Table of Contents

Overview

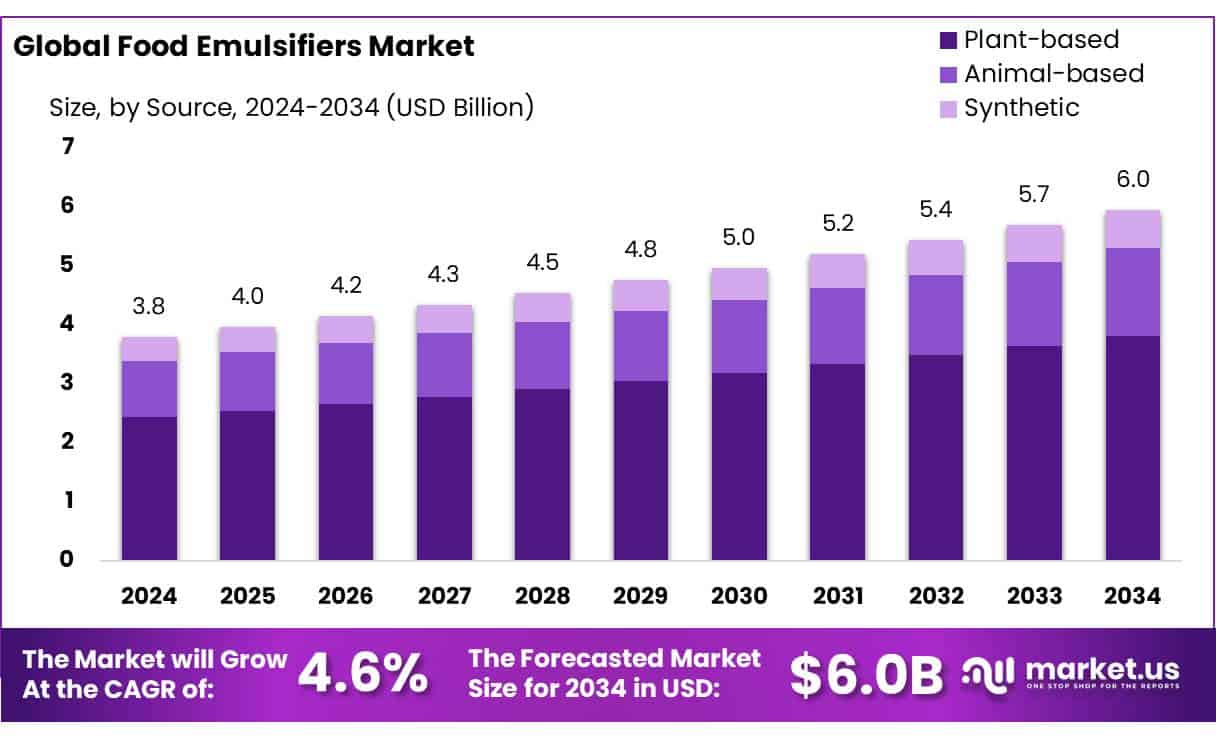

New York, NY – Sep 09, 2025 – The Global Food Emulsifiers Market is projected to reach approximately USD 6.0 billion by 2034, up from USD 3.8 billion in 2024, reflecting a CAGR of 4.6% between 2025 and 2034.

Food emulsifiers are chemical agents widely used in the food and beverage industry to stabilize emulsions and prevent ingredient separation, such as oil and water. They are essential for improving texture, consistency, and shelf-life in products like bakery items, dairy goods, confectionery, and processed meats. The global market is expanding steadily, fueled by shifting consumer preferences and advancements in food technology.

Industry leaders such as Dow, DuPont, Cargill, and Kerry Group are driving innovation to meet stringent quality standards and evolving market demands. In the U.S., the food processing sector where emulsifiers play a crucial role accounts for about 16% of total manufacturing shipments, according to USDA data.

Market growth is supported by rising demand for processed and convenience foods, as well as the health and wellness trend prompting reformulation with natural emulsifiers like soy or sunflower lecithin. Regulatory frameworks, including the EU’s Regulation (EC) No 1333/2008 and funding initiatives such as the European Investment Bank’s €100 million support for SMEs, further strengthen industry development.

Key Takeaways

- The food emulsifiers market is anticipated to grow from USD 3.8 billion in 2024 to nearly USD 6.0 billion by 2034, at a CAGR of 4.6%.

- The plant-based category leads the market, accounting for over 64.20% of total share.

- Mono-, di-glycerides, and their derivatives hold a strong 43.20% share in product types.

- Bakery and confectionery remain the top application segment, representing more than 37.40% of the market.

- North America dominates regionally, holding 46.20% of the market valued at approximately USD 1.7 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-food-emulsifiers-market/free-sample/

Report Scope

| Market Value (2024) | USD 3.8 Bn |

| Forecast Revenue (2034) | USD 6.0 Bn |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Source (Plant-based, Animal-based, Synthetic), By Type (Mono-, di-glycerides and Derivatives, Lecithin, Stearoyl Lactylates, Sorbitan Esters, Polyglycerol Ester, Others), By Application (Bakery and Confectionery, Convenience Foods, Dairy and Frozen Products, Meat, Poultry, and Seafood, Spreads and Margarines, Others) |

| Competitive Landscape | Cargill, Incorporated, Riken Vitamin Co., Ltd., Palsgaard A/S, Archer Daniels Midland Company, BASF SE, Corbion, Kerry Group, Ingredion Incorporated, International Flavors & Fragrances Inc, Tate & Lyle, Fine Organics, Stepan Company, Barentz, Puratos, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144933

Key Market Segments

By Source

Plant-Based Emulsifiers Dominate with 64.20% Market Share

In 2024, plant-based emulsifiers accounted for over 64.20% of the food emulsifiers market, reflecting a strong consumer shift toward natural and clean-label ingredients. This growth is fueled by rising health awareness and demand for products free from synthetic additives. Derived from plant sources, these emulsifiers appeal to health-conscious consumers seeking sustainable and naturally composed food products. With advancements in food technology and increasing sustainability concerns, reliance on plant-based emulsifiers is projected to strengthen in the coming years.

By Type

Mono-, Di-Glycerides & Derivatives Command 43.20% Share for Their Versatility

In 2024, mono-, di-glycerides, and their derivatives captured more than 43.20% of the market, underscoring their crucial role in food processing. Known for enhancing texture, stability, and shelf life, they are widely used in bakery, dairy, and other processed foods. Their ability to bind oil and water ensures smooth, consistent products, solidifying their position as an essential ingredient in the industry.

By Application

Bakery & Confectionery Lead with 37.40% Market Share

The bakery and confectionery sector held over 37.40% of the market in 2024, driven by the essential function emulsifiers serve in improving texture, volume, freshness, and stability. From breads to chocolates, emulsifiers enhance product quality and longevity. Continuous innovation in recipes and growing consumer expectations for premium bakery goods ensure steady demand, keeping this segment central to overall market growth.

Regional Analysis

North America leads the global food emulsifiers market, holding a 46.20% share valued at approximately USD 1.7 billion in 2024. This dominance is primarily fueled by the United States, a major hub for food production and innovation. Advanced food processing capabilities, coupled with a strong food and beverage sector, drive the region’s consistent demand for high-quality emulsifiers that enhance texture, stability, and shelf life.

Rising health consciousness among consumers has increased the preference for clean-label and natural emulsifiers, encouraging manufacturers to develop plant-based alternatives. The shift away from synthetic additives aligns with evolving dietary trends.

Additionally, supportive regulations from agencies like the U.S. FDA and Health Canada ensure stringent safety compliance, boosting trust and adoption. This combination of innovation, consumer demand, and regulatory backing firmly positions North America as a key growth engine in the global market.

Top Use Cases

1. Bakery Products Enhancement:

- Food emulsifiers are added to breads, cakes, and pastries to improve dough strength, texture, and volume while extending freshness. By stabilizing air incorporation, emulsifiers help maintain softness and delay staling, delivering consistent, high-quality baked goods that align with consumer expectations for texture and long shelf life.

2. Ice Cream & Frozen Desserts Stability:

- Emulsifiers help control ice crystal formation and stabilize fat-in-water emulsions in ice cream and similar frozen treats. This results in smoother, creamier textures, improved freeze-thaw resilience, and slower melting. These properties ensure the product retains its quality during storage and distribution.

3. Chocolate & Confectionery Consistency:

- In chocolate and confections, emulsifiers reduce viscosity, providing a smooth mouthfeel and preventing structural defects like fat bloom. They ensure uniform consistency and ease of molding or extrusion key for producing attractive, high-quality chocolate bars and fillings with stable texture.

4. Sauces, Dressings & Beverages Emulsion:

- Emulsifiers maintain stable mixtures of oil and water in sauces, dressings, and plant-based beverages. They improve texture and mouthfeel, ensuring smooth, homogenous products. This functionality is essential for delivering consistent consumer experiences in ready-to-use products.

5. Processed Meats & Dairy Alternatives:

- In products like sausages and meat substitutes, emulsifiers help bind fat, water, and protein enhancing texture, moisture retention, and sliceability. In dairy alternatives, they mimic natural creaminess and stabilize emulsions, ensuring pleasing texture and consistency in plant-based offerings.

Recent Developments

- Cargill, Incorporated

- Cargill continues to spotlight lecithin sunflower, soy and canola as label-friendly emulsifiers for bakery, confectionery and beverages, emphasizing non-GMO, allergen-management and clean-label formulation. Current materials position lecithin solutions for aeration, crystallization control and viscosity management, with technical guidance for replacing egg or synthetic emulsifiers in specific applications. While not a plant opening, Cargill’s 2024-2025 portfolio pages and sustainability content reinforce commercial focus on natural emulsification systems to meet reformulation, “free-from,” and cost-in-use goals across regions.

2. Palsgaard A/S

- Palsgaard has accelerated emulsifier and stabilizer capacity. In 2025 it announced major investments to expand the Netherlands site, lifting output for emulsifiers/stabilizers used in dairy, ice cream, and bakery while enhancing sustainability. In late 2024, Palsgaard (Nexus) broke ground on a RM1 billion plant in Johor, Malaysia, to serve Asia with specialty emulsifiers/stabilizers, citing strong demand and regional proximity advantages. These expansions reinforce Palsgaard’s position in plant-based, clean-label emulsification and multifunctional stabilizer systems for RTD beverages and bakery

3. Stepan Company

- Stepan’s Food & Health Ingredients platform (notably NEOBEE® MCTs) serves as emulsification aids and carriers in beverages, nutrition and flavors. 2025 corporate news focuses on surfactant capacity and innovation infrastructure, supporting broader emulsion science. While not a food-specific plant addition this year, Stepan’s technology and specialty lipid portfolio remain relevant for beverage clouding, flavor delivery and mouthfeel where emulsifier-lipid systems intersect.

4. Barentz

- Barentz continued M&A to strengthen specialty ingredients distribution. In 2025 it announced plans to acquire Fengli in Greater China and completed the acquisition of Germany’s NCD Ingredients. These moves expand Barentz’s access to functional systems including emulsifiers, texturants and stabilizers and technical application labs, improving service to food customers across APAC and Europe with local inventory and formulation support.

5. Tate & Lyle

- Tate & Lyle completed the combination with CP Kelco (2024-2025), creating a larger specialty solutions leader in mouthfeel and stabilization. 2025 news highlights IFT FIRST showcases and integration progress, adding pectins and specialty gums that synergize with emulsifiers to deliver viscosity, suspension and stability in beverages, dressings and dairy. The enlarged portfolio strengthens end-to-end texture design for clean-label reformulations.

Conclusion

The global food emulsifiers market is experiencing steady growth, supported by increasing demand for processed and convenience foods, cleaner labels, and natural ingredients. Key players such as Cargill, ADM, BASF, Corbion, Kerry Group, and Tate & Lyle are actively investing in product innovations, sustainability initiatives, and capacity expansions to meet evolving consumer preferences. Recent developments highlight a strong focus on plant-based and clean-label emulsifiers, catering to health-conscious and environmentally aware consumers.

Technological advancements in food processing and emulsifier functionality are enabling manufacturers to deliver improved texture, stability, and shelf-life in various food applications. Strategic collaborations, acquisitions, and new product launches are shaping the competitive landscape, with companies also prioritizing regulatory compliance and food safety standards. With North America and Europe leading in innovation, and Asia-Pacific witnessing rapid consumption growth, the market is set to expand steadily, offering significant opportunities for innovation-driven and sustainability-focused players in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)