Table of Contents

Overview

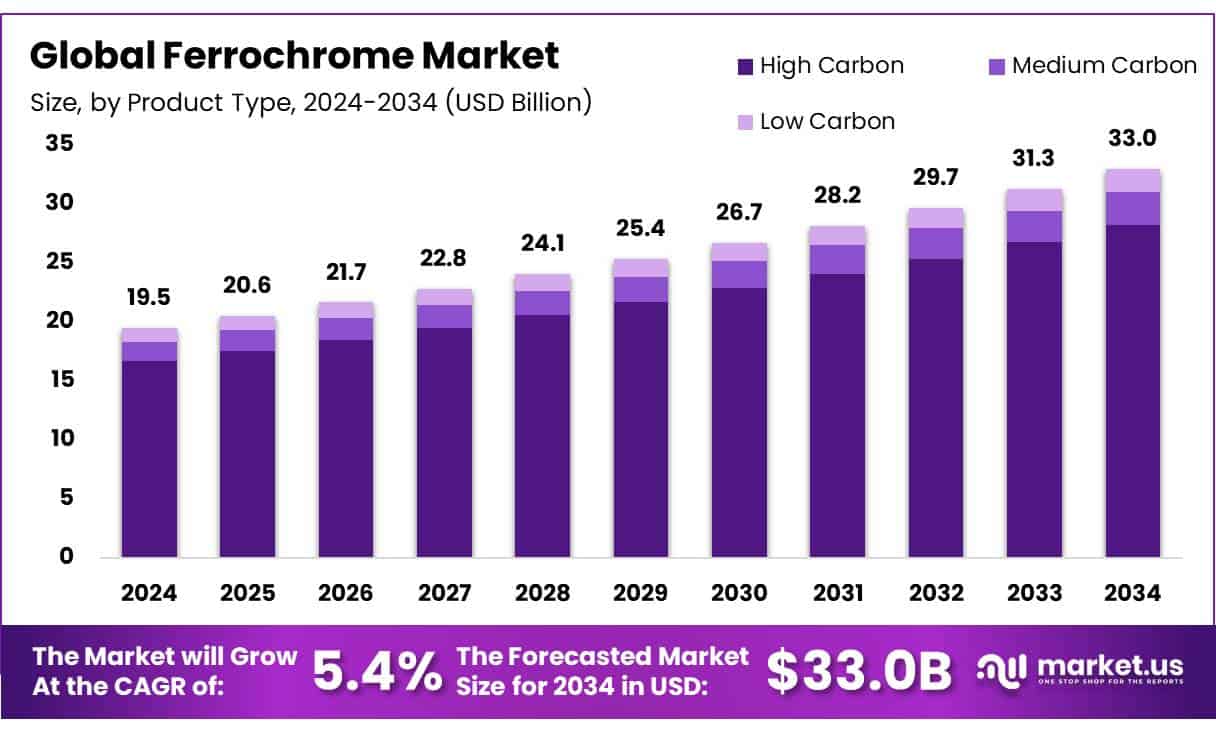

New York, NY – June 23, 2025 – The global ferrochrome market is projected to grow from approximately USD 19.5 billion in 2024 to around USD 33 billion by 2034, at a (CAGR) of 5.4% from 2025 to 2034. This growth is being driven by rising global demand for stainless steel—particularly in infrastructure and manufacturing sectors across emerging economies like China, India, and Southeast Asia. Rapid urbanization, energy infrastructure development, and the expanding automotive industry are all contributing to higher ferrochrome consumption.

Significant opportunities exist in low-carbon ferrochrome production, which addresses sustainability goals and allows ferrochrome to be used in green steel initiatives. Regional expansion is anticipated in Asia-Pacific, where investment in stainless steel plants is strongest. Overall, market dynamics reflect strong demand, sustainability-driven innovations, and growth opportunities across diverse industries, positioning ferrochrome as a key enabler for steel-based economies worldwide.

In 2024, the global ferrochrome market was led by the high carbon segment, which accounted for 85.5% of the product type share due to its widespread use in stainless and high-tensile steel production, offering cost-effectiveness and compatibility across steel grades. By form, granules held a dominant 26.3% share, favored for their uniformity, easy handling, and precision in alloying during steelmaking.

In terms of application, stainless steel remained the leading segment with a 77.8% share, driven by the essential role of ferrochrome in enhancing hardness, corrosion resistance, and durability—especially across automotive, construction, and industrial sectors. Among end uses, the building and construction segment dominated with a 46.4% market share, supported by growing demand for corrosion-resistant materials in sustainable infrastructure, smart buildings, and green-certified construction projects worldwide.

How Growth is Impacting the Economy

The expanding ferrochrome market is significantly contributing to economic activity across mining, metallurgy, manufacturing, and construction sectors. With 80% of ferrochrome output used in stainless steel production, the demand supports chromium mining, employment in alloy processing, and machinery manufacturing. As stainless steel consumption grows in infrastructure and automotive applications, investment flows into upstream operations and foundries are also increasing. The granulated form of ferrochrome is boosting operational efficiency in steel plants, enhancing productivity and cost savings.

Furthermore, the construction sector—driven by smart infrastructure and green building initiatives—stimulates demand for corrosion-resistant stainless steel, fueling ferrochrome usage. These developments encourage cross-sector collaboration and innovation, particularly in low-carbon and energy-efficient metallurgical processes. As governments invest in urban development and clean energy structures, ferrochrome continues to play a vital role in supporting industrial output, trade competitiveness, and sustainable construction practices—ultimately contributing to GDP growth and industrial resilience in both developed and emerging economies.

To capitalize on market growth, businesses should focus on securing stable chromium ore supplies through vertical integration or long-term mining partnerships. Investing in energy-efficient smelting technologies and emission reduction solutions can align with regulatory demands and improve profitability. Expanding high carbon ferrochrome production capacity—particularly in granule form—will support rising demand from large-scale stainless steel manufacturers.

Companies should also diversify their application base into specialty steel and cast iron markets. Strengthening logistics, adopting automated feeding systems, and offering customized product grades can enhance service to construction and automotive clients. Emphasizing sustainability and traceability in supply chains will also improve brand positioning.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/ferrochrome-market/free-sample/

Key Takeaways

- The global ferrochrome market was valued at USD 19.5 billion in 2024.

- The global ferrochrome market is projected to grow at a CAGR of 5.4 % and is estimated to reach USD 33.0 billion by 2034.

- Among product types, high carbon accounted for the largest market share of 85.5%.

- Among forms, granules accounted for the majority of the market share at 26.3%.

- By application, stainless steel accounted for the largest market share of 77.8%.

- By end-use, building & construction accounted for the majority of the market share at 46.4%.

- Asia Pacific is estimated as the largest market for ferrochrome with a share of 67.4% of the market share.

Experts Review

The current outlook for the ferrochrome market is strong, underpinned by sustained growth in stainless steel consumption across infrastructure, industrial equipment, and mobility sectors. High carbon ferrochrome is expected to remain the backbone of global supply due to its cost-efficiency and metallurgical compatibility.

Analysts anticipate continued dominance of stainless steel applications, while demand from green building projects and smart infrastructure will drive end-use diversification. As countries prioritize low-emission steel production and clean construction materials, ferrochrome producers that innovate in form, purity, and processing will capture long-term value. Overall, the market is well-positioned for balanced, global expansion through 2034.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=18241

Key Market Segments

By Product Type

- High Carbon

- Medium Carbon

- Low Carbon

By Form

- Granules

- Powder

- Lumps

By Application

- Stainless steel

- 200 Series

- 300 Series

- 400 Series

- Duplex Series

- Others

- Cast Iron

- Specialty Steel

- Others

By End-Use

- Building & Construction

- Automotive & Transportation

- Consumer Goods

- Mechanical Engineering & Heavy Industries

- Aerospace and Defense

- Others

Regional Analysis

In 2024, Asia Pacific led the global ferrochrome market with a dominant 67.4% share, driven by rapid industrial growth and increasing stainless steel production across major economies such as China, India, Japan, and South Korea. The region’s expanding construction, automotive, and heavy machinery sectors have significantly boosted demand for ferrochrome, a key component in stainless steel manufacturing.

According to the U.S. Geological Survey, over 80% of global ferrochrome output is used in stainless steel production, with Asia Pacific emerging as the largest consuming region due to its strong and growing stainless steel industry.

Top Use Cases

Stainless Steel Production: Ferrochrome is essential in making stainless steel alloys, providing over 80% of chromium needed. It enhances corrosion resistance, hardness, and durability in products like kitchenware, automotive parts, and industrial equipment. Its reliability and metallurgical benefits make it the go-to alloying material in global stainless steel manufacturing.

Engineering & Specialty Alloys: Medium and low carbon ferrochrome grades are used to manufacture high-strength and wear-resistant engineering steels, tool steels, and specialty alloys. These materials are ideal for demanding applications in heavy machinery, aerospace components, and energy systems, where performance under stress and temperature is critical.

Cast Iron & Foundry Applications: Ferrochrome is added to cast iron mixtures to improve wear resistance, hardness, and temperature stability. It supports applications like cylinder blocks, flywheels, pipes, and pump parts in industries such as automotive, oil and gas, and equipment manufacturing.

Refractory & High-Temperature Materials: Ferrochrome is used to produce refractory components and heat-resistant alloys, thanks to its high melting point and thermal stability. It enhances materials used in furnaces, kilns, crucibles, and liners in steel, cement, and glass industries.

Surface Treatment & Coatings: In metal coatings, ferrochrome is used to improve surface hardness and corrosion resistance. Applied as hard-facing or alloyed surfaces in thermal spray coatings, it enhances tool life and protection on wear-critical parts like cutting tools and wear plates.

Recent Developments

Samancor Chrome—recognized as the world’s largest ferrochrome producer with over 2 million tonnes of annual capacity—has launched a 100 MW solar project in Limpopo province, South Africa, to supply renewable energy directly to its smelting facilities. Additionally, the company announced plans to reduce charge chrome output starting early 2025 due to falling market prices and lower demand.

ERG is investing USD 92 million to build an 80 MW gas-utilization power plant at its Aktobe Ferroalloy facility in Kazakhstan, aiming for operations by 2026. This initiative will convert over 600,000 m³ of waste gas into electricity, helping eliminate flaring and support the country’s carbon-neutral goals. ERG has also ramped up safety measures across its key operations.

Glencore’s ferrochrome output remained stable in 2024, producing 295,000 tonnes in Q3—below 302,000 tonnes in Q2—with the Chinese 50% Cr import prices dipping from $1.03 to $0.98 per pound mid-year. The company continues to offer flexible pricing following removal of its quarterly benchmark.

Indiano Chrome has begun exploring expansion of its chromite beneficiation and ferrochrome plant in Odisha in 2025. The company acquired land and filed permit applications for a new smelting site designed to produce 50,000 TPA of high-carbon ferrochrome, targeting supply contracts with nearby stainless steel mills.

Hernic, South Africa’s third-largest ferrochrome producer, has undertaken technical upgrades across its smelting operations in 2025. These improvements aim to enhance furnace performance, reduce energy consumption, and lower greenhouse gas emissions. The company confirmed plans to increase output capacity while modernizing its facilities to ensure compliance with evolving environmental standards.

Vargön Alloys AB in Sweden has rolled out a new electric arc furnace in late 2024, designed to produce low-carbon ferrochrome. The upgrade supports green steel initiatives by halving CO2 emissions per tonne of product. Additionally, the company secured funding from national environmental grants to further improve its energy-efficiency and emissions monitoring systems.

Brazilian producer Ferbasa expanded its ferrochrome mine capacity in Minas Gerais during 2025 to meet growing stainless steel demand. The company completed studies to introduce precision sampling and ore blending to improve product consistency. An environmental permit has also been obtained to build a new crushing plant, enhancing ore recovery and reducing processing emissions.

Turkish ferrochrome company Yilmaden entered a joint venture in early 2025 aimed at developing a new blast furnace in Anatolia. The venture will produce high-carbon ferrochrome utilizing locally sourced chromite and aim to serve both domestic and Mediterranean markets. Construction is expected to begin in Q3 2025, with initial production targeted for 2026.

Glencore continues to produce ferrochrome through its South African operations. While no major 2025 advances were announced, the company reaffirmed investments in energy-efficiency projects across its plants and ongoing work to secure long-term chrome ore supply agreements to hedge production costs.

Armenian ferrochrome producer ALBCHROME launched a smelter capacity expansion in late 2024, increasing monthly ferrochrome output by approximately 20%. The investment also included furnace modernization to reduce energy usage and align with rising demand from regional stainless steel mills across Europe and the Middle East.

While Outokumpu is a major stainless steel producer, no recent specific updates on its ferrochrome sourcing or in-house production activities were identified in 2025. The company continues operations, most likely sourcing ferrochrome externally to support its steel plants.

IMFA has expanded its ferrochrome smelting capacity at its Kalinganagar plant in early 2025. The company installed a new submerged arc furnace and acid plants to handle increased slag volume, improving production flexibility and reducing environmental impact. The initiative supports the growth of India’s stainless steel industry.

India’s Balasore Alloys commissioned a captive power plant alongside its ferrochrome plant in late 2024. This upgrade aims to stabilize energy supply, reduce reliance on the state grid, and improve carbon emissions profile. The company also initiated trial operations for a new pulverizing system to enhance lump-to-powder conversion efficiency.

FACOR, an Indian ferrochrome manufacturer, announced a modernization project in 2025 focusing on furnace lining upgrades and automation of its Mossmorran plant. The initiative, backed by government stimulus, aims to reduce energy consumption by 15% and raise production capacity for domestic stainless steel demand.

Indiano Chrome has begun exploring expansion of its chromite beneficiation and ferrochrome plant in Odisha in 2025. The company acquired land and filed permit applications for a new smelting site designed to produce 50,000 TPA of high-carbon ferrochrome, targeting supply contracts with nearby stainless steel mills.

Conclusion

The ferrochrome market is growing steadily, supported by rising stainless steel demand, especially in construction, automotive, and industrial applications. High carbon ferrochrome and granulated forms remain at the forefront due to their performance, cost efficiency, and processing advantages.

Market expansion is creating opportunities across regions and industries, with sustainability and innovation becoming key focus areas. Businesses that invest in efficient production, secure sourcing, and clean metallurgy will benefit most. The long-term outlook remains positive, driven by infrastructure growth and global industrialization.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)