Table of Contents

Overview

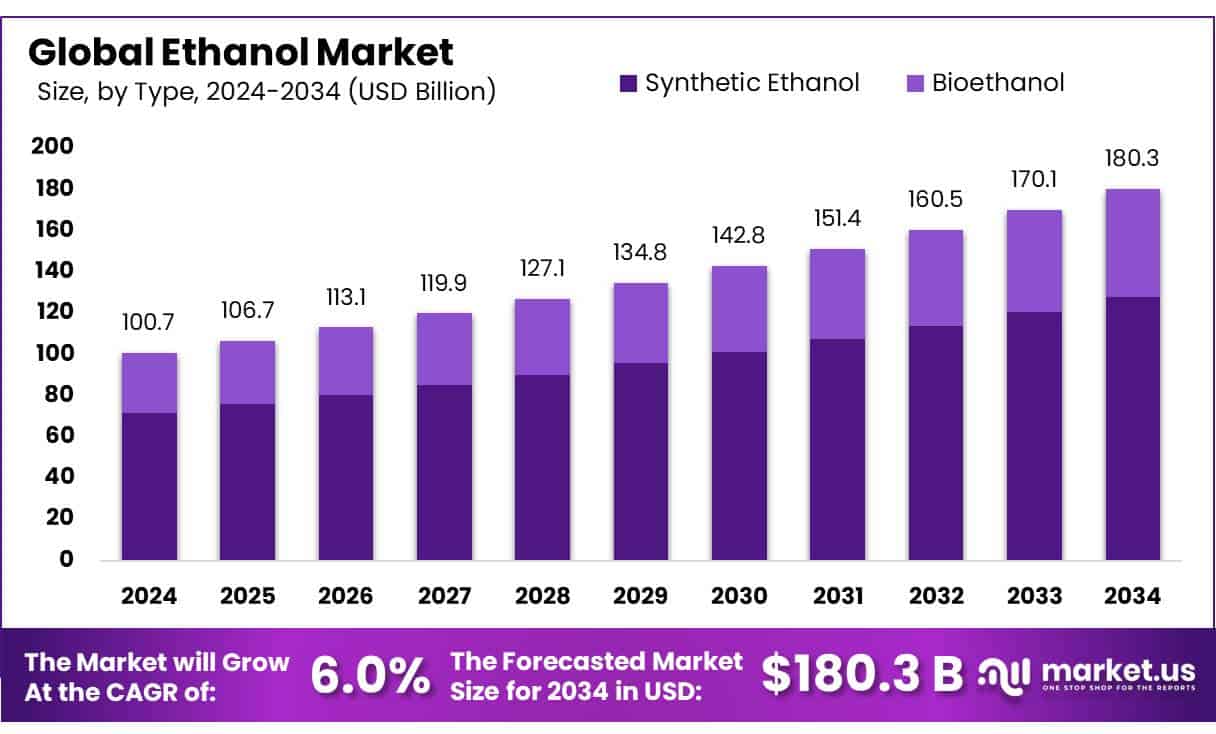

New York, NY – May 07, 2025 – The global Ethanol Market is experiencing strong growth, driven by rising demand for clean energy and sustainable fuel alternatives. In 2024, the market was valued at USD 100.7 billion and is projected to reach USD 180.3 billion by 2034, expanding at a steady CAGR of 6.0% from 2025 to 2034.

Synthetic Ethanol commanded a 71.2% share of the global ethanol market by type, driven by its cost-effective production and widespread industrial use, particularly in regions with abundant petrochemical feedstocks. Denatured ethanol captured a 59.2% share of the ethanol market by purity in 2024, fueled by its extensive use in industrial and fuel applications. Corn-based ethanol accounted for 48.2% of the global ethanol market by source in 2024. Fuel applications led the ethanol market in 2024, securing a 41.1% share by application, driven by ethanol’s role as a renewable fuel additive.

US Tariff Impact on Ethanol Market

Production of ethanol and biodiesel is concentrated in a small number of countries. The US and Brazil are the major ethanol producers, accounting for nearly 75% of the approximately 120 billion liters of current annual global output. The US alone produces about 50% of the world’s ethanol. Ethanol is consumed primarily in the countries where it is produced, and global trade is only 6-7% of world production.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/ethanol-market/request-sample/

These average MFN tariff rates conceal much larger discrepancies across economies in tariff rates applied to particular products. The United States imposes a 2.5% tariff on passenger vehicle imports (with internal combustion engines), while the European Union (10%), India (70%), and China (15%) impose much higher duties on the same product. For network switches and routers, the United States imposes a 0% tariff, but for similar products, India (10%) levies a higher rate. Brazil (18%) and Indonesia (30%) impose a higher tariff on ethanol than does the United States (2.5%).

Key Takeaways

- The Global Ethanol Market is projected to grow from USD 100.7 billion in 2024 to USD 180.3 billion by 2034, at a 6.0% CAGR.

- Synthetic ethanol dominates the market by type, holding over 71.2% share due to cost-effective production and industrial use.

- Denatured ethanol leads in purity, capturing 59.2% share, driven by its use in industrial and fuel applications.

- Corn is the top source for ethanol, holding a 48.2% share, supported by strong biofuel demand and agricultural infrastructure.

- Fuel is the largest application segment, with a 41.1% share, as ethanol is widely used as a renewable fuel additive.

- North America leads the ethanol market with a 48.2% share, generating USD 48.5 billion, driven by the U.S. as the top producer and consumer.

Analyst Viewpoint

The Ethanol Market offers strong investment potential, fueled by the global shift toward cleaner energy and supportive policies, though challenges persist. Next-generation biofuels, like cellulosic ethanol made from agricultural waste, are poised to meet rising sustainable fuel demand. Ethanol’s significant greenhouse gas savings compared to fossil fuels make it a favorite in eco-conscious markets, especially Europe.

However, risks include fluctuating raw material costs, competition from electric vehicles, and trade barriers, such as Brazil’s tariff-rate quota and China’s restrictive tariffs, which can erode profits. Technological advancements, including enhanced fermentation and carbon capture projects like Alto’s Pekin facility, improve efficiency and sustainability, boosting ethanol’s appeal. Yet, the regulatory landscape is mixed: policies like India’s E20 mandate and U.S. biofuel tax credits drive growth, but uncertainty from potential policy shifts under new administrations threatens long-term stability.

Ethanol Statistics

- Total Ethanol Production: 5.57 billion litres of ethanol.

- Co-products: 6.16 million tonnes of co-products produced.

- Fuel Use: 79% of ethanol output used for fuel.

- Greenhouse Gas Savings: Over 75% savings compared to fossil fuel.

- Food and Beverage Use: 5.6% of ethanol production.

- EU-sourced Feedstock: Over 98% of feedstock is grown or sourced in Europe.

- Industry Coverage: About 85% of EU renewable ethanol production.

- Fuel: 98% of U.S. gasoline contains ethanol (E10: 10% ethanol, 90% gasoline).

- Approximately 73% of global demand was for denatured ethanol. The majority of U.S. ethanol exports, three-fourths, were destined for Canada, the United Kingdom, and the European Union, with the rest distributed across 80 countries.

- Brazil adopted a tariff rate quota (TRQ) aimed at protecting its ethanol industry. Today, there is an 18% ethanol tariff for U.S. ethanol exports to the Brazilian market that is not fair for the U.S. ethanol industry.

Report Scope

| Market Value (2024) | USD 100.7 Billion |

| Forecast Revenue (2034) | USD 180.3 Billion |

| CAGR (2025-2034) | 6.0% |

| Segments Covered | By Type (Synthetic Ethanol, Bioethanol), By Purity (Denatured, Undenatured), By Source (Corn, Sugarcane, Wheat, Cellulose, Petrochemical), By Application (Pharmaceuticals, Fuel, Personal Care and Cosmetics, Beverages) |

| Competitive Landscape | The Archer Daniels Midland Company, POET, LLC, Valero Energy Corporation, Green Plains, Advanced BioEnergy LLC, Cargill, Incorporated, INEOS, HBL, LyondellBasell Industries, Sasol, Marquis Energy LLC, Pannonia Bio, BIOAGRA SA, Balrampur Chini Mills Ltd, Shree Renuka Sugars Ltd, The Andersons Inc., Bajaj Hindusthan Limited, Triveni Group, Raízen |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=22444

Key Market Segments

By Type: Synthetic Ethanol Dominates with 71.2% Market Share

- In 2024, Synthetic Ethanol commanded a 71.2% share of the global ethanol market by type, driven by its cost-effective production and widespread industrial use, particularly in regions with abundant petrochemical feedstocks. Derived primarily from ethylene, synthetic ethanol is favored for non-food-grade applications, including industrial solvents, chemical intermediates, cosmetics, paints, and pharmaceuticals, due to its reliable supply and consistent quality.

By Purity: Denatured Ethanol Leads with 59.2% Market Share

- Denatured ethanol captured a 59.2% share of the ethanol market by purity in 2024, fueled by its extensive use in industrial and fuel applications. Chemically altered to be unfit for consumption, it is a cornerstone of biofuel blends, supported by government policies aimed at reducing transportation sector emissions. Its cost advantage over undenatured ethanol makes it a preferred choice in manufacturing and energy applications.

By Source: Corn Holds 48.2% Market Share

- Corn-based ethanol accounted for 48.2% of the global ethanol market by source in 2024, maintaining its dominance, especially in the U.S., where it benefits from established agricultural infrastructure and is widely used as a biofuel. Corn ethanol supports rural economies and aligns with energy policies aimed at reducing petroleum imports and emissions. Its reliable supply chain and mature fermentation technology ensure its position as a key feedstock for fuel blending.

By Application: Fuel Applications Capture 41.1% Market Share

- Fuel applications led the ethanol market in 2024, securing a 41.1% share by application, driven by ethanol’s role as a renewable fuel additive. Blending ethanol with gasoline reduces emissions, enhances engine performance, and supports energy independence, with mandates like E10 and E20 fueling demand in regions such as Asia-Pacific and Latin America. Ethanol’s clean combustion, affordability, and availability make it a vital transitional fuel, particularly for internal combustion engines, despite the rise of electric vehicles.

Regional Analysis

- North America reinforced its dominance in the global ethanol market in 2024, capturing a 48.2% share and generating approximately USD 48.5 billion in revenue. The United States, the world’s leading ethanol producer and consumer, drives this regional supremacy. The region’s leadership stems from robust government policies, technological advancements, and a strong agricultural foundation.

- The U.S. Renewable Fuel Standard (RFS) plays a pivotal role by mandating renewable fuel blending into the national fuel supply, fostering significant investments in ethanol production, particularly in the corn-rich Midwest. In 2024, U.S. ethanol exports reached a record 1.9 billion gallons, valued at USD 4.3 billion, underscoring its global market influence.

- Technological innovations, including advanced enzyme technologies and fermentation processes, have boosted production efficiency, lowering costs and environmental impact. North America’s ethanol industry thrives on supportive policies, technological progress, and a commitment to sustainable energy, positioning the region to maintain its global leadership in the ethanol market for years to come.

Top Use Cases

- Biofuel for Transportation: Ethanol is widely used as a renewable fuel additive, blended with gasoline to reduce emissions and enhance octane levels. It powers vehicles in blends like E10 and E85, supporting cleaner air and energy independence, especially in countries with strong biofuel mandates.

- Industrial Solvents: Ethanol serves as a solvent in manufacturing paints, coatings, and cleaning products. Its ability to dissolve substances makes it essential for producing eco-friendly, low-VOC solvents, meeting the demand for sustainable industrial solutions.

- Alcoholic Beverages: Ethanol is a key ingredient in beer, wine, and spirits, driving demand in the global beverage industry. Its production from natural sources like corn and sugarcane supports a consistent supply for this growing market.

- Pharmaceuticals and Sanitizers: Ethanol is used in medicines, cough syrups, and hand sanitizers due to its antiseptic properties. Its role in killing bacteria and viruses makes it vital for healthcare and hygiene products.

- Cosmetics and Personal Care: Ethanol acts as a preservative and solvent in lotions, perfumes, and skincare products. Its ability to prevent microbial growth ensures product safety, meeting consumer demand for high-quality cosmetics.

Recent Developments

1. The Archer Daniels Midland (ADM) Company

- ADM has been expanding its ethanol production capabilities while focusing on low-carbon initiatives. The company is investing in carbon capture and storage (CCS) at its ethanol plants to reduce emissions. ADM also partnered with Summit Carbon Solutions to develop a major CCS project across its facilities. Additionally, ADM is exploring sustainable aviation fuel (SAF) from ethanol.

2. POET, LLC

- POET, the world’s largest biofuels producer, continues to innovate in ethanol efficiency and sustainability. The company recently announced expansions in its bioprocessing technology to increase yield and reduce carbon intensity. POET is also involved in carbon sequestration projects and advocates for year-round E15 sales to boost ethanol demand.

3. Valero Energy Corporation

- Valero, a leading ethanol producer, has been optimizing its ethanol plants for higher output and lower emissions. The company is investing in renewable diesel and SAF, leveraging ethanol as a feedstock. Valero’s joint venture with Darling Ingredients (DGD) focuses on low-carbon fuels, integrating ethanol into broader renewable energy strategies.

4. Green Plains

- Green Plains has shifted toward high-purity alcohol and sustainable protein production alongside ethanol. The company’s Ultra-High Protein initiative reduces carbon emissions while diversifying revenue. Green Plains also partnered with Tallgrass Energy to explore carbon capture at its ethanol facilities, enhancing sustainability.

5. Advanced BioEnergy, LLC

- Advanced BioEnergy has been upgrading its ethanol plants to improve efficiency and reduce carbon footprints. The company is exploring carbon capture partnerships and expanding into specialty alcohols for industrial applications. Its focus remains on optimizing ethanol production amid fluctuating energy markets.

Conclusion

The Ethanol Market is set for strong growth, driven by rising demand for clean energy and sustainable fuel solutions. The industry benefits from government biofuel mandates, environmental regulations, and the shift toward renewable energy. Ethanol’s versatility in fuel, beverages, and pharmaceuticals keeps demand high, while emerging markets in Asia and Latin America offer new expansion opportunities. Innovations in production, like cellulosic ethanol, further boost efficiency and cost-effectiveness.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)