Table of Contents

Overview

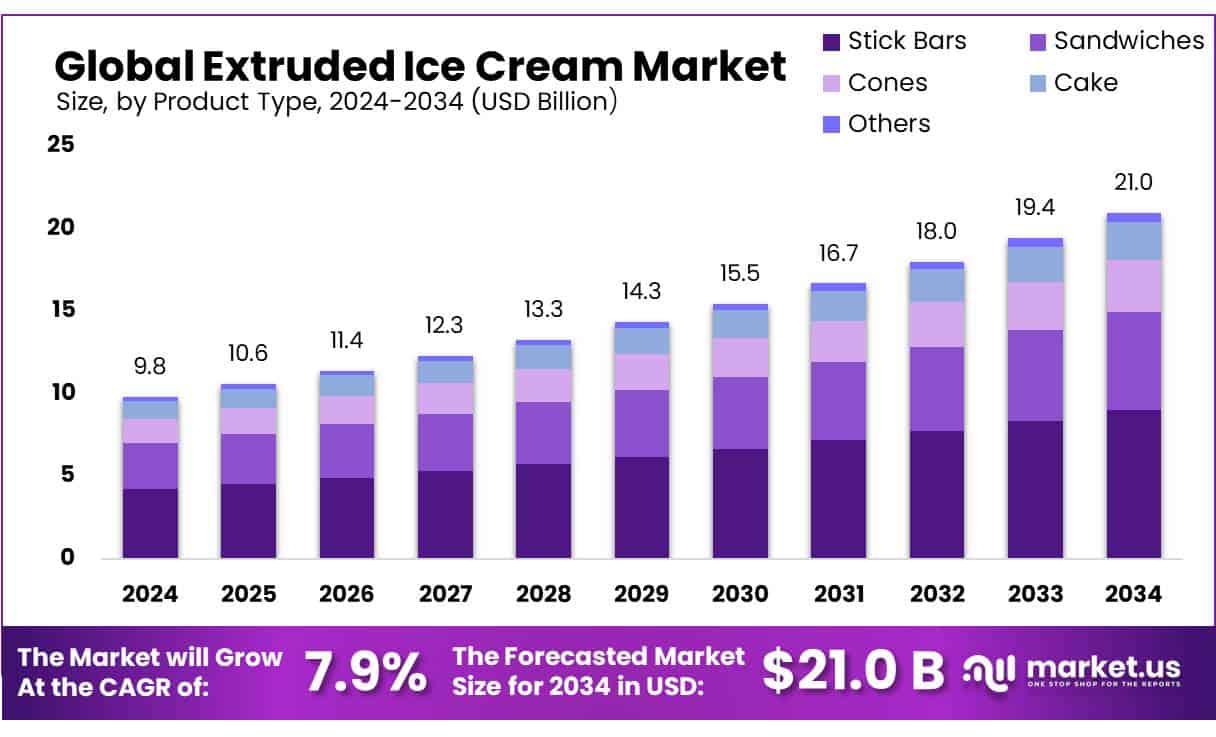

New York, NY – Oct 17, 2025 – The Global Extruded Ice Cream Market is projected to reach approximately USD 21.0 billion by 2034, up from USD 9.8 billion in 2024, registering a CAGR of 7.90% between 2025 and 2034.

Extruded ice cream, produced using extrusion technology, enables continuous manufacturing with consistent shapes and sizes, while allowing the addition of diverse flavors and inclusions. Popular in formats such as sticks, cones, and sandwiches, it appeals to consumers seeking both convenience and innovation in frozen desserts.

Market growth is fueled by advancements in freezing technologies and increased automation in production. Data from the Food and Agriculture Organization (FAO) shows steady global ice cream production growth, with extruded varieties making a notable contribution. In the U.S., production reached about 1.6 billion pounds in 2020, with extruded ice cream holding a significant share. USDA data indicates that U.S. per capita ice cream consumption averages 20.8 pounds annually, supported by rising demand for premium extruded products.

Globally, supportive government policies in the food processing sector are aiding market expansion. For instance, EU regulations on additives and labeling have encouraged innovation and improved product quality. Additionally, government investments in food processing technology R&D have reached up to $50 million in the past year across key markets, directly fostering advancements in ice cream extrusion.

Key Takeaways

- The extruded ice cream market is projected to grow from USD 9.8 billion in 2024 to approximately USD 21.0 billion by 2034, at a CAGR of 7.90%.

- Stick bars dominated the market, accounting for over 43.20% of the total share.

- Chocolate flavor led the market, representing more than 43.30% of the share.

- Supermarkets and hypermarkets were the leading distribution channels, holding over 53.40% of the market share.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/extruded-ice-cream-market/free-sample/

Report Scope

| Market Value (2024) | USD 9.8 Billion |

| Forecast Revenue (2034) | USD 21.0 Billion |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Product Type (Stick Bars, Sandwiches, Cones, Cake, Others), By Flavor (Chocolate, Strawberry, Caramel, Mixed, Others), By Distribution Channel (Supermarkets/Hypermarkets, Ice Cream Parlor, Online Retailers, Others) |

| Competitive Landscape | Blue Bell Creameries, GCMMF, General Mills, Halo Top Creamery, LLC, Lotte Confectionery Co. Ltd., Mars, Incorporated, NOTO, Tillamook, Unilever plc, Vadilal Group, Velvet Ice Cream Company, Inc., Wells Enterprises, Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145021

Key Market Segments

By Product Type

Stick Bars Maintain Leadership with Over 43.20% Share in 2024

In 2024, stick bars continued to dominate the extruded ice cream market, holding more than a 43.20% share. Their strong market position is fueled by their convenient, portable format, making them ideal for on-the-go consumption. The format also supports flavor and ingredient innovation, enabling brands to frequently introduce new varieties that keep consumers engaged. By balancing indulgence with convenience, stick bars have firmly established themselves as the preferred choice among frozen dessert consumers.

By Flavor

Chocolate Remains the Top Choice with Over 43.30% Share in 2024

Chocolate retained its top spot in the extruded ice cream market in 2024, commanding over a 43.30% share. Its enduring popularity stems from broad consumer appeal across age groups and regions. As a timeless classic, chocolate offers both comfort and familiarity, while its versatility allows endless combinations and variations, from rich dark chocolate to innovative pairings. This adaptability ensures it remains a consistent best-seller in the market.

By Distribution Channel

Supermarkets/Hypermarkets Hold Over 53.40% Share in 2024

Supermarkets and hypermarkets dominated extruded ice cream distribution in 2024, accounting for more than 53.40% of sales. Their leadership is driven by their wide product assortments, convenience of one-stop shopping, and strategic locations that ensure accessibility. The ability to stock large volumes and maintain consistent availability also makes them a preferred choice for consumers, solidifying their role as the primary retail channel for extruded ice cream.

Regional Analysis

North America maintained its leading position in the global extruded ice cream market in 2024, capturing a substantial 45.30% share, valued at approximately USD 10.8 billion. This dominance is largely driven by the U.S., where ice cream is deeply ingrained in both cultural traditions and everyday consumption. The region’s strong market performance is supported by high consumer purchasing power, a mature retail infrastructure, and ongoing innovation in flavors and product formats.

Advanced production technologies and expansive distribution networks enable a wide range of extruded ice cream products to be easily accessible through supermarkets, hypermarkets, and convenience stores. The presence of leading global brands, alongside an increasing number of artisanal and specialty manufacturers, keeps the market competitive and diverse.

Consumer preferences in North America continue to favor premium ice cream options, valued for their superior taste and quality. Additionally, growing interest in low-calorie and sugar-free varieties is shaping product development and influencing market strategies across the region.

Top Use Cases

- Commercial Chain Dessert Innovation:

Retail brands and foodservice outlets use extrusion technology to launch new ice cream formats like stick bars, bonbons, or shaped logs which help refresh their menus and attract trend-conscious consumers with unique textures, shapes, and appearances.

- High-Speed Industrial Production:

Large-scale manufacturers deploy extrusion lines in their factories to produce consistent, uniform ice cream products at high volumes with minimal labor, ensuring scalability and cost efficiency across supermarket supply chains.

- Inclusion-Rich Ice Cream Products:

Producers use extrusion systems capable of integrating large mix-ins such as cookie pieces or fruit chunks while preserving their structure, enabling premium product differentiation and enhancing visual and textural appeal to consumers.

- Health-Oriented and Specialty Varieties:

The extrusion process supports customization for emerging trends such as low-calorie, sugar-free, plant-based, or protein-enriched ice creams helping brands meet specific consumer dietary needs and carve niche segments.

- Flexible Product Customization for Catering & HORECA:

In hospitality and catering (HoReCa) sectors, extrusion allows suppliers to tailor individual dessert formats like mini-bars or novelty shapes helping chefs and event planners delight guests with bespoke frozen treats.

Recent Developments

- Blue Bell Creameries:

- Blue Bell has recently pledged to eliminate certified artificial colors such as Red 3, Red 40, Green 3, Blue 1 & 2, Yellow 5 & 6 from its ice cream products by December 31, 2027, aligning with the International Dairy Foods Association’s industry-wide initiative. Additionally, it revived its fan-favorite “Groom’s Cake” flavor in May 2025 after a seven-year hiatus, following a public vote through its “Great Scoop Revival Flavor Tournament”.

2. General Mills:

- General Mills’ food scientists have developed a novel ice cream formulation that remains solid for hours even in high heat by incorporating tannic acid, a plant-based antioxidant. This innovation underscores the company’s commitment to product performance and texture improvements in frozen desserts.

3. Mars, Incorporated:

- Mars Ice Cream unveiled plans to scale its ice cream business to USD 1 billion by 2030, backed by sustainability-driven innovations in packaging and ingredient sourcing such as reducing plastic use across product lines and supporting vanilla farmers financially. The company also launched the “Mars Ice Cream Innovation Studio” in Hackettstown, New Jersey a cutting-edge R&D facility featuring a test kitchen and packaging lab to accelerate product and sustainability advances.

4. Halo Top Creamery, LLC:

- Recent media coverage has raised health concerns about the sweetener erythritol used in Halo Top products, citing studies linking it to potential vascular effects and elevated risk of stroke or heart attack. Meanwhile, in retail news, a nationwide recall affected nearly 18,000 containers of Halo Top (and Blue Bunny) due to possible plastic contamination

5. Lotte Confectionery Co. Ltd.:

- Lotte Wellfood is aggressively expanding its ice cream operations: it completed a merger of its Indian subsidiaries to form a streamlined “One India” entity and is targeting 15% sales growth in India in the current year following the integration. Previously, Lotte invested USD 164 million to build the largest ice cream factory in South Korea by 2026

Conclusion

The global extruded ice cream market is witnessing steady expansion, supported by product innovation, facility upgrades, and strategic market positioning by key players. Tillamook has boosted capacity with a new Illinois plant and added popular flavors to its permanent lineup, enhancing national reach. Unilever is reshaping its ice cream portfolio with new product lines and preparing to spin off the business as the “Magnum Ice Cream Company” by late 2025.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)