Table of Contents

Overview

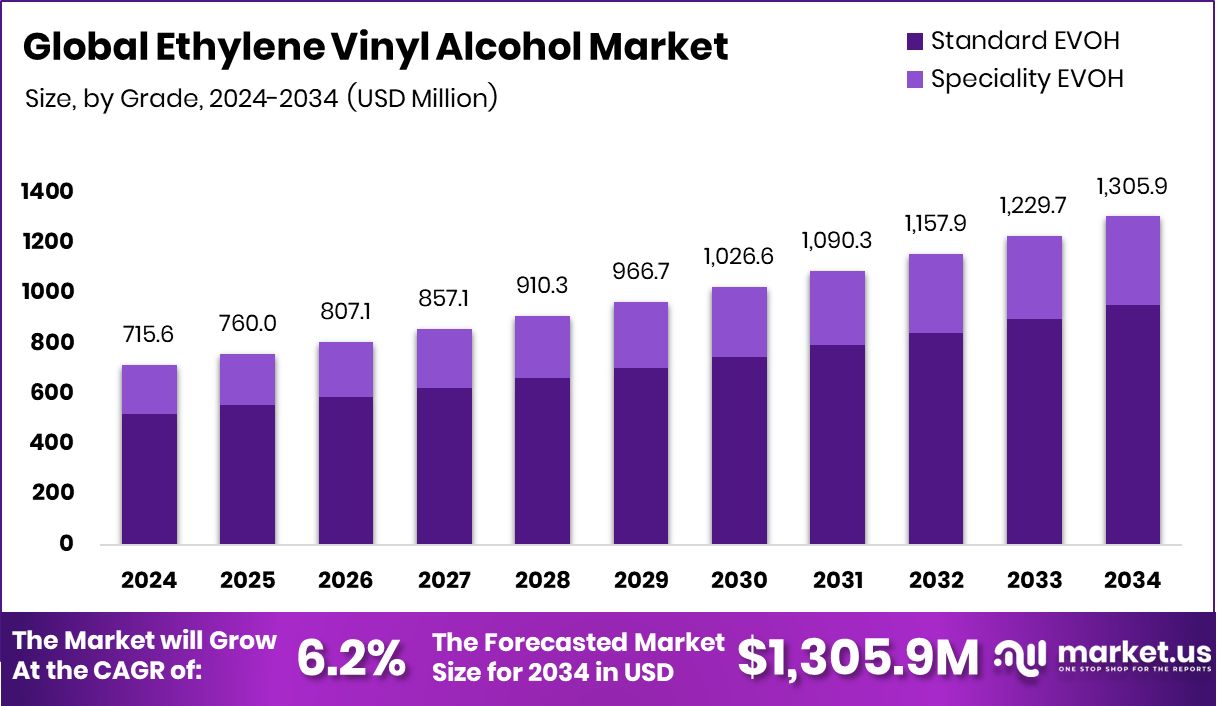

New York, NY – Nov 17, 2025 – The global Ethylene Vinyl Alcohol (EVOH) market is projected to increase from USD 715.6 million in 2024 to USD 1,305.9 million by 2034, growing at a 6.2% CAGR as adoption accelerates across sustainable, high-barrier packaging applications. The Asia-Pacific region holds 42.30% of the market, supported by rising demand for manufacturing and consumer packaged goods.

EVOH, a copolymer of ethylene and vinyl alcohol, is valued for its excellent gas-block properties, chemical resistance, and clarity, allowing long-shelf-life packaging for foods, pharmaceuticals, cosmetics, and sensitive industrial products. Its recyclability and compatibility with multilayer structures align with global sustainability commitments.

Growth is heavily influenced by food-safety regulations, shelf-life extension needs, and rising packaged-food consumption driven by urban lifestyles and e-commerce shipments. Manufacturers are also adopting advanced co-extrusion processes for lightweight and performance-driven packaging formats. Beyond food, EVOH is gaining relevance in medical devices, fuel systems, and eco-focused consumer brands aiming to replace traditional barrier plastics.

Recent funding momentum in clean beauty and green packaging reinforces future collaborations. Notable rounds include Renee Cosmetics (USD 30 million), Sugar Cosmetics (USD 4.5 million), Pilgrim (₹200 crore), Greenitio (USD 1.5 million), and Mila Beauté (USD 2.16 million). These investments signal a rising preference for sustainable packaging partners, creating strategic entry points for EVOH manufacturers.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-ethylene-vinyl-alcohol-market/request-sample/

Key Takeaways

- The Global Ethylene Vinyl Alcohol Market is expected to be worth around USD 1,305.9 million by 2034, up from USD 715.6 million in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- Standard Ethylene Vinyl Alcohol Market grade holds 72.9% share, driven by food safety and preservation needs.

- Films and sheets form 44.2% of the Ethylene Vinyl Alcohol Market, essential for flexible packaging.

- Packaging dominates the Ethylene Vinyl Alcohol Market with an 84.3% share due to sustainability trends.

- The Asia-Pacific market value reached approximately USD 281.2 million, driven by rising packaging demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165015

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 715.6 Million |

| Forecast Revenue (2034) | USD 1,305.9 Million |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Grade (Standard EVOH, Speciality EVOH), By Downstream Form (Films and Sheets (Co-extruded, Laminated), Fuel Tanks and Containers, Pipes and Tubes, Bottles and Pouches, Others), By End Use (Packaging (Food and Beverages, Pharmaceuticals, Cosmetics, Others), Industrial (Gasoline Tanks, Protective Membranes, Piping Systems, Landfill Covers, Others)) |

| Competitive Landscape | Mitsubishi Chemical Corporation, Kuraray, Chang Chun Group, SK Functional Polymers, Smurfit Kappa Group, Mondi plc |

Key Market Segments

By Grade Analysis

In 2024, Standard EVOH led the By Grade category of the Ethylene Vinyl Alcohol Market with a 72.9% share, reflecting its strong suitability for food, pharmaceutical, and industrial barrier applications. Its popularity comes from excellent oxygen and gas-blocking performance, helping extend shelf life and maintain product quality. This grade also provides a balanced mix of flexibility, durability, and processing versatility, making it compatible with common co-extrusion manufacturing methods.

Its cost-effectiveness further strengthens industry adoption, especially where performance and affordability must align. As companies pursue sustainable, safe, and long-lasting packaging materials, Standard EVOH continues to hold a leading position due to its reliability and alignment with global environmental and supply-chain priorities.

By Downstream Form Analysis

In 2024, Films and Sheets led the By Downstream Form category of the Ethylene Vinyl Alcohol Market with a 44.2% share, reflecting their broad adoption across food, medical, and industrial packaging, where oxygen- and moisture-barrier performance is critical. These EVOH formats help maintain freshness, improve safety, and extend product shelf life while aligning with global sustainability goals.

Their clarity, adaptability in multilayer packaging, and suitability for recyclable structures make them a preferred choice for packaging manufacturers and brand owners seeking reliable protection. With rising demand for durable, longer-lasting packaged goods, the Films and Sheets segment continues to reinforce its leadership and market relevance.

By End Use Analysis

In 2024, Packaging dominated the end-use segment of the Ethylene Vinyl Alcohol Market with an 84.3% share, underscoring EVOH’s critical role in extending shelf life by blocking oxygen and moisture. Its strong compatibility with multilayer packaging enables high-performance solutions for food, pharmaceuticals, and cosmetics, where preservation and safety remain top priorities.

Rising consumer expectations for long-lasting, clean-label, and sustainable packaging reinforce EVOH’s growing importance. Its recyclability, stable barrier performance, and suitability for diverse packaging formats support continued market preference, keeping EVOH firmly positioned as the leading material choice within the global packaging sector.

Regional Analysis

In 2024, Asia-Pacific led the Ethylene Vinyl Alcohol (EVOH) Market with a 42.30% share worth USD 281.2 million, supported by rapid packaging expansion, urbanization, and demand for high-barrier sustainable materials across China, Japan, South Korea, and India. Flexible and rigid packaging innovation further strengthens regional dominance.

North America continued its upward trajectory due to EVOH use in fuel tanks, healthcare packaging, and strict food-quality guidelines, while Europe maintained a stable position backed by recycling-focused regulations and advanced multilayer film systems.

Latin America displayed rising usage linked to evolving food consumption patterns, whereas the Middle East & Africa showed steady but smaller growth through industrial development and consumer product manufacturing expansion. Across all regions, sustainability policies, e-commerce packaging demand, and environmental compliance continue to accelerate EVOH deployment.

Top Use Cases

- Fresh-food packaging films: EVOH is used as a very thin barrier layer inside flexible food packaging films (like pouches for ready meals, meat, cheese) to block oxygen and gases, helping keep food fresh and reducing spoilage.

- Rigid containers for perishables: Because EVOH offers outstanding gas-barrier performance, it’s placed inside multilayer rigid containers or trays for refrigerated or shelf-stable foods to preserve flavour, colour, and nutritional quality.

- Automotive fuel-system barrier: In vehicle fuel tanks and pipes, EVOH is used as a barrier layer to prevent hydrocarbon vapour loss and permeation through plastic walls—reducing emissions and enhancing environmental performance.

- Chemical containment and geomembranes: EVOH technology is applied in geomembrane liners or chemical-barrier structures (e.g., under slabs) where chemical vapours or volatile organic compounds (VOCs) must be prevented from migrating into the environment.

- Active/functional packaging systems: EVOH can be combined with active ingredients (antioxidants, aroma scavengers) in packaging films to not only block oxygen, but also actively preserve quality or freshness (for instance, by embedding a natural extract in an EVOH layer).

Recent Developments

- In August 2024, Kuraray held a groundbreaking ceremony for a new plant in Singapore (via its subsidiary Kuraray Asia Pacific Pte. Ltd.) to produce EVAL™ EVOH resin. The planned facility will have an 18,000 tons/year capacity (with a front-end build of 36,000 t/y potential) and investment of US $410 million, with operations slated to begin end of 2026.

- In June 2024, SKFP published details of a compatibiliser solution for mixed recycled film feedstocks involving PE/EVOH laminates. The study identified that adding their LOTADER® 4210 tie-resin improved the mechanical and optical properties of recycled PE/EVOH films.

Conclusion

The Ethylene Vinyl Alcohol market is gaining steady attention as industries look for packaging materials that balance performance and sustainability. Its strong gas-barrier and chemical-resistant qualities make it suitable for food, medical, cosmetics, and industrial applications where product protection is essential. As companies move toward recyclable and environmentally responsible packaging formats, EVOH continues to be favored for its compatibility with multilayer technology.

Growing awareness of safety, extended shelf life, and clean-label packaging trends keeps demand rising. With ongoing material innovation, improved recyclability certifications, and interest from both consumer and industrial brands, EVOH is expected to remain a strategic choice across global supply chains.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)