Table of Contents

Introduction

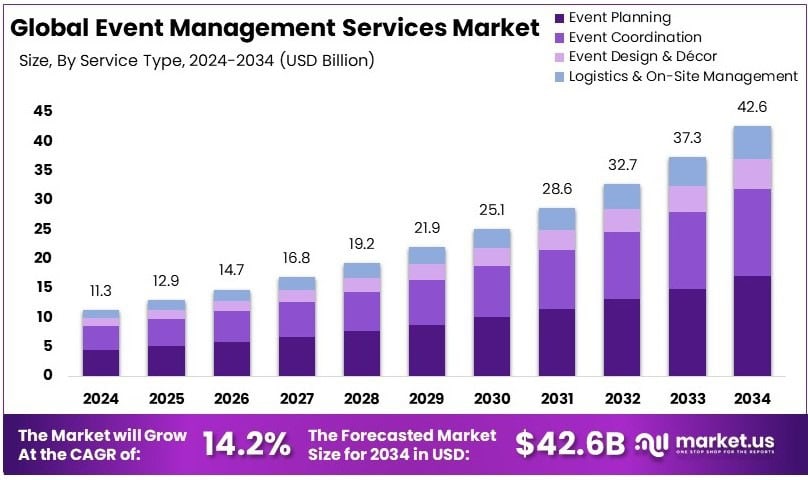

New York, NY – March 27, 2025 – The Global Event Management Services Market is projected to reach approximately USD 42.6 billion by 2034, up from USD 11.3 billion in 2024, representing a compound annual growth rate (CAGR) of 14.2% from 2025 to 2034.

Event management services encompass a broad range of professional services involved in planning, organizing, coordinating, and executing various events, such as corporate events, conferences, weddings, and festivals. These services include venue selection, logistics management, marketing, catering, entertainment, security, and guest management. The event management services market refers to the commercial ecosystem around these activities, which includes service providers such as event planners, coordinators, agencies, and technology platforms that facilitate event execution.

The market is driven by the growing demand for seamless, highly organized events across industries, such as corporate, entertainment, and social gatherings. Several growth factors have contributed to the expansion of the event management services market. Technological advancements, including event management software and mobile apps, have made event planning more efficient and cost-effective. Additionally, the increasing prevalence of virtual and hybrid events has created new avenues for growth, enabling a broader audience reach and a more diverse set of service offerings.

The demand for event management services has been significantly fueled by the rising number of corporate events, trade shows, and destination events, as organizations continue to invest in enhancing their brand presence and customer engagement. Furthermore, the growing trend of experiential marketing, where brands focus on delivering memorable experiences, has increased the need for specialized event services.

Key opportunities in this market include the expanding scope of personalized and niche event offerings, as well as the rise in demand for sustainable event management solutions. With continued technological innovation and an increasing emphasis on unique, high-quality event experiences, the market is expected to maintain its positive growth trajectory.

Key Takeaways

- The Event Management Services Market was valued at USD 11.3 billion in 2024 and is projected to reach USD 42.6 billion by 2034, growing at a CAGR of 14.2%.

- In 2024, Event Planning services dominate the service type segment, emphasizing their vital role in successful event execution.

- Corporate Events lead the event type category in 2024, driven by an increase in business activities and professional gatherings.

- Corporate Organizations are the leading end-users in 2024, reflecting their heavy reliance on professional event management services.

- North America is the market leader in 2024, with strong demand for organized event services across various industries.

Request a Sample Copy of This Report at https://market.us/report/event-management-services-market/request-sample/

Event Management Services Statistics

- The global events industry is projected to reach $2.5 trillion by 2035.

- 79% of event professionals use Event Management Systems to optimize planning.

- 59% of respondents prefer in-person events over other formats.

- Two-thirds of event attendees feel more positively about brands they interact with at events.

- 78% of organizers consider in-person conferences the most impactful marketing channel.

- In 2025, 24% of event professionals will focus on technological advancements.

- Artificial intelligence (AI) will be used by 50% of event professionals to enhance events.

- 80% of organizers view in-person events as critical to organizational success.

- 50% of planners prioritize event size and capacity when selecting venues.

- 44% consider services and facilities essential when choosing event locations.

- 42% of planners focus on cost as a key consideration.

- 34% of planners value food and beverage options, while 33% consider event date and seasonality.

- 32% of planners emphasize accessibility and technological capabilities when planning events.

- 79% of attendees conduct research on event topics before attending.

- 75% of event sponsors use events to explore new partnerships.

- 63% of marketers leverage trade shows for lead generation.

- 79% of professionals believe events significantly contribute to revenue.

- 25% of event budgets are dedicated to contingency planning.

Emerging Trends

- Integration of Technology: The adoption of technological solutions, such as event management software and mobile applications, has streamlined event planning and execution. For instance, French company Weezevent reported a significant increase in revenues from €23 million in 2013 to €350 million in 2023, attributed to its technological offerings in ticketing and cashless payments.

- Hybrid Events: Combining in-person and virtual elements, hybrid events have gained prominence, offering flexibility and broader reach. However, challenges persist, with 42% of marketers expressing concerns over the effectiveness of hybrid events.

- Sustainability Initiatives: There’s a growing emphasis on eco-friendly practices, such as reducing waste and promoting green venues, aligning with global sustainability goals.

- Data-Driven Decision Making: Utilizing data analytics to assess attendee engagement and event performance has become essential, enabling organizers to tailor experiences and improve outcomes.

- Personalized Experiences: Customizing events to cater to individual preferences enhances attendee satisfaction, leading to increased loyalty and positive word-of-mouth.

Top Use Cases

- Corporate Conferences: Organizing industry-specific conferences facilitates networking and knowledge sharing among professionals.

- Trade Shows and Exhibitions: These events provide platforms for businesses to showcase products and services, attracting potential clients and partners.

- Music and Cultural Festivals: Managing large-scale festivals requires meticulous planning to ensure smooth operations and attendee enjoyment.

- Weddings and Social Gatherings: Personal events benefit from professional management, ensuring seamless execution and memorable experiences.

- Sports Events: Coordinating sports tournaments and matches demands precise logistics and audience engagement strategies.

Major Challenges

- Budget Constraints: Managing event costs effectively while delivering quality experiences remains a significant challenge. Financial limitations often lead to compromises in event quality.

- Technological Integration: Incorporating new technologies can be hindered by high costs and resistance to change among stakeholders. The cost of technology was identified as the biggest challenge to adopting new tools for business events.

- Attendee Engagement: Capturing and maintaining attendee interest in a competitive market requires innovative content and interactive formats.

- Logistical Complexities: Coordinating various aspects, from venue selection to vendor management, involves intricate planning and execution.

- Compliance and Regulations: Adhering to local and international regulations, including health and safety standards, necessitates thorough knowledge and vigilance.

Top Opportunities

- Virtual and Hybrid Event Solutions: Developing platforms that support virtual and hybrid events opens new revenue streams and expands audience reach.

- AI and Automation: Implementing artificial intelligence for tasks like attendee registration and personalized recommendations enhances efficiency and user experience.

- Experiential Marketing: Creating immersive and interactive event experiences can significantly boost brand engagement and loyalty.

- Data Analytics Services: Offering analytics services to assess event performance and attendee behavior provides valuable insights for future planning.

- Sustainability Consulting: Assisting clients in organizing eco-friendly events aligns with global sustainability trends and appeals to environmentally conscious audiences.

Purchase the Full Report Now at https://market.us/purchase-report/?report_id=137094

Key Player Analysis

The Global Event Management Services Market in 2024 is characterized by a diverse group of prominent players, each offering unique services that cater to various segments of the market. Freeman, a leader in the industry, is known for providing comprehensive event solutions including design, logistics, and technology. Their focus on creating immersive experiences positions them as a key player in driving market growth.

Informa Markets and Reed Exhibitions, both major players in the trade show and exhibition sector, contribute significantly to the market by facilitating large-scale global events that attract industry professionals. Live Nation Entertainment, with its vast network in the entertainment space, continues to expand its presence by integrating technology and live events, further enhancing customer engagement.

Cvent and BCD Meetings & Events, specializing in corporate meetings and events, benefit from growing demand for business travel management and event planning software. Companies like MCI Group, George P. Johnson Experience Marketing, and Jack Morton Worldwide focus on creating experiential marketing campaigns that are crucial for brand activation.

The evolving role of digital transformation in the event management space is reinforced by players such as Capita Travel and Events, which emphasize technology-driven solutions. With the market steadily evolving, these key players are expected to remain integral in shaping the industry’s future.

Top Companies in the Market

- Freeman

- Informa Markets

- Reed Exhibitions

- Live Nation Entertainment

- Clarion Events

- Cvent

- BCD Meetings & Events

- MCI Group

- George P. Johnson Experience Marketing

- SMG (now ASM Global)

- Conference Care

- Capita Travel and Events

- Jack Morton Worldwide

Recent Developments

- In 2025, American Express Global Business Travel (Amex GBT), operated by Global Business Travel Group, Inc. (NYSE: GBTG), announced a revised merger agreement with CWT. This updated arrangement follows their original merger agreement from March 2024. The adjustment reflects new terms that further solidify the partnership, positioning both companies for greater growth in the travel, expense, and meetings sectors.

- In 2024, Planned secured $35 million in Series B funding, marking a significant milestone in their growth journey. Having already experienced a 30x revenue increase since their Series A, Planned now counts top-tier clients like PwC, AWS, and Instacart among its partners. The new investment promises to fuel further innovations in the travel and events industry, benefiting both the company and its expanding network of clients.

- In 2024, Groupize completed the acquisition of The Vendry, enhancing its offerings in the meetings and travel management sector. The addition of over 73,000 venues and vendors expands Groupize’s extensive database, which now includes more than 190,000 global hotels. This acquisition will significantly enrich the experience for corporate event planners, who now have access to an even broader array of resources to meet their planning needs.

- In 2024, Grip, an AI-driven event platform, acquired the event management system (EMS) from Connectiv Holdings. This strategic acquisition enhances Grip’s product suite, now offering comprehensive tools for event organizers, including registration, exhibitor management, and advanced badge features. With this acquisition, Grip strengthens its position as a complete, end-to-end solution for commercial event organizers looking to maximize revenue and streamline operations.

- In September 2024, Events.com, a leader in event management technology, announced the expansion of its Share Subscription Facility (SSF) with Global Emerging Markets (GEM) to $200 million. This increase from the initial $100 million commitment highlights the strong market confidence in Events.com and its potential to revolutionize the events industry with cutting-edge solutions.

- In January 2024, Cvent, a leader in meetings and events technology, announced the acquisition of Jifflenow and iCapture. These acquisitions enhance Cvent’s ability to provide superior scheduling and lead capture solutions for corporate events. With Jifflenow’s appointment scheduling tools and iCapture’s lead management capabilities, Cvent is further solidifying its market leadership as a comprehensive solution provider for in-person business events.

Conclusion

The event management services sector is experiencing significant expansion, propelled by technological innovations and a heightened demand for both corporate and entertainment events. The integration of advanced technologies, such as artificial intelligence and virtual reality, has streamlined event planning processes, enhancing engagement and operational efficiency. This trend is particularly evident in regions like India, where a burgeoning young and affluent population is attracting global music artists, thereby boosting the live entertainment market. However, the industry faces challenges, including economic fluctuations and regulatory complexities, which necessitate strategic adaptation by event management professionals. Overall, the market outlook remains positive, with sustained growth anticipated as the sector continues to innovate and meet evolving consumer demands.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)