Table of Contents

Overview

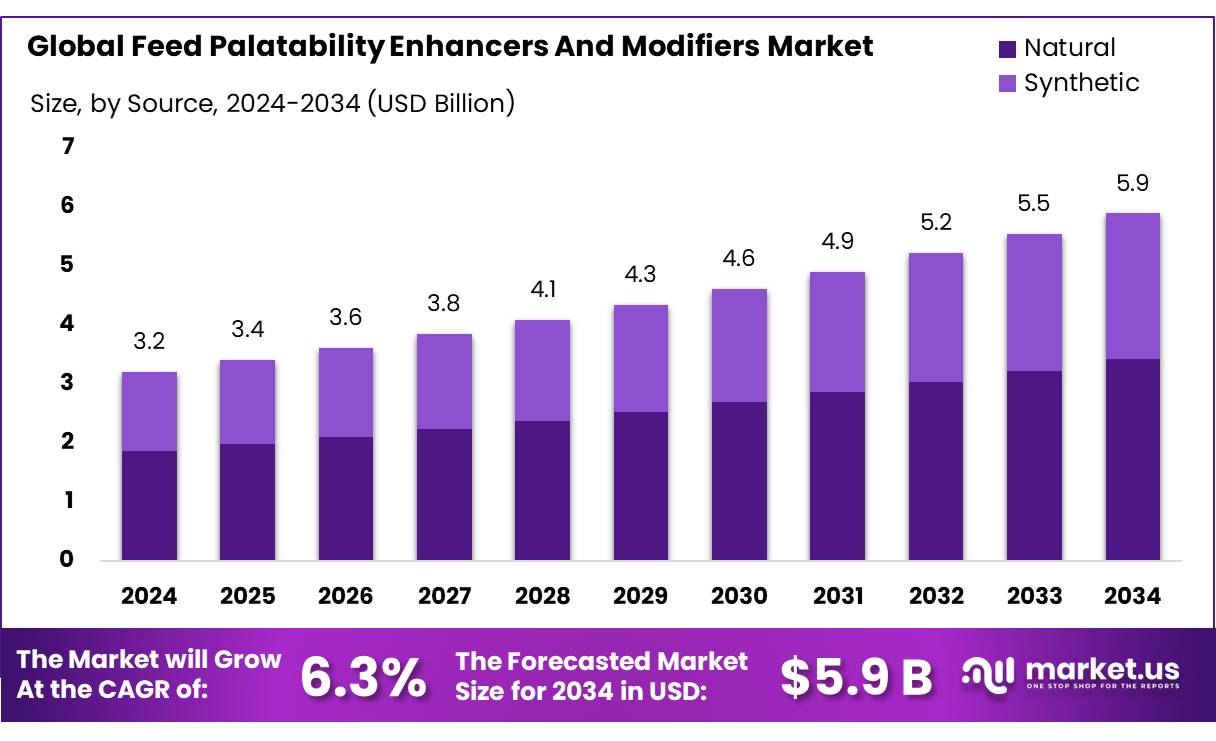

New York, NY – August 25, 2025 – The Global Feed Palatability Enhancers and Modifiers (FPEMs) Market is projected to reach USD 5.9 billion by 2034, growing from USD 3.2 billion in 2024, with a compound annual growth rate (CAGR) of 6.3% during the forecast period (2025–2034). In 2024, the Asia-Pacific region led the market, holding a 38.3% share, equivalent to USD 1.2 billion in revenue.

India’s FPEM market is witnessing robust growth due to rising demand for high-quality animal products and advancements in animal nutrition. FPEMs, such as flavors, sweeteners, aroma enhancers, and texturants, play a critical role in improving the taste and aroma of animal feed, thereby boosting feed intake and enhancing livestock performance.

Offers a 50% capital subsidy for establishing feed and fodder value addition units, including Total Mixed Ration (TMR) preparation and fodder block production. With an INR 15,000 crore allocation, this fund encourages private investment in animal husbandry infrastructure, including feed manufacturing facilities.

The government’s 20% fuel blending policy has spurred ethanol production, increasing the supply of Distillers Dried Grains with Solubles (DDGS), a cost-effective protein source for animal feed. This surplus has reduced demand for traditional oilmeals, highlighting the evolving dynamics of the feed ingredient market.

Key Takeaways

- Feed Palatability Enhancers and Modifiers Market size is expected to be worth around USD 5.9 Bn by 2034, from USD 3.2 Bn in 2024, growing at a CAGR of 6.3%.

- Natural feed palatability enhancers and modifiers captured a dominant market position, holding more than a 58.2% share.

- Flavors held a dominant position in the feed palatability enhancers and modifiers market, capturing more than a 39.3% share.

- The poultry segment held a dominant position in the feed palatability enhancers and modifiers market, capturing more than a 33.9% share.

- Asia Pacific held a dominant position in feed palatability enhancers and modifiers, capturing 38.3% of global demand, USD 1.2 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-feed-palatability-enhancers-and-modifiers-market/request-sample/

Report Scope

| Market Value (2024) | USD 3.2 Billion |

| Forecast Revenue (2034) | USD 5.9 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Source (Natural, Synthetic), By Product (Flavors, Sweeteners, Texturants, Aroma Enhancers, Others), By Livestock (Poultry, Ruminant, Swine, Aquaculture, Pet, Others) |

| Competitive Landscape | Adisseo, Associated British Foods plc (ABF), Kemin Industries, Inc., Kerry Group Plc, Symrise AG, and Elanco Animal Health |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155187

Key Market Segments

Source Analysis

In 2024, natural feed palatability enhancers and modifiers led the market, securing over 58.2% of the share. This dominance stems from growing consumer demand for natural and organic products, driving the use of natural additives in animal feed. Derived from plant, animal, or microbial sources, these enhancers are viewed as safer and more sustainable, aligning with the global push for clean-label products.

The rise in organic farming and increased awareness of natural ingredient benefits have further boosted this segment’s growth. Synthetic additives, engineered to mimic or enhance natural flavors and aromas, offer cost-effective and consistent solutions for feed manufacturers, particularly in large-scale animal farming. However, their growth is challenged by the shift toward natural products and concerns over potential health risks associated with synthetic additives.

Product Analysis

In 2024, flavors dominated the feed palatability enhancers and modifiers market, accounting for over 39.3% of the market share. This is driven by the rising demand for tasty and nutritious animal feed across poultry, swine, and aquaculture sectors. Flavors enhance feed taste and aroma, improving intake and supporting animal growth and performance.

Their widespread use reflects their ability to stimulate appetite and promote healthy livestock development. The flavors segment is poised for continued growth, fueled by advancements in flavor technology and the development of more effective flavoring agents. Increasing awareness among livestock producers of the benefits of palatable feed additives will further drive demand. As global demand for animal-based products grows, flavors will play a critical role in enhancing feed palatability, ensuring sustained innovation and market expansion.

Livestock Analysis

In 2024, the poultry segment led the feed palatability enhancers and modifiers market, capturing over 33.9% of the market share. This is driven by the high feed demand from extensive global poultry farming, particularly in broiler production. Palatability enhancers improve feed intake, enhance efficiency, promote healthy growth, and reduce mortality rates in poultry.

The global surge in demand for poultry meat and eggs, key protein sources, reinforces this segment’s dominance. Palatability enhancers ensure poultry consume sufficient feed, supporting optimal growth and productivity. The short production cycles in poultry farming require additives that deliver rapid improvements in weight gain and feed conversion efficiency.

Regional Analysis

In 2024, the Asia-Pacific region dominated the feed palatability enhancers and modifiers market, accounting for 38.3% of global demand (USD 1.2 billion). This is driven by the region’s massive feed production and diverse protein mix, including poultry, swine, and aquaculture. Producing approximately 533.1 million metric tons of compound feed in 2024, Asia-Pacific remains the world’s largest producer, despite a slight 0.8% decline.

This supports strong demand for flavors, sweeteners, attractants, and masking agents that enhance feed intake. Aquaculture is a key driver, with Asia-Pacific accounting for over 90% of global aquaculture volumes, surpassing wild catch for the first time in 2024. This boosts demand for palatability enhancers in shrimp and finfish diets. Poultry, a major volume contributor, benefits from high-throughput broiler and layer feed systems, where appetite stimulation and off-note masking improve feed conversion, supported by Asia’s leading chicken-meat producers.

Top Use Cases

- Improving Poultry Feed Intake: Feed palatability enhancers make poultry feed tastier, encouraging chickens to eat more. This boosts growth rates and egg production, especially in large-scale farms. Natural flavors and sweeteners mask bitter additives, ensuring consistent feed consumption, which improves feed efficiency and reduces waste in poultry operations.

- Enhancing Aquaculture Diets: In fish and shrimp farming, palatability enhancers improve feed appeal, increasing consumption. This supports faster growth and better health in aquatic species. Flavors tailored to specific species, like salmon or tilapia, ensure optimal nutrient absorption, vital for meeting the rising global demand for seafood.

- Boosting Swine Growth Rates: Palatability enhancers in swine feed improve taste, encouraging piglets to eat more after weaning. Sweeteners like sucralose increase feed intake, promoting healthy weight gain. This is crucial for large-scale pork production, where consistent growth and feed efficiency directly impact profitability.

- Supporting Pet Food Appeal: Palatability enhancers make pet food more appealing to dogs and cats, ensuring they eat balanced diets. Flavors and texturants improve taste and texture, catering to picky eaters. This supports pet health and meets owner demands for high-quality, natural pet food products.

- Enhancing Cattle Feed Efficiency: In cattle farming, palatability enhancers improve the taste of feed, encouraging consistent consumption. This leads to better weight gain and milk production. Natural additives like molasses or flavor blends mask off-flavors, ensuring ruminants get proper nutrition, which is key for dairy and beef industries.

Recent Developments

1. Adisseo

Adisseo has advanced its palatability offerings with its SenseUp range, leveraging sensory analysis and machine learning to predict animal preference. Recent focus is on sustainable, plant-based solutions to mask bitter notes in alternative protein diets, addressing the shift away from animal by-products. Their research targets robust solutions for young animal feeds and aqua species.

2. Associated British Foods plc (ABF)

Through its AB Agri division, ABF is leveraging digital tools like its ePal system to create precision palatability solutions. Recent developments focus on enhancing the taste and smell of sustainable feeds containing novel ingredients like insect meal. Their work ensures animal intake remains high despite less palatable raw materials, supporting the circular economy and reducing food waste in supply chains.

3. Kemin Industries, Inc.

Kemin is expanding its flagship palatability product, LysiFresh Protect, with new research validating its efficacy in preserving feed freshness and enhancing intake under high-heat, high-humidity conditions. Their recent developments emphasize antioxidant-rich, natural-source palatability modifiers that protect fats and oils from rancidity, a key cause of feed rejection, particularly in pet food and aqua feed.

4. Kerry Group Plc

Kerry leverages its human taste expertise to develop next-generation, natural palatability solutions for animal feed. A key recent development is their portfolio expansion to include clean-label, yeast-based modifiers and hydrolyzed proteins. They focus on enhancing the nutritional profile while improving mask-and-mask capabilities for medications and minerals in pet food and livestock diets, supporting health and wellness trends.

5. Symrise AG

Symrise AG’s Animal Nutrition division (formerly Diana Pet Food) is intensifying research into palatability for alternative protein diets, including plant-based and single-cell proteins. A key development is their use of data analytics to map pet taste preferences and create highly targeted palatability enhancers. They focus on sustainable, natural ingredients to improve acceptance of eco-friendly feeds without compromising performance.

Conclusion

The Feed Palatability Enhancers and Modifiers Market is growing due to rising demand for animal protein and efficient farming. These additives improve feed intake, animal health, and productivity across poultry, aquaculture, swine, pets, and cattle. Natural and sustainable options are gaining traction, driven by consumer preferences. Despite regulatory and cost challenges, innovations in flavors and formulations ensure strong market potential.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)