Table of Contents

Overview

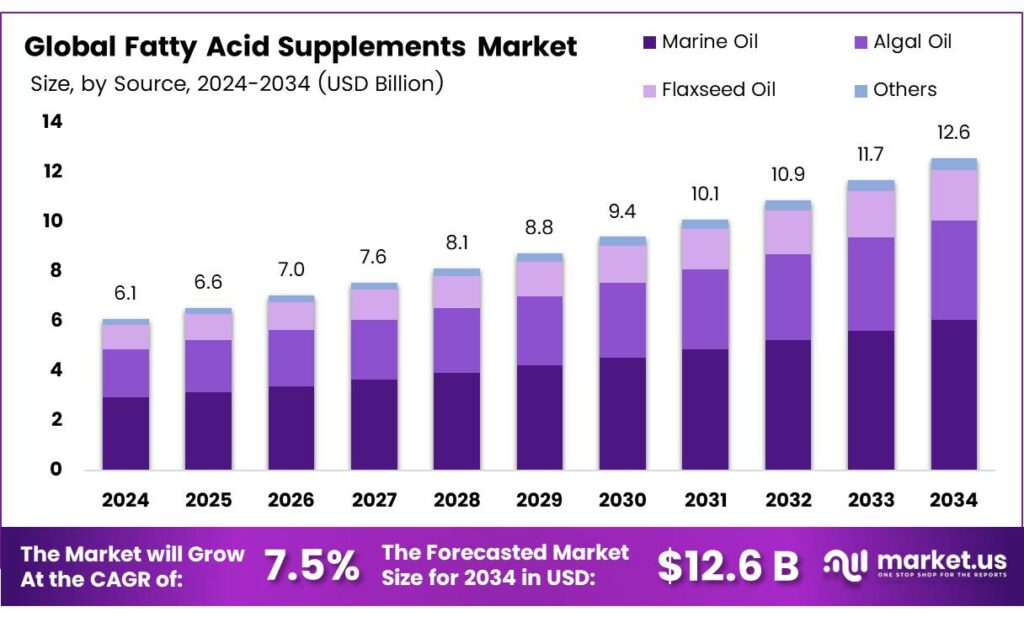

New York, NY – September 19, 2025 – The Global Fatty Acid Supplements Market is projected to grow from USD 6.1 billion in 2024 to around USD 12.6 billion by 2034, expanding at a CAGR of 7.5% during 2025–2034. Polyunsaturated fatty acids (PUFAs) are central to this growth, divided mainly into omega-3 and omega-6 fatty acids. Like all fatty acids, PUFAs consist of long carbon chains with a carboxyl group at one end and a methyl group at the other.

Their key distinction from saturated and monounsaturated fatty acids lies in the presence of two or more double bonds along the carbon chain, which makes them essential for human health. Among PUFAs, omega-3 fatty acids are the most widely recognized. Characterized by their first carbon–carbon double bond located three carbons from the methyl end, they are often referred to as n-3s.

These are commonly found in foods like flaxseed and fish, as well as in concentrated fish oil supplements. The three most studied omega-3s include alpha-linolenic acid (ALA) with 18 carbons, eicosapentaenoic acid (EPA) with 20 carbons, and docosahexaenoic acid (DHA) with 22 carbons. While ALA is essential, its conversion into EPA and DHA in the human body, primarily through liver metabolism, remains highly limited, with rates of less than 15%. This makes direct intake of EPA and DHA through diet or supplementation the most reliable way to maintain optimal levels.

Absorption efficiency of omega-3 fatty acids is particularly high, averaging around 95%, which is comparable to other dietary fats. Within the intestines, free fatty acids are absorbed, incorporated into chylomicrons, and carried into the bloodstream through the lymphatic system, ensuring effective bioavailability. Guidelines for nutrient intake are established by the Dietary Reference Intakes (DRIs), developed by the Food and Nutrition Board of the Institute of Medicine (now the National Academy of Medicine).

These include the Recommended Dietary Allowance (RDA), which meets the nutritional needs of 97%–98% of healthy individuals; Adequate Intake (AI), which is applied when data is insufficient for an RDA but still ensures nutritional adequacy; the Estimated Average Requirement (EAR), designed to meet the needs of 50% of individuals, typically for population-level assessments; and the Tolerable Upper Intake Level (UL), which sets the maximum daily intake unlikely to pose health risks.

Key Takeaways

- The Global Fatty Acid Supplements Market is projected to grow from USD 6.1 billion in 2024 to USD 12.6 billion by 2034, at a CAGR of 7.5%.

- Marine Oil led the market in 2024 with a 48.2% share, driven by the popularity of fish and krill oil for omega-3 benefits.

- Dietary Supplements held a 38.4% market share in 2024, fueled by demand for convenient formats like soft gels and gummies.

- Supermarkets and Hypermarkets captured a 38.6% share in 2024, favored for their wide variety of supplement brands.

- North America dominated with a 32.6% revenue share in 2024, valued at USD 1.9 billion, due to high consumer awareness and robust retail infrastructure.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-fatty-acid-supplements-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.1 Billion |

| Forecast Revenue (2034) | USD 12.6 Billion |

| CAGR (2025-2034) | 7.5% |

| Segments Covered | By Source (Marine Oil, Algal Oil, Flaxseed Oil, Others), By Application (Dietary Supplements, Functional Food, Beverages, Infant Formula, Pharmaceuticals, Others), By Distribution Channel (Supermarket and Hypermarket, Department Stores, Drug Stores, Online, Others) |

| Competitive Landscape | Koninklijke DSM N.V., Arista Industries, Croda Health Care, Copeinca AS, Glaxo Smith Kline plc, EFG Elbe Fetthandel GmbH, Epax AS, KANCOR, Mahashian Di Hatti Pvt., Ltd., Ajinomoto Co. Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156738

Key Market Segments

By Source

Marine Oil dominated the global fatty acid supplements market in 2024, commanding a 48.2% share. Fish oil and krill oil, rich in omega-3 fatty acids like EPA and DHA, drive this segment due to their benefits for heart health, cognitive function, and inflammation reduction. With cardiovascular diseases as the leading cause of death globally, per the World Health Organization, demand for marine-derived supplements remains strong. Sustainable fishing advancements and aquaculture investments ensure a reliable supply, reinforcing marine oil’s market leadership as consumers prioritize high-quality, natural omega-3 sources.

By Application

Dietary supplements led the market in 2024 with a 38.4% share, fueled by demand for convenient formats like capsules, soft gels, and gummies. Growing awareness of omega-3, omega-6, and omega-9 benefits for heart, brain, and immune health drives adoption, especially amid rising lifestyle-related illnesses and nutrient deficiencies. The shift toward preventive healthcare and interest from younger demographics in wellness products, including plant-based and vegan options, supports steady growth in this segment.

By Distribution Channel

Supermarkets and hypermarkets captured a 38.6% market share in 2024, driven by their wide product range, accessibility, and promotional offers. These retail channels benefit from consumer trust and high foot traffic, particularly as health-conscious shopping grows. The expansion of global retail chains into emerging markets and rising middle-class incomes further boost sales, solidifying supermarkets and hypermarkets as the preferred choice for fatty acid supplement purchases.

Regional Analysis

North America held a 32.6% share of the global fatty acid supplements market in 2024, valued at approximately USD 1.9 billion. The U.S. drives this dominance, supported by high consumer awareness of omega-3 benefits, a strong preventive healthcare culture, and a robust retail and e-commerce infrastructure. Product innovations, such as specialized formulations and sustainable sourcing, along with stringent FDA regulations ensuring quality, fuel steady growth. Demand is further propelled by applications in cognitive health, prenatal nutrition, and anti-inflammatory support.

Top Use Cases

- Heart Health Support: People with heart concerns often turn to fatty acid supplements like omega-3s to help maintain better blood flow and reduce strain on the cardiovascular system. These supplements can ease everyday worries about energy levels and overall vitality, making them a simple addition to daily routines for those aiming to stay active and feel more secure in their long-term wellness journey.

- Brain Function Boost: For folks dealing with focus challenges or memory dips, fatty acid supplements provide gentle support to sharpen mental clarity and mood stability. They act like a natural ally for the brain, helping users navigate busy days with less fog and more confidence, especially useful for students or professionals seeking steady cognitive perks without harsh stimulants.

- Joint Comfort Aid: Individuals experiencing stiffness from daily wear or active lifestyles find relief through fatty acid supplements that soothe inflammation around joints. This makes movement easier and more enjoyable, allowing people to pursue hobbies or exercise with reduced discomfort, turning potential limitations into opportunities for a more flexible, pain-free routine.

- Eye Wellness Protection: Those spending hours on screens or noticing subtle vision changes benefit from fatty acid supplements that nurture retinal health and guard against age-related strains. It’s an easy way to promote clearer sight and comfort during prolonged tasks, helping users maintain sharp visuals for work, reading, or leisure without added hassle.

- Immune System Strengthening: In times of seasonal shifts or mild health dips, fatty acid supplements help fortify the body’s natural defenses for quicker bounce-backs. They offer subtle reinforcement to keep users feeling resilient and proactive about wellness, ideal for families or travelers wanting reliable support against everyday environmental stresses.

Recent Developments

1. Koninklijke DSM N.V.

DSM is innovating in algal omega-3s to support sustainability. Their OMEGA portfolio is a key plant-based alternative to fish oil, targeting the dietary supplement and food fortification markets. Recent focus is on promoting the cardiovascular and cognitive benefits of their high-potency, traceable ingredients to brand partners, emphasizing their non-GMO and allergen-free profile.

2. Arista Industries

Arista continues to be a diversified supplier of high-purity oils. A key recent development is the expansion of their GMO-free, plant-based omega offerings, including Ahiflower oil, which boasts a high SDA content for efficient conversion to EPA. They emphasize providing a broad spectrum of fatty acids for B2B clients, focusing on custom formulation support and technical expertise.

3. Croda Health Care

Croda is heavily investing in its Omega-3s for Life strategy, highlighting the importance of EPA and DHA for healthy aging. A major development is the commercialization of its new, highly concentrated and sustainable algal oil, Incromega DHA/EPA V, which offers a triglyceride-form concentration. This addresses demand for high-potency, plant-based solutions in supplements and pharmaceuticals.

4. Copeinca AS

Copeinca AS was acquired by China Fishery Group over a decade ago. The company as an independent entity no longer exists, and its former assets are now part of a larger conglomerate. Therefore, there are no recent developments from the standalone company Copeinca AS in the fatty acid supplement space.

5. Glaxo Smith Kline plc

GSK divested its consumer healthcare division, which included its fatty acid supplement brands like Horlicks and Omega-3 offerings, to form a new independent company called Haleon. Therefore, recent developments for consumer fatty acid supplements now fall under Haleon, not GSK, which is now a pure-play biopharma company focused on vaccines and specialty medicines.

Conclusion

Fatty Acid supplements as a bright spot in the wellness world, riding a wave of smart consumers who prioritize natural heart, brain, and joint care. With folks ditching processed eats for cleaner boosts, these easy pills shine for busy lives, blending proven perks like reduced swelling and sharper focus. Emerging plant-based twists draw in vegans and eco-minded, while steady buzz from health chats fuels fresh growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)