Table of Contents

Introduction

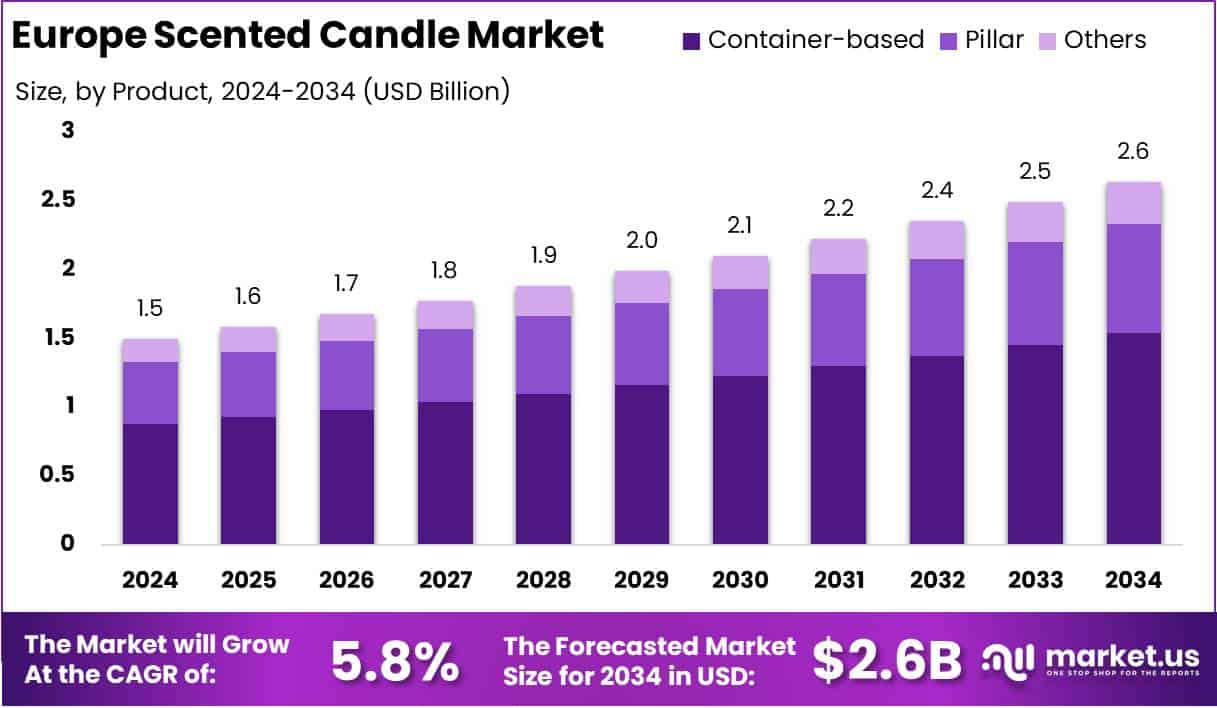

New York, NY – March 07, 2025 – The Europe scented candle market is projected to reach approximately USD 2.6 billion by 2034, up from USD 1.5 billion in 2024, registering a compound annual growth rate (CAGR) of 5.8% during the forecast period of 2025 to 2034.

The Europe scented candle market refers to the segment within the broader home fragrance industry, encompassing candles infused with various aromatic compounds designed to provide pleasant scents and enhance indoor ambiance. The European scented candle market comprises diverse product offerings, ranging from luxury and premium scented candles to mass-market varieties, appealing to a wide consumer demographic across countries such as Germany, France, the UK, Italy, and Scandinavia.

Growth within this market can be attributed to several key factors, including increasing consumer preference for wellness, relaxation, and lifestyle-enhancing products. Rising disposable incomes and shifting consumer behaviors toward home decor and aesthetic enhancement have further bolstered market demand.

Additionally, growing awareness about the benefits of aromatherapy, coupled with consumer inclination toward eco-friendly and natural products, has positively influenced purchasing decisions. Demand remains robust, particularly driven by younger consumers and millennials who exhibit significant interest in premiumization and personalized home fragrance experiences. Seasonal gifting trends and the prevalence of scented candles as decorative items also consistently drive market demand throughout the year.

Opportunities within the European scented candle market lie notably in product innovation, sustainability initiatives, and expansion into online sales channels. Manufacturers are increasingly focusing on eco-conscious consumers by introducing sustainable packaging and natural ingredients, presenting potential growth avenues. Furthermore, expanding digital marketing strategies and direct-to-consumer platforms offer considerable opportunity for market players aiming to enhance consumer engagement, increase brand visibility, and capture market share in this steadily growing segment.

Key Takeaways

- The Europe scented candle market is projected to expand from USD 1.5 billion in 2024 to USD 2.6 billion by 2034, with a CAGR of 5.8% during 2025-2034.

- Container-based scented candles represented the largest segment, holding 58.4% of the market in 2024.

- Paraffin wax emerged as the leading wax type, capturing 38.3% of the total market share in 2024.

- Jar candles were the dominant product category, accounting for 47.4% of the market in 2024.

- The mass segment significantly contributed to the market, holding a share of 62.3% in 2024.

- Floral fragrances were the most preferred fragrance type, representing 28.3% of the market share in 2024.

- Supermarkets and hypermarkets led distribution channels, accounting for 44.4% of total sales in 2024.

Europe Scented Candle Market Statistics

- Europe accounts for 60% of global candle imports.

- The European Union consumed approximately 756,000 tons of candles in 2023, a 13.4% decline from 2022.

- Poland exported 266,000 tons of candles in 2023, marking a 17.9% decrease from 2022.

- Germany remains the top importer of Polish candles.

- The EU imported 170,500 tons of candles in 2023.

- The EU candle production in 2023 was valued at €1.9 billion.

- Soy candles burn cleaner, last longer, and are 100% vegan, unlike paraffin candles.

- Over 90% of candle users light them for a relaxing ambiance.

- Candles cause an average of 23 house fires daily in the U.S.

- The Holocaust Children’s Memorial in Israel has a hall of mirrors lit by six candles, symbolizing 1.5 million children lost.

- The Stockholm Exhibition displayed a 24.38-meter-tall candle.

- More than 350 candle companies operate in the United States.

- 90% of German consumers have purchased home wellness products such as scented candles, and 59% use them regularly.

- 94% of British consumers have bought scented candles, with 64% using them regularly.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 2.6 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Product (Container-based, Pillar, Others), By Wax Type (Synthetic Wax, Paraffin Wax, Plant-Based Wax, Animal Wax), By Product Type (Jar, Pillar, Tea Light, Floating Candles, Others), By Category (Mass, Premium), By Fragrance (Fruity, Floral, Exotic, Spicy and Sweet, Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | Desirepath Mississippi, LLC, Diptyque Distribution LLC, Diptyque Paris, GALA GROUP GMBH, Godrej Consumer Products Ltd., Heaven Scent Incense Limited, Lalique Group SA, MVP Group International Inc., NEST Fragrances, Newell Brands Inc., Paddywax LLC, Portmeirion Group Limited , Prolitec, Reckitt Benckiser Group PLC, S.C. Johnson and Son Inc., ScentAir Technologies LLC, Seda France, The Bridgewater Candle Co., The Estée Lauder Companies Inc. , The Procter and Gamble Co., Welburn Candles Pvt. Ltd., Whax Holdings Ltd. |

Emerging Trends

- Home Wellness Integration: A significant majority of European consumers, ranging from 59% to 73%, regularly purchase and use home wellness products such as scented candles, indicating a strong integration of these items into daily routines.

- Seasonal and Festive Demand: The demand for candles increases notably during European festivals like Christmas and Easter, reflecting cultural practices that incorporate candle usage during celebrations.

- Sustainable Product Preferences: There is a growing consumer preference for eco-friendly candles made from natural materials like soy wax and beeswax, aligning with broader environmental consciousness.

- Diverse Fragrance Offerings: Manufacturers are expanding their product lines to include a wide variety of scents, catering to diverse consumer preferences and enhancing the sensory experience associated with scented candles.

- E-commerce Expansion: The online segment is experiencing significant growth, with consumers increasingly purchasing candles through e-commerce platforms, benefiting from the convenience and access to a broader product range.

Top Use Cases

- Home Ambiance Enhancement: Scented candles are widely used to create a pleasant and inviting atmosphere within homes, contributing to interior aesthetics and comfort.

- Aromatherapy Practices: The use of scented candles in aromatherapy has gained popularity, offering relaxation and stress relief benefits through specific fragrances.

- Gifting Purposes: Scented candles have become popular gift items, especially during holidays and special occasions, due to their aesthetic appeal and perceived luxury.

- Event Decorations: Candles are commonly utilized in event settings, such as weddings and parties, to enhance ambiance and décor.

- Mindfulness and Meditation: Individuals incorporate scented candles into mindfulness and meditation practices to create a calming environment conducive to focus and relaxation.

Major Challenges

- Competition from Alternative Fragrance Products: The availability of alternative home fragrance products, such as electric diffusers and scented sprays, presents competition to traditional candles.

- Market Saturation: The abundance of candle brands and products in the market can make it challenging for new entrants to establish a unique presence.

- Raw Material Sourcing: Fluctuations in the availability and cost of raw materials, such as natural waxes, can impact production and pricing strategies.

- Environmental Concerns: Consumers are increasingly scrutinizing the environmental impact of candle production and disposal, pushing companies toward more sustainable practices.

- Regulatory Compliance: Adherence to stringent safety and quality regulations within the European Union requires continuous compliance efforts from manufacturers.

Top Opportunities

- Development of Eco-Friendly Products: Investing in the creation of candles made from sustainable materials can attract environmentally conscious consumers.

- Personalization and Customization: Offering personalized candle options, such as custom fragrances or designs, can enhance consumer engagement and loyalty.

- Expansion into Emerging Markets: Exploring untapped markets within Europe, particularly in Eastern European countries, can provide new growth avenues.

- Collaborations with Artists and Designers: Partnering with creatives to produce limited edition candles can differentiate products and appeal to niche markets.

- Technological Integration: Incorporating technology, such as smart candles that can be controlled via mobile applications, may attract tech-savvy consumers seeking modern home accessories.

Key Player Analysis

The Europe Scented Candle Market in 2024 is characterized by a diverse competitive landscape, with both established global brands and niche luxury players driving growth. Newell Brands Inc., Reckitt Benckiser Group PLC, and Procter & Gamble Co. remain dominant, leveraging their extensive distribution networks and brand equity to maintain significant market shares.

Their focus on product innovation, sustainability, and premiumization continues to shape consumer preferences. Similarly, S.C. Johnson and Son Inc., known for its air care expertise, has expanded its scented candle portfolio with eco-friendly and long-lasting fragrances to appeal to environmentally conscious consumers.

Luxury and artisanal brands, such as Diptyque Paris, Lalique Group SA, and NEST Fragrances, have strengthened their market positioning by catering to the premium segment. These companies emphasize craftsmanship, high-quality natural ingredients, and unique fragrance blends, attracting affluent consumers seeking exclusivity.

Portmeirion Group Limited and Paddywax LLC have also capitalized on the demand for aesthetically designed home décor candles, integrating sophisticated packaging with artisanal scents.

Emerging players such as Welburn Candles Pvt. Ltd., Whax Holdings Ltd., and The Bridgewater Candle Co. are intensifying competition by focusing on sustainable practices, soy-based wax, and ethical sourcing. Meanwhile, technology-driven firms like ScentAir Technologies LLC and Prolitec are innovating in the home and commercial fragrance segment, offering automated scent diffusion solutions.

Top Key Players in the Market

- Desirepath Mississippi, LLC

- Diptyque Distribution LLC

- Diptyque Paris

- GALA GROUP GMBH

- Godrej Consumer Products Ltd.

- Heaven Scent Incense Limited

- Lalique Group SA

- MVP Group International Inc.

- NEST Fragrances

- Newell Brands Inc.

- Paddywax LLC

- Portmeirion Group Limited

- Prolitec

- Reckitt Benckiser Group PLC

- S.C. Johnson and Son Inc.

- ScentAir Technologies LLC

- Seda France

- The Bridgewater Candle Co.

- The Estée Lauder Companies Inc.

- The Procter and Gamble Co.

- Welburn Candles Pvt. Ltd.

- Whax Holdings Ltd.

Regional Analysis

The European scented candle market has witnessed steady growth, driven by increasing consumer demand for home fragrances and premium lifestyle products. Germany holds a dominant position in the market, emerging as the leading importer, followed by the United Kingdom and the Netherlands, which also contribute significantly to the market share. France, Belgium, and Austria represent smaller but notable markets, supporting regional demand through a growing preference for aromatherapy and decorative candles. The market’s expansion is further influenced by evolving consumer preferences, rising disposable income, and the growing influence of online retail channels.

Recent Developments

- In 2024, L Catterton invests in British fragrance brand Vyrao, founded by former fashion buyer Yasmin Sewell. The niche brand successfully secures its second round of funding, with participation from Manzanita Capital and Estée Lauder’s corporate venture arm.

- In 2024, Puig acquires a majority stake in Dr. Barbara Sturm, the luxury skincare brand established in 2014 by Dr. Barbara Sturm. Recognized for her expertise in anti-inflammatory treatments, Dr. Sturm has developed a premium portfolio spanning skincare, body care, haircare, and supplements.

- In 2024, Bic finalizes the acquisition of Tangle Teezer, the UK-based hairbrush brand. The deal, valued at 200 million euros, sees the consumer goods giant expanding its beauty portfolio with the well-known brush manufacturer, previously owned by Mayfair Equity Partners.

- In 2024, Violette_FR secures Series B funding to accelerate global expansion, enhance digital capabilities, and drive product innovation. Founded by Violette Serrat, the French makeup brand attracts investment from Silas Capital and Experience Capital, reinforcing its growth ambitions.

Conclusion

The European scented candle market is set to grow steadily, driven by increasing consumer demand for home ambiance, wellness, and aromatherapy products. Factors such as rising disposable incomes, eco-conscious preferences, and expanding online sales channels are fueling market expansion. While challenges like market saturation and competition from alternative home fragrance products exist, opportunities in product innovation, sustainability, and personalized experiences will continue to shape market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)