Table of Contents

Overview

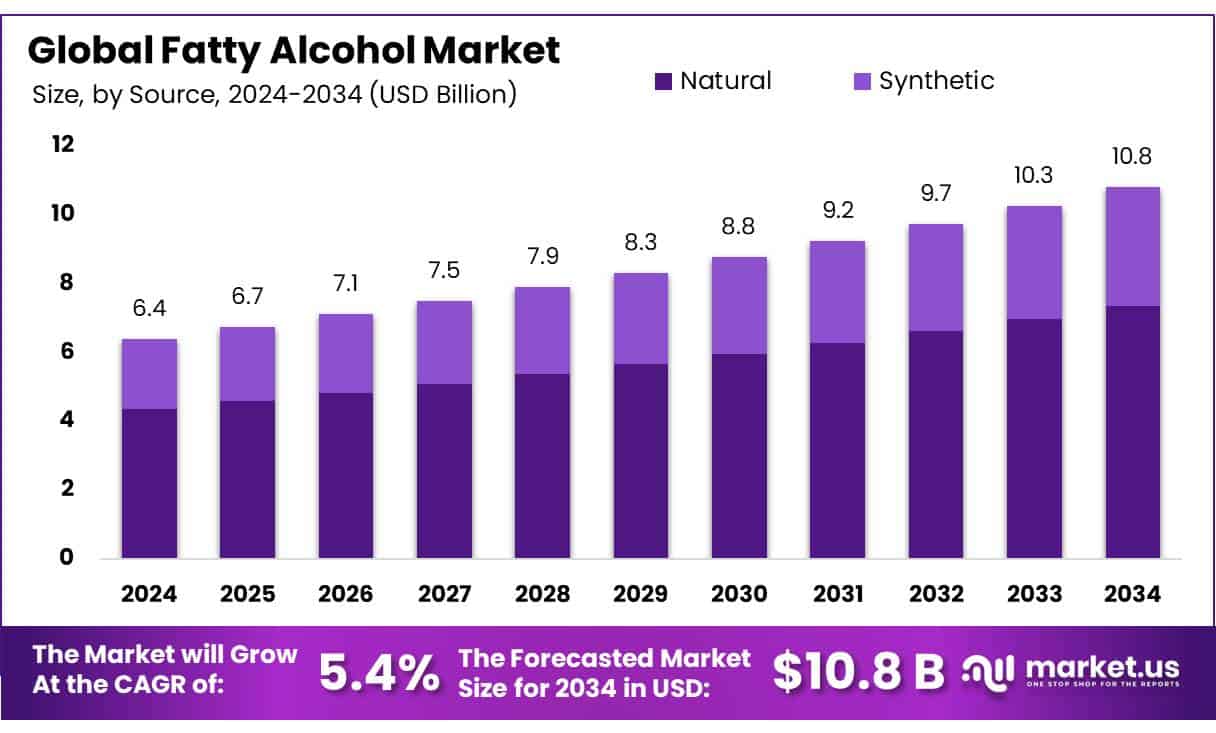

New York, NY – May 12, 2025 – The global Fatty Alcohol Market is set for steady growth, with its size expected to rise from USD 6.4 billion in 2024 to around USD 10.8 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.4% from 2025 to 2034.

Natural fatty alcohols, sourced from palm, coconut, and soybean oils, dominated the market in 2024 with a 68.2% share. Growing consumer preference for organic, plant-based ingredients in personal care, detergents, and surfactants drives this segment. Long-chain fatty alcohols captured a 42.6% market share in 2024, driven by their use in industrial lubricants, surfactants, and personal care products. Their emollient and lubricating properties make them ideal for cosmetics and skincare. Soaps and detergents accounted for 34.5% of the fatty alcohol market in 2024, fueled by demand for biodegradable, eco-friendly cleaning products.

US Tariff Impact on Fatty Alcohol Market

The U.S. imposed 25% tariffs on many Canadian and Mexican imports on March 4; products that qualify for preferential treatment under the United States-Mexico-Canada Agreement (USMCA), which includes most wine, beer, and spirits, are not subject to the additional tariffs effective March 7.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/fatty-alcohol-market/request-sample/

Canada imposed 25% tariffs on U.S. beer, spirits, and wine starting March 13. Mexico said it would impose retaliatory tariffs on U.S. goods but has yet to do so. The U.S. imposed additional 10% tariffs on Chinese imports, including alcoholic beverages, as of February 4; it increased the tariffs to 20% on March 4. The EU said it would impose a 50% tariff on U.S. bourbon and whiskey starting April 1; the so-called whiskey export tariffs have been pushed back to mid-April and are under review. The U.S. threatened but hasn’t implemented a 200% tariff on all alcoholic beverages from the EU.

Key Takeaways

- The Global Fatty Alcohol Market is projected to grow from USD 6.4 billion in 2024 to USD 10.8 billion by 2034, at a CAGR of 5.4%.

- Natural fatty alcohols dominate with a 68.2% market share, driven by demand for sustainable sources like palm, coconut, and soybean oils.

- Long-chain fatty alcohols hold a 42.6% share, fueled by their use in lubricants, surfactants, and personal care products.

- Soaps and Detergents lead with a 34.5% share, boosted by consumer preference for biodegradable and eco-friendly cleaning products.

- Asia-Pacific is the largest market, valued at USD 2.7 billion, due to strong industrial output and demand for biodegradable surfactants.

Analyst Viewpoint

The Fatty Alcohol Market thrives on demand from sustainable personal care and cleaning sectors, which drive over half of its consumption. Investment prospects are particularly strong in Asia-Pacific, where low labor costs and abundant raw materials like palm oil fuel production. However, challenges include volatile palm oil prices that inflate costs and geopolitical disruptions, such as the Russia-Ukraine conflict, which strain supply chains. While consumer demand for eco-friendly products supports growth, competition from synthetic alternatives threatens profitability.

Environmental concerns over palm oil sourcing pose reputational risks. Investors should prioritize R&D in bio-based technologies and secure strategic supply chain partnerships to capitalize on opportunities, while staying agile amid regulatory and price fluctuations. The fatty alcohol market offers dynamic potential but demands careful strategy and adaptability.

Report Scope

| Market Value (2024) | USD 6.4 Billion |

| Forecast Revenue (2034) | USD 10.8 Billion |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Source (Natural, Synthetic), By Type (Long Chain, Short Chain, Pure and Mid cut, Higher Chain), By Application (Soaps and Detergents, Personal Care, Lubricants, Plasticizers, Amines, Pharmaceuticals, Others) |

| Competitive Landscape | Shell plc, Kao Corporation, Global Green Chemicals Public Company Ltd., Sasol Ltd., Wilmar International Ltd., Godrej Industries Ltd., Musim Mas Group, KLK OLEO, PandG Chemicals, SABIC, VVF Ltd., PTT Global Chemical Public Company Ltd., CREMER OLEO GmbH and Co. KG, Arkema, Sinarmas Cepsa Pte. Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=123702

Key Market Segments

By Source

- Natural fatty alcohols, sourced from palm, coconut, and soybean oils, dominated the market in 2024 with a 68.2% share. Growing consumer preference for organic, plant-based ingredients in personal care, detergents, and surfactants drives this segment. Regulatory support for sustainable sourcing and a focus on reducing carbon footprints further bolsters its position. Natural sources will likely maintain their lead, shaping the market’s eco-conscious trajectory.

By Type

- Long-chain fatty alcohols captured a 42.6% market share in 2024, driven by their use in industrial lubricants, surfactants, and personal care products. Their emollient and lubricating properties make them ideal for cosmetics and skincare. As demand for bio-based, biodegradable alternatives rises, this segment is poised for sustained growth, underscoring its critical role in the market.

By Application

- Soaps and detergents accounted for 34.5% of the fatty alcohol market in 2024, fueled by demand for biodegradable, eco-friendly cleaning products. Consumer preference for sustainable, natural ingredients has spurred innovation in plant-based formulations. This segment is expected to retain its dominance as manufacturers continue to prioritize renewable resources, reinforcing fatty alcohols’ importance in household and industrial cleaning.

Regional Analysis

The Asia-Pacific region led the global fatty alcohol market in 2024, generating USD 2.7 billion in market value. Its dominance stems from strong industrial output, a booming personal care and cosmetics sector, and growing demand for biodegradable surfactants. Key producers like Indonesia, Malaysia, and the Philippines leverage abundant palm oil resources to drive fatty alcohol production.

China, the region’s largest consumer, fuels market growth through its expansive chemical and personal care industries, with significant demand for bio-based surfactants. India is also gaining traction, supported by investments in bio-based chemical production and government policies promoting sustainable sourcing. APAC’s market leadership is expected to continue into 2025, propelled by industrialization, heightened awareness of sustainable products, and supportive renewable sourcing initiatives.

Top Use Cases

- Personal Care Products: Fatty alcohols are widely used in cosmetics like creams, lotions, and shampoos. They act as emollients, making skin and hair soft, and as thickeners for smooth textures. The growing demand for natural, plant-based ingredients boosts their popularity in sustainable personal care formulations.

- Soaps and Detergents: Fatty alcohols are key in producing eco-friendly soaps and detergents. They create surfactants that help remove dirt and grease. Rising consumer preference for biodegradable cleaning products drives their use, especially in household and industrial cleaning solutions.

- Industrial Lubricants: Long-chain fatty alcohols serve as lubricants in industrial applications. Their excellent lubricating properties reduce friction in machinery, enhancing efficiency. The push for bio-based, sustainable alternatives in manufacturing fuels demand for these alcohols in various industries.

- Pharmaceuticals: Fatty alcohols are used in ointments and topical medications. They act as emulsifiers and stabilizers, ensuring consistent drug delivery. Their skin-friendly properties make them ideal for sensitive applications, with growing demand in natural and organic pharmaceutical products.

- Food Industry: In food processing, fatty alcohols function as emulsifiers and stabilizers in products like sauces and desserts. They improve texture and shelf life. The trend toward clean-label, plant-based ingredients supports their use in sustainable food formulations.

Recent Developments

1. Shell plc

- Shell has been advancing its bio-based fatty alcohols production to meet the growing demand for sustainable ingredients. The company focuses on integrating renewable feedstocks into its manufacturing processes, aligning with global decarbonization goals. Shell’s fatty alcohols are widely used in detergents, personal care, and industrial applications. Recent efforts include optimizing production efficiency and expanding supply chains to serve eco-conscious markets.

2. Kao Corporation

- Kao has strengthened its fatty alcohol business by developing high-purity, plant-derived variants for premium cosmetics and cleansers. The company emphasizes sustainability, using responsibly sourced palm oil and RSPO-certified materials. Recent innovations include ultra-mild fatty alcohols for sensitive skin formulations. Kao also collaborates with suppliers to enhance traceability and reduce environmental impact.

3. Global Green Chemicals Public Company Limited (GGC)

- GGC, a subsidiary of PTT Global Chemical, has expanded its fatty alcohol production capacity to serve Southeast Asian markets. The company focuses on green chemistry, producing bio-based fatty alcohols for personal care and home care products. Recent developments include partnerships with regional brands to supply sustainable surfactants and alcohols.

4. Sasol Limited

- Sasol continues to lead in synthetic and natural fatty alcohols, with recent investments in cleaner production technologies. The company has introduced new low-carbon footprint fatty alcohols for the European and North American markets. Sasol also emphasizes circular economy initiatives, recycling byproducts to minimize waste in its manufacturing processes.

Conclusion

The Fatty Alcohol market is poised for steady growth. This growth is fueled by strong demand from personal care, detergents, and pharmaceuticals, where fatty alcohols are valued for their natural, mild, and eco-friendly properties. The rising popularity of green and sustainable products is pushing manufacturers to adopt bio-based fatty alcohols, creating new opportunities. Emerging markets, especially in Asia and Latin America, are key growth drivers due to increasing disposable incomes and demand for premium personal care products. With ongoing innovations and expanding applications, the fatty alcohol market remains a promising sector for businesses and investors in the coming decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)