Table of Contents

Overview

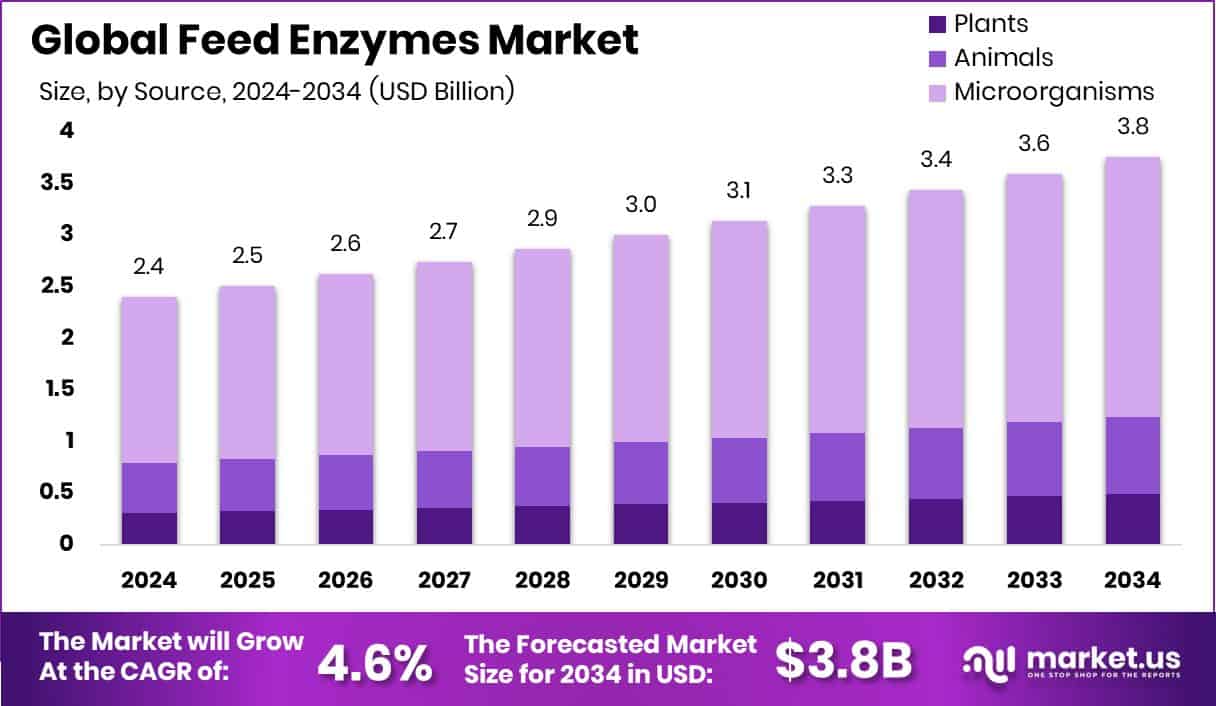

New York, NY – August 20, 2025 – The global feed enzymes market is projected to reach approximately USD 3.8 billion by 2034, rising from USD 2.4 billion in 2024, at a CAGR of 4.6% from 2025 to 2034. Asia-Pacific continues to lead the market with a dominant share, largely driven by strong adoption in poultry farming. Feed enzymes, whether natural or synthetic, are added to animal feeds to enhance nutritional value and digestibility. By breaking down complex proteins, fats, and carbohydrates into simpler forms, these enzymes improve feed efficiency, reduce waste, and promote better animal health and growth rates.

This market plays a crucial role in the animal agriculture sector, catering to poultry, swine, ruminants, and aquaculture. Its core focus lies in improving feed conversion, enhancing production quality, and supporting environmentally sustainable farming practices. Growing global demand for animal protein driven by population growth and higher disposable incomes has amplified the need for efficient and cost effective animal production. Feed enzymes enable producers to achieve better feed utilization, lowering production costs while increasing yields of meat, eggs, and dairy.

Regulatory pressure on livestock waste management is also fueling market growth. By enhancing nutrient absorption, enzymes minimize undigested waste, which reduces emissions and improves manure quality. Government-backed programs are further supporting industry expansion, with grants ranging from hundreds of thousands to millions of dollars already allocated to strengthen supply chain resilience. These factors position feed enzymes as a vital solution for meeting both productivity and environmental goals in modern livestock farming.

Key Takeaways

- The global feed enzymes market is projected to reach about USD 3.8 billion by 2034, rising from USD 2.4 billion in 2024, with a CAGR of 4.6% between 2025 and 2034.

- Microorganisms are the primary source, accounting for 67.30% of the market share.

- Carbohydrates lead the product segment with a 43.30% share.

- Powder formulations remain the most preferred form, representing 68.30% of the market.

- Poultry remains the top application area, making up 47.50% of total usage.

- The Asia-Pacific market has reached USD 1.1 billion, driven by increasing livestock demand.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-feed-enzymes-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.4 Billion |

| Forecast Revenue (2034) | USD 3.8 Billion |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Source (Plants, Animals, Microorganisms), By Product Type (Carbohydrases (Amylases, Xylanase, Cellulases, Glucanase, Others), Phytase, Proteases, Lipases, Others), By Formulation (Powder, Liquid), By Application (Poultry (Broiler, Turkeys, Layer, Others), Ruminant (Beef Cattle, Dairy Cattle, Calves, Others), Swine, Aquaculture, Others) |

| Competitive Landscape | Novozymes A/S, DSM, Dupont, BASF SE, AB Vista, Cargill, Incorporated, Kerry Group, Danisco A/S, Advanced Enzyme Technologies Limited, Adisseo, Novus International, Inc., Elanco, ADM, Kemin Industries, Bioproton Pty Ltd., Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144720

Key Market Segments

1. By Source Analysis

- In 2024, microorganisms emerged as the dominant source in the feed enzymes market, securing a commanding 67.30% share. Their popularity stems from sustainable and efficient production through fermentation, primarily using bacteria and fungi, which allows for large-scale, cost-effective enzyme manufacturing. These microbial enzymes offer consistent performance across various feed conditions, enhance livestock nutrition, and support eco-friendly farming practices. Continuous advancements in biotechnology and genetic engineering further boost their efficiency, stability, and adaptability, ensuring they remain a preferred choice for modern feed formulations.

2. By Product Type Analysis

- Carbohydrases led the product type segment in 2024 with a 43.30% share, reflecting their essential role in improving feed digestibility. Enzymes like amylase, cellulase, and xylanase break down complex carbohydrates, making nutrients more accessible and boosting energy utilization, particularly in poultry and swine diets. Their adoption is driven by economic benefits, including lower feed costs and better feed conversion ratios. Versatile across various feed ingredients, carbohydrases support sustainable livestock production by maximizing nutrient absorption and minimizing waste, solidifying their strong market position.

3. By Formulation Analysis

- Powder formulations dominated the feed enzymes market in 2024, holding a 68.30% share due to their stability, long shelf life, and ease of incorporation into dry feed mixes. They are cost-effective to produce, store, and transport, making them ideal for large-scale feed manufacturing. Powdered enzymes also ensure even distribution in feed, promoting consistent nutrient delivery and improved animal performance. Their practicality and durability under varied environmental conditions make them the preferred formulation across global feed operations.

4. By Application Analysis

- Poultry remained the largest application segment in 2024, accounting for 47.50% of the feed enzymes market. This dominance is linked to enzymes’ ability to improve nutrient absorption, enhance feed efficiency, and reduce production costs through better digestibility of essential nutrients. Growing global demand for poultry meat and eggs, fueled by protein-rich dietary trends, has increased the reliance on enzyme supplementation. Additionally, feed enzymes help poultry producers meet environmental goals by reducing farm waste, while technological innovations continue to deliver more targeted solutions for poultry health and productivity.

Regional Analysis

- In 2024, Asia-Pacific emerged as the leading region in the global feed enzymes market, capturing 46.30% of the total share with a market value of USD 1.1 billion. This dominance is fueled by the rapid expansion of livestock and poultry industries in key markets such as China, India, and Southeast Asia.

- Growing demand for meat and dairy products, along with heightened awareness of feed efficiency, has significantly boosted enzyme adoption in the region. North America is experiencing steady growth, supported by advanced farming techniques and a strong focus on premium nutrition solutions, while Europe’s uptake is driven by strict antibiotic regulations and an emphasis on sustainable livestock management.

- The Middle East & Africa market is gradually expanding, led by the rise of poultry farms and increasing protein consumption, whereas Latin America especially Brazil and Argentina shows moderate growth as producers adopt enzymes to improve efficiency and reduce costs.

- With its large livestock base, supportive policies, and continuous feed innovation, Asia-Pacific is expected to maintain its position as the global leader in feed enzyme revenues in the years ahead.

Top Use Cases

- Enhancing Nutrient Digestibility in Poultry: Feed enzymes such as phytase, xylanase, and protease break down complex starches, fibers, and proteins helping poultry absorb more nutrients. This boosts growth rates and reduces feed costs by improving feed conversion effectiveness and minimizing undigested waste.

- Optimizing Swine Growth Performance: Proteases and amylases in pig diets promote better protein and starch breakdown, while beta-glucanases enhance fiber digestion. These enzymes increase feed utilization, support faster weight gain, and improve overall health and productivity.

- Improving Ruminant Fiber Utilization: Cellulase and xylanase help ruminants like cattle and sheep digest fibrous components in feeds, boosting energy extraction. This supports milk production, weight gain, and overall efficiency when feeding high fiber or forage heavy diets.

- Supporting Aquaculture Nutrition: Feed enzymes aid fish and shrimp in utilizing plant-based proteins by enhancing digestibility. This not only improves feed efficiency and growth rates but also reduces nitrogen and phosphorus waste resulting in healthier aquatic systems.

- Using Alternative Feed Ingredients More Effectively: By breaking down anti nutritional factors in non-conventional ingredients, enzymes allow farmers to incorporate cheaper or byproduct feed sources. This flexibility reduces feed costs while maintaining nutritional value and supporting sustainability.

Recent Developments

1. Novozymes A/S

- Novozymes completed a major strategic merger with Chr. Hansen in late 2023, forming a consolidated entity now known as Novonesis. In a significant follow-up, Novonesis acquired dsm-firmenich’s share in the Feed Enzyme Alliance in early 2025 for EUR 1.5 billion, integrating sales and distribution capabilities with its existing R&D and production functions. This move strengthens its global leadership in animal biosolutions, allowing greater customer reach and vertical integration from product innovation to market implementation.

2. DSM (dsm-firmenich)

- DSM, now operating as dsm-firmenich following its merger with Firmenich, made a strategic shift by divesting its Feed Enzyme Alliance stake in early 2025 to Novonesis for EUR 1.5 billion. Prior to this deal, DSM and Novozymes had co-developed and launched the Ronozyme® feed enzymes range including protease, phytase, xylanase, and amylase geared toward enhancing feed efficiency and sustainability in China. These steps reflect DSM’s evolving role in animal nutrition and its strategic decision to refocus after the alliance exit.

3. DuPont de Nemours, Inc.

- DuPont Animal Nutrition strengthened its phytase enzyme leadership with the launch of Axtra® PHY GOLD, a next-generation phytase offering superior efficacy, thermostability, and feed cost savings for poultry and pork producers. Earlier, DuPont had expanded the reach of its innovative Axtra® PHY GOLD product across Southeast Asia including Malaysia, Thailand, and Australia beginning in 2021. These moves underscore DuPont’s commitment to delivering advanced enzyme solutions with strong value propositions for global animal feed markets.

4. BASF SE

- BASF significantly expanded its feed enzyme production capacity in Ludwigshafen, Germany, to increase fermentation output of key enzyme lines such as Natuphos® E, Natugrain® TS, and Natupulse® TS. The company also extended its partnership with Cargill (Provimi), rolling out Enzae® Manno a mannanase based enzyme product for the first time in South Korea. These actions demonstrate BASF’s commitment to boosting supply capabilities and innovation while expanding its geographic footprint in feed enzyme distribution.

Conclusion

The global feed enzymes market is set for steady growth as the demand for animal protein continues to rise worldwide. Increasing restrictions on antibiotic use, coupled with the need for better feed efficiency and improved animal health, are driving enzyme adoption. Advances in enzyme formulations, including tailored blends and sustainable solutions, are expected to enhance productivity while reducing environmental impact. Asia-Pacific remains the leading region due to its strong livestock base and supportive government policies, while other regions are steadily expanding their presence. Overall, feed enzymes will play a key role in shaping the future of sustainable livestock production.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)