Table of Contents

Overview

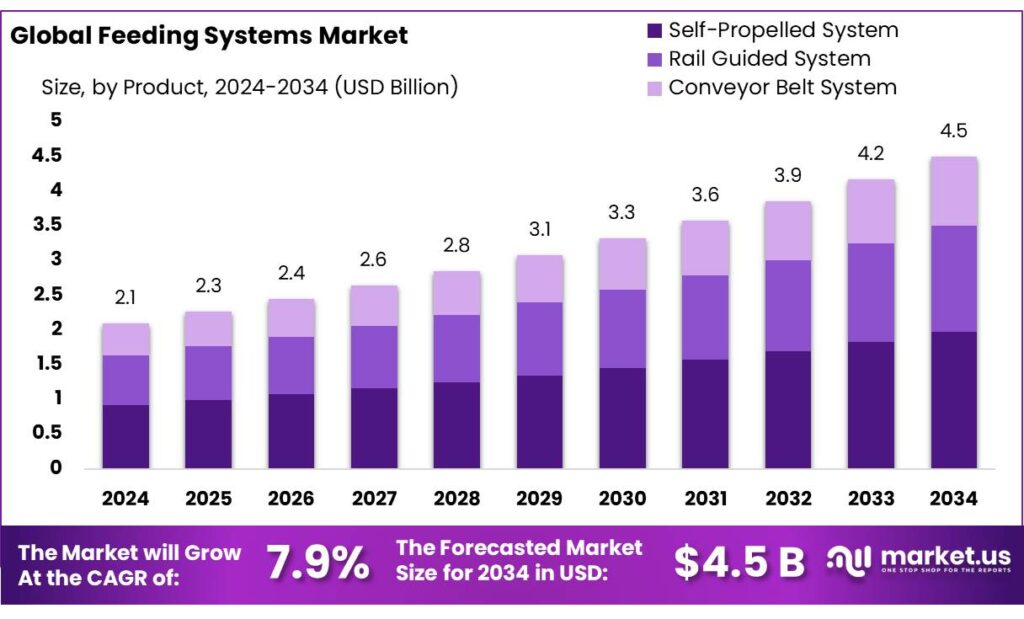

New York, NY – September 30, 2025 – The Global Feeding Systems Market is projected to reach USD 4.5 billion by 2034, up from USD 2.1 billion in 2024, growing at a CAGR of 7.9% between 2025 and 2034. In 2024, North America dominated the market, holding a 42.4% share valued at USD 0.8 billion.

In India, the animal feed sector plays a vital role in sustaining the livestock industry, which forms a cornerstone of the agricultural economy. India produced about 52.8 million metric tons of compound feed, ranking as the world’s fourth-largest producer. The feed mix primarily includes broiler feed (19.72 million metric tons), layer feed (16.14 million metric tons), and dairy feed (13.94 million metric tons).

Government initiatives have been a strong growth catalyst. Under the National Livestock Mission (NLM), subsidies of up to 50% (capped at INR 50 lakh) are offered for setting up feed and fodder value-addition units, including hay, silage, and Total Mixed Ration facilities. Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), with a budget of INR 15,000 crore, supports private players, Farmer-Producer Organizations (FPOs), and entrepreneurs in establishing modern feed manufacturing units.

Technological innovation is also driving progress. Precision feeding systems, sustainable practices, and alternative feed ingredients such as Distillers Dried Grains with Solubles (DDGS) are enhancing efficiency and lowering costs. Notably, India’s DDGS production has grown nearly 13-fold in just two years and is expected to reach 5.5 million tons by 2025.

However, the industry faces significant challenges. The 19th Livestock Census highlights a deficit of 64% in green fodder and 61.1% in dry fodder. To bridge this gap, regional governments are stepping in. West Bengal, for instance, is expanding maize cultivation by 60,000 hectares over three years to meet surging feed demand.

Key Takeaways

- The Global Feeding Systems Market size is expected to be worth around USD 4.5 billion by 2034, from USD 2.1 billion in 2024, growing at a CAGR of 7.9%.

- Self-Propelled System held a dominant market position, capturing more than a 43.9% share of the overall feeding systems industry.

- Automated held a dominant market position, capturing more than a 67.7% share in the feeding systems market.

- Dairy Farm held a dominant market position, capturing more than a 39.2% share of the overall feeding systems market.

- North America held a dominant position in the Feeding Systems market, capturing 42.4% of revenue—about USD 0.8 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-feeding-systems-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.1 Billion |

| Forecast Revenue (2034) | USD 4.5 Billion |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Product (Self-Propelled System, Rail Guided System, Conveyor Belt System), By Technology (Manual, Automated), By Application (Dairy Farm, Poultry Farm, Swine Farm, Equine Farm, Others) |

| Competitive Landscape | Afimilk Ltd., Agrologic Ltd, Cormall AS, CTB, Inc., DairyMaster, DeLaval, GEA Group, Aktiengesellschaft, HETWIN Automation System GmbH, Lely Holding S.A.R.L., Pellon Group Oy |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157395

Key Market Segments

Product Analysis

In 2024, Self-Propelled Feeding Systems led the feeding systems market, securing a 43.9% share. Their dominance stems from their flexibility, efficiency, and labor-saving features, making them ideal for large-scale dairy and cattle operations. These systems enable precise ration mixing, reduce reliance on multiple tractors, and streamline feed distribution, addressing challenges like labor shortages and rising costs.

Technology Analysis

Automated Feeding Systems held a commanding 67.7% market share in 2024. Their popularity among livestock producers, particularly in large dairy and poultry operations, reflects their ability to minimize labor, reduce feed waste, and ensure consistent rations. These technology-driven solutions are now seen as essential for enhancing efficiency and profitability.

Application Analysis

Dairy Farm Feeding Systems captured a 39.2% share of the market in 2024, driven by rising global milk production and demand for efficient feeding solutions. These systems support consistent feed management, critical for animal health and milk yields, making them a vital investment for large-scale dairy operations.

Regional Analysis

North America dominated the Feeding Systems market in 2024, accounting for 42.4% of revenue, approximately USD 0.8 billion. The region’s leadership is driven by its large-scale dairy and beef operations, which prioritize feed efficiency, labor savings, and precise ration delivery. Automated bunk feeders, robotic mixers, and silo-to-trough metering systems are widely adopted, supported by robust dealer networks, quick service, and reliable aftermarket parts, minimizing downtime across diverse farm sizes.

Regulatory and buyer demands for traceability and sustainability are boosting investment in systems that track feed composition, timing, and intake while integrating with herd management software for compliance and audits. Producers are increasingly investing in scalable platforms combining hardware with software modules, enabling features like sensor-based monitoring, remote diagnostics, and data dashboards. These solutions deliver clear returns through reduced feed waste, lower fuel consumption, and improved labor predictability.

Top Use Cases

- Dairy Farm Optimization: Automated feeding systems in dairy operations deliver precise rations to cows based on their lactation stage, boosting milk output while cutting down on wasted feed. Farmers mix forages and supplements efficiently, easing labor demands and supporting herd health through consistent nutrition, which leads to better overall farm productivity and animal welfare.

- Poultry Production Efficiency: In poultry farms, conveyor-based systems distribute balanced feed automatically across large flocks, ensuring even intake to promote uniform growth and egg production. This setup minimizes manual handling, reduces contamination risks, and allows quick adjustments for bird age or health needs, making it ideal for high-volume operations focused on a steady supply.

- Beef Cattle Finishing: Self-propelled mixers in beef feedlots blend grains and silage on-site, enabling targeted feeding that speeds up weight gain before market. These systems handle bulk materials smoothly, lower transport needs, and adapt to seasonal forage shortages, helping ranchers maintain quality meat yields with less environmental strain from overfeeding.

- Swine Farm Automation: Rail-guided feeders in pig barns provide timed portions of nutrient-rich feed, optimizing growth cycles and reducing aggression over food access. By integrating sensors for intake monitoring, farms cut excess nutrients in manure, support cleaner operations, and scale easily for expanding herds, enhancing biosecurity, and daily management.

- Aquaculture Nutrient Delivery: In fish farming, automated dispensers release pellets at set intervals into tanks, matching feed to water quality and fish size for faster growth and lower pollution. These systems prevent overfeeding that harms aquatic health, save on manual labor, and integrate with monitoring tools for sustainable yields in intensive setups.

Recent Developments

1. Afimilk Ltd.

Afimilk has integrated its feeding management within the AfiFarm 5 software platform, focusing on data-driven ration adjustments. Recent developments include enhanced algorithms that correlate real-time milk analysis with feed intake, allowing for proactive ration tweaks to improve component yields and cow health. This creates a unified management system linking feeding directly with milking and health data for a holistic herd overview.

2. Agrologic Ltd

Agrologic has advanced its cloud-based FeedWatch system with improved mobile connectivity and remote management tools. Recent updates focus on user-friendly interfaces for scheduling and monitoring feed deliveries across multiple locations. Enhancements include more precise feed bunk management alerts and integration with weather data to anticipate changes in herd intake, helping producers prevent feed spoilage and ensure consistent feed access.

3. Cormall AS

Cormall specializes in durable, precise liquid dosing systems. A key recent development is the further refinement of their Dosa and Viscow systems for accurate administration of additives, fats, and molasses. They focus on improving mixing homogeneity and valve reliability to handle viscous products, ensuring consistent delivery of nutrients and supporting better feed efficiency and ration consistency in automated feeding setups.

4. CTB, Inc. (A Berkshire Hathaway Company)

Through its Chore-Time brand, CTB has been advancing its automated feeding systems for various livestock. Recent developments include the PowerFeed feed delivery system, designed for enhanced durability and low maintenance. Innovations focus on robust drive systems and intuitive controls for precise, programmable feed delivery, reducing labour and ensuring timely, consistent feeding schedules to support animal growth and performance.

5. DairyMaster

DairyMaster’s recent developments for its Gemini Feed Commander focus on integration and control. Enhancements include more sophisticated water ratio control for TMR consistency and improved communication with farm management software. The system now offers more detailed reporting on feed usage and variances, helping farmers quickly identify and rectify issues, reduce waste, and maintain optimal feed quality for herd health and productivity.

Conclusion

Feeding Systems as a game-changer in modern agriculture, blending smart tech with practical needs to tackle labor shortages and boost livestock health. With a clear shift toward automation and eco-friendly practices, these tools are helping farms run smoothly, cut down on waste, and meet rising food demands without harming the planet. Wider adoption promises stronger, more resilient operations that balance profitability with sustainability, paving the way for innovative farming worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)