Table of Contents

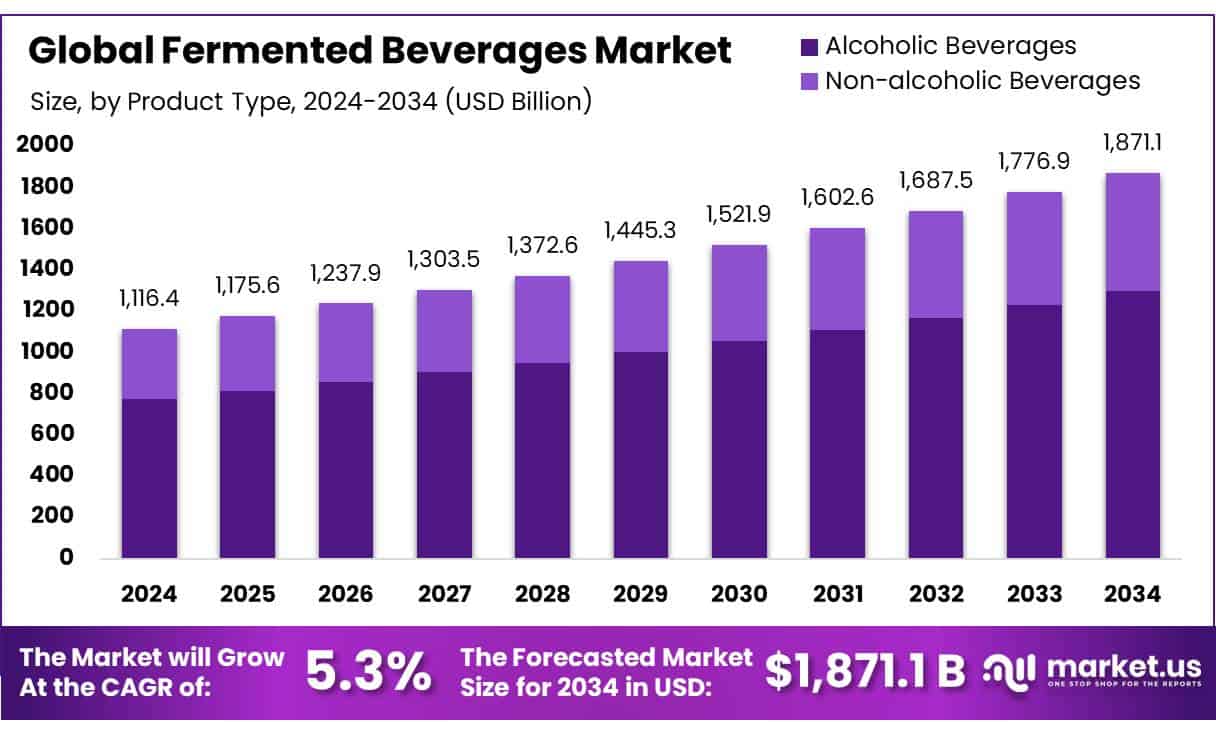

New York, NY – July, 24 2025 – The global fermented beverages market is poised for robust expansion, projected to grow from USD 1,116.4 billion in 2024 to approximately USD 1,871.1 billion by 2034, registering a compound annual growth rate (CAGR) of 5.3%.

North America led the market in 2024, accounting for over 34.9% of total revenue, equating to USD 389.6 billion. This growth is primarily driven by increasing health consciousness and a consumer shift toward functional and probiotic rich drinks like kombucha and kefir, which offer digestive, immunity boosting, and overall wellness benefits.

The market’s expansion is further supported by government backed initiatives and large scale investments in fermentation infrastructure. For instance, in the U.S., a USD 25 million federally backed loan in November 2023 financed the development of a commercial-scale fermentation plant with a 600,000 liter capacity. In India, the Ethanol Blended Petrol (EBP) programme for the 2021/22 ethanol sugar year not only reduced greenhouse gas emissions by 2.7 million tonnes but also saved around USD 289 million in foreign exchange demonstrating the broader advantages of fermentation based technologies, including those used in beverage production.

Government policies continue to fuel market development. In India, the Ministry of Food Processing Industries received a budget allocation of Rs. 3,290 crore for 2024–25 a 13% increase over the previous year. Schemes such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and the Production Linked Incentive Scheme for the Food Processing Industry (PLISFPI), with an allocation of Rs. 2,173 crore, aim to strengthen food processing infrastructure and support innovation. These supportive measures, along with growing awareness of the health benefits associated with fermented beverages, are expected to drive long term market growth.

Key Takeaways

- The global fermented beverages market is projected to reach approximately USD 1,871.1 billion by 2034, up from USD 1,116.4 billion in 2024, registering a CAGR of 5.3% during the forecast period.

- Alcoholic beverages dominate the market, accounting for over 69.3% of the total share, making them the leading product category in the fermented beverages segment.

- Bottled packaging leads the global market, securing more than 47.8% of the total packaging share in fermented beverages.

- Supermarkets and hypermarkets represent the largest distribution channel, capturing over 41.2% of the global market share.

- North America stands out as the top regional market, holding a substantial 34.9% share, equivalent to around USD 389.6 billion in market value.

➤ For a deeper understanding, click on the sample report link: http://market.us/report/global-fermented-beverages-market/free-sample/

Report Scope

| Market Value (2024) | USD 1116.4 Bn |

| Forecast Revenue (2034) | USD 1871.1 Bn |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Type (Alcoholic Beverages, Non-alcoholic Beverages), By Packaging (Bottles, Cans, Sachets, Cartons, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Others) |

| Competitive Landscape | Dohler, Biotiful Dairy, Novonesis Group, Danone, Diageo, Heineken, Kirin Holdings, Lifeway Foods, PepsiCo, Sula Vineyards, Suntory Holdings Limited, The Coca-Cola Company, Yakult Honsha |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152900

Key Market Segments

By Type Analysis

- In 2024, alcoholic beverages led the fermented beverages market, holding a dominant 69.3% share. This significant market portion is driven by the strong cultural integration of products like beer, wine, cider, and spirits across various regions and demographics. Global demand remains high, particularly in developed nations, while rising disposable incomes in emerging markets such as Asia-Pacific and Latin America are accelerating consumption. The popularity of craft brews, nightlife culture, and evolving consumer tastes continue to support growth in this segment.

By Packaging Analysis

- Bottles emerged as the preferred packaging type in 2024, capturing over 47.8% of the global fermented beverages market. Their widespread use is due to their effectiveness in preserving taste, carbonation, and shelf life crucial for both alcoholic and non alcoholic beverages like kombucha, beer, and kefir. Consumers favor bottles for their visual appeal, ease of transport, and premium presentation. Additionally, smaller producers and craft beverage makers often choose bottles for branding opportunities and aesthetic customization.

By Distribution Channel Analysis

- Supermarkets and hypermarkets dominated the distribution landscape in 2024, accounting for more than 41.2% of the fermented beverages market share. This is attributed to their broad accessibility, extensive product variety, and strong consumer trust. These retail formats allow shoppers to explore multiple brands, take advantage of promotions, and ensure freshness and quality. Their layout also encourages impulse purchases, especially of new and trending fermented products like flavored kombuchas and functional drinks.

Regional Analysis

- North America solidified its position as the largest regional market in the global fermented beverages industry, capturing a significant 34.9% share. This equates to a market value of approximately USD 389.6 billion. The region’s leadership is largely attributed to its well established consumption of both traditional and functional fermented beverages across key countries such as the United States, Canada, and Mexico.

- Consumer preferences in North America are rapidly evolving toward healthier and low sugar beverage options. Fermented drinks like kombucha, kefir, and other probiotic rich beverages are gaining widespread popularity due to their perceived health benefits, particularly in areas of digestion and immune support. This shift in preferences is influencing product innovation and expanding offerings in retail and food service sectors.

- Retail dynamics are also playing a critical role in market growth. Fermented beverages have become more prominent in stores, aided by increased investments in point of sale refrigeration, premium displays, and wider shelf space in supermarkets and convenience stores. This improved visibility, along with heightened consumer awareness about gut health, continues to drive strong demand across North America.

Top Use Cases

- Gut health wellness drinks: Kombucha, kefir, and other probiotic beverages are increasingly used as everyday wellness enhancers. Consumers choose them for improved digestion, boosted immunity, and natural nutrient intake. The rising awareness of health benefits and low‑sugar options makes these drinks popular replacements for sodas and sugary beverages.

- Plant based & dairy free innovation: With more people adopting vegan or lactose‑intolerant diets, non dairy fermented drinks like water kefir and plant‑based yogurts are gaining traction. These products meet dietary needs, attract eco conscious consumers, and offer diverse flavour profiles, positioning them as a growth segment in the broader fermented beverages sphere.

- Premium & craft alcoholic variants: Craft beers, small‑batch ciders, and artisanal spirits continue to fuel the alcoholic beverage category, which holds around 69% market share. These premium products leverage unique recipes, local ingredients, and storytelling to appeal to consumers seeking sophisticated taste experiences and willing to pay higher prices.

- Retail impulse purchase channels: Supermarkets and hypermarkets offer strong visibility and shelf presence for fermented drinks, driving impulse buys. Strategic in store placements, bundled promotions, and seasonal releases encourage consumers to try new flavours, helping brands increase trial and adoption rates across both alcoholic and non alcoholic lines.

- Commercial refrigeration & point of sale investment: Retailers are investing in dedicated chilled display units to store fermented drinks like kombucha and kefir. These fridges preserve product freshness, improve visibility, and enhance premium perception. For brands, this translates to better shelf appeal and higher sales, especially in health focused sections.

Recent Developments

1. Döhler:

- Döhler North America has launched a new R&D innovation hub in Princeton, NJ, comprising 20,000 sq ft of advanced laboratories and a customer experience center. This facility accelerates development of functional, plant-based, and fermented beverage systems by enabling co-creation with clients. Their acquisition of Premier Juices strengthens their natural and fruit-based ingredient portfolio for the fermentation and nutrition sectors.

2. Biotiful Dairy:

- UK-based Biotiful Dairy was acquired by Müller UK & Ireland earlier this year, marking a significant step into the mainstream kefir market. Their high protein kefir line with 20 g of protein and live cultures per bottle is now well established in UK retail, boosting the growth of kefir as both a health and sports nutrition drink.

Danone:

- Danone introduced “Actimel Triple Action,” a fortified yogurt shot with billions of L. casei ferments plus vitamins and minerals targeting gut and immune health, rolling it out across Europe. It also launched Almimama, a synbiotic probiotic supplement to prevent mastitis, expanding its fermentation expertise into functional nutrition supplements.

Diageo:

- Diageo recently unveiled Fusion Allterra, an extension of its open-innovation programme focused on sustainability and fermentation-led beverage innovation. Alongside this, its Innovation Showcase revealed Gen Z’s strong preference for fermented-ingredient drinks in casual “third spaces,” guiding new product development pipelines.

Heineken:

- Heineken is increasing investments in low/no‑alcohol beer, with its R&D center pushing innovation in this fast-growing category (6.8% CAGR). In FY 2024, premium beers grew by 5%, led by Heineken at 9%. It’s also expanding non-alcoholic packaging formats like slim cans.

Kirin Holdings:

- Kirin’s LC Plasma infused iMUSE series reached ¥23 billion in sales in early 2025, expanding immune focused fermented drinks like Kirin iMUSE Green launched in November 2024. They also renewed their Oishii Immune Care lineup, reflecting growing consumer demand for postbiotic-fermented functional beverages.

Conclusion

Despite competition from isotonic and hypotonic alternatives, hypertonic formulations continue gaining traction, supported by ongoing innovation, clean label trends, and improved accessibility via supermarkets, hypermarkets, and e‑commerce channels. As fitness participation rises and preferences shift toward functional beverages, demand for high-performance hydration solutions is expected to remain robust throughout the next decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)