Table of Contents

Overview

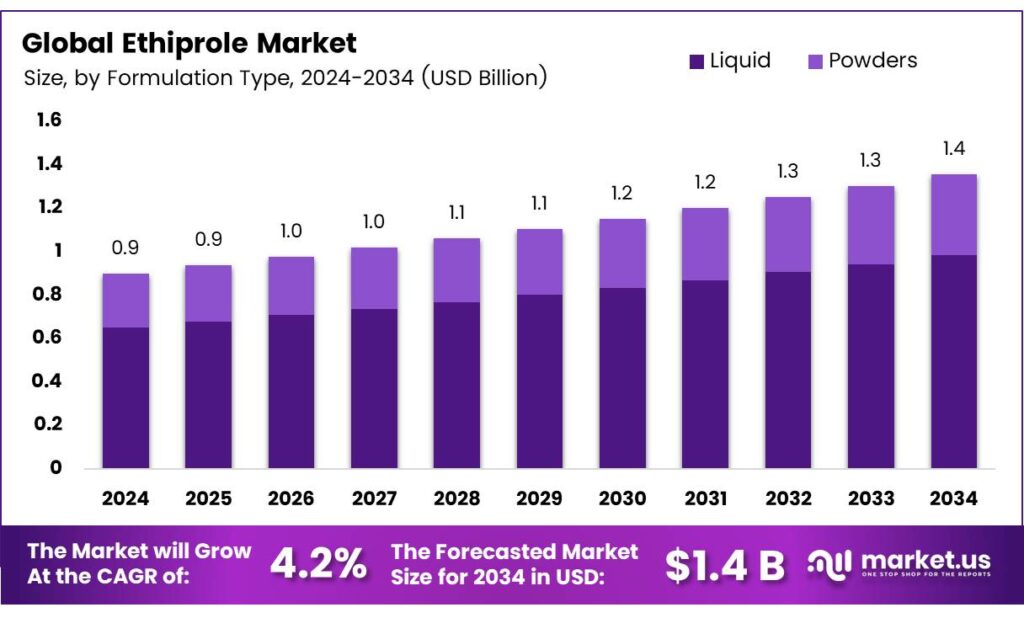

New York, NY – September 26, 2025 – The Global Ethiprole Market is projected to grow from USD 0.9 billion in 2024 to around USD 1.4 billion by 2034, expanding at a CAGR of 4.2% between 2025 and 2034.

Ethiprole, a phenylpyrazole insecticide, is structurally related to fipronil but contains an ethylsulfinyl group instead of a trifluoromethylsulfinyl group. Research highlights differences in their photochemistry, metabolism, and potency at the gamma-aminobutyric acid (GABA) receptor. Under sunlight exposure, ethiprole undergoes oxidation, reduction, and desethylsulfinylation, whereas fipronil primarily experiences desulfinylation.

Ethiprole also forms its sulfone metabolite faster than fipronil in both in vitro and in vivo studies. Importantly, both compounds and their derivatives demonstrate strong biological activity in GABA receptor assays and topical toxicity tests on insects. As a non-systemic insecticide, ethiprole is effective against a broad spectrum of pests, making it valuable for crop protection.

However, regulatory acceptance remains varied. CODEX has not established Maximum Residue Limits (MRLs) in Canada or Mexico, and ethiprole is not registered for crop use in the U.S. or Canada. Still, it is approved for tea in Japan and for rice cultivation in Brazil, Indonesia, Japan, Thailand, and Vietnam, with conditional approval in China.

In Japan, formulations include suspension concentrates (100–200 g/L) for rice and tea, granules (20 g/kg, 2% GR), and dustable powders (5 g/kg, 0.5% DP). Agriculture remains the largest consumer sector, particularly in Asia-Pacific countries such as China and India, where large-scale rice and cotton farming drives adoption. Ethiprole continues to play a key role in safeguarding crop yields and supporting food security in regions with intensive agriculture.

Key Takeaways

- The Global Ethiprole Market is expected to reach USD 1.4 billion by 2034 from USD 0.9 billion in 2024, with a CAGR of 4.2%.

- Liquid formulations dominated in 2024, holding a 72.4% share due to ease of application and high efficacy.

- Cereal Crops led in 2024 with a 38.7% share, driven by extensive rice, wheat, and maize cultivation.

- Agricultural Insecticide applications held a 63.5% share in 2024, fueled by pest pressures on major crops.

- Asia Pacific commanded 43.7% of market revenues in 2024, roughly USD 0.3 billion, led by intensive agriculture.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-ethiprole-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 0.9 Billion |

| Forecast Revenue (2034) | USD 1.4 Billion |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Formulation Type (Liquid, Powders), By Crop Type (Cereal Crops, Fruits and Vegetables, Oilseeds, Plantations, Others), By Application (Agricultural Insecticide, Pest Control, Public Health, Others) |

| Competitive Landscape | BASF, Bayer, Adama Agricultural Solutions, Nufarm, Sumitomo Chemical, Syngenta, UPL Limited, Meghmani Organics Ltd., SRIRAMCHEM |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157229

Key Market Segments

By Formulation Type

Liquid Formulation Commands 72.4% Market Share

In 2024, liquid formulations dominated the global ethiprole market, holding a 72.4% share. Their popularity stems from ease of use, uniform application, and superior absorption, making them highly effective for pest control across key crops.

Liquid ethiprole is favored by farmers for its compatibility with modern spraying equipment, ensuring precise application and minimal waste.

This formulation is expected to maintain its lead, especially in regions with extensive cereal, soybean, and horticultural crop production. The shift toward mechanized spraying systems enhances the cost-effectiveness and convenience of liquid formulations. Additionally, their rapid action against resistant pests solidifies their role in integrated pest management, further driving market preference.

By Crop Type

Cereal Crops Hold 38.7% Market Share

Cereal crops led the global ethiprole market in 2024 with a 38.7% share, driven by widespread cultivation of rice, wheat, and maize staples critical to global food security. Ethiprole is extensively used in Asia-Pacific, Latin America, and parts of Africa to protect these crops from pests like planthoppers, stem borers, and leaf beetles, ensuring consistent yields.

Demand for ethiprole in cereal production is projected to grow as global population growth fuels the need for increased grain output. Government initiatives to reduce crop losses, particularly in cereal-dependent regions, further bolster ethiprole’s importance. Its efficacy against resistant pest strains makes it a vital tool for sustainable cereal farming.

By Application

Agricultural Insecticides Lead with 63.5% Share

In 2024, agricultural insecticides accounted for 63.5% of the global ethiprole market, driven by rising pest pressures on crops like rice, soybeans, maize, and vegetables. Ethiprole-based insecticides are preferred for their ability to combat resistant pests such as planthoppers, beetles, and locusts, supporting higher yields and crop stability.

This segment is expected to maintain its dominance as global food demand rises with population growth. Climate-driven pest outbreaks and government support for integrated pest management further increase reliance on ethiprole. Its efficiency and compatibility with other pest control measures reinforce its leadership in agricultural applications.

Regional Analysis

Asia-Pacific Dominates with 43.7% Share, USD 0.3 Billion Market Value

Asia-Pacific led the global ethiprole market in 2024, capturing a 43.7% share valued at approximately USD 0.3 billion. This dominance is driven by intensive agriculture in countries like China, India, Thailand, Vietnam, and Indonesia, where ethiprole is widely used to protect high-value crops such as rice, sugarcane, and vegetables.

The region’s growth is fueled by demand for better crop quality, extended shelf life, and effective pest control against threats like planthoppers, leaf miners, thrips, phyllids, and aphids. Ethiprole’s high efficacy enhances yields, particularly for rice and sugarcane.

Low labor costs, a large agricultural workforce, and supportive regulatory frameworks in countries like China and India facilitate widespread ethiopropel production and adoption. Leading companies, including Bayer CropScience, are expanding production, innovating, and forming partnerships to meet this demand. While Asia-Pacific thrives due to aggressive crop protection needs and favorable policies, North America and Europe lag due to environmental and health concerns.

Top Use Cases

- Protecting Rice Crops from Hoppers: Farmers spray ethiprole on rice fields to stop plant hoppers from sucking sap and spreading diseases. This keeps plants healthy and boosts grain output without harming helpful bugs much. It’s easy to mix with sprays and works fast, fitting well into daily farm routines for better harvests in wet areas.

- Guarding Sugarcane Against Beetles: In sugarcane farms, ethiprole targets beetles that chew stems and cause big losses. Applied as a liquid, it spreads evenly to kill pests while leaving the crop untouched. Growers like it for lasting protection during growth seasons, helping maintain sweet yields for sugar making.

- Controlling Aphids on Soybeans: Soybean fields get ethiprole to fight aphids that curl leaves and weaken pods. This insecticide acts quickly on contact, reducing bug numbers so plants grow strong. It’s a go-to for large farms using machines, cutting down on repeated sprays and saving time for busy seasons.

- Managing Thrips in Cotton Plants: Cotton growers use ethiprole against thrips that damage buds and lower fiber quality. Sprinkled early, it stops pests from feeding and breeding. This helps keep cotton clean and fluffy, ideal for export markets where clean crops fetch higher prices without extra cleaning costs.

- Shielding Vegetables from Leaf Miners: For veggies like tomatoes, ethiprole knocks out leaf miners that tunnel and spoil greens. It’s safe for edible parts when used right, ensuring fresh produce reaches markets. Gardeners and big operations rely on it for a steady supply, blending with other safe pest tricks.

Recent Developments

1. BASF

BASF has been actively developing new formulations and combinations to enhance Ethiprole’s efficacy and address resistance. Recent focus includes integrating it into comprehensive solutions for rice and specialty crops, emphasizing safer application methods and environmental compatibility. Their efforts are part of a broader Integrated Pest Management (IPM) strategy to ensure sustainable use.

2. Bayer

While Bayer’s crop science portfolio is extensive, recent public developments specifically on Ethiprole have been limited. The company’s focus has shifted towards newer insecticide technologies and biological solutions. Ethiprole remains a part of their established product range in certain regions, but significant recent investment or regulatory news pertaining directly to it has not been prominent in their corporate communications.

3. Adama Agricultural Solutions

Adama offers Ethiprole-based products, such as Stento, for controlling pests in rice and vegetables. Their recent developments focus on providing effective, accessible solutions to farmers, particularly in Asia. Adama emphasizes the use of Ethiprole within resistance management programs, often promoting its combination with other modes of action to prolong its lifespan and efficacy against pests like the Brown Planthopper.

4. Nufarm

Nufarm supplies Ethiprole as a key ingredient in products like Viper, targeted at sucking and chewing pests in various crops. Their recent activity involves maintaining supply and supporting label approvals in key markets. Nufarm positions Ethiprole as a reliable component in its portfolio, focusing on its cost-effectiveness and role in managing insecticide resistance when used responsibly in rotation with other chemicals.

5. Sumitomo Chemical

Sumitomo Chemical, as a primary patent holder, continues to develop and defend the Ethiprole market. Recent developments include securing and maintaining global registrations. The company invests in research to expand its use patterns and improve formulation technology. Their strategy focuses on maximizing the product’s value throughout its lifecycle, especially in regions where its use is still critical for pest control.

Conclusion

Ethiprole stands out as a smart pick for modern farming challenges. It tackles tough pests in key crops while fitting into eco-friendly plans that cut chemical use. With farms pushing for stronger yields and safer methods, this insecticide opens doors for growth in busy growing regions. Makers can thrive by teaming up on new mixes and easy tools, keeping it a top choice for steady, healthy food supplies ahead.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)