Table of Contents

Overview

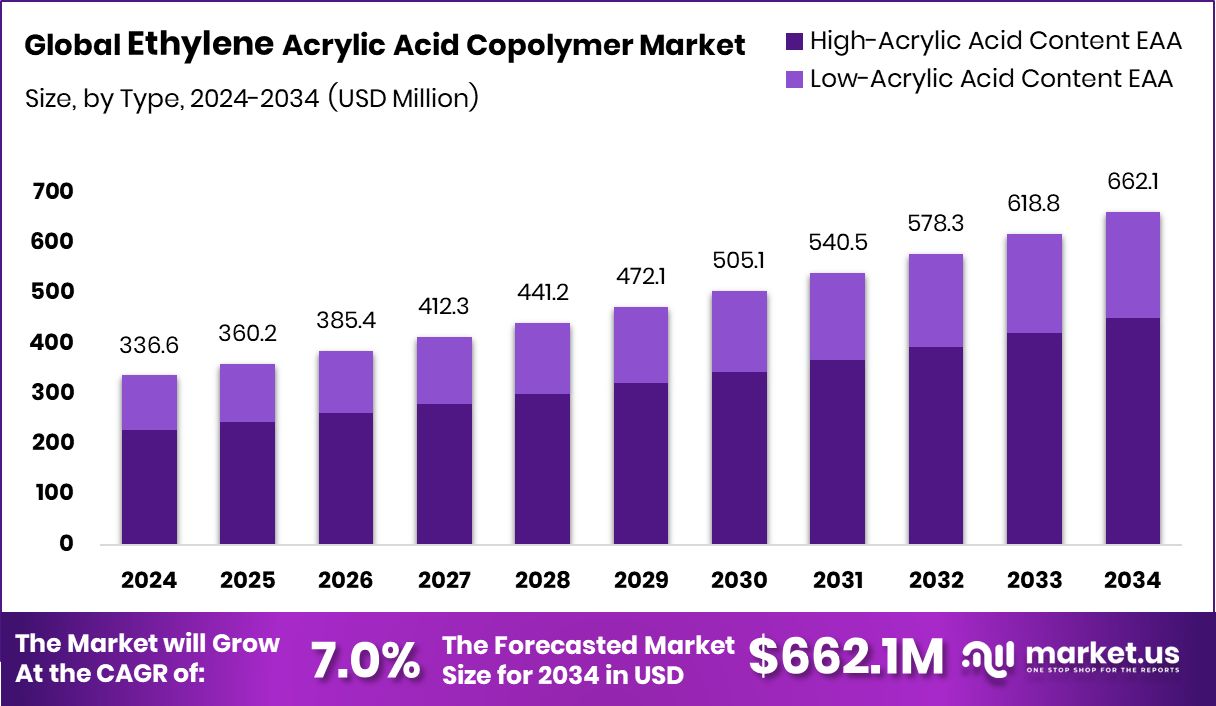

New York, NY – Nov 06, 2025 – The global market for ethylene acrylic acid copolymer (EAA) is projected to rise from approximately USD 336.6 million in 2024 to around USD 662.1 million by 2034, reflecting a compound annual growth rate (CAGR) of 7.0% from 2025 to 2034. In 2024, North America held a dominant share, accounting for 43.2% of the market, which equates to about USD 145.4 million, driven largely by strong demand in packaging and adhesive applications.

EAA is a thermoplastic resin formed by copolymerizing ethylene with acrylic acid, offering the softness and toughness typical of polyethylene combined with the adhesion and polar functionality of acrylic acid. This enables EAA to bond effectively with metals, paper, and various polymers, making it a favorite in packaging films, extrusion coatings, adhesives, and barrier layers. Its key advantages—durability, chemical resistance, and heat-seal capability—make it particularly suited to food, industrial, and flexible packaging uses.

The market’s growth is fuelled by expansion in the packaging industry, where increasing use of flexible and recyclable films drives demand for advanced tie-layer materials like EAA. On the innovation front, funding events such as the USD 2.65 million seed round for New Iridium and the USD 3.6 billion alpha-olefin industrial park planned by China’s Satellite Chemical underscore the strengthening upstream production infrastructure supporting EAA.

Additionally, investments such as the USD 152 million return-on-innovation fund and USD 5.3 million federal funding for biotech ventures in Houston highlight the broader advanced materials ecosystem that will reinforce new EAA-based applications in coatings, bio-adhesives, and high-performance laminates.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-ethylene-acrylic-acid-copolymer-market/request-sample/

Key Takeaways

- The Global Ethylene Acrylic Acid Copolymer Market is expected to be worth around USD 662.1 million by 2034, up from USD 336.6 million in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- In 2024, the high-acrylic-acid-content EAA segment led the ethylene acrylic acid copolymer market with a 68.9% share.

- The Film Grade segment dominated the Ethylene Acrylic Acid Copolymer Market, accounting for 59.4% due to strong use in flexible packaging.

- Extrusion processing held a 56.2% share in the Ethylene Acrylic Acid Copolymer Market, driven by packaging film production.

- The adhesives application segment captured 58.3% share of the ethylene acrylic acid copolymer market owing to superior bonding properties.

- Packaging end-use remained dominant in the ethylene acrylic acid copolymer market, contributing a 67.8% share due to global sustainability demand.

- The North American market value reached around USD 145.4 million during the year.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=163624

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 336.6 Billion |

| Forecast Revenue (2034) | USD 662.1 Billion |

| CAGR (2025-2034) | 7.0% |

| Segments Covered | By Type (High-Acrylic Acid Content EAA, Low-Acrylic Acid Content EAA), By Grade (Injection Grade, Film Grade), By Processing Method (Extrusion, Injection Molding, Others), By Application (Adhesives, Packing Films, Others), By End-User (Packaging, Construction, Others) |

| Competitive Landscape | Dow Inc., ExxonMobil, LyondellBasell, Arkema, BASF SE, SK Global Chemical Co. Ltd., Honeywell International Inc., Wacker Chemie AG, Eastman Chemical Company |

Key Market Segments

By Type Analysis

In 2024, high-acrylic acid content EAA dominated the By Type segment of the Ethylene Acrylic Acid Copolymer Market, capturing a 68.9% share. This leadership stems from its exceptional adhesion strength, flexibility, and compatibility with metals, paper, and polymers. High-acrylic acid grades are widely used in multilayer packaging, coatings, and adhesive applications, where durability, moisture resistance, and chemical stability are essential.

Their superior seal integrity and film clarity make them indispensable in flexible packaging and extrusion coating processes. With industries increasingly focusing on high-performance and durable polymer materials, high-acrylic acid EAA remains the material of choice, offering both mechanical reliability and functional adaptability to meet the evolving demands of advanced packaging and industrial bonding applications.

By Grade Analysis

In 2024, Film Grade emerged as the leading segment in the By Grade category of the Ethylene Acrylic Acid Copolymer Market, accounting for a 59.4% share. Its dominance is driven by excellent clarity, flexibility, and strong adhesion, making it ideal for multilayer packaging films and extrusion coatings. Film-grade EAA delivers outstanding seal strength, toughness, and resistance to grease and moisture, crucial for food and industrial packaging.

It also maintains high performance under temperature variations, enhancing its role in advanced flexible packaging. Steady demand from film manufacturers and packaging converters underscores its market leadership, with film-grade EAA remaining the preferred material for applications requiring durability, versatility, and consistent barrier properties in modern packaging systems.

By Processing Method Analysis

In 2024, extrusion dominated the By Processing Method segment of the Ethylene Acrylic Acid Copolymer Market, securing a 56.2% share. This leading position stems from its high efficiency in producing films, coatings, and multilayer laminates with precise thickness control and excellent uniformity. The extrusion method promotes optimal dispersion of acrylic acid units, enhancing both adhesion strength and mechanical performance in end-use applications.

It remains the preferred choice for flexible packaging films, paper coatings, and tie layers due to its scalability and consistent output quality. Additionally, extrusion maintains material integrity under high temperatures and pressure, supporting its widespread use in industrial and packaging applications. This combination of efficiency, reliability, and performance firmly established extrusion as the dominant processing method in 2024.

By Application Analysis

In 2024, adhesives led the By Application segment of the Ethylene Acrylic Acid Copolymer Market, commanding a 58.3% share. This strong position results from EAA’s exceptional bonding strength, flexibility, and durability, making it ideal for packaging, construction, and industrial applications. The copolymer’s excellent adhesion to metals, plastics, and paper ensures dependable performance in challenging conditions.

Additionally, its resistance to moisture, heat, and chemicals enhances the longevity and reliability of adhesive products. As industries increasingly adopt lightweight, high-performance bonding materials, EAA-based adhesives continue to gain preference for their balance of strength, versatility, and environmental resilience, securing their market leadership in 2024.

By End-User Analysis

In 2024, packaging dominated the By End-User segment of the Ethylene Acrylic Acid Copolymer Market, capturing a 67.8% share. This leadership stems from EAA’s exceptional adhesion, flexibility, and sealing performance, which make it essential for flexible and multilayer packaging films.

The material’s strong resistance to moisture, grease, and chemicals ensures superior product protection and longer shelf life. Widely used in food, beverage, and industrial packaging, EAA enhances barrier strength and heat-seal efficiency across various applications.

Additionally, the growing demand for lightweight, durable, and recyclable packaging solutions continues to reinforce the segment’s dominance. This combination of functional performance and sustainability positions packaging as the primary driver of growth within the Ethylene Acrylic Acid Copolymer Market in 2024.

Regional Analysis

In 2024, North America dominated the Ethylene Acrylic Acid Copolymer Market, holding a 43.20% share valued at approximately USD 145.4 million. This leadership is driven by robust demand from the packaging, automotive, and construction sectors, which rely on EAA for adhesives, coatings, and barrier films. The region benefits from advanced manufacturing infrastructure and steady investments in sustainable packaging materials.

Europe followed with stable growth, supported by stringent environmental standards and rising adoption of recyclable packaging solutions. The Asia-Pacific region showed strong momentum due to rapid industrial expansion and growing use of flexible packaging.

Meanwhile, Latin America and the Middle East & Africa experienced gradual growth, driven by increasing industrialization and expanding coating and extrusion film applications. Overall, North America continues to set market trends through technological innovation and sustainability initiatives, reinforcing its dominant role in the global EAA copolymer industry.

Top Use Cases

- Flexible & multilayer packaging films: EAA is used as a tie-layer or adhesive component in multilayer packaging films (for example, snack pouches or drink pouches) because it bonds to metals, paper and other polymers and offers strong seals and moisture/grease resistance.

- Adhesives for diverse substrates: Because EAA contains acrylic acid units, it has polar groups that allow it to adhere well to metals, glass, paper and plastics—making it useful in adhesive formulations without needing primers.

- Coatings & extrusion laminates: EAA can be used as an extrusion-coating material or laminating layer, offering control of film thickness and uniformity, plus adhesion and durability for coated paper, film or metal surfaces.

- Cable and wire jacketing/insulation: EAA is employed in the cable/wire industry, particularly as an adhesion promoter or tie layer between strength members and jackets, helping maintain integrity under thermal and mechanical stress.

- Barrier layer in food and industrial packaging: The copolymer’s resistance to moisture, grease, gas or chemicals enables it to act as a barrier layer in packaging—helping keep contents safe and extend shelf life.

- Primer or coating for polar substrates: EAA dispersions (aqueous or solvent) serve as primers or coatings on substrates such as paper, metal foil or untreated film—offering excellent adhesion and allowing subsequent coatings/inks to bond strongly.

Recent Developments

- In September 2025, Dow announced the launch of DOWSIL™ 5-1050 Polymer Processing Aid (PPA) for blown and stretch film applications. This product offers a fluoropolymer-free alternative, aimed at film packaging manufacturers facing regulatory and consumer-driven pressures. While not explicitly labelled as an EAA copolymer, this launch is in the film packaging/processing domain that overlaps with EAA end-uses.

- In October 2024, Arkema launched a new bio-based ethyl acrylate product at its Carling, France, facility. This ethyl acrylate is produced entirely from bioethanol feedstock, offering a bio-carbon content (BCC) of ~40% and reducing the product carbon footprint by up to ~30%.

- In June 2024, LyondellBasell announced that it had expanded its compounding production capacity in China. On 14 June 2024, the company started an additional production line at its Dalian site under its Advanced Polymer Solutions (APS) business, with an annual capacity of 20,000 tonnes. This expansion is aimed chiefly at high-performance polypropylene compounds for automotive (especially new-energy vehicles) and supports their local responsiveness in China.

Conclusion

The Ethylene Acrylic Acid Copolymer Market continues to expand steadily, driven by the increasing need for high-performance materials in packaging, coatings, and adhesives. The polymer’s excellent adhesion, flexibility, and resistance properties make it valuable across multiple industrial applications. Its compatibility with recyclable and lightweight materials also supports the global shift toward sustainability.

Continuous advancements in polymer processing and film technologies are further widening their use in packaging and construction. Moreover, growing investment in eco-friendly solutions and innovative material development by leading chemical producers ensures that ethylene acrylic acid copolymer remains a key component in the evolution of modern industrial materials.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)