Table of Contents

Overview

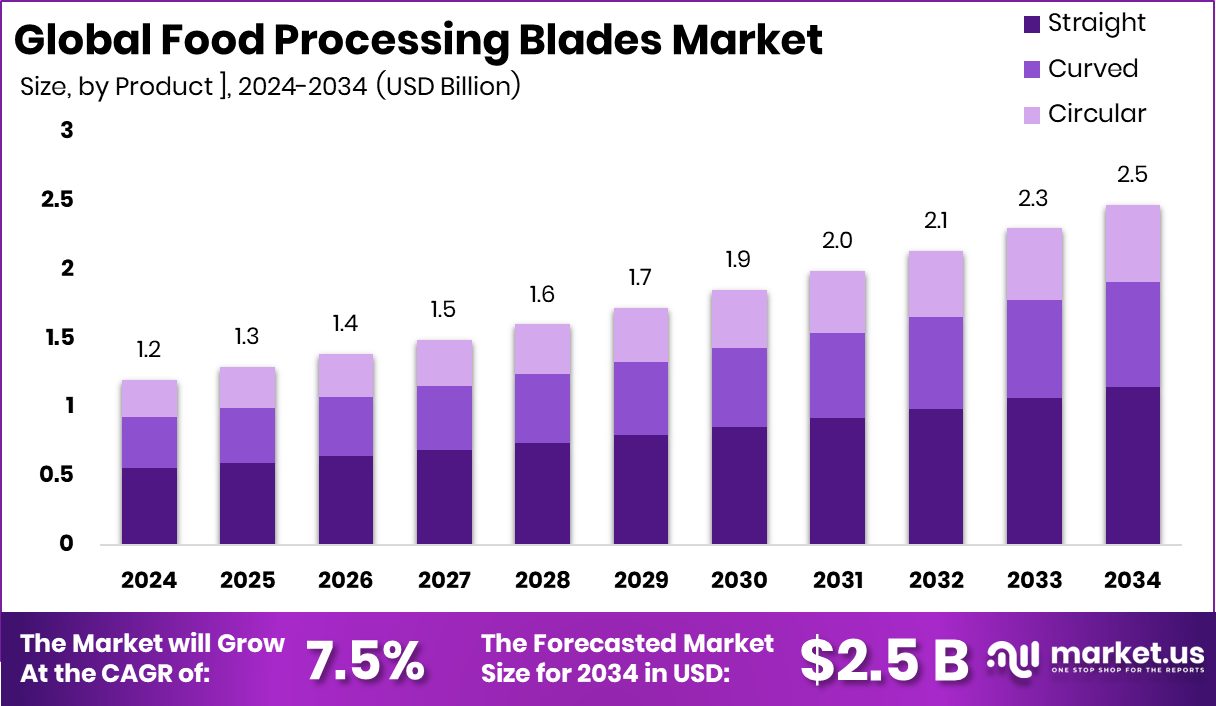

New York, NY – September 15, 2025 – The Global Food Processing Blades Market is projected to reach USD 2.5 billion by 2034, rising from USD 1.2 billion in 2024, reflecting a strong CAGR of 7.5% between 2025 and 2034. Within this, the Asia Pacific region is set to generate USD 0.5 billion in blade sales, driven by rapid automation in food processing facilities.

Food processing blades are precision cutting tools engineered for tasks such as slicing, dicing, chopping, and shaping food products during large-scale manufacturing. Made from high-grade stainless steel and other food-safe materials, these blades deliver durability, sharpness, and corrosion resistance. Their applications span meat processing, bakery production, vegetable and fruit preparation, and cheese manufacturing, where hygiene and precision are critical for maintaining quality and safety.

In line with innovation, companies such as SLICE have launched a USD 54 nipper for precision cutting, designed for both professional and hobby use. The market represents the global trade, design, and usage of blades across diverse food production sectors, from industrial-scale plants to specialized processors. Growth is being shaped by rising automation, the need for higher efficiency, and stricter food safety regulations.

At the same time, investments in food supply chain solutions are increasing, with Silo securing USD 32 million in funding to strengthen financial management systems. Similarly, innovation in adjacent sectors continues, as AM 4 AM raised €1.3 million to expand metal powder production, indirectly supporting advanced manufacturing technologies relevant to blade production. Key demand drivers include the surge in ready-to-eat meals, frozen foods, and packaged fresh produce, all of which require uniformity and precision in cutting.

Retail demand for standardized sizes and shapes is fueling investment in specialized, longer-lasting blades. Additionally, policy changes, such as Ohio’s proposed budget cuts of USD 120 million to the H2Ohio initiative, reflect the ongoing interplay between food production, funding, and sustainability. Overall, the market is set for robust expansion as food processors increasingly adopt automated, high-performance blade solutions to meet evolving consumer and industry demands.

Key Takeaways

- The Global Food Processing Blades Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034.

- Straight blades hold 46.3% of the Food Processing Blades Market, valued for precision and versatile cutting.

- Stainless steel accounts for 39.1% of the Food Processing Blades Market, driven by durability and hygiene requirements.

- Slicing applications capture 26.7% of the Food Processing Blades Market, supported by rising packaged food production demand.

- Protein processing dominates 56.9% of the Food Processing Blades Market, reflecting growing global consumption of meat and seafood products.

- Strong demand for packaged food boosts the Asia Pacific’s 42.8% market growth.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/food-processing-blades-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.2 Billion |

| Forecast Revenue (2034) | USD 2.5 Billion |

| CAGR (2025-2034) | 7.5% |

| Segments Covered | By Product (Straight, Curved, Circular), By Material (Stainless Steel, High-carbon Steel, Carbide, Ceramic, Plastic, Others), By Application (Slicing, Grinding, Dicing, Skinning, Peeling, Cutting/Portioning, Others), By End-use (Proteins, Fruits, Vegetables, Nuts, Others) |

| Competitive Landscape | Simonds International, Urschel Laboratories, Inc., Dexter Russell, M.K. Morse LLC, Fortifi Food Processing Solutions, Grote Company, Wilbur Curtis, Jarvis India, Hallde, Talsabell S.A. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155362

Key Market Segments

By Product Analysis

Straight Blades Hold 46.3% Share in 2024

In 2024, straight blades accounted for a leading 46.3% share of the Food Processing Blades Market. Their dominance stems from their versatility across multiple applications such as slicing, chopping, portioning, and dicing, where precision and uniformity are crucial. The efficient design of straight blades allows for smooth, consistent cuts, making them an integral component of high-speed production lines in meat, vegetable, bakery, and cheese processing.

Ease of sharpening and low maintenance requirements further enhance their appeal, reducing downtime and operational costs for manufacturers. The rising demand for packaged and ready-to-cook foods has also reinforced their importance, as consistent product sizing improves both presentation and cooking performance.

With advancements in stainless steel quality and blade treatment technologies, straight blades now offer greater durability and reliability, ensuring long-term performance. As global food processors continue to adopt automation and standardized production practices, straight blades are expected to maintain their dominant position in precision cutting solutions.

By Material Analysis

Stainless Steel Leads with 39.1% Share in 2024

In 2024, stainless steel blades captured a 39.1% share of the Food Processing Blades Market, reflecting their unmatched combination of durability, sharpness retention, and compliance with food safety standards. Stainless steel’s natural resistance to corrosion and bacterial growth makes it the preferred material for applications ranging from meat and seafood to bakery, dairy, fruits, and vegetables.

The ability to maintain sharpness over extended use ensures consistent cutting quality, which is vital for high-volume operations. Stainless steel’s adaptability to both manual and automated machinery has broadened its use across diverse production settings. Advances in metallurgical treatments and blade design have further improved hardness and edge retention, lowering replacement frequency and cutting costs.

By Application Analysis

Slicing Applications Dominate with 26.7% Share in 2024

In 2024, slicing applications led the Food Processing Blades Market, accounting for a 26.7% share. The widespread use of slicing blades across meat, poultry, seafood, bakery, fruit, and vegetable processing highlights their central role in achieving uniform thickness and presentation. Their efficiency supports portion control, reducing waste while improving yield—an essential factor for cost optimization in industrial-scale operations.

Growing demand for ready-to-eat meals, deli items, and frozen foods has fueled investment in high-performance slicing blades that deliver standardized cuts for consumer convenience and retail appeal. Innovations such as sharper edges, enhanced coatings, and wear-resistant finishes have extended blade lifespans, reducing maintenance needs and boosting production efficiency. The increasing integration of automated slicing equipment in processing facilities further drives demand, solidifying slicing as the most influential application area in the market.

By End-use Analysis

Protein Processing Leads with 56.9% Share in 2024

In 2024, protein processing dominated the Food Processing Blades Market with a 56.9% share. This segment’s stronghold reflects the essential role of blades in meat, poultry, and seafood processing, where precision cutting, portioning, and deboning are critical for maintaining product quality and meeting strict hygiene standards.

High-performance blades are engineered to withstand continuous use in demanding environments, resisting wear from contact with dense muscle fibers and bones. Advanced stainless steel and coated blade technologies further enhance durability, edge retention, and corrosion resistance. Rising global consumption of processed protein products—driven by urban lifestyles and the growth of foodservice sectors has intensified demand.

Additionally, the expansion of frozen and ready-to-cook protein products requires blades capable of cutting both fresh and frozen meat with accuracy. As automation advances in meat and seafood processing plants, the reliance on durable, high-efficiency blades in protein processing is expected to grow steadily.

Regional Analysis

Asia Pacific Captures 42.8% Share, Valued at USD 0.5 Billion

In 2024, the Asia Pacific held the leading position in the Food Processing Blades Market, with a 42.8% share valued at USD 0.5 billion. The region’s growth is fueled by the rapid expansion of food processing industries in countries such as China, India, Japan, and Australia, supported by urbanization, population growth, and rising demand for packaged and ready-to-eat foods.

Substantial investments in modern food manufacturing facilities, coupled with widespread adoption of automation technologies, have boosted demand for high-performance blades. Government-backed initiatives aimed at improving food safety and hygiene standards have also driven processors to adopt stainless steel and advanced coated blades.

While North America and Europe continue to show steady growth supported by innovation and well-established processing infrastructures, Latin America and the Middle East & Africa are gradually expanding their market presence through investments in modern facilities. However, Asia Pacific remains unmatched in scale, benefiting from strong supply chains, a skilled workforce, and proximity to major consumer markets, ensuring its leadership in global food processing blade consumption well into the next decade.

Top Use Cases

- Meat Slicing for Retail Packaging: Food processing blades are used to slice meat into uniform portions for retail packaging. High-precision stainless steel blades ensure clean cuts, maintaining product quality and appearance. They handle various meat types, like beef or poultry, meeting consumer demand for consistent, ready-to-cook products while ensuring hygiene and efficiency in large-scale operations.

- Vegetable Dicing for Frozen Foods: Blades dice vegetables like carrots and potatoes for frozen food products. Durable, sharp blades ensure precise cuts, preserving texture and quality. They support high-speed processing, meeting the demand for convenient, pre-cut vegetables. Automated systems with custom blades enhance efficiency, reducing waste and ensuring uniformity in size for consumer satisfaction.

- Bakery Dough Cutting: In bakeries, blades cut dough into uniform shapes for bread, pastries, or rolls. Stainless steel or ceramic blades ensure clean, non-stick cuts, maintaining dough consistency. This supports high-volume production, meeting consumer demand for consistent baked goods. Specialized blade designs improve precision, reducing waste and ensuring product uniformity.

- Cheese Slicing for Pre-Packaged Products: Food processing blades slice cheese into uniform portions for pre-packaged products. Sharp, corrosion-resistant blades ensure smooth cuts without crumbling, preserving texture and quality. They cater to the growing demand for convenient, portion-controlled cheese products, supporting high-speed production while maintaining hygiene and meeting food safety standards.

- Fruit Peeling and Coring: Blades are used to peel and core fruits like apples or pineapples for canned or ready-to-eat products. Specialized blades ensure minimal waste and precise cuts, preserving fruit quality. They support high-throughput processing, meeting consumer demand for convenient, pre-prepared fruits while maintaining efficiency and hygiene in production.

Recent Developments

1. Simonds International

Simonds International has expanded its CEBL XR bandsaw blade line, specifically engineered for high-performance meat and poultry cutting. The recent development focuses on advanced tooth geometry and a specialized coating that reduces friction and gumming from fats, significantly extending blade life in high-volume, cold environments. This innovation addresses the need for reduced downtime and increased cut consistency.

2. Urschel Laboratories, Inc.

Urschel Labs continues to lead in precision cutting with recent refinements to the shear-type cutting blades used in their Comitrol processors. The focus is on ultra-hygienic design and specialized stainless steels that maintain a sharper edge for longer, ensuring uniform particle size reduction and superior product quality in applications like cheese, nut butters, and prepared meats, while meeting stringent sanitary standards.

3. Dexter Russell

Dexter Russell has introduced new ergonomic handle designs for its San-Safe series of food processing knives and blades. The development focuses on improving user safety and reducing fatigue for workers performing repetitive cutting, boning, and trimming tasks. Coupled with their high-carbon, stain-resistant steel, these updates enhance control and sanitation in demanding processing environments.

4. M.K. Morse LLC

M.K. Morse has developed new food-grade bandsaw blades featuring a specialized Bi-Metal construction with a high-speed steel edge. Recent enhancements include a non-stick PTFE coating specifically formulated to resist material adhesion from fatty tissues and proteins. This innovation improves cutting efficiency, extends blade life, and simplifies cleaning for processors cutting frozen meat, fish, and poultry.

5. Fortifi Food Processing Solutions

Fortifi’s recent development is the integration of its REELSPLICE technology into blade systems for continuous food processing lines. This innovation allows for the endless splicing of bandsaw blades without a welded joint, creating a smoother, stronger, and more consistent cut. This eliminates joint failure, reduces vibration, and improves yield and operational efficiency for large-scale protein processors.

Conclusion

The Food Processing Blades Market is growing due to the rising demand for processed and convenience foods. Blades ensure precision, hygiene, and efficiency in meat, vegetable, bakery, cheese, and fruit processing. Technological advancements, like durable materials and automation, drive market expansion. With increasing consumer preferences for ready-to-eat products, the demand for high-quality, specialized blades will continue to rise, supporting industry growth.