Table of Contents

Overview

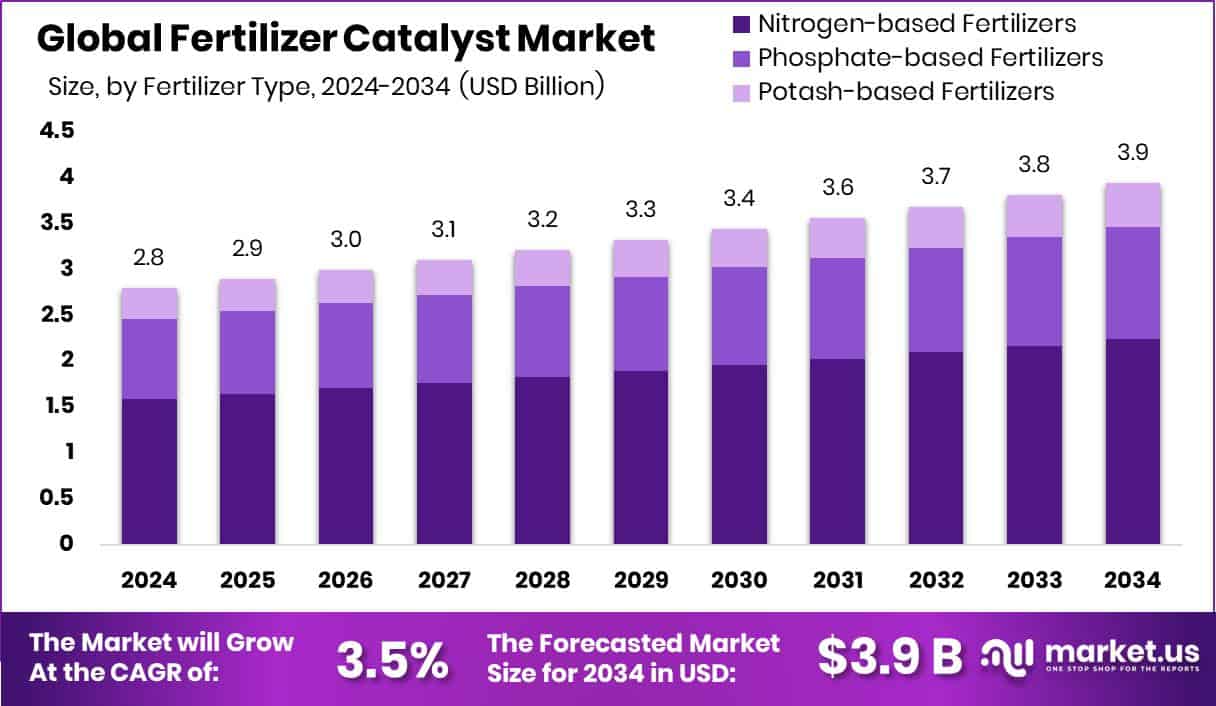

New York, NY – August 25, 2025 – The Global Fertilizer Catalyst Market is projected to reach USD 3.9 billion by 2034, rising from USD 2.8 billion in 2024, with a steady CAGR of 3.5% between 2025 and 2034. Asia Pacific leads with a 41.80% share, valued at USD 1.1 billion, driven by fertilizer demand growth.

Fertilizer catalysts, such as iron-based and ruthenium-based compounds, are essential in ammonia and urea production, enhancing efficiency, lowering energy costs, and ensuring consistent output. Their role in large-scale fertilizer manufacturing helps reduce environmental impact while supporting higher yields. Notably, Waterloo received a $3.95M grant to expand fertilizer capacity in Iowa, while Copernic Catalysts secured $8M in Seed Prime funding led by Breakout Ventures to scale sustainable ammonia technology.

The market benefits from global food demand and farmland limitations, pushing fertilizer producers to optimize operations. Key funding initiatives include $1.3M for urea production efficiency, the CCEA’s Rs 100 crore grant to Brahmaputra Valley Fertilizer Corporation, and smaller agri-tech investments such as Chai Shots’ $5M round, Pehle Jaisa’s $300K raise, and MazaoHub’s $200,000 Catalyst Fund support.

Sustainability is a major driver, with catalysts enabling reduced greenhouse gas emissions. The trend is supported by significant financing flows, such as SK Capital Partners’ Catalyst Fund II at US$800M, alongside ventures like a South African startup raising $1.6M for energy and water management. These developments highlight innovation, efficiency, and investment momentum shaping the fertilizer catalyst industry’s future.

➤ Click the sample report link for complete industry insights: https://market.us/report/fertilizer-catalyst-market/request-sample/

Key Takeaways

- The Global Fertilizer Catalyst Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- Nitrogen-based fertilizers hold a 56.9% share in the Fertilizer Catalyst Market, driving global production efficiency.

- Iron-based catalysts account for 23.2% of the Fertilizer Catalyst Market, enhancing ammonia synthesis and productivity.

- The Haber-Bosch process represents 38.7% of the Fertilizer Catalyst Market, enabling large-scale nitrogen fertilizer manufacturing.

- Strong agricultural activities in the Asia Pacific support 41.80%, a USD 1.1 Bn market value.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155496

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.8 Billion |

| Forecast Revenue (2034) | USD 3.9 Billion |

| CAGR (2025-2034) | 3.5% |

| Segments Covered | By Fertilizer Type (Nitrogen-based Fertilizers, Phosphate-based Fertilizers, Potash-based Fertilizers), By Product (Iron Based Catalysts, Nickel Based Catalysts, Cobalt Based Catalysts, Vanadium Based Catalysts, Zinc Based Catalysts, Ruthenium Based Catalysts, Rhodium Based Catalysts, Chromium Based Catalysts, Molybdenum Based Catalysts, Copper Chromite Catalyst, Platinum Based Catalysts, Palladium Based Catalysts), By Process (Haber-Bosch Process, Potassium Fertilizer Production, Nitric Acid Production, Contact Process, Urea Production) |

| Competitive Landscape | Clariant AG, Johnson Matthey, Unicat Catalyst Technologies, Albemarle Corporation, Quality Magnetite, Axens, Agricen, Thyssenkrupp AG, Topsoe, CHEMCAT |

Key Market Segments

By Fertilizer Type Analysis

In 2024, Nitrogen-based Fertilizers held a 56.9% share, making them the leading segment of the Fertilizer Catalyst Market. Their dominance comes from the high use of urea, ammonium nitrate, and ammonia, which are vital for boosting crop growth and yields.

The strong adoption of nitrogen fertilizers in cereals, grains, and cash crops has reinforced this position, especially in regions with intensive farming. Catalysts are key to their production, improving ammonia synthesis efficiency, cutting energy use, and ensuring consistent quality.

Rising input costs and tighter environmental rules further highlight the need for catalysts, as they support cleaner methods and help reduce emissions while meeting sustainability targets. With growing population pressures and food security needs, nitrogen fertilizers remain central to agriculture, ensuring steady demand for advanced catalyst technologies and sustaining the segment’s leadership.

By Product Analysis

In 2024, Iron-Based Catalysts accounted for 23.2% of the Fertilizer Catalyst Market in the by-product segment, holding a leading position due to their vital role in ammonia synthesis for nitrogen-based fertilizers. Their popularity comes from strong catalytic activity, durability under high pressure and temperature, and cost efficiency compared to alternatives.

Ongoing advancements in catalyst formulation have strengthened this dominance by improving efficiency, lowering energy needs, and ensuring consistent fertilizer quality. Iron-based catalysts also align with environmental standards and adapt well to both traditional and emerging low-carbon production methods, making them essential for sustainable manufacturing.

Backed by rising agricultural demand and the push to control production costs, iron-based catalysts are expected to maintain their leadership. Their reliability, economic advantages, and support for efficiency goals secure their position as a cornerstone in global fertilizer production.

By Process Analysis

In 2024, the Haber-Bosch Process captured a 38.7% share of the Fertilizer Catalyst Market by process, maintaining its role as the dominant method for ammonia production, the backbone of nitrogen-based fertilizers.

Its leadership is built on proven efficiency in converting nitrogen and hydrogen into ammonia under high heat and pressure, with catalysts enhancing reaction speed and yield. The process is widely adopted across global fertilizer plants due to its scalability, reliability, and adaptability to varied production needs.

Catalysts play a central role in this process, reducing energy use and extending operational life, which supports cost-effective large-scale production. Ongoing advancements in catalyst design have boosted efficiency further while lowering carbon emissions, supporting sustainability objectives.

Driven by global food demand and the need for higher agricultural productivity, producers continue to depend on the Haber-Bosch process. With its established infrastructure, high conversion efficiency, and continuous technological progress, it remains the cornerstone of fertilizer production worldwide.

Regional Analysis

In 2024, the Asia Pacific led the global Fertilizer Catalyst Market with a 41.80% share, valued at USD 1.1 billion. This dominance is supported by the region’s vast farming base, dense population, and rising need to boost yields on limited farmland. Major fertilizer users such as China, India, and Indonesia drive demand, especially for nitrogen-based fertilizers, where catalysts enhance production efficiency.

The region benefits from rapid industrial growth in fertilizer manufacturing and strong government support for agricultural productivity. Producers are also investing in energy-efficient and sustainable catalyst technologies, aligning with environmental goals. Expansion of domestic fertilizer plants has further strengthened supply while reducing import reliance.

With ongoing advancements in catalyst design and growing adoption of sustainable farming methods, the Asia Pacific is set to maintain its leadership. Rising food needs, large-scale fertilizer production, and continuous innovation keep the region at the forefront of the global fertilizer catalyst market.

Top Use Cases

- Speeding Up Ammonia Production: Fertilizer catalysts significantly accelerate the Haber‑Bosch process—turning nitrogen and hydrogen into ammonia much faster and with less energy. This makes large-scale ammonia fertilizer production more efficient and cost-effective.

- Enabling Solar-Driven Ammonia at Room Conditions: Scientists have designed light-sensitive catalysts that turn nitrogen and water into ammonia using just sunlight—working at normal temperature and pressure. This could one day allow fertilizer production powered by solar energy, with much lower energy costs.

- Recovering Nitrogen from Fertilizer Runoff: A new catalyst can convert waste runoff from fertilizers back into neutral nitrogen, helping cut pollution while recycling nutrients—a step toward more sustainable agriculture.

- Producing Phosphorus-Based Fertilizers More Cleanly: Catalysts help extract usable phosphorus from phosphate rocks quickly and efficiently. This improves slow‑release fertilizers, reduces nutrient runoff into waterways, and promotes healthier, more sustainable crop growth.

- Nitrate Cleanup & Ammonia Generation: A novel iron‑molybdenum carbide catalyst converts nitrates into ammonia efficiently using electricity (like from renewables). It yields high ammonia and supports cleaner, energy-effective fertilizer production while reducing harmful nitrate levels.

Recent Developments

- In June 2025, Albemarle published its 2024 Sustainability Report, highlighting efforts to cut carbon emissions, boost renewable energy use, and support customers’ sustainability goals. This includes improvements in energy procurement and tracking product carbon footprints.

- In June 2025, Unicat Catalyst Technologies agreed to a settlement for potential civil liability. This involved 13 apparent violations under U.S. sanctions, due to providing catalyst products and consulting services to Iran and a blocked Venezuelan entity—an important compliance and legal matter.

- In July 2024, Clariant deepened its partnership with KBR to boost the use of AmoMax® catalysts alongside KBR’s K‑GreeN® process, targeting both traditional and green ammonia production. This helps make fertilizer production cleaner, using renewable hydrogen.

- In May 2024, Johnson Matthey signed a Memorandum of Understanding (MoU) with thyssenkrupp Uhde to jointly offer an integrated low-carbon (blue) ammonia solution. Building on decades of collaboration, this combines JM’s LCH™ hydrogen reforming catalysts with Uhde’s ammonia synthesis process, aiming for up to 99% CO₂ capture—a key step toward greener fertilizer-related ammonia production.

Conclusion

The Fertilizer Catalyst Market is set for steady growth as agriculture continues to demand higher efficiency and sustainability. Catalysts remain vital in fertilizer production, especially for ammonia and urea, by reducing energy use, improving yields, and lowering emissions. With global population growth and rising food needs, fertilizer producers are under pressure to expand output while meeting stricter environmental standards.

Advances in catalyst technology, government support, and investment in low-carbon solutions strengthen this market’s role in sustainable farming. Overall, fertilizer catalysts will remain a cornerstone for balancing productivity, cost efficiency, and environmental responsibility in global agriculture.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)