Table of Contents

Overview

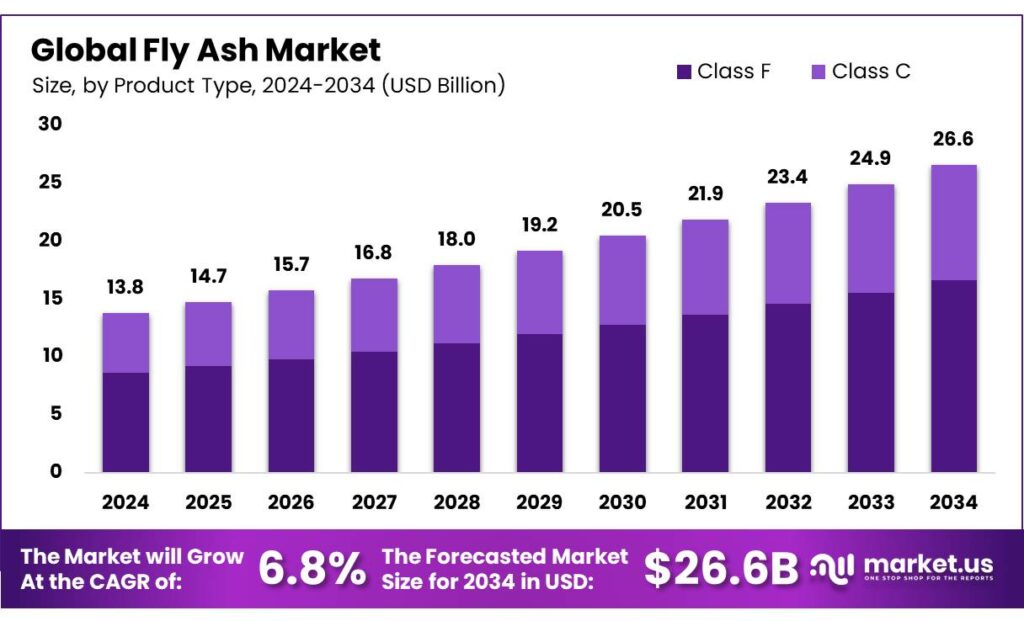

New York, NY – September 18, 2025 – The Global Fly Ash Market is projected to grow from USD 13.8 billion in 2024 to approximately USD 26.6 billion by 2034, expanding at a CAGR of 6.8% between 2025 and 2034. In 2024, Asia Pacific emerged as the leading region, accounting for more than 57.4% of the market share and generating USD 7.9 billion in revenue.

Fly ash, a fine powder generated as a byproduct of coal combustion in power plants, is rich in silica, alumina, and iron oxide. Its primary use is in the construction sector, particularly as a cement substitute in concrete, where it enhances durability, strength, and workability. It is also applied in asphalt, soil stabilization, and other building materials. Among the different grades, Class F fly ash remains the most widely utilized.

Market growth is strongly tied to the demand from the construction industry. However, supply challenges are emerging as many countries transition toward renewable energy sources and gradually reduce reliance on coal, leading to limited fly ash availability. On the other hand, growing sustainability trends and government initiatives promoting the safe and productive use of fly ash are creating new opportunities.

Key Takeaways

- The Global Fly Ash Market was valued at USD 13.8 billion in 2024, at a CAGR of 6.8% and is estimated to reach USD 26.6 billion by 2034.

- Based on product types, fly ash that belongs to class F dominated the market in 2024, comprising about 58.2% share of the total global market.

- Among the applications of fly ash, the cement and concrete manufacturing industry dominated the market in 2024, accounting for around 43.1% of the market share.

- Asia Pacific was the largest market for fly ash in 2024 due to its rapidly expanding construction and infrastructure industry.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-fly-ash-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 13.8 Billion |

| Forecast Revenue (2034) | USD 26.6 Billion |

| CAGR (2025-2034) | 6.8% |

| Segments Covered | By Product Type (Class F, Class C), By Applications (Cement and Concrete, Bricks and Blocks, Road Construction, Soil Stabilization, Mining, Others) |

| Competitive Landscape | Boral Limited, Charah Solutions, CEMEX S.A.B de C.V., LafargeHolcim Ltd., Ashtech (India) Pvt. Ltd., Separation Technologies LLC, Cement Australia Holdings Pty Ltd., Salt River Materials Group, Ash Grove Cement Company, Dirk Group, Other Key Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156663

Key Market Segments

Product Type Analysis

The fly ash market is divided into Class F and Class C based on product type. In 2024, Class F fly ash held a dominant 58.2% market share, driven by its advantageous chemical and durability properties. With low calcium content (typically under 10%) and high levels of silica, alumina, and iron oxide, Class F exhibits strong pozzolanic activity, forming cementitious compounds when combined with lime or cement binders.

This makes it highly resistant to sulfate corrosion and alkali-silica reactions, ideal for concrete in challenging environments. In contrast, Class C fly ash, with 20-30% calcium oxide, offers self-cementing properties and early strength gains but is less suitable for harsh conditions due to higher alkali and sulfate content, which can also reduce mix flexibility in projects prioritizing long-term durability.

Application Analysis

In 2024, the cement and concrete industry accounted for 43.1% of global fly ash consumption, outpacing other applications such as bricks and blocks, road construction, soil stabilization, and mining. Fly ash’s role as a supplementary cementitious material enhances workability, reduces the heat of hydration, and improves durability by refining the concrete’s pore structure and resisting chemical degradation.

These properties make it essential for blended cements and high-performance concrete, particularly in large-scale projects like roller-compacted concrete dams, where they minimize thermal cracking and enhance structural integrity. Other applications, including bricks and blocks, benefit from fly ash’s pozzolanic properties, while its use in soil stabilization and mining supports land reclamation and environmental restoration, though these sectors hold smaller market shares.

Regional Analysis

Asia Pacific Dominated the Global Fly Ash Market in 2024

In 2024, the Asia Pacific region, led by China and India, commanded a 57.4% revenue share of the global fly ash market, valued at approximately USD 7.92 billion. This dominance is driven by extensive coal-based energy infrastructure and rapid urbanization in countries like China, India, Indonesia, and Vietnam, which generate significant fly ash volumes used in cement, concrete, bricks, and road projects.

The International Energy Agency (IEA) reported a notable demand increase in 2024, with India’s coal demand rising by 70 metric tons and China’s by 56 metric tons. China alone accounted for over 56% of global coal consumption (4.8 billion metric tons) in 2023. To manage fly ash accumulation and reduce landfill use, government initiatives in these countries promote its utilization in construction and environmental applications.

Top Use Cases

- Portland Cement and Concrete Additive: Fly ash acts as a smart mix-in for cement and concrete, making builds stronger and longer-lasting without cracking easily. Builders love it because it cuts down on raw material needs and helps create smoother pours for homes, bridges, and big projects. This keeps costs low while boosting eco-friendly vibes in everyday construction.

- Bricks and Blocks Production: In making bricks and blocks, fly ash steps in as a key ingredient that lightens the load yet amps up durability against weather and wear. It’s a go-to for factories churning out affordable building pieces for walls and floors. This use turns waste into sturdy homes and factories, saving energy in the process.

- Road Base and Soil Stabilization: Fly ash firms up loose soil for road bases, preventing shifts and potholes over time. Road crews mix it in to create solid foundations for highways and streets that handle heavy traffic better. It’s a simple fix for uneven ground, making travel safer and cheaper to maintain in busy areas.

- Waste Stabilization and Fill: For locking away harmful waste, fly ash binds it tight to stop leaks into soil or water. It’s also great for filling low spots in land projects, like building pads or embankments. This keeps sites clean and stable, turning tricky cleanup jobs into smooth, safe spaces for new developments.

- Mining and Land Reclamation: In mining spots, fly ash helps restore worn-out land by enriching soil and preventing erosion after digs. It rebuilds surfaces for planting or building, bringing back green areas faster. This makes old mine sites useful again, supporting nature recovery while opening doors for fresh community uses.

Recent Developments

1. Boral Ltd.

Boral is expanding its fly ash harvesting operations, securing new long-term ash supply agreements with power stations. A key development is their innovative “Boral Pathway” program, focusing on increasing the recovery and processing of previously landfilled ash. This initiative aims to enhance the sustainability of construction materials and secure future supply for the concrete industry in Australia.

2. Charah Solutions

Charah Solutions is a leader in fly ash beneficiation through their patented MP618 technology, which processes unusable ponded ash into a high-quality product. Recent developments include launching new processing facilities and securing multi-year contracts with utility companies to manage and harvest legacy ash ponds, turning environmental liabilities into sustainable construction materials.

3. CEMEX S.A.B. de C.V.

CEMEX is advancing its circular economy model by increasing the use of fly ash as a clinker substitute in its cement and concrete products. A key recent initiative is their “Vertua” low-carbon concrete range, which utilizes high volumes of fly ash to significantly reduce the carbon footprint. They are also partnering with energy providers to secure a stable supply of recycled fly ash.

4. Lafarge Holcim Ltd.

LafargeHolcim is aggressively integrating fly ash into its ECOPact and Susteno product lines, promoting circular construction. A major recent development is their “Geocycle” business, which uses co-processing to recycle fly ash and other industrial wastes. They are also investing in new grinding technologies to improve the performance and increase the substitution rates of fly ash in their cement formulations.

5. Ashtech (India) Pvt. Ltd.

Ashtech India is rapidly expanding its fly ash processing and distribution capacity to meet growing demand from India’s infrastructure sector. Recent developments include commissioning new advanced processing plants near power stations and pioneering the use of conditioned fly ash (CFA) technology. This ensures a consistent, high-quality product for ready-mix concrete and cement manufacturers, supporting sustainable construction.

Conclusion

Fly Ash evolving from an overlooked power plant leftover into a cornerstone of green building practices worldwide. Its knack for enhancing materials while slashing waste is fueling steady demand across construction, roads, and cleanup efforts. With builders and regulators pushing for smarter, earth-friendlier options, fly ash stands out as a versatile player that cuts emissions and sparks innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)