Table of Contents

Overview

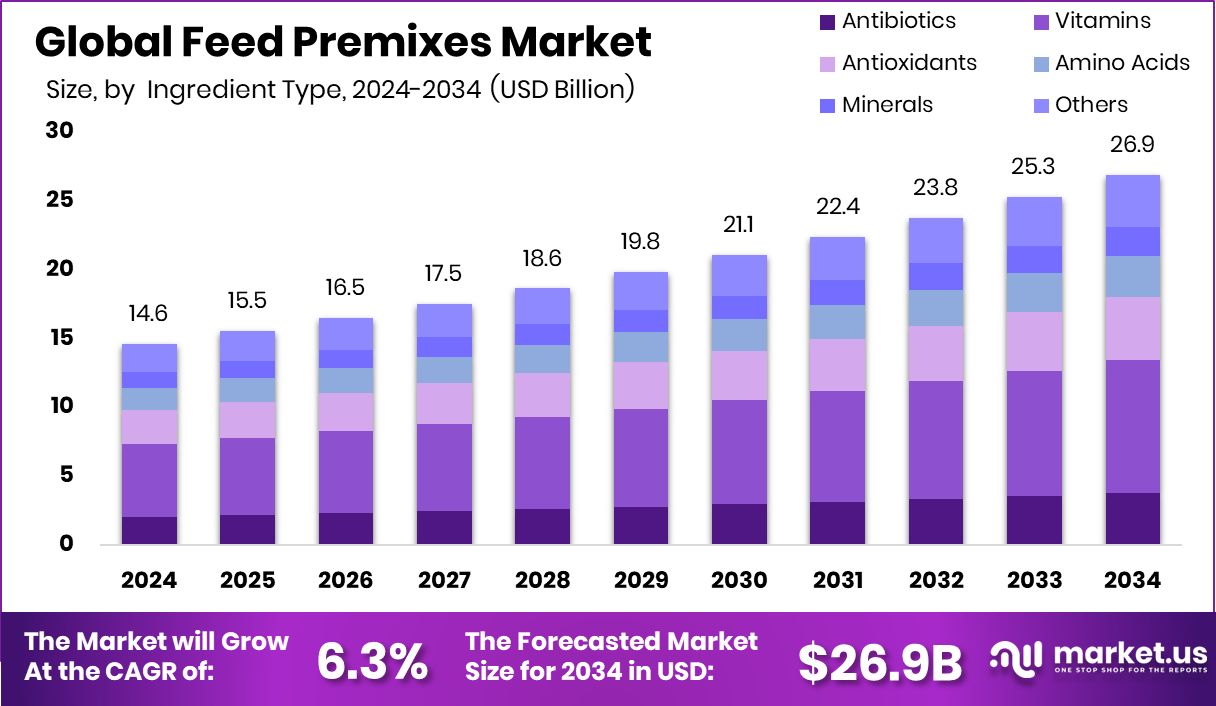

New York, NY – August 22, 2025 – The Global Feed Premixes Market, valued at USD 14.6 billion in 2024, is projected to reach USD 26.9 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2034. Feed premixes, which are concentrated blends of essential nutrients such as vitamins, minerals, and amino acids, are critical additives in animal feed, enhancing feed quality, animal health, and productivity.

These premixes are tailored to meet the specific dietary requirements of various species, including livestock, poultry, aquaculture, and pets, across different production stages. The market is driven by increasing global demand for high-quality meat, dairy, and poultry products, alongside the need for improved feed efficiency and animal health. North America accounts for a significant share of this demand, contributing 45.7% to the market’s growth.

Factors such as rising livestock farming, population growth, and shifting dietary preferences toward protein-rich foods are key drivers of market expansion. Additionally, higher income levels in emerging economies are boosting the demand for nutrient-rich animal feed. Advances in feed technology and precision nutrition are further fueling the development of specialized premix formulations. For instance, Trouw Nutrition’s €2.33 million investment in a feed mill in Northern Ireland highlights the industry’s commitment to meeting this growing demand.

Key Takeaways

- The Global Feed Premixes Market is expected to be worth around USD 26.9 billion by 2034, up from USD 14.6 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- Vitamins hold a 36.3% share, reflecting their essential role in animal health.

- Dry feed premixes dominate with 89.4%, favored for storage, stability, and ease of mixing.

- Poultry leads at 43.2%, driven by rising global demand for quality poultry products.

- The market value in North America reached USD 6.6 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/feed-premixes-market/request-sample/

Report Scope

| Market Value (2024) | USD 14.6 Billion |

| Forecast Revenue (2034) | USD 26.9 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Ingredient Type (Antibiotics, Vitamins, Antioxidants, Amino Acids, Minerals, Others), By Form (Dry, Liquid), By Animal Type (Pet, Poultry, Ruminant, Swine, Aquaculture, Others) |

| Competitive Landscape | Cargill, Inc., ADM, DLG, ForFramers, Danish Agro, BASF SE, Land O’Lakes Inc., Godrej Agrovet Limited, DSM-Firmenich, InVivo Group |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155102

Key Market Segments

By Ingredient Type: Vitamins Lead with 36.3% Market Share

In 2024, vitamins commanded a 36.3% share of the feed premixes market by ingredient type, underscoring their vital role in animal health, immunity, and productivity. Essential for metabolism, reproduction, and growth, vitamins are a cornerstone of livestock and poultry feed formulations. Their use in premixes ensures balanced nutrition, prevents deficiencies, and enhances feed conversion efficiency, directly boosting production outcomes.

The demand for vitamin-based premixes is fueled by a growing emphasis on disease prevention and reduced antibiotic use in animal farming. Producers increasingly rely on vitamin fortification to naturally strengthen immunity and sustain herd health. Additionally, the rising demand for high-quality meat, milk, and eggs amplifies the need for vitamin supplementation.

By Form: Dry Premixes Dominate with 89.4% Share

Dry premixes held an 89.4% share of the feed premixes market by form in 2024, driven by their long shelf life, ease of storage, and cost-effectiveness. Preferred for large-scale feed production, dry formulations offer superior stability for sensitive nutrients like vitamins and minerals, ensuring consistent nutritional quality. Their compatibility with automated mixing systems and uniform blending with various feed types enhances their widespread use.

Lower contamination risks and easier handling compared to liquid premixes further bolster their appeal. Dry premixes are highly adaptable across livestock, poultry, aquaculture, and pet nutrition sectors. As global demand for high-quality animal protein rises, dry premixes remain the preferred choice for their reliability, cost benefits, and practicality, ensuring their continued dominance in the market.

By Animal Type: Poultry Leads with 43.2% Share

Poultry accounted for a 43.2% share of the feed premixes market by animal type in 2024, driven by the global poultry industry’s rapid growth as a primary source of meat and eggs. Feed premixes are critical for supporting poultry’s fast growth, high feed conversion efficiency, and consistent product quality. Enriched with vitamins, minerals, and amino acids, premixes enhance immunity, reproductive performance, and flock health, reducing mortality and boosting output.

The increasing global demand for affordable, lean protein sources like chicken and eggs has heightened the reliance on premixes in poultry farming. Large-scale integrated farming systems, where consistent feed quality is vital for profitability, further drive their adoption. The shift toward antibiotic-free poultry production has also increased the use of high-quality premixes for natural health support, particularly in developed and emerging markets.

Regional Analysis

In 2024, North America led the global feed premixes market with a 45.7% share, generating USD 6.6 billion in revenue. This dominance is driven by advanced livestock production systems, widespread adoption of precision nutrition, and stringent feed quality standards in the U.S. and Canada.

The region’s robust poultry, swine, and dairy industries rely heavily on nutrient-rich premixes to ensure productivity, animal health, and product quality. Europe follows closely, propelled by regulations promoting sustainable farming and reduced antibiotic use.

The Asia Pacific region is experiencing rapid growth, fueled by increasing meat consumption, expanding poultry production, and rising awareness of animal nutrition. The Middle East & Africa and Latin America are seeing gradual adoption as their livestock sectors modernize and demand for protein-rich diets grows. North America’s advanced infrastructure, innovative research, and established supply chains solidify its position as the global leader in the feed premixes market.

Top Use Cases

- Enhancing Poultry Growth: Feed premixes with vitamins and amino acids boost poultry growth and egg production. They ensure balanced nutrition, improve feed efficiency, and reduce mortality. Farmers use premixes to support faster weight gain and better flock health, meeting the rising demand for affordable chicken and eggs in global markets.

- Improving Dairy Cow Milk Yield: Premixes enriched with minerals and vitamins enhance milk production in dairy cows. They support reproductive health and strengthen immunity, leading to consistent milk quality. Farmers rely on these blends to optimize nutrition, ensuring higher yields and better profitability in the competitive dairy industry.

- Supporting Aquaculture Sustainability: In fish farming, premixes provide essential nutrients like vitamins and minerals to improve fish growth and health. They reduce reliance on fishmeal, promoting eco-friendly practices. Tailored formulations enhance feed efficiency, supporting sustainable aquaculture to meet the growing global demand for seafood.

- Boosting Swine Health: Premixes for swine deliver amino acids and antioxidants to enhance immunity and growth. They help reduce antibiotic use by naturally strengthening pigs against diseases. Farmers use these blends to improve meat quality and feed conversion, catering to the increasing demand for high-quality pork products.

- Optimizing Pet Nutrition: Feed premixes for pets provide balanced vitamins and minerals for optimal health. They support digestion, coat quality, and immunity in dogs and cats. Pet owners and manufacturers use premixes to create nutrient-rich pet foods, meeting the rising demand for premium, health-focused pet products.

Recent Developments

1. Cargill, Inc.

Cargill is advancing its Nutrena feed line with a focus on precision nutrition and sustainability. Recent developments include using data analytics to create custom premixes that optimize animal health and reduce environmental impact. They are also expanding their micro-nutrient offerings to support animal immunity and gut health, responding to the reduced use of antibiotics in livestock production.

2. ADM

ADM is leveraging its global supply chain to enhance traceability and sourcing of non-GMO and organic premix ingredients. A key development is their investment in novel additives, such as probiotics and phytogenics, to create next-generation premix solutions. They are also focusing on integrated systems that connect premix formulas to on-farm performance data, helping producers improve efficiency and meet sustainability goals.

3. DLG Group

DLG, a major European agricultural player, is integrating digital tools into its premix business. Their recent “DLG Connect” platform provides customers with data-driven advice for optimal premix utilization. They are also expanding their functional feed concepts, which include specialized premixes aimed at improving specific outcomes like sow longevity or piglet vitality, supporting a move towards more targeted animal nutrition.

4. ForFarmers

ForFarmers is focusing on sustainability through its “Total Feed” approach, where premixes are designed to lower the overall environmental footprint of livestock farming. A key initiative is the development of low-emission premixes that reduce nitrogen and methane excretion. They are also championing circular economy principles by incorporating safe, alternative ingredients into their premix formulations.

5. Danish Agro

Danish Agro is developing innovative premix solutions to support the reduction of medicinal zinc and antibiotics in piglet feed. Their recent research focuses on robust combinations of organic acids, probiotics, and enzymes to maintain gut health without reliance on pharmaceuticals. This aligns with strict EU regulations and the growing consumer demand for responsibly produced animal protein.

Conclusion

The Feed Premixes Market is thriving due to growing demand for high-quality animal protein and sustainable farming practices. With advancements in precision nutrition and tailored formulations, premixes enhance animal health, productivity, and feed efficiency across poultry, dairy, aquaculture, swine, and pet sectors. As global livestock and pet populations rise, feed premixes will remain crucial for meeting nutritional needs and ensuring sustainable, profitable farming.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)