Table of Contents

Overview

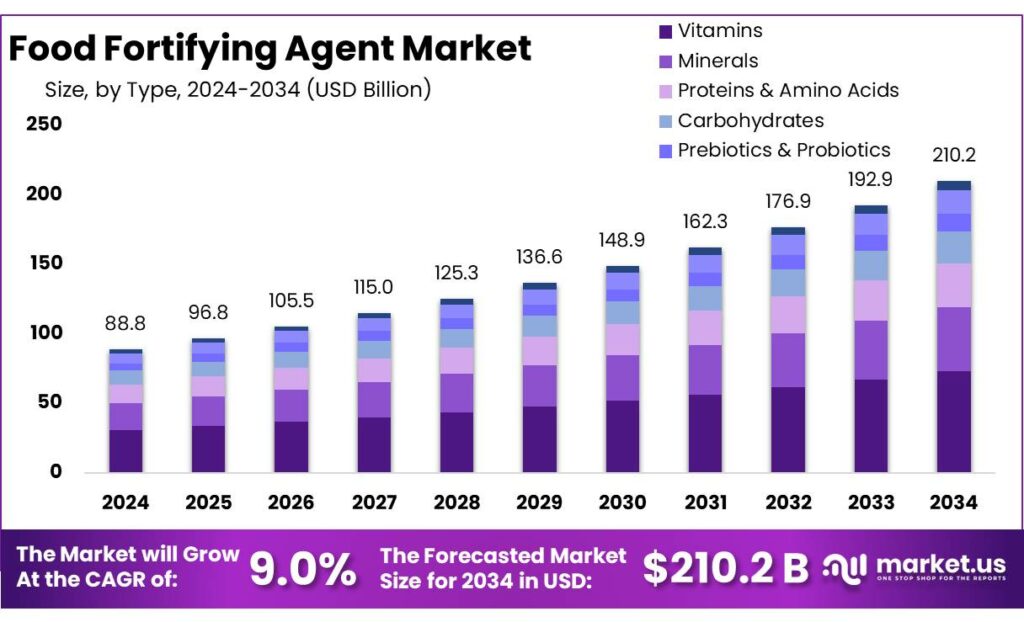

New York, NY – September 17, 2025 – The Global Food Fortifying Agent Market is projected to reach USD 210.2 billion by 2034, up from USD 88.8 billion in 2024, expanding at a CAGR of 9.0% from 2025 to 2034. In 2024, North America led the market with a 38.5% share, contributing approximately USD 34.1 billion in revenue.

Food fortifying agents such as vitamins, minerals, amino acids, and other bioactive compounds are increasingly integrated into staple foods to combat widespread micronutrient deficiencies and improve public health outcomes. Global initiatives have also been key in advancing adoption. The Global Alliance for Improved Nutrition (GAIN) has facilitated the procurement of micronutrient premixes worth USD 79 million, distributed across 53 countries. Similarly, the Food Fortification Initiative (FFI) supports fortification programs in 30 nations while monitoring progress across 196 countries, especially in cereals.

Despite broad implementation, gaps remain. About 125 countries have mandatory fortification policies, with 94% of households consuming some form of salt and 96% accessing fortifiable salt. However, surveys across 22 national programs show that less than half of households consume adequately fortified foods, and only 45% of tested products meet national standards. This underscores ongoing challenges in quality control, regulatory monitoring, and ensuring equitable coverage.

Key Takeaways

- Food Fortifying Agent Market size is expected to be worth around USD 210.2 Billion by 2034, from USD 88.8 Billion in 2024, growing at a CAGR of 9.0%.

- Vitamins held a dominant market position, capturing more than a 34.8% share in the Food Fortifying Agent Market.

- Drum Drying held a dominant market position, capturing more than a 68.9% share in the Food Fortifying Agent Market.

- Dairy & Dairy-based Products held a dominant market position, capturing more than a 31.2% share in the Food Fortifying Agent Market.

- North America clearly stood out as the dominant region in the Food Fortifying Agent Market, capturing 38.5% of global share, which corresponds to about USD 34.1 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/food-fortifying-agent-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 88.8 Billion |

| Forecast Revenue (2034) | USD 210.2 Billion |

| CAGR (2025-2034) | 9.0% |

| Segments Covered | By Type (Vitamins, Minerals, Proteins and Amino Acids, Carbohydrates, Prebiotics and Probiotics, Lipids, Others), By Process (Drum Drying, Dusting), By Application (Dairy and Dairy-based Products, Infant Formula, Cereals and Cereal-based Products, Beverages, Dietary supplements, Fats and Oils, Others) |

| Competitive Landscape | ADM, Advanced Organic Materials, S.A., Arla Foods Ingredients Group PS, BASF SE, DSM, Evonik Industries AG, Ingredion Inc., Kellogg Co., Nestle SA, Omya International AG |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156474

Key Market Segments

By Type Analysis

Vitamins Lead with 34.8% Market Share in 2024

In 2024, vitamins commanded a leading 34.8% share of the Food Fortifying Agent Market, driven by their critical role in addressing nutritional deficiencies, particularly in vitamin D, A, and B-complex. Widely incorporated into dairy, cereals, juices, and infant formulas, vitamins are a trusted and scientifically supported fortification agent, enhancing daily nutrition. Their dominance is fueled by consumer confidence in their efficacy and widespread use by food and beverage manufacturers.

Vitamins are projected to maintain their market leadership, propelled by growing global health awareness and expanded government fortification programs targeting malnutrition. Mandatory fortification, such as vitamin D in dairy or vitamin A in edible oils, further solidifies their position. With versatility across processed foods and increasing demand for preventive healthcare, vitamins remain the cornerstone of food fortification, ensuring accessible nutrition across developed and emerging markets.

By Process Analysis

Drum Drying Commands 68.9% Market Share in 2024

In 2024, drum drying dominated the Food Fortifying Agent Market with a 68.9% share, favored for its ability to preserve sensitive nutrients like vitamins, proteins, and minerals while producing stable, powdered forms. Its cost-effectiveness, scalability, and retention of nutritional value make it ideal for fortified cereals, baby foods, and instant meals, meeting the needs of food producers globally.

Drum drying is expected to retain its dominance as demand for fortified convenience foods rises. The process ensures uniformity and nutritional accuracy, supporting mass production and shelf-life stability. Its adaptability for both large- and small-scale operations enhances its appeal across diverse markets. Drum drying remains the preferred fortification technology, delivering consistent, nutrient-rich products to meet the growing need for convenient, healthy meal options.

By Application Analysis

Dairy & Dairy-Based Products Lead with 31.2% Share in 2024

In 2024, dairy and dairy-based products held a leading 31.2% share of the Food Fortifying Agent Market, driven by their widespread consumption and suitability as carriers for vitamins, minerals, and probiotics. Fortified with essentials like vitamin D, calcium, and iron, dairy products such as milk, cheese, and yogurt address nutritional gaps, particularly for children and the elderly.

This segment is expected to maintain its dominance, supported by government fortification programs and growing consumer demand for nutrient-enriched functional foods. Dairy brands emphasize the health benefits of fortified products, boosting their appeal. The rising popularity of flavored fortified milk and yogurts further expands the segment’s reach. Dairy and dairy-based products remain the most reliable platform for fortification, securing their leadership in the global market.

Regional Analysis

North America leads with a 38.5% share (USD 34.1 billion) in the 2024 Food Fortifying Agent Market

In 2024, North America emerged as the leading region in the Food Fortifying Agent Market, accounting for 38.5% of global revenue, equal to USD 34.1 billion. This dominance is driven by high consumer awareness of nutrition, a well-established food processing sector, and proactive government regulations that encourage fortification. Policies supporting the enrichment of everyday staples such as dairy products, breakfast cereals, and edible oils with key nutrients like vitamins A, D, and folic acid have further strengthened the region’s position, ensuring widespread adoption of fortified foods.

Top Use Cases

- Nutrient Boost in Breakfast Cereals: Food makers add vitamins like B-complex and iron to cereals to fight morning energy slumps and anemia. This simple step turns everyday flakes into a quick health win, helping busy families start the day strong without extra pills. Kids love the taste, while parents get peace of mind from hidden goodness in every bowl.

- Bone Health in Dairy Drinks: Milk and yogurt get extra vitamin D and calcium to keep bones tough, especially for growing kids and older folks. It’s a daily sip that cuts down on weak bones and falls. Brands mix it in smoothly, so it feels like regular milk but packs a health punch for lifelong strength.

- Immune Support in Fruit Juices: Juices fortified with vitamin C and zinc help ward off colds and boost defenses in flu season. Fruit flavors hide the extras, making it fun for all ages to sip smarter. This easy swap in breakfast routines builds stronger bodies, cutting sick days and keeping energy high year-round.

- Brain Growth in Baby Formulas: Infant formulas laced with DHA, iron, and folic acid support tiny brains and steady growth. New parents rely on this to mimic breast milk’s perks when needed. It eases worries about gaps in early nutrition, setting babies up for sharp learning and healthy milestones from day one.

- Heart Aid in Edible Oils: Cooking oils enriched with vitamins A and E tackle vision issues and heart risks in daily meals. In homes worldwide, a dash of stir-fries or curries delivers stealthy protection. It fits any kitchen, turning routine cooking into a shield against hidden health threats for the whole family.

Recent Developments

1. ADM

ADM is expanding its portfolio of bio-fermented, nature-derived fortificants. Recent developments include the launch of a heat-stable vitamin D ingredient, designed for use in beverages and bakery, and the acquisition of Deerland Probiotics & Enzymes to enhance its gut-health solutions. These moves address the growing demand for science-backed, sustainable nutritional ingredients.

2. Advanced Organic Materials, S.A. (AOM)

AOM specializes in developing and manufacturing organic mineral complexes. A key recent development is their ongoing research into the bioavailability of their Sucrosomial Iron and other mineral platforms. They are focusing on applying this technology to new food and beverage categories, offering a highly absorbable and gut-friendly fortification solution without the metallic aftertaste or side effects of traditional minerals.

3. Arla Foods Ingredients Group P/S

Arla Foods Ingredients is innovating in dairy-based fortification. A significant development is the promotion of their whey protein ingredients, such as Lacprodan PL-20, for fortifying foods and beverages for healthy aging. This supports muscle maintenance in older adults. They also focus on adding high-quality dairy proteins to products for children to aid growth and development.

4. BASF SE

BASF continues to lead in vitamin and carotenoid production. A major recent development is their commitment to producing entirely renewable-based vitamins, like Vitamin A. They are also expanding their 4D³ (Deeper Dietary Deficiency Discovery) portfolio, using data to identify and address specific global nutrient gaps with tailored fortification solutions, moving beyond one-size-fits-all approaches.

5. DSM

DSM (now part of Firmenich as DSM-Firmenich) is a major innovator. A key recent development is the launch of their ampli-D portfolio, which includes highly concentrated vitamin D ingredients requiring less volume for fortification. They are also advancing their life’s range of sustainable, algae-based omega-3s (EPA/DHA) for plant-based and other food applications, addressing a critical nutritional gap.

Conclusion

The Food Fortifying Agents sector, driven by folks craving smarter eats to dodge nutrient shortfalls and chronic woes, it’s a goldmine for makers blending vitamins into everyday grub like cereals and drinks. Governments pushing staple fortification in spots like Asia and Africa amp up demand, while tech tweaks make nutrients stick better without messing with taste. Clean labels and custom blends are the next wave, promising wider reach and fatter wallets for players who nail health trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)