Table of Contents

Overview

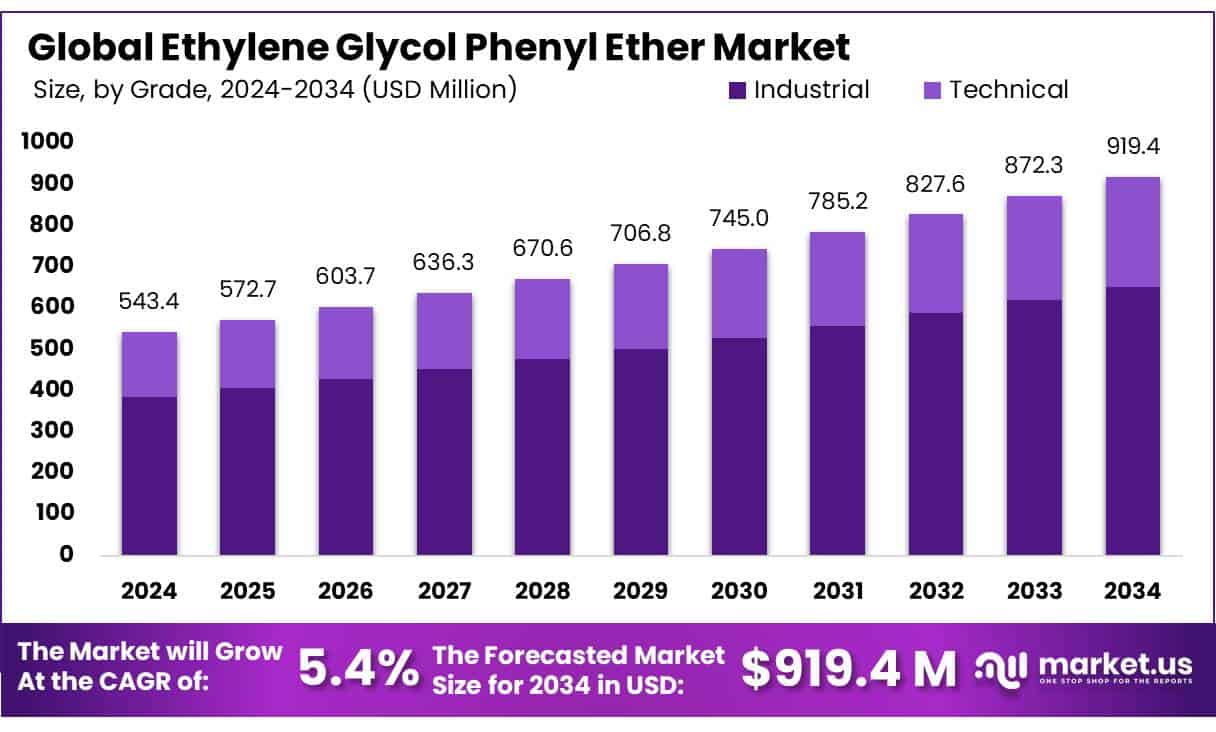

New York, NY – May 12, 2025 – The Ethylene Glycol Phenyl Ether (EPH) market is experiencing steady growth, driven by its versatile applications and rising demand across multiple industries. Valued at USD 543.4 million in 2024, the global market is projected to reach USD 919.4 million by 2034, growing at a CAGR of 5.4% from 2025 to 2034.

In 2024, the Industrial Grade of Ethylene Glycol Phenyl Ether (EPH) commanded a leading 70.4% share of the global market, driven by its extensive use in coatings, paints, and industrial cleaning solutions. The Paints and Coatings segment led the Ethylene Glycol Phenyl Ether market, securing a 37.6% share. EPH’s role as a solvent in paint systems formulations, valued for its low evaporation rate and excellent solvency, drives its prominence in water-based coatings, improving flow and leveling.

US Tariff Impact on Market

NEW YORK (ICIS)–2 April 2025 – Liberation Day by US President Trump saw a sweeping and substantial salvo of reciprocal tariffs, with a baseline tariff set at 10% but for many countries, much higher customized levels. The higher reciprocal tariffs are scheduled to come into effect on 9 April, with the baseline 10% tariff imposed on 5 April.

However, as of 8 April, there is emerging optimism on the potential for trade deals following comments from US President Trump that South Korea and China want to make a deal, and from administration officials that the US is in discussions with a number of countries.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/ethylene-glycol-phenyl-ether-market/request-sample/

The reciprocal tariff levels, which include 34% on China, 20% on the EU, 46% on Vietnam, 32% on Taiwan, 26% on India, 25% on South Korea, and 24% on Japan, were very much higher than anticipated. For China, 34% in reciprocal tariffs to come into effect on 9 April would be on top of the previous 20% tariffs the US implemented in February (10%) and March (10%), catapulting additional US tariffs on China this year to 54%.

Key Takeaways

- The Global Ethylene Glycol Phenyl Ether Market is projected to grow from USD 543.4 million in 2024 to USD 919.4 million by 2034, at a CAGR of 5.4%.

- Industrial-grade ethylene glycol phenyl ether holds a dominant 70.4% market share, driven by its use in coatings, paints, and industrial cleaners.

- Paints and Coatings account for a 37.6% market share, fueled by EPH’s solvency and low evaporation rate in water-based formulations.

- The Asia-Pacific region leads with a 51.2% market share, valued at USD 278.2 million, reflecting strong regional demand.

Analyst Viewpoint

The Ethylene Glycol Phenyl Ether (EPH) market is thriving, driven by its wide-ranging applications and increasing demand in cosmetics, pharmaceuticals, and coatings. The rising consumer preference for eco-friendly and paraben-free products is propelling EPH’s use as a stabilizer in personal care, ensuring product quality and shelf life.

Technological advancements in polymerization and formulation are enhancing EPH’s effectiveness in coatings, while bio-based EPH derivatives are gaining traction for their reduced environmental footprint. However, stringent regulations from agencies like the EPA and ECHA, citing health concerns such as skin irritation, restrict EPH’s use in consumer goods, particularly in pharmaceuticals.

These compliance challenges drive up costs but also spur innovation in low-VOC and sustainable formulations. As demand grows, especially in Asia-Pacific, which commands a 51.2% market share, opportunities abound for manufacturers to innovate and expand into emerging markets like India and China, capitalizing on the shift toward high-performance, eco-conscious solutions.

Report Scope

| Market Value (2024) | USD 543.4 Million |

| Forecast Revenue (2034) | USD 919.4 Million |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Grade (Industrial, Technical), By Application (Paints and Coatings, Printing Inks, Textile Dyes, Home Care, Personal Care and Cosmetics, Rubber and Latex, Pharmaceutical) |

| Competitive Landscape | The Dow Chemical Company, Guangdong Guanghua Sci-Tech Co., Ltd, Haihang Industry, Liaoning Kelong Fine Chemical Co., Ltd, Lanxess AG, Amines and Plasticizers Ltd., Clariant, Galaxy Surfactants Ltd., BASF SE, Oceanic Pharmachem Pvt. Ltd |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147862

Key Market Segments

By Grade

- In 2024, the Industrial Grade of Ethylene Glycol Phenyl Ether (EPH) commanded a leading 70.4% share of the global market, driven by its extensive use in coatings, paints, and industrial cleaning solutions. Its superior solvency and dispersant properties make it a top choice for enhancing chemical formulations, particularly in the automotive and construction sectors, where demand for high-performance coatings and paints is robust. The push for industrial cleaning solutions that meet strict regulatory standards further boosted their adoption.

By Application

- In 2024, the Paints and Coatings segment led the Ethylene Glycol Phenyl Ether market, securing a 37.6% share. EPH’s role as a solvent in paint systems: formulations, valued for its low evaporation rate and excellent solvency, drives its prominence in water-based coatings, improving flow and leveling. The surge in construction and infrastructure projects, particularly in the Asia-Pacific region, which holds a 51.2% market share, fueled demand for industrial and architectural coatings. Rising production in the paints and coatings industry, coupled with its use in chemical synthesis, reinforces this segment’s dominance.

Regional Analysis

The Asia-Pacific (APAC) region solidified its position as the leading market for Ethylene Glycol Phenyl Ether (EPH), holding a commanding 51.2% share, equivalent to approximately USD 278.2 million. This dominance is driven by the rapid growth of industrial and manufacturing sectors in key countries like China, India, and South Korea.

China, the region’s largest EPH producer and consumer, benefits from its vast industrial infrastructure and booming personal care and cosmetics industries, which heavily utilize EPH in paints, coatings, and industrial cleaners. India’s EPH demand is surging due to accelerated urbanization, infrastructure projects, and the need for advanced cleaning solutions.

Meanwhile, Japan and South Korea are seeing increased EPH use in personal care products, particularly as a solvent and preservative in skincare and haircare formulations. Supportive government policies promoting sustainable manufacturing and industrial growth further enhance EPH adoption across the region.

Top Use Cases

- Solvent in Paints and Coatings: EPH is widely used as a solvent in water-based paints and coatings, offering excellent solvency and low evaporation rates. It enhances flow, leveling, and durability, making it ideal for industrial and architectural coatings.

- Stabilizer in Cosmetics and Personal Care: EPH acts as a stabilizer in skincare and haircare products, ensuring product longevity and quality. Its compatibility with paraben-free formulations meets consumer demand for eco-friendly cosmetics. The rising personal care market in Japan and South Korea boosts EPH usage, contributing to its strong growth in the APAC region.

- Industrial Cleaning Solutions: EPH’s effective dispersant properties make it a key ingredient in industrial cleaners, used in the automotive and manufacturing sectors. It meets stringent regulatory standards for eco-friendly cleaning.

- Pharmaceutical Formulations: EPH serves as a solvent and stabilizer in pharmaceutical products, aiding in drug formulation. Despite regulatory restrictions due to health concerns like skin irritation, its use in specialized applications persists.

- Chemical Synthesis Intermediate: EPH functions as an intermediate in producing high-performance polymers and specialty chemicals. Its adoption in advanced materials for the aerospace and automotive industries drives market growth. The shift toward sustainable materials and government-backed material science initiatives further enhances EPH’s role in chemical synthesis applications.

Recent Developments

1. The Dow Chemical Company

- Dow has been focusing on the sustainable production of EGPE, integrating bio-based raw materials to reduce its carbon footprint. Recent initiatives include optimizing manufacturing processes to enhance purity for high-performance coatings and cleaning applications. Dow also expanded its Triton series, incorporating EGPE in eco-friendly formulations.

2. Guangdong Guanghua Sci-Tech Co. Ltd.

- Guanghua Sci-Tech has increased EGPE production capacity to meet the rising demand in the textile and ink industries. The company emphasizes high-purity grades with low residual solvents. Recent R&D focuses on improving stability for high-temperature applications.

3. Haihang Industry

- Haihang launched a new EGPE grade with improved solubility for agrochemical formulations. The company strengthened supply chains to ensure global availability, particularly in Europe and Southeast Asia. Recent certifications include REACH and ISO 9001.

4. Liaoning Kelong Fine Chemical Co., Ltd.

- Kelong introduced cost-effective EGPE batches targeting the paint and coating sector. The company enhanced distillation techniques to minimize impurities. Recent partnerships with domestic distributors aim to boost market penetration.

5. Lanxess AG

- Lanxess integrated EGPE into its high-performance additives for electronics and industrial cleaners. Recent innovations include low-VOC formulations compliant with EU regulations. The company also invested in green chemistry initiatives for EGPE derivatives.

Conclusion

The Ethylene Glycol Phenyl Ether (EPH) market is poised for robust growth. Driven by its critical role in paints, coatings, cosmetics, and industrial cleaners, particularly in the Asia-Pacific region with a 51.2% share, EPH benefits from rising demand for eco-friendly and high-performance solutions. Despite regulatory challenges, innovations in sustainable formulations and expanding industrial sectors in China and India offer significant opportunities. With its versatility and strong market presence, EPH is set to thrive, providing manufacturers and suppliers with promising prospects for growth and innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)