Table of Contents

Overview

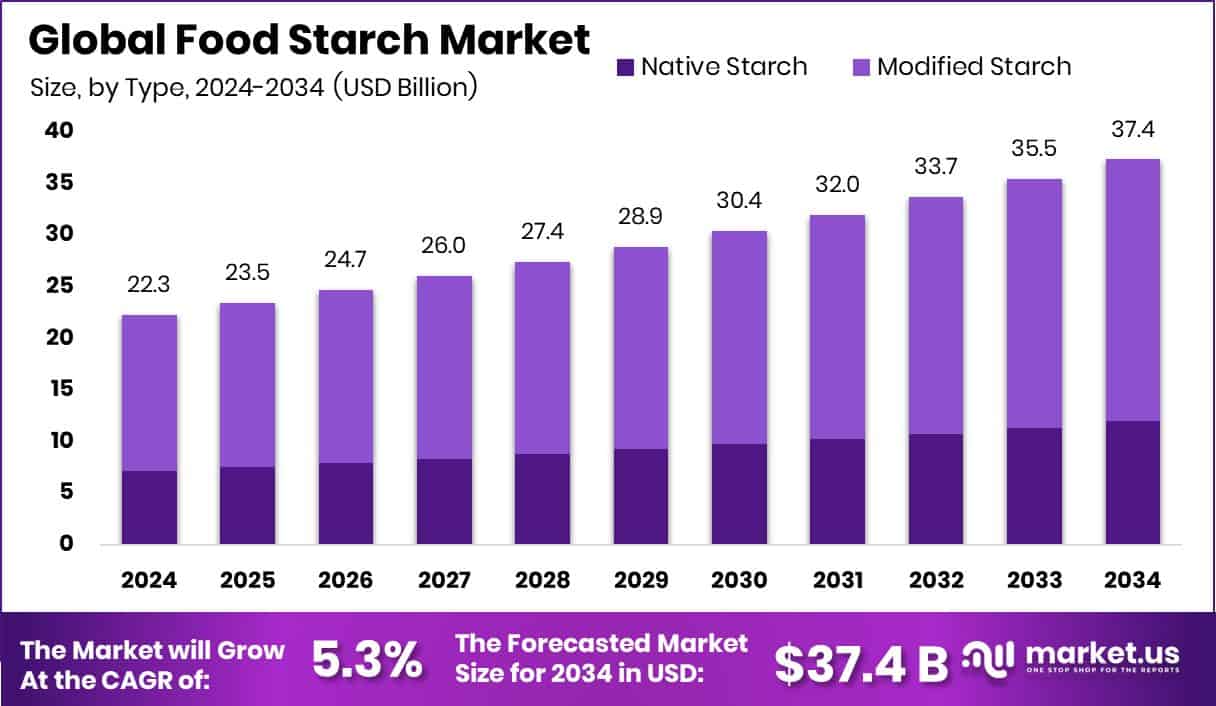

The Global Food Starch Market is projected to reach approximately USD 37.4 billion by 2034, rising from USD 22.3 billion in 2024. This reflects a compound annual growth rate (CAGR) of 5.3% between 2025 and 2034. The Asia-Pacific region leads the market, fueled by robust demand, with its market value estimated at USD 10.5 billion.

Food starch is a naturally occurring carbohydrate extracted from sources such as corn, potato, wheat, rice, and tapioca. It plays a crucial role in the food and beverage industry due to its thickening, stabilizing, and gelling capabilities. When combined with water and heated, starch granules swell and form a paste, enhancing the texture and consistency of products like soups, sauces, gravies, baked goods, and dairy-based foods.

The food starch market encompasses the global production, trade, and use of starch-based ingredients in a wide variety of food applications. This includes both native and modified starches used in processed foods, ready meals, snacks, and beverages. The market is increasingly shaped by consumer demand for clean-label, plant-based, and gluten-free alternatives. Its growth is fueled by evolving dietary preferences, the functional requirements of industrial food processing, and the need for improved product texture, shelf stability, and flavor.

Market expansion is largely driven by the rising consumption of processed and ready-to-eat foods. As urbanization intensifies and lifestyles become more fast-paced, consumers are gravitating toward convenient food options that frequently rely on starches for structural integrity and consistency. Additionally, the push for cleaner labels has led food manufacturers to replace synthetic additives with natural, plant-based starches. For instance, companies like A&B are innovating in this space, having recently secured a US$180,000 grant to advance their Next Gen sweet potato starch project.

The growing popularity of gluten-free diets has also fueled demand for alternative starches such as rice and tapioca. These sources help food producers deliver appealing textures and flavors without relying on gluten, addressing the needs of health-conscious and gluten-intolerant consumers. Key industries such as bakery, dairy, and meat processing continue to be major drivers of starch demand.

Key Takeaways

- The global food starch market is projected to reach approximately USD 37.4 billion by 2034, rising from USD 22.3 billion in 2024, with a compound annual growth rate (CAGR) of 5.3% between 2025 and 2034.

- Modified starch leads the market, holding a dominant 67.9% share, attributed to its wide-ranging functional applications.

- Maize stands out as the primary raw material, representing 59.3% of the global market share.

- Starch in powder form is the most commonly used, accounting for 86.2% of total consumption due to its ease of use and versatility.

- The bakery and confectionery segment is the top application area, capturing 29.8% of the market, driven by the need for improved texture, shelf life, and consistency.

- The Asia-Pacific region holds a significant position in the market, with its food starch segment valued at USD 10.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/food-starch-market/free-sample/

Report Scope

| Market Value (2024) | USD 22.3 Billion |

| Forecast Revenue (2034) | USD 37.4 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Type (Native Starch, Modified Starch), By Source (Maize, Wheat, Potato, Others), By Form (Powder, Liquid), By Application (Bakery and Confectionary, Snacks, Soup, Sauces and Dressings, Dairy Products, Meat and Meat Products, Others) |

| Competitive Landscape | Archer Daniels Midland Company, Cargill Inc., Ingredion Inc., Tate & Lyle Plc, Roquette Frères, Royal Avebe, BENEO, Grain Processing Corporation, Tereos SA, Gulshan Polyols, Cosun Beet Company, Emsland Group, Zhucheng Xingmao, Global Bio-Chem, Shandong Fuyang, Sunar Group, Siam Modified Starch, Südzucker AG, Vedan International |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152942

Key Market Segments

By Type Analysis

Modified starch commands a 67.9% share of the food starch market.

As of 2024, modified starch holds a leading position in the “By Type” category, accounting for 67.9% of the global food starch market. This dominance is attributed to its enhanced functional attributes, which make it highly suitable for a wide array of food applications.

Modified starch is engineered to improve performance characteristics such as heat resistance, solubility, and stability under acidic or mechanical conditions traits essential for modern food production. Its versatility has led to widespread adoption in processed foods like frozen meals, dairy products, sauces, dressings, and instant mixes, where uniform texture and extended shelf life are critical.

The growing reliance on modified starch reflects the food industry’s increasing need for customizable ingredients that meet industrial processing demands without sacrificing product quality. Its ability to maintain texture, improve viscosity, and withstand freeze-thaw cycles has made it a go-to ingredient in food formulation. Furthermore, the surge in demand for convenience foods has strengthened its role in delivering consistent texture and sensory appeal, cementing its position as a cornerstone in food manufacturing.

By Source Analysis

Maize leads the segment with a 59.3% market share.

In 2024, maize emerged as the dominant source in the food starch market, representing 59.3% of the total share. This leadership is primarily due to maize’s widespread availability, cost-efficiency, and adaptable nature in both native and modified forms.

Maize starch is favored for its neutral flavor, digestibility, and suitability across various applications from bakery and dairy products to sauces, snacks, and processed meats. It also plays a key role in industrial processes like fermentation, enzymatic conversion, and extrusion, offering functional flexibility in production.

Its extensive use highlights maize’s established role as a fundamental raw material in starch production. The ability to scale its supply meets the high demand from food manufacturers aiming for product consistency, efficiency, and performance.

By Form Analysis

Powdered starch dominates with an 86.2% market share.

In terms of physical form, powdered starch holds a commanding 86.2% share in 2024. Its widespread popularity stems from ease of handling, long shelf life, and seamless integration into both dry and liquid formulations.

Powdered starch is a preferred choice in industrial food manufacturing due to its stability during storage and transport. It allows for accurate dosing and consistent quality control, which is critical in producing uniform textures in finished products. Applications include instant soups, bakery mixes, sauces, and confectionery.

Additionally, the powdered form offers fast solubility and reactivity when heated, contributing to efficient food processing. Its dominance reflects the market’s shift toward convenience foods and functional ingredients that support streamlined production and product reliability.

By Application Analysis

Bakery and confectionery lead with 29.8% market share.

In 2024, the bakery and confectionery sector emerged as the leading application area in the food starch market, capturing 29.8% of the total share. This prominence underscores starch’s importance in enhancing texture, structure, and shelf life in sweet and baked goods.

In bakery applications, starch serves as a moisture-retention agent, helping maintain softness and extend freshness in bread, cakes, and pastries. It also plays a role in dough handling and batter stability, contributing to better product quality.

In confectionery, starch is essential in shaping and setting products like gummies and jellies, offering thickening and gelling functionality. It helps achieve the right chewiness, clarity, and mouthfeel attributes highly valued by consumers.

This segment’s dominance reflects ongoing demand for processed sweets and baked snacks worldwide. With evolving tastes and increasing production volumes, starch continues to be a crucial component in delivering consumer-preferred textures and experiences.

Regional Analysis

Asia-Pacific leads the global food starch market with a 47.4% share in 2024.

In 2024, the Asia-Pacific region emerged as the dominant player in the global food starch market, capturing 47.4% of the total market, valued at USD 10.5 billion. This leadership is driven by the region’s robust food processing sector, growing urban populations, and rising consumption of packaged and convenience foods, particularly in countries like China, India, and across Southeast Asia.

Consumer demand in the region is increasingly focused on ingredients that improve texture, stability, and shelf life, boosting the uptake of both native and modified starches in everyday food products.

North America holds a substantial share of the market as well, supported by continued demand for modified starches across bakery, dairy, and processed meat categories. Manufacturers in the region prioritize consistency and performance, keeping starch in high demand.

In Europe, market growth remains steady, particularly in countries promoting clean-label and plant-based diets. Starch is widely used here as a natural alternative to synthetic additives, aligning with consumer preferences for transparency and natural ingredients.

The Middle East & Africa region is seeing a gradual increase in food starch usage, driven primarily by growing urbanization and the rising consumption of processed foods in metropolitan areas.

Latin America, although currently holding a smaller portion of the global market, is showing promising growth. Expanding food production capabilities and a shift toward convenience-focused eating habits are contributing to its emerging potential in the food starch industry.

Top Use Cases

1. Thickening & Stabilizing Sauces and Soups: Food starch is widely used to thicken, stabilize, and add viscosity in sauces, gravies, custards, and dressings. Modified and native starches help maintain consistency and suspension in liquid foods, ensuring smooth texture without adding strong flavors or cloudiness. This functionality is essential in processed sauces, soups, and dairy-based dressings used in packaged food production.

2. Emulsifier & Binding Agent in Processed Meats: In processed meats like sausages, deli slices, or ready‑to‑cook products, starch functions as an emulsifier and binder. It helps bind water and fat, improving sliceability, juiciness, and shelf life. Modified starches are particularly valuable here for delivering consistent texture under varying conditions and processing stresses.

3. Texture Enhancer in Bakery & Confectionery: Starch plays a central role in baked goods and sweets, boosting softness, crispness, and shelf life. In cakes, it retains moisture for a tender crumb; in confectionery like gummies or jellies, starch helps set and form shapes, delivering desired chewiness and clarity. It is a core ingredient in bakery and confectionery formulations.

4. Instant Thickening in Ready‑to‑Eat Mixes: Pre‑gelatinized and modified starches enable quick thickening with minimal heating. Heat‑stable starch forms are used in instant soups, sauces, desserts, and dry mixes to achieve viscosity upon adding cold or warm water. This instant functionality improves convenience and processing efficiency in RTE and convenience foods.

5. Freeze‑Thaw Stability in Frozen Foods: Modified starches engineered for freeze‑thaw resistance are used in frozen meals, fillings, and sauces. These starches maintain texture and prevent syneresis (liquid separation) during thawing and reheating. They ensure cellular structure holds under cold storage cycles, enhancing consumer appeal and quality control in frozen food products.

Recent Developments

Archer Daniels Midland Company (ADM): ADM is expanding its Carbohydrate Solutions business, investing in significant new starch production capacity at its Marshall, Minnesota facility. The expansion supports demand across food, beverage, and plant-based BioSolutions markets. This move aligns with global trends toward sustainable and versatile starch demand. ADM continues to lead innovation and scale in modified starch solutions.

Cargill Inc.: Cargill remains one of the top global manufacturers in the food starch sector. It continues to invest in clean‑label and natural modifications of starch and is featured prominently in recent market reports forecasting growth driven by emulsification and thickening needs in food products. Cargill’s initiatives aim to meet the growing demand for functional and sustainable starch derivatives.

Ingredion Inc.: Ingredion continues strengthening its starch portfolio through strategic acquisitions and plant upgrades. It has expanded its capacity in North America and enhanced functionality via investments in non‑GMO and clean‑label starches. Ingredion also continues global expansion and innovation in modified starch products used across food, beverage, and industrial applications.

Tate & Lyle Plc: Tate & Lyle finalized the acquisition of CP Kelco in mid‑2024 for US $1.8 billion, bolstering its ingredient range with natural texture solutions like pectin and specialty gums. This strengthens its position in the modified starch market by enhancing clean‑label texture offerings.

Roquette Frères: Roquette has completed the acquisition of IFF Pharma Solutions in early 2024, expanding its product offerings in functional starches and excipients. The move reinforces its status as a global leader in modified and native starches for food, pharma, and industrial applications.

Grain Processing Corporation (GPC): GPC remains recognized among top corn and industrial starch manufacturers globally. While no major new project was publicly announced, the company continues robust supply to food and industrial customers, securing its position alongside ADM, Cargill, Roquette, and Tate & Lyle.

Tereos SA: Tereos is highlighted as a leading player in starch derivatives markets, investing in enhanced enzyme‑based modifications to produce higher‑functionality starches. The company is expanding its regional reach and supporting applications in clean-label food and beverage products.

Südzucker AG: Südzucker, via its Cosun Beet subsidiary, remains integral to the starch derivatives market. It continues collaboration on clean-label innovations and regional expansion in Europe. Market reports identify the company as a key player in starch production and derivatives development across industrial applications.

Conclusion

The global food starch market is poised for strong growth, rising from approximately USD 22.3 billion in 2024 to around USD 37.4 billion by 2034, driven by a steady CAGR of 5.3% from 2025 to 2034. Demand is fueled by the rising popularity of processed and convenience foods, the expanding use of clean-label ingredients, and functional requirements in baking, sauces, dairy, and snacks.

Modified starch dominates the market (about 67.9%) due to its versatility and thermal stability, while maize remains the primary source of starch (59.3% share). Asia‑Pacific leads regionally with a USD 10.5 billion market in 2024. Overall, food starch remains a cornerstone ingredient in the evolving food industry supporting texture, stability, and product innovation across global sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)