Table of Contents

Overview

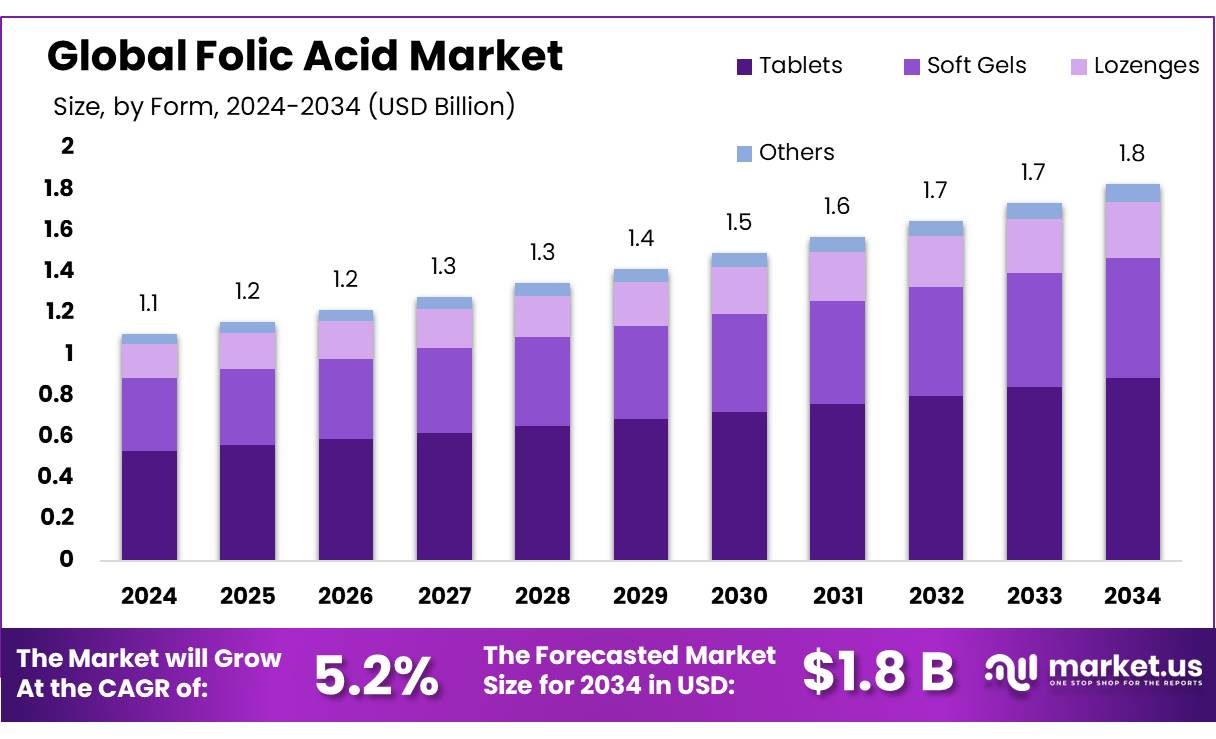

New York, NY – August 07, 2025 – The Global Folic Acid Market is projected to grow from USD 1.1 billion in 2024 to approximately USD 1.8 billion by 2034, with a CAGR of 5.2% during the forecast period (2025–2034). In 2024, North America led the market, accounting for over 46.4% of the share, with revenues of USD 0.5 billion.

Folic acid concentrates are critical in addressing micronutrient deficiencies, particularly in regions with high rates of neural tube defects (NTDs). Over 70 countries have adopted mandatory folic acid fortification in staple foods, significantly lowering NTD incidence. In India, the Food Safety and Standards Authority of India (FSSAI) mandates fortifying wheat flour with 75–125 µg/kg of folic acid, in line with WHO guidelines.

Government initiatives significantly drive the folic acid market by tackling malnutrition. In India, programs like the Centrally Sponsored Pilot Scheme distribute fortified rice containing iron, folic acid, and vitamin B12 to vulnerable groups. The Public Distribution System (PDS) and Mid-Day Meal Scheme (MDM) also incorporate fortified wheat flour and rice to improve nutritional outcomes.

Rising awareness of folic acid’s health benefits and its ability to prevent up to 90% of NTD cases fuels demand. This has spurred food manufacturers to adopt fortification practices and governments to expand fortified food programs. In India, the Food Fortification Initiative (FFI) promotes micronutrient fortification, with states like Haryana fortifying wheat flour with 130 mcg of folic acid per 100 grams, distributed through PDS, MDM, and Integrated Child Development Services (ICDS) to reduce NTD prevalence among vulnerable populations.

Key Takeaways

- The Folic Acid Market size is expected to be worth around USD 1.8 billion by 2034, from USD 1.1 billion in 2024, growing at a CAGR of 5.2%.

- Tablets held a dominant market position, capturing more than a 48.4% share in the folic acid market.

- 98% And Above held a dominant market position, capturing more than a 52.7% share in the folic acid market.

- Vegetables held a dominant market position, capturing more than a 44.9% share in the folic acid market.

- Pharmaceuticals held a dominant market position, capturing more than a 41.2% share in the folic acid market.

- Offline held a dominant market position, capturing more than a 67.9% share in the folic acid market.

- North America stands as the dominant region in the global folic acid market, commanding a substantial share of 46.4% in 2024, equivalent to approximately USD 0.5 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/folic-acid-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.1 Billion |

| Forecast Revenue (2034) | USD 1.8 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Form (Tablets, Soft Gels, Lozenges, Others), By Purity Level (90% To 98%, 98% And Above, Below 90%), By Source (Vegetables, Fruits, Others), By Application (Pharmaceuticals, Food and Beverages, Nutraceuticals, Animal Feed, Others), By Distribution Channel (Offline, Online) |

| Competitive Landscape | BASF SE, Changzhou Niutang Chemical Plant Co. Ltd., DSM N.V., Hebei Jiheng Group Pharmacy Co. Ltd., Jiangxi Tianxin Pharmaceutical Co., Ltd., Jiheng Pharmaceutical, Medicamen Biotech Ltd, Nantong Changhai Food Additive, Shandong Xinfa Pharmaceutical Co., Ltd., Tyson Foods |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153594

Key Market Segments

By Form Analysis

In 2024, tablets commanded a 48.4% share of the folic acid market by form, attributed to their portability, ease of use, and extended shelf life. Tablets are favored in both prescription and over-the-counter settings, particularly for pregnant women and those addressing anemia or vitamin deficiencies. Their stability makes them well-suited for widespread distribution through government health programs and retail pharmacies.

Growing awareness of prenatal health, especially in developing countries, continues to boost demand for tablet-based folic acid. In 2025, tablets are expected to maintain dominance, supported by healthcare recommendations and global fortification initiatives promoting accessible supplementation. Their standardized dosing ensures consistent nutrient delivery, aligning with consumer preferences for reliable, user-friendly solutions.

By Purity Level Analysis

In 2024, the 98% and above purity segment led the folic acid market with a 52.7% share, driven by its critical role in pharmaceutical formulations requiring high safety and efficacy standards. This high-purity grade is vital for prenatal vitamins and fortified foods, meeting stringent global health regulations.

With rising demand for precise supplementation in maternal health programs, manufacturers prioritize high-purity folic acid to ensure consistency and trust. In 2025, this segment is projected to retain its lead, fueled by strict quality standards and growing exports of high-purity active pharmaceutical ingredients (APIs). The dominance of this category highlights the shift toward premium, clinically validated folic acid in both developed and emerging markets.

By Source Analysis

In 2024, vegetable-derived folic acid held a 44.9% market share, reflecting consumer preference for natural, plant-based supplements in the food and nutraceutical sectors. Leafy greens like spinach, broccoli, and kale, rich in folate, are key sources for clean-label and organic formulations. This segment’s growth is fueled by health-conscious consumers avoiding synthetic additives and favoring transparent, sustainable sourcing.

By Application Analysis

In 2024, the pharmaceutical segment held a 41.2% share of the folic acid market, driven by its essential role in preventing folate deficiency, neural tube defects (NTDs), and anemia. Folic acid is a cornerstone of prenatal supplements and is widely prescribed during pregnancy to support fetal development.

This segment also supports therapeutic formulations like multivitamins and injectables used in clinical settings. In 2025, pharmaceuticals are expected to maintain their lead, bolstered by healthcare recommendations and government initiatives promoting maternal and preventive nutrition. The segment’s strength underscores folic acid’s critical role in clinical applications.

By Distribution Channel Analysis

In 2024, offline distribution captured a 67.9% share of the folic acid market, driven by the widespread availability of pharmacies, hospitals, clinics, and retail stores. Consumers favor offline channels for face-to-face consultations, immediate product access, and trusted pharmacy recommendations.

Government health programs and hospital-based prenatal care rely heavily on offline distribution to deliver folic acid tablets to pregnant women and anemic patients. In 2025, offline channels are expected to remain dominant, particularly in rural and semi-urban areas with limited internet access. Their reliability and reach make them the preferred distribution method globally.

Regional Analysis

In 2024, North America held a 46.4% share of the global folic acid market, valued at approximately USD 0.5 billion. This dominance is driven by robust regulatory frameworks, widespread public health campaigns, and high consumer awareness of folic acid’s benefits.

In the United States, the FDA’s mandatory fortification of enriched grain products with folic acid since 1996 has significantly reduced neural tube defect rates. Similarly, Canada’s 1998 fortification mandate led to a 46% decline in NTDs, highlighting the success of these policies. North America’s leadership reflects its strong commitment to public health and effective fortification strategies.

Top Use Cases

- Prenatal Health Supplements: Folic acid is widely used in prenatal vitamins to prevent neural tube defects in newborns. Its demand surges due to growing awareness among pregnant women and healthcare recommendations, driving sales in pharmaceutical and nutraceutical markets, especially in regions with mandatory fortification policies.

- Food Fortification Programs: Folic acid is added to staple foods like bread, cereals, and rice to address folate deficiencies. Government initiatives in over 80 countries promote fortification, boosting market growth in the food and beverage sector by ensuring widespread nutrient access.

- Anemia Treatment: Folic acid is a key ingredient in treatments for folate-deficiency anemia. Its use in pharmaceutical formulations, including tablets and injectables, supports market expansion as healthcare providers prescribe it for patients with anemia-related conditions.

- Nutraceutical Products: Folic acid is incorporated into dietary supplements like capsules and gummies, appealing to health-conscious consumers. The rising trend of personalized nutrition and preventive health drives demand in the nutraceutical market, particularly for natural folate sources.

- Cardiovascular Health Support: Folic acid is used in supplements targeting heart health by reducing homocysteine levels, linked to cardiovascular diseases. Growing consumer awareness of preventive health fuels demand for folic acid in nutraceuticals and functional foods.

Recent Developments

1. BASF SE

BASF has enhanced its folic acid production with high-purity, bioavailable forms for supplements and fortified foods. Their Quatrefolic (5-MTHF) is a patented, directly active folate, improving absorption over synthetic folic acid. Recent innovations include heat-stable folic acid for baked goods and beverages.

2. Changzhou Niutang Chemical Plant Co., Ltd.

Niutang has expanded its GMP-certified folic acid production, supplying high-quality folate for pharmaceuticals and nutraceuticals. They focus on cost-effective, high-yield synthesis and export to global markets. Recent developments include micronized folic acid for better solubility in liquid supplements.

3. DSM N.V. (now part of Firmenich as DSM-Firmenich)

DSM’s MetaFolin (L-methylfolate) is a premium bioactive folate for prenatal and mental health supplements. They’ve partnered with food brands to integrate folic acid in fortified staples like flour. Recent research highlights folic acid’s role in reducing neural tube defects.

4. Hebei Jiheng Group Pharmacy Co., Ltd.

Jiheng Group has scaled up pharmaceutical-grade folic acid production, supplying raw material for tablets and injections. They emphasize low heavy-metal, high-purity folate for medical use. Recent investments include green chemistry processes to reduce environmental impact.

5. Jiangxi Tianxin Pharmaceutical Co. Ltd.

Tianxin specializes in high-potency folic acid for supplements and animal feed. Their micronized folate powder improves blend uniformity in multivitamins. Recent expansions include new FDA-compliant production lines for global exports.

Conclusion

The Folic Acid Market is thriving due to its critical role in prenatal care, food fortification, and health supplements. Growing consumer awareness, government support, and innovative applications in pharmaceuticals, nutraceuticals, and cosmetics fuel its expansion. With rising demand for preventive health and personalized nutrition, the market is poised for steady growth, offering opportunities for new product development and market penetration.