Table of Contents

Overview

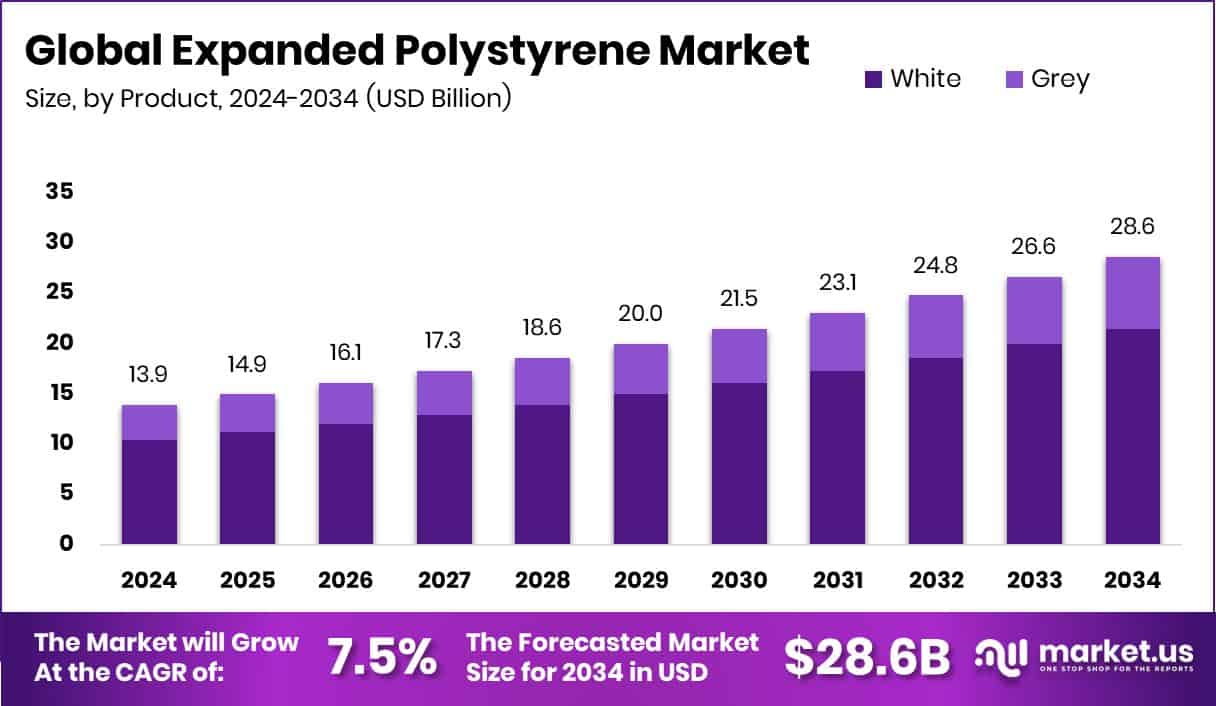

New York, NY – October 15, 2025 – The Global Expanded Polystyrene (EPS) Market is projected to reach USD 28.6 billion by 2034 from USD 13.9 billion in 2024, expanding at a 7.5% CAGR. Asia Pacific leads with 44.8% of the market, driven by robust infrastructure growth and packaging demand.

EPS, a lightweight cellular plastic made from expanded polystyrene beads, is valued for its insulation, cushioning, and shock-absorbing properties. It is widely used in packaging, construction, insulation, and disposable containers. Rising e-commerce and building efficiency initiatives are key growth drivers, while recycling and sustainability pressures are reshaping production.

Funding activity highlights this shift: Mushroom Material secured USD 8.5 million to develop bio-based, fungus-derived EPS alternatives, and Polystyvert raised USD 16 million in Series B funding to enhance recycling for styrenic plastics. These efforts align with global moves toward circularity and reduced virgin resin dependency.

However, future demand will hinge on cost competitiveness, evolving regulations, and the adoption of biodegradable or recyclable substitutes. Overall, EPS maintains strong demand in packaging and construction, but innovation in bio-based and recycled materials—backed by recent funding—signals a transformation toward a more sustainable and circular EPS industry.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-expanded-polystyrene-market/request-sample/

Key Takeaways

- The Global Expanded Polystyrene Market is expected to be worth around USD 28.6 billion by 2034, up from USD 13.9 billion in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034.

- In 2024, White Expanded Polystyrene Market dominated with a 74.9% share, driven by insulation demand.

- Construction applications led the Expanded Polystyrene Market with 44.8% share, fueled by rising energy-efficient building projects worldwide.

- The Asia Pacific market value reached around USD 6.2 billion, driven by construction demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161052

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 13.9 Billion |

| Forecast Revenue (2034) | USD 28.6 Billion |

| CAGR (2025-2034) | USD 28.6 Billion |

| Segments Covered | By Product (White, Grey), By Application (Construction, Packaging, Automotive, Others) |

| Competitive Landscape | BASF SE, Alpek S.A.B. de C.V., LG Chem, KANEKA CORPORATION, SIBUR, SUNPOR, Synthos, TotalEnergies, Supreme Petrochem Ltd, NOVA Chemicals |

Key Market Segments

By Product Analysis

In 2024, White Expanded Polystyrene (EPS) dominated the market’s product segment with a 74.9% share. Its leadership stemmed from extensive use in packaging, insulation, and lightweight construction applications. The material’s low cost, easy molding, and superior thermal insulation made it a preferred choice across multiple industries. White EPS plays a crucial role in protective packaging for electronics, appliances, and food items, ensuring product safety and stability during transport.

Its recyclability and long-lasting nature further strengthened demand, particularly as industries pursue sustainable material solutions. Owing to these advantages, white EPS remains the most commercially successful and widely adopted variant in the global market.

By Application Analysis

In 2024, the Construction segment dominated the Expanded Polystyrene (EPS) Market by application, accounting for 44.8% of total demand. EPS is highly valued in this sector for its superior thermal insulation, lightweight composition, and cost-effectiveness. It is extensively used in insulation boards, roofing, and structural panels, providing strong moisture resistance and long-term energy efficiency.

The growing focus on sustainable, energy-efficient buildings continues to boost EPS adoption in both residential and commercial construction. Its ability to lower project costs while improving environmental performance makes it an essential material in modern architecture, reinforcing its leading role within global construction applications.

Regional Analysis

In 2024, Asia Pacific dominated the global Expanded Polystyrene (EPS) Market with a 44.80% share, valued at about USD 6.2 billion. This strong position was supported by rapid construction growth and packaging demand in China, India, and Southeast Asia. Expanding infrastructure, fast urbanization, and rising use of energy-efficient materials boosted EPS adoption for insulation and lightweight building solutions.

North America maintained steady demand through renovation projects and consumer packaging, while Europe advanced with strict sustainability standards and recycling efforts. The Middle East & Africa benefited from increasing investments in housing and infrastructure, and Latin America showed gradual growth via packaging applications.

Overall, Asia Pacific’s dominance reflects its manufacturing strength, expanding consumer base, and government policies promoting energy-efficient construction, solidifying its leadership in global EPS consumption.

Top Use Cases

- Building Insulation: EPS boards are placed in walls, roofs, and floors to keep homes warm in winter and cool in summer. Their closed-cell foam traps air and resists moisture, improving energy efficiency.

- Protective Packaging for Electronics & Fragile Goods: EPS is molded into custom inserts around TVs, computers, appliances, and glassware to absorb shocks during shipping, protecting delicate items

- Food & Cold Chain Containers: EPS is used to make foam trays, cups, and insulated boxes for seafood, fruits, meat, or ice cream—keeping them at stable low temperatures during transport.

- Insulated Concrete Forms / Structural Panels: EPS core is used in insulated concrete forms (ICFs) or sandwich panels (SIPs), combining structural strength with insulation in walls or roofs.

- Horticulture & Seedling Trays: EPS trays are widely used to germinate seedlings—lightweight, insulating, and easy to shape—helping protect young plants and maintain soil warmth.

Recent Developments

- In August 2025, Kaneka’s Green Planet™ foam-molded material (used in Sony BRAVIA TV packaging) won the 49th Kinoshita Packaging Technology Award, acknowledging innovation in replacing EPS/foam with a biodegradable variant.

- In June 2025, SIBUR raised its target for recycled plastics to 600,000 metric tons per year by 2030 and increased its low-carbon/bio-based product goals to 400,000 metric tons per year. This suggests a strategic direction toward sustainability and circularity in polymer production.

- In March 2025, BASF introduced a pilot building insulation board using Neopor® F 5 Mcycled™, which contains ~10% mechanically recycled EPS. The board was applied to the façade of a residential building in Frankfurt as part of a retrofit project.

- In November 2024, Alpek announced it would close its Beaver Valley EPS facility in Monaca, Pennsylvania, by January 2025. That plant had a capacity of ~123,000 tons of EPS and represented less than 2% of Alpek’s total assets. The company plans to shift production to its other EPS plants to reduce costs.

Conclusion

The Expanded Polystyrene Market is evolving toward greater sustainability and innovation. Growing environmental awareness is driving manufacturers to explore recyclable and bio-based alternatives while maintaining the material’s core benefits of insulation, durability, and cost efficiency. Increasing applications in construction, packaging, and consumer goods continue to strengthen market relevance.

Industry players are also investing in circular economy initiatives and advanced recycling technologies to reduce waste and improve resource efficiency. As global regulations tighten around plastic usage, expanded polystyrene is transitioning toward more sustainable production models, ensuring its continued importance across diverse industrial and consumer applications in the years ahead.