Table of Contents

Overview

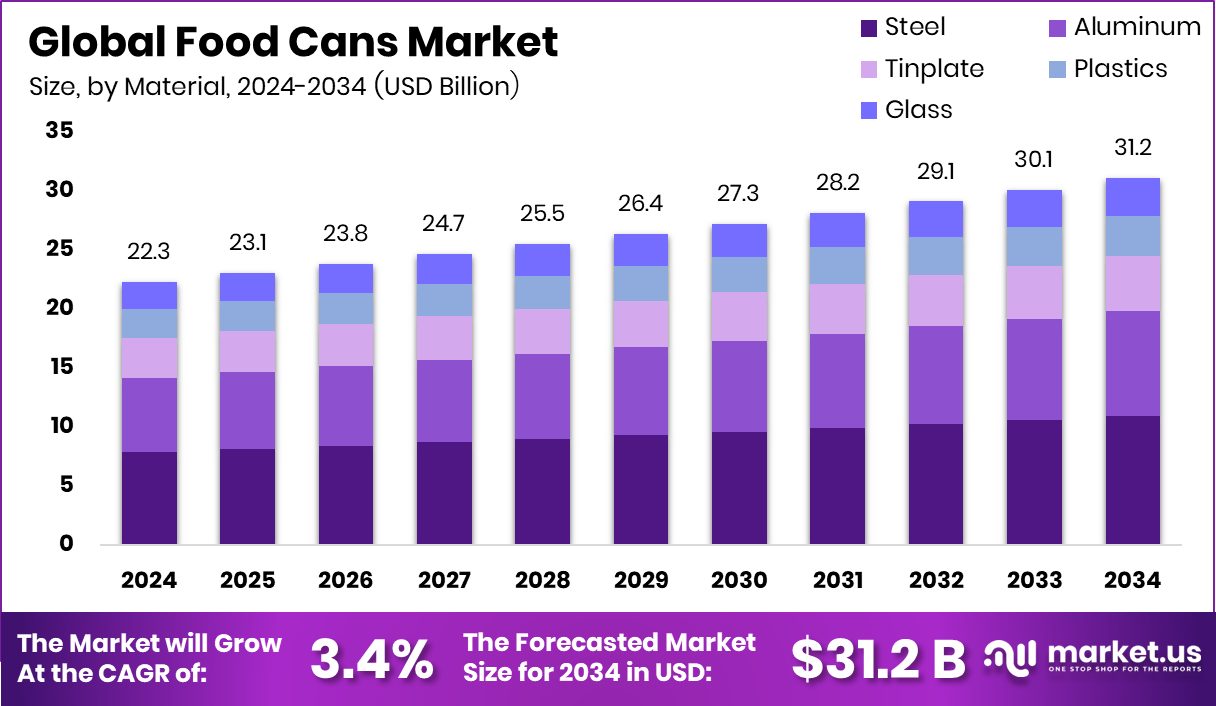

New York, NY – September 15, 2025 – The Global Food Cans Market is projected to reach USD 31.2 billion by 2034, rising from USD 22.3 billion in 2024, at a CAGR of 3.4% between 2025 and 2034. In 2024, North America held a 45.9% share, valued at USD 10.2 billion, supported largely by strong recycling initiatives.

Food cans are sealed containers, typically manufactured from tin-plated steel or aluminum, designed to protect food from contamination and extend shelf life. They are widely used for packaging fruits and vegetables, meats, seafood, soups, and ready-to-eat meals. Their durability, ability to endure transportation, and compatibility with high-heat sterilization make them a trusted choice for both perishable and non-perishable products.

The food cans market encompasses global production, trade, and consumption across categories such as meat, fruits, vegetables, beverages, and pet food. It covers the full supply chain from raw material sourcing and manufacturing to distribution and retail, catering to industries that rely on long-lasting and safe food packaging solutions. Market growth is fueled by urbanization, busier lifestyles, and rising demand for ready-to-eat meals.

Increasing awareness of food safety and recyclability is also driving adoption. Additionally, higher consumption of processed foods, particularly in emerging economies, and the rise of e-commerce grocery channels are accelerating market penetration. Recent industry activity highlights this momentum, with Ready, Set, Food securing $3 million in funding led by Danone Ventures and Agricool raising $28 million to expand container-based fruit cultivation.

Key Takeaways

- The Global Food Cans Market is expected to be worth around USD 31.2 billion by 2034, up from USD 22.3 billion in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034.

- Steel holds a 56.8% share in the Food Cans Market, driven by durability and effective preservation qualities.

- Two-piece cans dominate the Food Cans Market with a 67.3% share, offering superior strength and efficient manufacturing.

- Fish and seafood lead the Food Cans Market applications, capturing 24.6% share due to extended freshness benefits.

- Strong demand for packaged meals boosted North America by 45.9%, USD 10.2 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-food-cans-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 22.3 Billion |

| Forecast Revenue (2034) | USD 31.2 Billion |

| CAGR (2025-2034) | 3.4% |

| Segments Covered | By Material (Steel, Aluminum, Tinplate, Plastics, Glass), By Can Type (Two-Piece, Three-Piece, Composite Cans), By Application (Fish and Seafood, Ready Meals, Powder Products, Fruits and Vegetables, Processed Food, Pet Food, Others) |

| Competitive Landscape | Ardagh Group, Ball Corporation, CAN-PACK S.A., Dell Monte Foods, Dole plc, Kaira Cans, Kian Joo Group, Kraft Heinz, Silgan Holdings, Nampak, Sonoco Products Company, Trivium Packaging |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155405

Key Market Segments

Material Analysis

Steel commands a 56.8% share of the global food cans market in 2024, leading the By Material segment due to its superior strength, barrier properties, and cost-effectiveness. Ideal for packaging fruits, vegetables, soups, and pet food, steel’s durability ensures resistance to damage during transport and storage. Its ability to endure high-temperature sterilization preserves food safety and nutritional quality, extending shelf life.

Steel’s infinite recyclability without quality loss aligns with stringent environmental regulations and consumer demand for sustainable packaging, particularly in North America and Europe, where robust recycling infrastructure enhances its market dominance. Advances in manufacturing have produced lighter, stronger steel cans, reducing costs for production and shipping. With growing global demand for shelf-stable foods, steel’s safety, durability, and eco-friendliness ensure its continued market leadership.

Can Type Analysis

Two-piece cans hold a commanding 67.3% share of the food cans market in 2024, dominating the By Can Type segment. Their seamless design, formed from a single metal sheet via drawing and ironing, eliminates side seams, minimizing leakage risks and enhancing food safety. These cans offer excellent durability and dent resistance, making them ideal for ready-to-eat meals, soups, vegetables, and pet food.

The two-piece design supports high-quality printing for enhanced shelf appeal and is lightweight, reducing material and transportation costs while maintaining structural integrity. Compatible with high-speed automated filling lines, two-piece cans boost production efficiency for large-scale food processors. Driven by demand for convenient, packaged foods in both developed and emerging markets, their cost-effectiveness, recyclability, and consumer trust ensure continued dominance.

Application Analysis

Fish and seafood lead the By Application segment with a 24.6% share of the food cans market in 2024. High global demand for preserved marine products, such as tuna, sardines, salmon, and shellfish, stems from their convenience, long shelf life, and year-round availability. Canning preserves nutrients, flavor, and freshness through high-heat sterilization, making it a reliable choice for consumers, especially in regions with limited access to fresh seafood.

Growing health awareness, particularly around omega-3 fatty acids, drives consumption, while the portability of canned seafood suits quick meals and emergency food reserves. Advancements in lightweight packaging and attractive labeling, combined with expanded retail and e-commerce channels, bolster this segment’s growth. The fish and seafood category is poised to maintain its strong market position as demand rises in both developed and emerging economies.

Regional Analysis

North America leads the global food cans market in 2024 with a 45.9% share, valued at USD 10.2 billion. This dominance is fueled by high consumption of packaged foods, advanced retail infrastructure, and strong recycling systems that support metal packaging’s high recovery rates. Consumers in the U.S. and Canada favor canned goods for their convenience, safety, and long shelf life, aligning with fast-paced lifestyles and demand for ready-to-eat meals.

Europe trails closely, driven by strict food safety standards and a focus on sustainable packaging. Asia Pacific is a fast-growing market, propelled by urbanization, rising incomes, and expanding retail networks. The Middle East & Africa and Latin America show steady growth, supported by increasing packaged food adoption and improved supply chains. North America’s advanced manufacturing, efficient distribution, and consumer confidence in canned goods solidify its market leadership, with a strong outlook for the forecast period.

Top Use Cases

- Emergency & Disaster Relief Supplies: Food cans are ideal for relief kits in disasters. They have long shelf lives, resist spoilage, and require no refrigeration, making them perfect for transporting food to remote areas. Relief agencies prefer canned goods like beans, soups, vegetables, and meats because they stay safe, retain nutrients, and can feed many people during crises.

- Retail Ready Meals & Convenience Foods: Many consumers today want fast, ready-to-eat meals. Canned meals meet that demand—they are pre-cooked, simply heated, and eaten. Supermarkets stock canned soups, pastas, and stews. As people’s lifestyles get busier, especially in cities, this segment is growing strongly, driving demand for quality cans that ensure taste and safety.

- Pet Food Packaging: Pet food brands use cans for wet or luxe pet foods. Metal cans protect flavor, preserve proteins, and prevent contamination. The pet food segment is expanding because more households own pets and are willing to spend on premium canned food. Durable cans also help in storage and transport in varied climates without damaging contents.

- Seafood & Meat Preservation: Seafood (like tuna, sardines) and meats (like corned beef) often come canned. Canning allows thorough cooking and sealing, which kills bacteria and preserves meat safely for months. It supports both domestic consumption and export markets, especially where cold-chain (refrigerated transport) is weak or expensive.

- Sustainable Packaging & Recycling Branding: Producers increasingly market food in recyclable aluminum or steel cans. These metals are highly recyclable, reducing the environmental footprint. Brands can use this to appeal to customers who care about sustainability. Regulations and consumer awareness push producers to innovate with lighter cans, BPA-free linings, and recyclable designs, boosting this use case.

Recent Developments

1. Ardagh Group

Ardagh is innovating in sustainable packaging, launching its ‘Infinite Loop’ food cans in Europe. These are made with a minimum of recycled aluminum and are designed to be infinitely recyclable. This initiative supports a circular economy and responds to growing consumer demand for environmentally responsible packaging options from food brands.

2. Ball Corporation

Ball Corporation continues to advance its aluminum stewardship, promoting the infinitely recyclable nature of its food cans. A key development is the increased use of its ReAl alloy, which contains significantly more recycled content. They are also investing in digital printing technology to offer brands more customizable, shorter-run can designs, enhancing marketing agility and reducing waste.

3. CAN-PACK S.A.

The CAN-PACK Group has expanded its global production footprint significantly. A key recent development is the focus on value-added decorations and shapes for food cans, moving beyond standard cylinders to offer unique, shelf-differentiating designs for brand owners. They are also enhancing their lines to support more sustainable production processes and materials.

4. Dell Monte Foods

While not a can manufacturer, Del Monte Foods is a major user of food cans. Their recent developments focus on the content, committing to sustainable sourcing. They have initiatives to make 100% of their plastic packaging reusable, recyclable, or compostable, a principle that extends to their metal can linings and labels, ensuring the entire package is environmentally conscious.

5. Dole plc

Similar to Del Monte, Dole is a producer that utilizes canned packaging. Their primary recent development is the Dole Promise, which includes goals to eliminate processed sugar from all their products and move towards zero fossil-based packaging. This pushes innovation towards more sustainable can liners and recyclable materials for their fruit and vegetable products sold in cans.

Conclusion

Food cans remain a vital part of global food packaging because they combine safety, durability, and convenience. Across many segments, prepared meals, pet food, meat & seafood, and consumer demand for sustainable packaging, they fulfill critical needs. As urbanization, environmental awareness, and consumer lifestyles evolve, the market for food cans is likely to continue growing steadily. Producers who innovate in materials (lighter, safer, recyclable), improve supply chains, and adapt to changing preferences will be best positioned to benefit in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)