. This timing captures impulse buyers, helping vendors maximize off-hours sales and create memorable after-dark experiences.

Recent Developments

1. Prestige Food Trucks

Prestige Food Trucks is expanding its customization options, focusing on integrated Point-of-Sale (POS) systems and energy-efficient, battery-powered kitchens. This addresses the growing demand for streamlined operations and sustainability. Their recent designs also feature enhanced outdoor branding panels for superior marketing impact at events. The company continues to lead with durable, customer-specific builds that prioritize both operator convenience and modern aesthetic appeal in a competitive market.

2. United Food Truck

United Food Truck has recently launched its new “Commander Series,” a line of semi-permanent food trailers designed for high-volume locations like breweries and fixed events. They are also emphasizing faster production times to meet increasing demand. The company continues to promote its comprehensive service, from concept to financing, making truck ownership more accessible. Their focus remains on durable, stainless steel construction for long-term reliability in the industry.

3. M&R SPECIALTY TRAILERS AND TRUCKS

M&R is experiencing significant growth, recently expanding its manufacturing facility to increase production capacity. They are incorporating more smart technology into their builds, including advanced monitoring systems for refrigeration and generator functions. A key recent development is their increased focus on concession trailers for large-scale vending at festivals, alongside their custom food trucks. This expansion allows them to serve a broader range of mobile food service clients.

4. Veicoli Speciali

Based in Italy, Veicoli Speciali is pushing the boundaries of design with its new “E-Motion” series, focusing on fully electric and hybrid food trucks for the European market. They are integrating innovative, space-saving layouts and premium materials to create high-end, mobile kitchens. Recent developments highlight their commitment to reducing emissions and noise pollution, catering to cities with strict environmental regulations and clients seeking a luxury, sustainable brand image.

5. Futuristo Trailers

Futuristo is gaining attention for its compact, agile Urban Pod models designed for tight city spaces and pop-up events. A key recent development is their partnership with a tech firm to offer an optional, pre-installed digital management suite for inventory and sales analytics. They are also using lighter, composite materials to improve fuel efficiency without compromising on kitchen functionality, appealing to first-time owners and urban entrepreneurs.

Conclusion

Food Trucks transform into a lively force in the dining world, blending mobility with fresh ideas to meet everyday cravings. They offer a smart way for entrepreneurs to dive into business with low startup hurdles, while delighting customers with convenient, creative eats that fit busy lives. The trend leans toward greener vehicles and tech-savvy ordering, pointing to even wider appeal in cities and events. Food trucks keep evolving, promising more tasty adventures and steady growth for those ready to roll with the changes.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)