Table of Contents

Overview

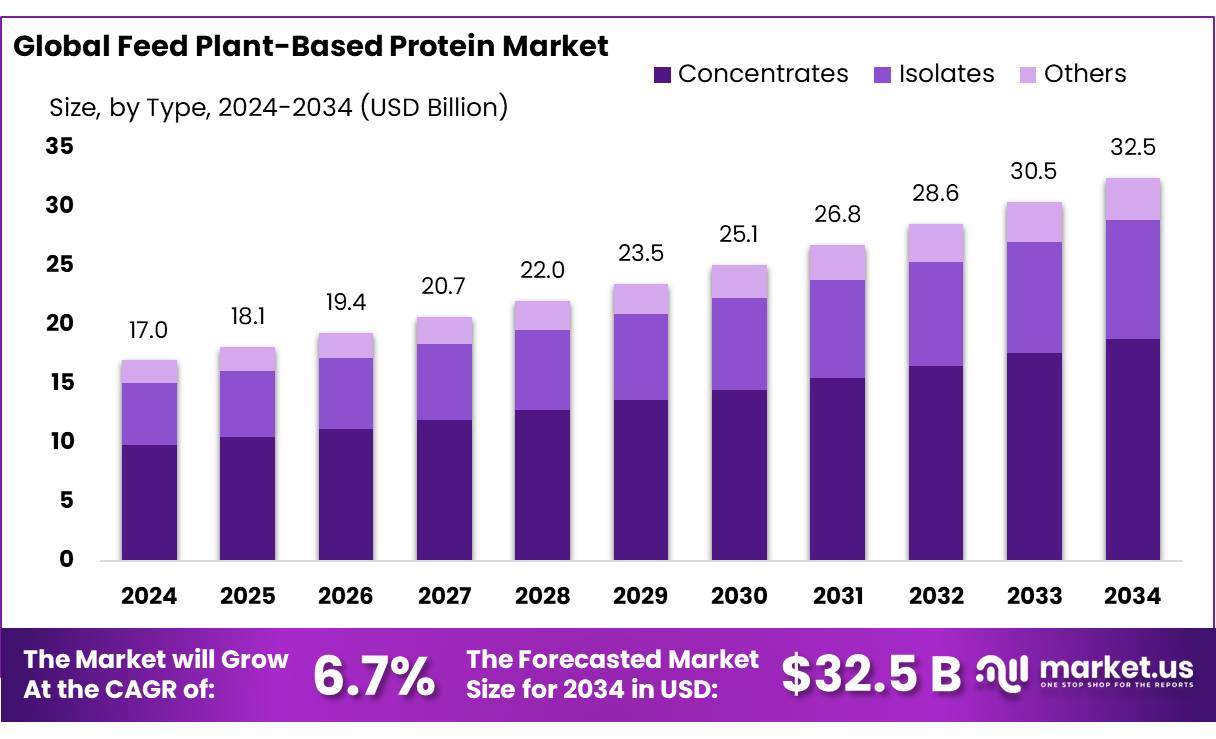

New York, NY – August 25, 2025 – The Global Feed Plant-Based Protein Market is projected to grow from USD 17.0 billion in 2024 to USD 32.5 billion by 2034, with a CAGR of 6.7% during the 2025–2034 forecast period. In 2024, North America led the market, holding a 45.6% share with USD 7.7 billion in revenue.

In India, the demand for plant-based protein concentrates is driven by health-conscious consumers adopting plant-based diets for health and sustainability reasons. This is reflected in the rise of startups like GoodDot, which produces 65,000 plant-based meat substitutes daily, and the expansion of plant-based product offerings. In 2022, India’s non-animal-derived protein market reached 1.9 thousand tonnes, with soy protein concentrate dominating at 49.4%, followed by soy protein isolate at 36.1%.

Growing awareness of lactose intolerance and the environmental impact of animal agriculture further fuels this shift in both human and animal nutrition. The Indian plant-based food market reached USD 36 million in 2024, with dairy alternatives growing faster than meat substitutes. Government initiatives are supporting this growth. The Animal Husbandry Infrastructure Development Fund (AHIDF), launched in 2020 with INR 15,000 crore, encourages private investment in animal husbandry infrastructure, including feed plants.

The Pradhan Mantri Matsya Sampada Yojana (PMMSY), introduced in 2019, promotes sustainable aquaculture, indirectly benefiting the feed industry. Additionally, the Prime Minister Dhan-Dhaanya Krishi Yojana, launched in July 2025 with an annual budget of ₹24,000 crore, supports crop diversification, sustainable farming, and credit access, benefiting approximately 1.7 crore farmers.

Key Takeaways

- The Global Feed Plant-Based Protein Market size is expected to be worth around USD 32.5 billion by 2034, from USD 17.0 billion in 2024, growing at a CAGR of 6.7%.

- Concentrates held a dominant market position, capturing more than a 57.9% share.

- Soy held a dominant market position, capturing more than a 48.2% share.

- Poultry held a dominant market position, capturing more than a 37.4% share.

- North America stands as the leading region in the global feed plant-based protein market, commanding a significant share of approximately 45.6%, equating to a market value of around USD 7.7 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/feed-plant-based-protein-market/request-sample/

Feed Plant-Based Protein Statistics

- The conversion of plant-based proteins to animal proteins is inefficient, amounting to approximately only 3% of plant proteins transformed into animal proteins.

- Taking into account the land use, if the same quantity of plant-based proteins were directly used for human consumption, less than 10% of the land area would be needed to produce food crops to feed crops for producing the same amount of animal proteins.

- Organic whole food soya protein (PVL) is a good source of protein (18% of Daily Value), fiber (18% of Daily Value), and potassium (12% of Daily Value).

- The protein content of soybeans ranges from 36–56% of the dry weight.

- In Canada (2023), non‑animal‑derived proteins totaled 43.6 thousand tonnes (~75% of protein ingredient sales), versus 13.3 thousand tonnes (~23%) for animal‑derived proteins.

- Of those in Canada, the demand share for plant‑based protein ingredients is: soy protein concentrate 51.9%, gluten 31.1%, soy isolate 10.4%, pea protein 5.6%, and vegetable proteins 1.0%.

Report Scope

| Market Value (2024) | USD 17.0 Billion |

| Forecast Revenue (2034) | USD 32.5 Billion |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Type (Concentrates, Isolates, Others), By Source (Soy, Wheat, Pea, Sunflower, Others), By Livestock (Poultry, Pets, Swine, Ruminants, Aquatic Animals) |

| Competitive Landscape | AGRANA Beteiligungs-AG, AGT Foods, Alltech, Inc., Aminola, Avebe UA, Batory Foods, Adisseo Co., Ltd, Cargill, Incorporated, Emsland Group, Ingredion Incorporated |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155101

Key Market Segments

By Type Analysis

Concentrates dominate with a 57.9% share due to their nutritional reliability and cost-effectiveness. In 2024, concentrates were favored for their consistent amino-acid profile, higher digestibility compared to raw meals, and dependable performance in poultry, aquaculture, and young-animal diets.

Feed formulators valued concentrates for improving feed conversion ratios and stabilizing outcomes despite variable raw material quality. The segment benefited from robust oilseed processing, ensuring a steady supply of soy, rapeseed/canola, and pea protein concentrates. Procurement teams also noted concentrates’ ease of meeting sustainability and regulatory requirements, simplifying supply chains for large feed mills.

By Source Analysis

Soy leads with a 48.2% share due to its high protein content and versatility. In 2024, soy’s dominance stemmed from its rich protein profile, balanced amino acids, and reliable global supply. Large-scale soybean crushing in regions like the United States, Brazil, and Argentina ensured consistent availability of soy meal and concentrates, meeting the nutritional demands of poultry, swine, and aquaculture. Soy’s adaptability made it a preferred choice for diverse feed formulations, supporting both commercial livestock and specialty animal diets.

By Livestock Analysis

Poultry holds a 37.4% share, driven by its need for efficient feed solutions. In 2024, the poultry sector’s demand for nutrient-dense feeds fueled its dominance, as these formulations supported rapid growth and efficient feed conversion in broilers and layers. Plant-based proteins like soy concentrates and pea protein provided balanced amino-acid profiles while keeping costs manageable. The poultry industry’s short production cycles heightened its reliance on high-quality protein sources to optimize growth performance and flock health.

Regional Analysis

North America leads with a 45.6% share, valued at USD 7.7 billion. In 2024, North America’s dominance was driven by its advanced agricultural infrastructure, growing consumer demand for sustainable and ethical farming, and significant investments in research.

The United States, a key player, saw increased demand for plant-based proteins in animal feed, fueled by consumer shifts toward plant-based diets and supported by USDA initiatives promoting sustainable agriculture. Canada also contributed, with government support for plant-based protein research and rising vegan and vegetarian populations driving demand for plant-based feed solutions.

Top Use Cases

- Poultry Feed Enhancement: Plant-based proteins like soy and pea concentrates improve poultry feed with high digestibility and balanced amino acids. They support faster growth and better feed conversion in broilers and layers, reducing costs while meeting nutritional needs, making them a go-to choice for poultry farmers aiming for efficiency and sustainability.

- Aquaculture Nutrition: Soy and canola-based proteins are used in fish feed to replace fishmeal, offering a sustainable alternative. They provide essential nutrients for healthy fish growth, reduce environmental impact, and lower feed costs, supporting the growing demand for eco-friendly aquaculture practices worldwide.

- Pet Food Innovation: Plant-based proteins, such as pea and hemp, are added to pet foods for their nutritional benefits and allergen-free properties. They cater to health-conscious pet owners seeking sustainable, high-quality diets for dogs and cats, boosting market appeal with clean-label, eco-friendly products.

- Ruminant Feed Solutions: Plant-based proteins like soybean meal enhance ruminant diets, supporting milk and meat production. Their high protein content and digestibility improve animal health and productivity, making them a cost-effective, sustainable choice for dairy and beef farmers looking to optimize feed formulations.

- Swine Feed Optimization: Soy and wheat proteins in swine feed provide essential amino acids for growth and muscle development. They improve feed efficiency and reduce reliance on animal-based proteins, aligning with sustainable farming trends while maintaining cost-effectiveness and nutritional quality for hog producers.

Recent Developments

1. AGRANA Beteiligungs-AG

AGRANA is leveraging its expertise in fruit and starch to develop sustainable protein ingredients. While traditionally focused on human food, their non-GMO plant-based proteins and fermentation-derived products present significant potential for high-value aquaculture and pet feed markets, aligning with the circular bioeconomy by utilizing co-product streams from their core production processes.

2. AGT Foods

AGT Foods is a global leader in pulse processing (peas, lentils, chickpeas). They are strategically expanding their production of high-purity plant-based proteins and concentrates. Recent developments focus on scaling capacity to meet growing global demand for sustainable, clean-label protein ingredients, which are increasingly used in aquaculture and livestock feed as alternatives to fishmeal and soy to reduce environmental impact.

3. Alltech, Inc

Alltech is investing in novel fermentation technologies to produce sustainable protein for feed. Their recent acquisition of a state-of-the-art fermentation facility in Missouri is a key development, aimed at scaling the production of USDA-certified organic yeast-based protein, Alltech Algae, and other alternative ingredients to provide traceable, reliable options for the animal feed industry.

4. Aminola

Aminola is a B2B developer focused on creating plant-based protein solutions specifically for aquaculture. A key recent development is the successful scale-up of their proprietary processing technology to produce non-GMO rapeseed/canola protein concentrates. This aims to provide a viable, local European alternative to imported soy and fishmeal, addressing sustainability and supply chain security for fish farmers.

5. Avebe UA

Avebe, a potato starch co-operative, is innovating with its potato protein portfolio. A significant recent development is the optimization of its Potex protein texturizer, derived from starch production side streams. This product is designed as a highly functional and sustainable protein source for aquafeed, helping to improve the texture of feed pellets and promote fish growth and health.

Conclusion

The Feed Plant-Based Protein Market is growing rapidly due to rising demand for sustainable and cost-effective animal nutrition. With applications in poultry, aquaculture, pet food, ruminants, and swine, plant-based proteins offer nutritional benefits, environmental advantages, and versatility. As consumer preferences shift toward ethical and eco-friendly practices, the market is poised for strong growth, driven by innovation and supportive government policies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)