Table of Contents

Overview

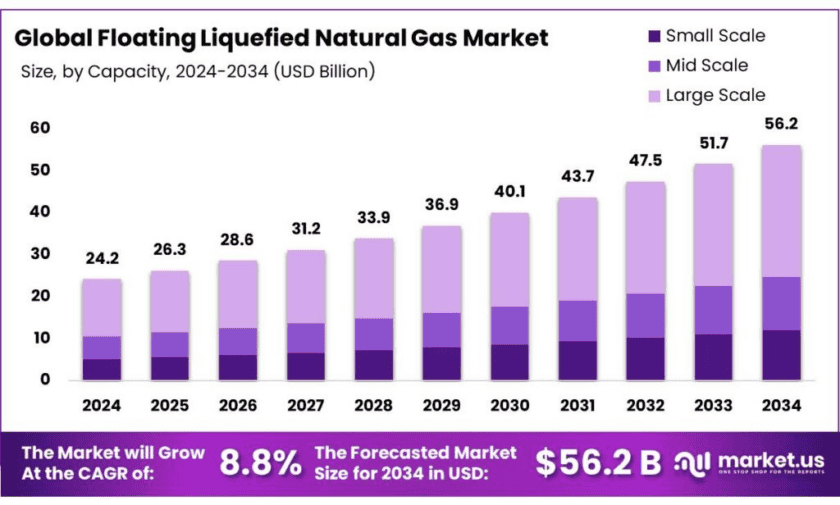

New York, NY – Oct 29, 2025 – The global floating liquefied natural gas (FLNG) market was valued at USD 24.2 billion in 2024 and is projected to reach USD 56.2 billion by 2034, growing at a compound annual growth rate CAGR of 8.8% between 2025 and 2034. The market’s expansion is supported by the rising demand for cost-efficient and flexible LNG production methods that reduce reliance on traditional onshore infrastructure.

In 2024, North America dominated the global FLNG market, accounting for 35.1% of total revenue, valued at approximately USD 8.5 billion. This leadership is attributed to the region’s robust offshore energy development, technological innovation, and strong government support for natural gas export projects. The United States, in particular, continues to invest heavily in offshore LNG liquefaction facilities to meet global energy demand and enhance export capacity.

FLNG technology enables offshore production, liquefaction, and storage of natural gas directly from subsea fields, eliminating the need for expensive onshore pipelines and terminals. These floating facilities are ship-like vessels that store LNG onboard before transferring it to other tankers for transport, offering significant flexibility and lower capital costs. The ability to relocate facilities between gas fields further strengthens operational efficiency and long-term value creation.

Environmental advantages remain a key market driver, as FLNG systems reduce the carbon footprint by minimizing large-scale onshore construction. Moreover, the ability to access previously uneconomical or remote gas reserves provides new revenue opportunities for energy producers. However, space constraints on floating vessels and operational complexity continue to present engineering and safety challenges.

Globally, LNG trade volumes reached 407 million tonnes in 2024, marking an increase of 3 million tonnes from 2023 — the lowest annual addition in the past decade. This indicates a tightening supply landscape, which could further enhance the strategic value of FLNG projects in the global natural gas market over the coming years.

Key Takeaways

- The global floating liquefied natural gas market was valued at USD 24.2 billion in 2024.

- The global floating liquefied natural gas market is projected to grow at a CAGR of 8.8% and is estimated to reach USD 56.2 billion by 2034.

- Based on the capacities of floating liquefied natural gas, large-scale capacities dominated the market in 2024, comprising about 56.1% share of the total global market.

- Based on the deployment of FLNG, offshore deployment was at the forefront of the market in 2024, accounting for a 64.5% share of the total global market.

- Among the applications of the FLNG, the production/liquefaction application dominated the market in 2024, accounting for around 58.6% of the market share.

- North America was the largest market for floating liquefied natural gas in 2024, accounting for around 35.1% of the total global consumption.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-floating-liquefied-natural-gas-market/free-sample/

Report Scope

| Market Value (2024) | USD 24.2 Bn |

| Forecast Revenue (2034) | USD 56.2 Bn |

| CAGR (2025-2034) | 8.8% |

| Segments Covered | By Capacity (Small Scale, Mid Scale, Large Scale), By Deployment (Offshore, Near Shore), By Application (Production/Liquefaction, Storage & Transportation, Regasification) |

| Competitive Landscape | Shell, Petronas, Golar LNG, ExxonMobil, Eni SpA, Hoegh LNG, Technip Energies, Samsung Heavy Industries, Hyundai Heavy Industries, KBR, JGC Corporation, SBM Offshore, BW Offshore, MODEC, TotalEnergies, Other Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161004

Key Market Segments

By Capacity Analysis: In 2024, large-scale floating liquefied natural gas (FLNG) capacities dominated the market, accounting for 56.1% of the total share. The dominance of large-scale projects is primarily due to the high capital and technical requirements of offshore liquefaction facilities, which are more cost-effective at greater capacities. The substantial investment needed for liquefaction, storage, and offloading systems can be better justified when distributed across higher production volumes, thereby improving operational efficiency and overall returns. Furthermore, major offshore gas reserves such as those in Australia and Mozambique demand large-scale infrastructure to optimize extraction. Consolidating operations into a single, high-capacity FLNG vessel also enhances storage capacity, reduces offloading frequency, and ensures stable operations in remote offshore environments.

By Deployment Analysis: In terms of deployment, offshore facilities led the global floating liquefied natural gas market in 2024, holding a 64.5% market share. Offshore deployment is preferred because FLNG units are specifically engineered to process gas directly at offshore fields, minimizing the need for expensive subsea pipelines and reducing infrastructure costs. This approach also lessens environmental impact and bypasses the regulatory and land-related challenges often associated with coastal development. By operating offshore, countries can access deep-water and remote gas reserves that are not economically feasible with traditional onshore facilities. Additionally, offshore deployment offers enhanced flexibility, allowing producers to respond swiftly to changes in global LNG demand while maintaining environmental sustainability.

By Application Analysis: Based on application, the production and liquefaction segment dominated the FLNG market in 2024, representing 58.6% of total revenue. The primary function of FLNG technology is to extract, process, and liquefy natural gas at sea, where onshore facilities are impractical or uneconomical. Converting gas to liquid form offshore reduces its volume by approximately 600 times, making storage and export more efficient. While storage and transportation are managed by LNG carriers and regasification typically occurs onshore or through floating regasification units (FSRUs), FLNG units remain focused on upstream operations. Their strategic placement at production sites enhances resource utilization and significantly reduces the logistical complexities of gas transportation to shore.

List of Segments

By Capacity

- Small Scale

- Mid-Scale

- Large Scale

By Deployment

- Offshore

- Near Shore

By Application

- Production/Liquefaction

- Storage & Transportation

- Regasification

Regional Analysis

North America Market Analysis dominates with 35.1% share in 2024, valued at USD 8.5 billion, supported by industrial expansion and green policies

In 2024, North America dominated the global floating liquefied natural gas (FLNG) market, holding a 35.1% share and generating approximately USD 8.5 billion in revenue. The region’s leadership in this sector is primarily driven by its abundant natural gas reserves, advanced offshore infrastructure, and robust export network. The United States has positioned itself as a global frontrunner in LNG production, with the Gulf of Mexico serving as a major operational base for offshore liquefaction and export activities. The continued expansion of shale gas production across the U.S. has created surplus supply, and FLNG technology provides a cost-effective and flexible means of monetizing gas fields that are not connected to traditional onshore terminals.

Additionally, Canada is leveraging its Pacific coastline to develop FLNG projects aimed at supplying energy to key Asian markets, enhancing the region’s export potential. With North America accounting for over 26% of total global natural gas output in 2024, its strategic investments in FLNG infrastructure reinforce its position as a vital contributor to the global energy supply chain and a driving force in the next phase of offshore LNG development.

Top Use Cases

Unlocking stranded offshore gas fields: FLNG units allow companies to access offshore natural gas reserves that traditional on-shore plants cannot reach economically. As one guide notes, “FLNGs produce, liquefy, store and transfer liquefied natural gas via carrier ship to the mainland” and thereby “unlock gas resources from underwater gas fields that may once have been economically or environmentally challenging to obtain.” For example, by using FLNG technology operators avoid long pipelines and complex land-based infrastructure. This means previously-stranded volumes become commercial, increasing the supply base of LNG.

Rapid scalability and cost-efficiency: Because FLNG systems are built offshore and close to the gas source, they often require lower capital investment compared to large onshore LNG trains. According to a study, FLNG components allow liquefaction units to be constructed in controlled ship-yard environments, improving cost-effectiveness. Moreover, economies of scale improve when shipments of LNG can be made directly from sea-based facilities. This means the time-to-market for offshore gas projects can shrink, which is especially useful for remote or smaller gas fields.

Enhancing energy security and supply flexibility: FLNG platforms contribute to energy-security strategies by enabling exports as well as near-shore regasification for import markets. For example, a recent industry article states that floating LNG platforms “are widening access to LNG … enhancing energy resilience, and helping nations achieve a more secure energy future.” In regions with fluctuating demand or limited land infrastructure, FLNG gives governments and operators a more adaptable option to meet maritime, power generation or export markets.

Environmental footprint reduction in offshore development: By locating liquefaction and storage offshore, and using less onshore construction, FLNG can reduce environmental disturbance on coasts and marine environments. One overview highlights that when all processing occurs on board the floating unit, “the need for long pipelines to the shore … dredging and jetty construction … are eliminated,” which lowers environmental footprint. This helps align with sustainability targets and can support regulatory approval in sensitive offshore zones.

Flexibility in asset redeployment and lifecycle optimisation: An important use-case for FLNG is the ability to relocate or redeploy the facility when a field is depleted or market demand shifts. As one analysis states: “FLNG units are portable and can be relocated as needed, allowing operators to move to new fields or adjust assets based on market demand or geopolitical shifts.” This makes the investment less rigid than fixed onshore plants and improves long-term asset flexibility.

Recent Developments

In 2023, Shell reported approximately 40 million tonnes of LNG equity capacity globally and noted global LNG trade reached 404 million tonnes in that year. Although not all LNG is from floating facilities, Shell’s pioneering Prelude FLNG off Australia underscores its FLNG leadership. As a market-research analyst, I view Shell’s presence in FLNG as a strategic bet to exploit remote gas fields with floating liquefaction technology, leveraging its scale in liquefaction, shipping and global trade to strengthen its LNG business.

PETRONAS: In 2023 the company produced 2,431 kboe/d of oil and gas, including 1,581 kboe/d of natural gas. PETRONAS is also studying a standalone FLNG project offshore Suriname as of August-2024, signalling deeper involvement in floating LNG. From an analyst’s perspective, PETRONAS is leveraging its offshore expertise and gas production base to expand in FLNG, thereby gaining flexibility to access remote fields and strengthen its LNG export and offshore liquefaction value chain.

In 2023 Golar LNG reported total operating revenues of USD 298 million, a net loss of USD 47 million, and an Adjusted EBITDA of USD 356 million. The company’s FLNG unit “Hilli” exceeded its production targets, and the FLNG “Gimi” arrived and moored offshore Mauritania/Senegal in 2023. From an analyst perspective, Golar LNG is firmly focused on floating liquefied natural gas assets, deploying vessels and securing anchoring hubs as key steps in its growth trajectory.

In 2024 ExxonMobil disclosed that its offshore LNG project in Mozambique’s Area 4 has been redesigned to deliver 18 million tonnes per annum (mtpa) of LNG, up from an earlier 15 mtpa goal. This project includes deep-water floating liquefied natural gas (FLNG) infrastructure and forms a critical part of the company’s global LNG expansion strategy. As market analysis suggests, ExxonMobil is leveraging scale, deep-water technology and partner networks to position itself strongly in the FLNG value chain.

Eni SpA: In 2023 Eni recorded revenues of €93.7 billion and a net income of €4.8 billion, highlighting ongoing oil & gas strength. On the FLNG side, Eni’s “Tango FLNG” (0.6 MTPA LNG) started production in December 2023, while the follow-on “Nguya FLNG” (2.4 MTPA) is under construction, raising total capacity to ~3 MTPA offshore Congo. As a market-research analyst, I view Eni’s FLNG strategy as a critical pivot: leveraging floating infrastructure to unlock remote gas reserves, diversify its LNG portfolio, and strengthen its global footprint in floating liquefaction.

In 2023 Höegh LNG delivered the strongest net result in its history, driven by delivery of critical floating infrastructure in Europe. For the full year ended December 31 2023, the company reported EBITDA of USD 78 million in Q4 alone. From an analyst’s lens, Höegh LNG is capitalising on the shift toward floating storage & regasification units (FSRUs) and FLNG frameworks, positioning itself as a go-to provider of offshore LNG solutions that deliver flexibility and scale in dynamic gas markets.

In January 2024 Samsung Heavy Industries (SHI) secured a US$ 1.5 billion order for a floating liquefied natural gas (FLNG) unit in North America. Additionally, SHI announced a deep-water FLNG concept (MLF-O) capable of raising cargo capacity from 180,000 to 220,000 m³ and received approval in principle in 2025.

Conclusion

In conclusion, floating liquefied natural gas (FLNG) technology is increasingly proving itself as a vital tool in unlocking offshore gas reserves, improving supply flexibility and advancing energy-security goals.

Global FLNG capacity stood at around 14.1 million tonnes per annum (mtpa) in 2024 and is projected to reach 42 mtpa by 2030, growing nearly three-fold in just six years. That said, stakeholders must navigate regulatory, environmental and technological challenges—such as deep-water mooring, liquefaction reliability and off-take logistics—to fully capitalise on this opportunity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)